About Zoom

Zoom is a cloud-based SaaS application that allows private individuals as well as businesses to virtually interact with each other. Communication can occur via text, audio, video, or a combination of the three.

Users can hold one-on-one meetings or conduct video conferences with up to 500 participants. Screen sharing allows meeting participants to better coordinate within meetings and distribute information.

The worldwide adoption of Zoom is powered by its two core products: Zoom Meetings and Chat as well as Zoom Rooms and Workspaces.

Zoom Meetings can be attended and held via a web browser, or desktop and mobile applications. The Chat works as an extension to the Meeting product where users can interact through a chat with each other, share files, or create groups.

Rooms and Workspaces, on the other hand, allows businesses to utilize hardware such as a computer, tablet, camera, microphone, and more to hold virtual meetings. The product is specifically aimed at larger-scale organizations, which need to hold meetings across different offices.

To make integration with the hardware easier, Zoom even offers its own set of hardware that they developed in collaboration with other manufacturers (including the Poly X Series or DTEN ON).

Other products the company has developed are:

-

- Zoom Phone, a cloud phone system that comes with features such as intelligent call routing, automated attendants, voicemails, dialing personas, call recording, and many more

- Zoom Video Webinars, a conferencing tool that allows businesses to easily conduct large online events with audio, video, and screen sharing

- An app marketplace, where existing customers can install third-party applications such as HubSpot, Slack, or Trello to enhance the functionality of the product experience

Zooms applications and hardware products are available across the globe. The company counts worldwide renowned businesses as customers, including the likes Uber, Rakuten, TransferWise, and many more.

A Short History Of Zoom

Zoom was founded in 2011 by Eric Yuan (CEO), a former executive at the video and web conferencing company Cisco WebEx.

Prior to starting Zoom, Yuan spent 14 years leading various engineering teams – first at WebEx, then at Cisco after its acquisition of WebEx in 2007.

He joined WebEx as one of the company’s first software engineers in 1997 after his 9th visa application finally got approved.

At Cisco, he often saw how frustrated the company’s customers were with their inability to listen to their demands and the slow product iteration process.

For instance, every time a user logged into a WebEx conference, the company’s systems would have to classify which version of a product (Android, iPhone, Mac, or PC) to execute, which slowed things down tremendously. If too many people were on the line, the connection would be severely strained, which led to bad audio and video quality. Plus, the applications lacked features such as screen-sharing for mobile phones.

In 2011, Yuan decided to pack his bags and venture out on his own – making sure to take a team of 40 Cisco engineers with him in the process.

Initially, the company started out as Saasbee, but rebranded to Zoom soon after. In the early days, Zoom faced the problem of attracting investors since nobody believed existing giants such as Skype, Hangouts (by Google), and WebEx could be dethroned.

Luckily, Yuan’s network, which included former WebEx CEO Subrah Iyar, as well as his deep technological experience provided him with the necessary credibility to raise $3 million for Zoom’s seed round.

Two years later, in 2013, Zoom finally launched its first product (while announcing a $6 million Series A round).

The quality of the product stood out immediately and allowed the small software startup to become one of the leaders in the video conferencing industry. Video conferences could be held on all hardware platforms (i.e. desktop, mobile, tablet) with the ability to host 40 people at the same time.

Because Zoom’s pricing was significantly cheaper, customers were flooding in right from the get-go. Soon after its launch, the company amassed a customer base of over 1,000 businesses which hosted a total of 140,000 meetings. By May 2013, Zoom crossed the magic mark of 1 million participants.

Over the years, Zoom quietly added more and more features as well as customers to its platform.

The continued success culminated in the company’s IPO in April 2019. At the time, Zoom surprised many investors due to the fact it already operated on a profit. This stood in stark contrast to its tech counterparts including Uber, Lyft, or Pinterest, which continued to burn money at excessive rates.

In 2020, as a result of the coronavirus pandemic, Zoom rose to worldwide prominence as many companies began to use it to conduct meetings and organize their work processes. With its rise to worldwide fame, the company received some backlash for its handling of security matters.

Also Read: SaaS Business Model and How It Works?

