The term “start-up” was originally coined in the early tech revolution in the 1970s, referring to a new breed of small companies characterized by exponential growth. The term start-up became a popular term in the 1990s and early 2000s business boom with brands like Microsoft or Apple scaling up at a rapid pace than ever seen before.

A start-up is a type of business that is inherently designed to grow fast; whose business model is repeatable, scalable, or capable of solving a problem in an innovative manner. Most known and popular startups are known for finding new and scalable solutions to known problems.

The government of India defines a startup as an entity working towards innovation, development, deployment, and commercialization of new products, processes, or services driven by technology or intellectual property.

Exploring diverse options like Green Bay Money Markets can provide startups with innovative funding avenues to support their growth and expansion.

Startups are also associated with high-risk propositions where they might fail due to multiple reasons. A few of the most common reasons for the startups are :

- Lack of finance

- Poor Business planning and execution

- Lack of proper marketing

- Internal team issues

- Market Competition

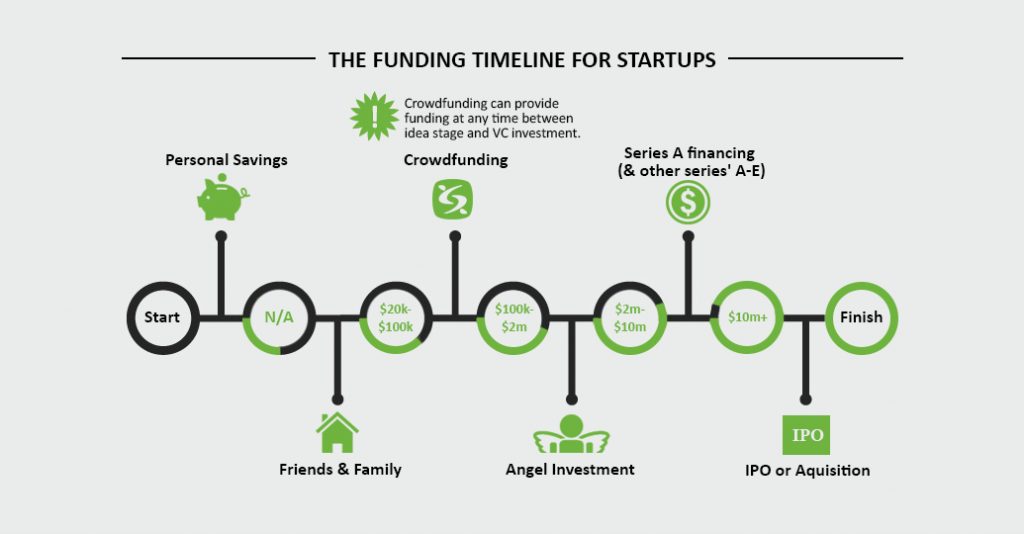

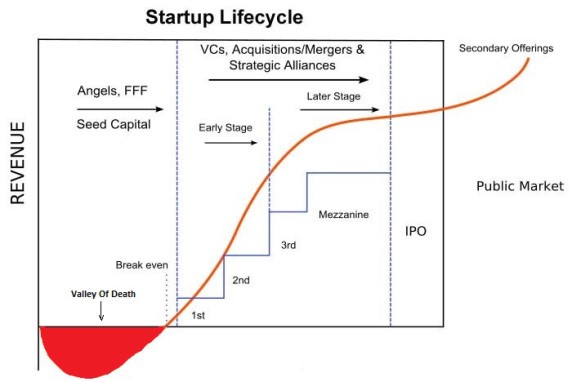

A constant flow of money is essential for any startup to survive and live the competition and thus there is always a need for constant finance. Startups look for fundings via different channels and funding rounds. Founders usually start with personal savings and look for funds within family and friends. The next step for a startup is to get funding via crowdfunding.

Crowdfunding

Crowdfunding is one of the routes for beginner startups where Founders usually look for funding via crowdsourcing platforms. Founders produce a business pitch detailing the goals, values and plans for the company and consumers donate for the startup.

Seed Financing

The seed financing will provide the capital needed to support salaries for founders/management, R&D, technology proof-of-concept, prototype development, and testing, etc. Sources of capital may include personal funds, friends, family, and angel investors.

Series A Financing

Typically the Series A is the company’s first institutional financing—led by one or more venture investors. Valuation of this round will reflect progress made with seed capital, the quality of the management team, and other qualitative components.

Series B Financing

The Series B is usually larger financing than Series A. At this point, we can assume development is complete and technology risk removed. Valuation is gauged on a blend of subjective and objective data—human capital, technical assets, IP, milestones achieved thus far, comparable company valuations rationalized revenue forecasts.

Series C Financing

The Series C may be later-stage financing designed to strengthen the balance sheet, provide operating capital to achieve profitability, finance an acquisition, develop further products, or prepare the company for exit via IPO or acquisition. The company often has predictable revenue, backlog, and EBITDA at this point, providing outside investors with a breadth of hard data points to justify the valuation.

Also Read: