Wells Fargo & Company (NYSE: WFC) is a leading financial services company with roughly $1.9 trillion in assets, serving one out of every three American families and more than 10% of small companies, and is the country’s biggest middle-market banking provider. Through its four reportable operational categories, Consumer Banking and Lending, Commercial Banking, Corporate and Investment Banking, and Wealth & Investment Management, it offers a diverse range of banking, investment, and mortgage products and services, as well as consumer and commercial finance.

The corporation is headquartered in San Francisco, California, with operational headquarters in Manhattan and management offices around the United States and overseas. The corporation operates in 35 countries and has a global customer base of more than 70 million people. The Financial Stability Board considers it a ‘systemically important financial institution’.

Wells Fargo Bank, N.A., the company’s primary subsidiary, is a national bank headquartered in Sioux Falls, South Dakota, and chartered in Wilmington, Delaware. It is the United States’ fourth-largest bank by total assets and one of the largest by bank deposits and market capitalization. Wells Fargo is one of the “Big Four” banks in the United States, along with JPMorgan Chase, Bank of America, and Citigroup. It has a total of 8,050 branches and 13,000 ATMs. It is one of the most valuable bank names in the world.

History of the company

Wells Fargo & Company and Minneapolis-based Norwest Corporation merged in 1998 to establish Wells Fargo & Company in its current form. While Norwest was the formal winner, the amalgamated business adopted the Wells Fargo name and relocated to San Francisco, while its banking subsidiary merged with Wells Fargo’s Sioux Falls-based banking subsidiary.

With the 2008 acquisition of Charlotte-based Wachovia, Wells Fargo became a coast-to-coast bank. Wells Fargo was placed 7th on the Forbes Global 2000 list of the world’s largest public companies and 37th on the Fortune 500 list of the world’s largest corporations. Regulators have conducted several probes against the corporation. The Federal Reserve stopped Wells Fargo from growing its roughly $2 trillion asset base any further unless the business fixed its internal flaws to the satisfaction of the Federal Reserve on February 2, 2018, as a result of the Wells Fargo account fraud scandal.

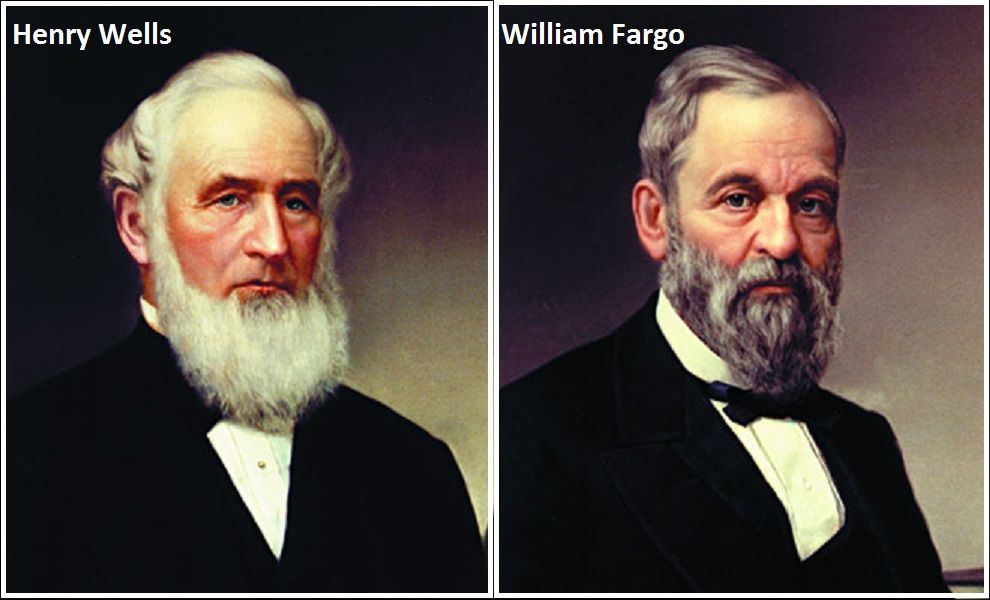

Henry Wells (1805–78) and William George Fargo (1818–81), who had previously worked for the American Express Company, founded the original company. In March 1852, they and other partners founded Wells, Fargo & Company to address the banking and express requirements of the California Gold Rush. The corporation handled the acquisition, sale, and transportation of gold dust, bullion, and species, as well as other items, from the West Coast to the East Coast by ship, passing the Isthmus of Panama overland.

