Berkshire Hathaway is a holding company that owns a number of companies, including GEICO and Fruit of the Loom. Warren Buffett serves as its chairman and CEO. Berkshire Hathaway is located in Omaha, Nebraska, and was founded as a consortium of textile milling plants.

History of Berkshire Hathaway – How it started?

Berkshire Hathaway, an American holding firm established in Omaha, Nebraska, that acts as Warren Buffett’s investment vehicle. In the early twenty-first century, it was one of the largest firms in the United States in terms of revenue. The corporation was also renowned for its high stock price (about $350,000 for one Class A share in 2020) and the tiny amount of its headquarters employees (about 25 people).

Berkshire Hathaway’s origins may be traced back to two Massachusetts textile companies: Hathaway Manufacturing Company (founded in 1888) and Berkshire Cotton Manufacturing Company (incorporated 1889). Berkshire Cotton was renamed Berkshire Fine Spinning Associates in 1929, and in 1955 it combined with Hathaway to establish Berkshire Hathaway, Inc. In 1965, an investment group led by Buffett gained complete ownership of the corporation. Berkshire Hathaway disposed of its textile assets in 1985, by which time it had established itself as a holding company for Buffett’s other investments and corporate acquisitions.

Buffett grew Berkshire Hathaway by investing in undervalued firms, purchasing many of them, and then delegating significant authority to the subsidiaries’ management. Insurance firms were a significant part of Berkshire Hathaway’s portfolio from the beginning of his tenure. National Indemnity Company and National Fire & Marine Insurance Company (now a part of National Indemnity) were acquired in 1967, with GEICO following in 1996 and General Reinsurance following in 1998.

However, the company’s acquisitions have always been diverse, including Scott Fetzer Company (1986), owner of reference and educational publisher World Book; Benjamin Moore (2000), paint producer; and Fruit of the Loom (2002), underclothing manufacturer. The purchase of the Burlington Northern Santa Fe Corporation (2010), owner of BNSF Railway, for around $44 billion was a larger transaction than any the business had ever completed. Regardless of their diversity, Berkshire Hathaway companies have almost always been drawn from established industries instead of new sectors..

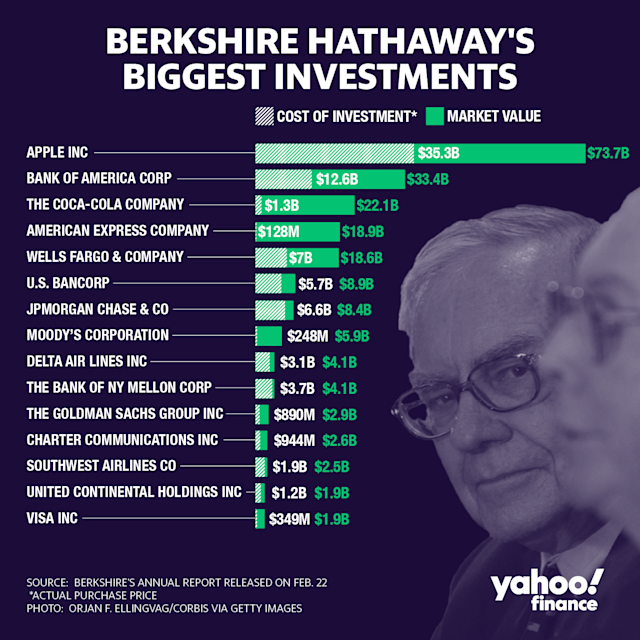

Berkshire Hathaway also has major stakes in firms that it does not own. For example, since 1989, it has owned between 6 and 10% of the Coca-Cola Company, and by 2021, it will possess more than 5% of Apple Inc. shares.

Also Read: HDFC Bank – Profile, History, Share Price, Marketing Strategies

Warren Buffet – The Wall Street Legend

You can’t discuss Berkshire Hathaway and its incredible history without mentioning its founder, Wall Street legend Warren Buffet.

Buffet’s combination of down-town common sense and home run stock decisions has made the Sage of Omaha a household name not only on Wall Street, but also on Main Street.

Buffett has amassed a fortune as one of the world’s most astute value investors, particularly as a thorough analyzer of promising equities (he is worth $85 billion as of February 2020). His intuitive ability to discover firms with cheap share prices was and continues to be his calling card.

Buffett and his partner, Charlie Munger, have transformed Berkshire Hathaway into a business powerhouse in the United States. At Berkshire Hathaway’s annual shareholders meeting in Omaha each year, Buffett and Munger, together with legions of corporate stakeholders, celebrate the firm’s success.

Warren Buffett was born on August 30, 1930, in Omaha, Nebraska. He was born into a business family; his grandparents managed a grocery store, and his father was an investment specialist who was elected to Congress in 1942.

When Warren Buffett was 11 years old, he bought his first stock, Cities Service Preferred, for $38 per share. Buffett took to stock-picking like a seasoned pro, amassing approximately $53,000 in portfolio assets (in today’s dollars) by the age of 16.

His early stock-picking lessons have stood the test of time. Buffett understood as a young investor that choosing equities was difficult, so when he discovered a good one, he held on to it for as long as he could.

Buffett continued to invest into his twenties and, at the age of 32, discovered Berkshire Hathaway, a New England textile concern.

To read more content like this, subscribe to our newsletter