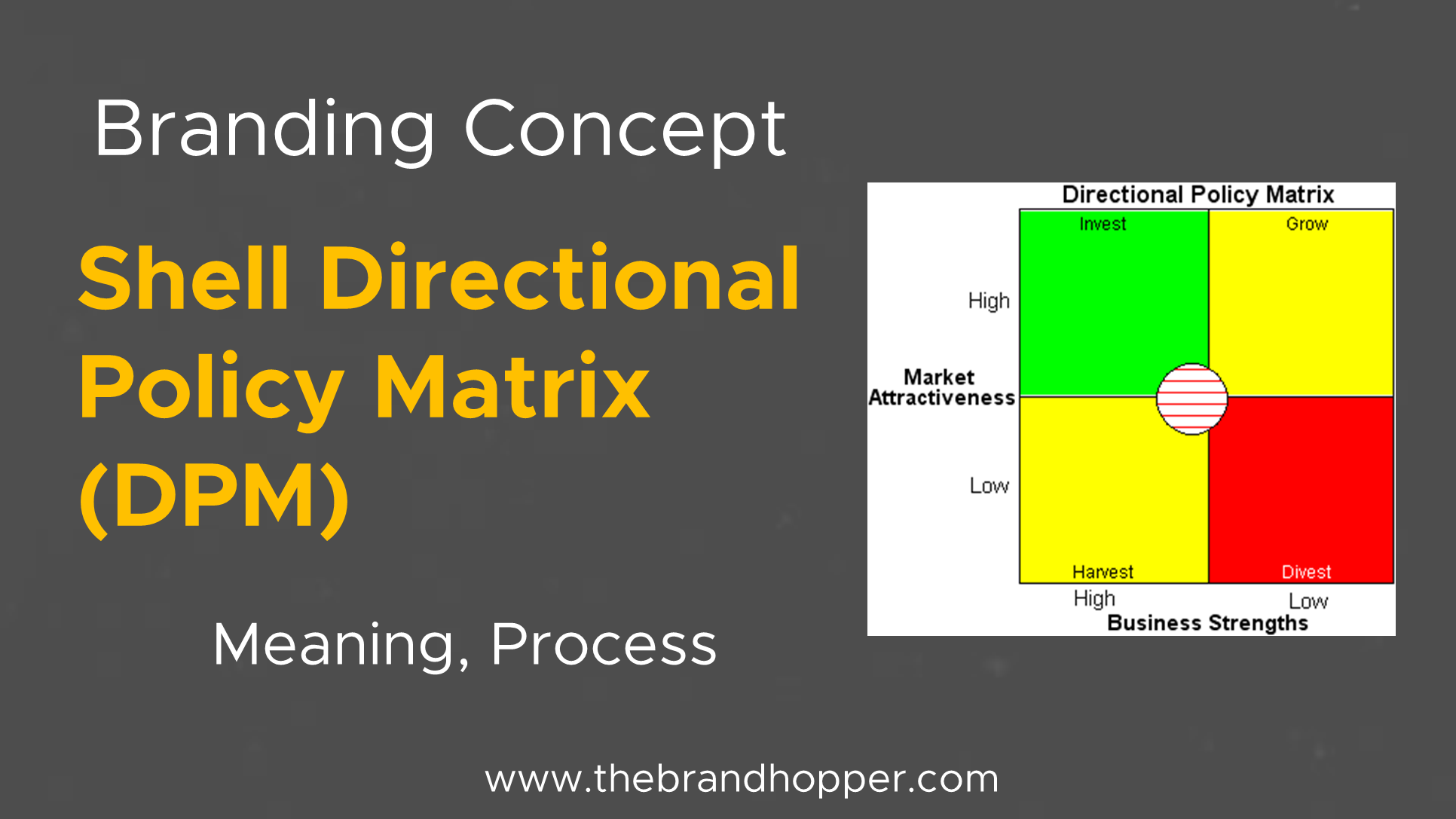

The Shell Directional Policy Matrix is another refinement of the Boston Matrix. Along the horizontal axis are prospects for sector profitability, and along the vertical axis is a company’s competitive capability. As with the GE Business Screen, the location of a Strategic Business Unit (SBU) in any cell of the matrix implies different strategic decisions.

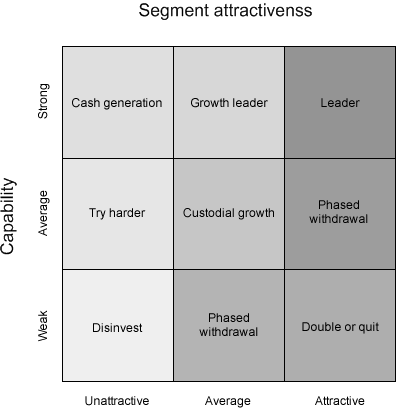

• Double or quit – gamble on potential major SBU’s for the future.

• Growth – grow the market by focusing just enough resources here.

• Custodial – just like a cash cow, milk it and do not commit any more resources.

• Cash Generator – Even more like a cash cow, milk here for expansion elsewhere.

• Phased withdrawal – move cash to SBU’s with greater potential.

• Divest – liquidate or move these assets a fast as you can.

However decisions often span options and in practice, the zones are an irregular shape and do not tend to be accommodated by box shapes. Instead, they blend into each other.

Each of the zones is described as follows:

• Leader – major resources are focused upon the SBU.

• Try harder – could be vulnerable over a longer period of time, but fine for now

Also Read

To read more content like this, subscribe to our newsletter