Wells Fargo grew into the staging business in the decade after 1855, with overland lines from Missouri and the Midwest to the Rockies and the Far West. During the last six months of the Pony Express operation in 1861, it ran the western portion of the route from Salt Lake City to San Francisco. In 1866, a massive consolidation united nearly all Western stagecoach lines under the Wells Fargo banner, giving the business the world’s greatest stagecoach empire. Although stagecoach became less popular after the completion of the first transcontinental railroad in 1869, Wells Fargo coaches continued to serve areas where railroads did not exist, in some cases far into the early twentieth century.

Few names were more well-known than Wells Fargo during the era of the stagecoach. Its agents and messengers earned a national reputation for both their daring—getting the express through no matter what—and their professionalism. All transactions must be conducted with civility, according to Henry Wells, and the corporation must serve all, regardless of creed, color, or gender. Wells Fargo is most known for its transcontinental delivery operations, which gave rise to the business’s most enduring symbol, the horse-drawn nine-passenger Concord (New Hampshire) stagecoach, which the corporation used for public occasions well into the twenty-first century. The company’s hefty green treasure chest placed behind the driver’s seat, where gold bars, coins, financial paperwork, and the passengers’ belongings were held, piqued the interest of highway robbers of the day. As many stagecoach bandits learned to their disadvantage, these boxes were zealously guarded by an armed company agent; one such guard was the famed gunman Wyatt Earp. The business later constructed museums in places across the United States to showcase its colorful past.

The Wells Fargo Nevada National Bank was formed in 1905 when Wells Fargo’s banking operations (in California) were split from its express business and amalgamated with the Nevada National Bank (established 1875). The Wells Fargo Bank & Union Trust Co. was formed in 1923 when this bank amalgamated with the Union Trust Company (established 1893) to form the Wells Fargo Bank & Union Trust Co., which was later shortened to Wells Fargo Bank in 1954. It amalgamated with the massive American Trust Company (founded in 1854) in 1960 to establish the Wells Fargo Bank American Trust Company. Wells Fargo & Company, a holding company, was founded in 1969 and acquired all of the shares of Wells Fargo Bank, NA, as the bank was renamed. Wells Fargo Bank had thousands of retail branches in the United States by the early twenty-first century and had grown to become one of the country’s major banks, offering banking, mortgages, insurance, and financial management services. Through subsidiaries, affiliates, and retail outlets, it also created a global footprint.

Also Read: HDFC Bank – India’s Most Valuable Brand

Other businesses have had the right to use the Wells Fargo name in the past. The domestic activities of Wells Fargo the express carrier were taken over by American Railway Express Company (reorganised in 1929 as Railway Express Agency, Inc., and going into bankruptcy in 1975 as REA Express, Inc.) in 1918. Wells Fargo’s international express division operated independently until 1924 when the American Express Company purchased a majority interest in Wells Fargo shares and absorbed the remainder of the company’s express operations. However, during its time under American Express, Wells Fargo developed security services, which were sold to Baker Industries, Inc. in 1967, along with the rights to the Wells Fargo name, and survived through the subsidiary Wells Fargo Armored Service Corp., which included Wells Fargo Guard Services and Wells Fargo Alarm Services. In 1997, Loomis Armored Inc. and Wells Fargo Armored Service Corp. merged to form Loomis, Fargo & Co., a branch of Swedish firm Securitas AB.

Wachovia agreed to be bought by Wells Fargo for $14.8 billion in stock on October 3, 2008, after turning down a better offer from Citigroup. A New York state judge imposed a temporary restraining order on October 4, 2008, preventing the acquisition from proceeding until the competing Citigroup offer was worked out. Citigroup claimed that it and Wachovia had an exclusivity agreement that prevented Wachovia from engaging with other potential buyers. On October 5, 2008, a New York state appeals court overturned the injunction late in the evening. The FDIC then brokered talks between Citigroup and Wells Fargo to achieve an acceptable conclusion to the impasse. Those talks fell through. Citigroup was unwilling to take on more risk than the $42 billion caps set by the prior FDIC-backed transaction (any losses exceeding $42 billion would have been borne by the FDIC). Citigroup did not object to the transaction but claimed $60 billion in penalties for allegedly breaching an exclusivity agreement with Wachovia.

To read more content like this, subscribe to our newsletter