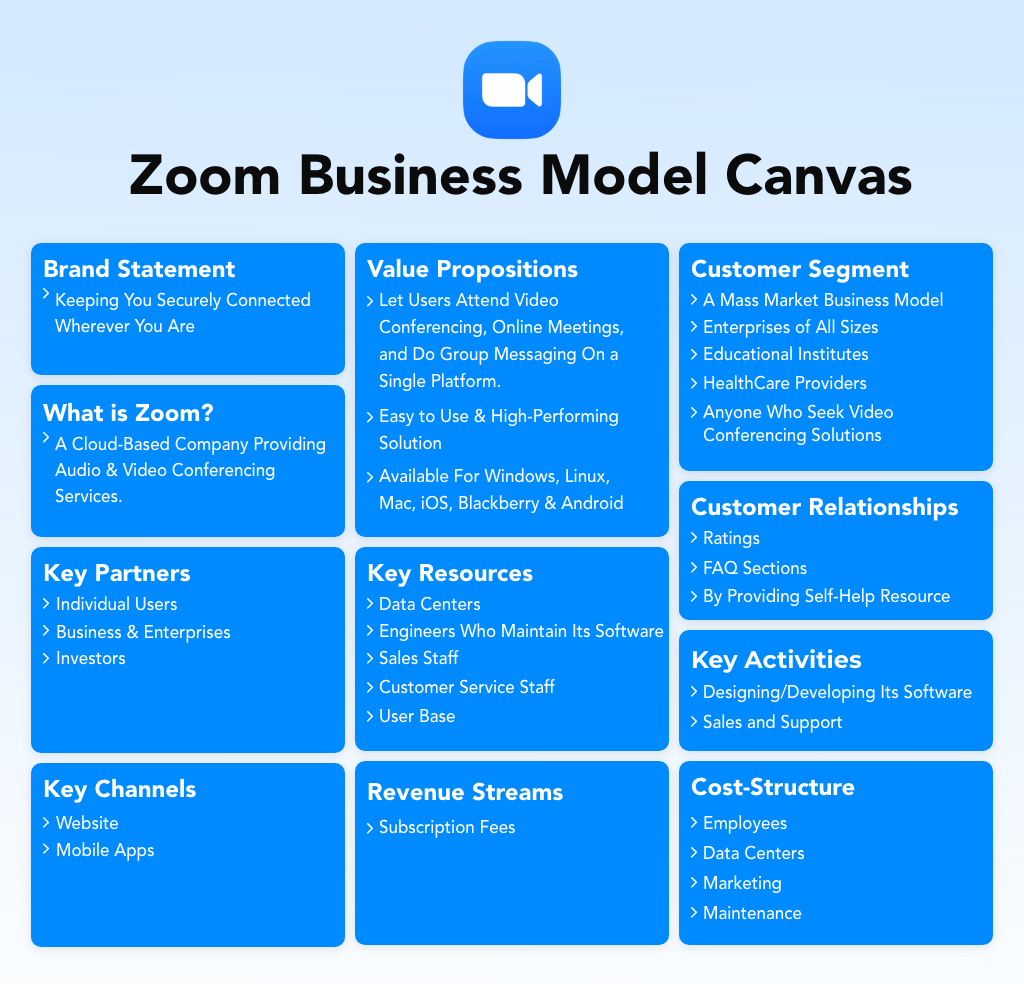

How Does Zoom Make Money? – Zoom Business Model

Zoom makes money via subscription fees, hardware sales, advertising, as well as by investing into other startups.

The company operates on a freemium model, which means that customers can use Zoom’s products for free. If they intend to access more advanced features, such as being able to host up to 500 participants being able to record calls, customers will have to pay a fee.

However, Zoom also has started to monetize freemium users through the introduction of ads.

Regardless of its monetization methods, Zoom’s competitive advantage continues to be grounded in its ability to deliver a flawless product experience characterized by fast loading times, high-quality audio and video output, as well as its ease of use.

Without further ado, let’s take a closer look at each of the Zoom’s revenue streams in the section below.

Subscription Fees

The vast majority of revenue that Zoom generates comes from charging various subscription fees in exchange for access to its suite of software products.

Zoom’s flagship product is its Meetings platform which enables teams and businesses to communicate online via audio, video, and text.

Apart from its free Basic plan, Zoom offers paid versions such as Pro, Business, and Enterprise.

These products are all aimed at a different set of customers and, depending on the price paid, allow them to host varying numbers of participants, obtain recording transcripts, or even host conferences in the firm’s native branding.

Zoom is then being able to cross-sell by offering ancillary services, such as more cloud storage or premium support, for an additional fee.

Similarly, it also monetizes its other software products, such as Zoom Rooms or Zoom Events & Webinar, via monthly or yearly software licensing fees.

Additionally, Zoom offers dedicated plans and products for a variety of industries including education and healthcare.

By tailoring its service to a specific customer segment, Zoom vastly increases the possibility of selling into that customer type.

On top of that, some of these customers, such as universities, are not very likely to replace Zoom (and thus churn) due to the sluggishness that comes with being an academic institution.

As a result, once Zoom has managed to engrain itself into such an organization (or even larger enterprises), it is unlikely to be replaced to the complexity being involved.

This, in turn, allows Zoom to better forecast its future revenue, which it can then use to buy up other companies (for example to extend its product suite) or invest into startups (more on that later).

Hardware Sales

Next to its software products, Zoom also offers various hardware items that enhance the experience of its software suite.

More precisely, Zoom offers dozens of different telephones, tablets, speakers, whiteboards, and more.

These products are offered in cooperation with other hardware manufacturers such as DTEN, Yealink, Neat., and more.

Customers then pay a monthly subscription fee for every hardware device that they source.

Zoom then shares that revenue with the hardware device manufacturer that takes care of the installation as well as maintenance service.

Advertising

Another, albeit very small, stream of revenue are the ads that Zoom shows after a meeting commences.

Originally introduced in November 2021, ads are only being displayed to free Basic users who don’t pay for its product.

Consequently, this finally enables Zoom to also monetize the users that do not want or need to pay for its products.

Just like with any other form of online advertising, Zoom is likely being compensated on a per-impression basis. That means whenever a user sees an advert, Zoom generates a small amount of revenue.

With tens of millions of active users, this can quickly compound into a significant portion of revenue.

Investments

As previously stated, Zoom, in April 2021, unveiled a fund with which it would invest into startups that build on top of its ecosystem.

Over the course of 2021, Zoom has invested in more than 20 startups out of its $100 million-strong Zoom Apps Fund.

Zoom generates money from the fund whenever it is able to sell shares in the companies it invests in for a greater price than they were purchased for.

It has to be noted that such a liquidation event is likely only occurring after multiple years have passed. Zoom can sell those shares during a secondary funding round (when existing investors get the chance to cash out), a sale, or IPO.

Apart from making money from those investments, the goal is to actually enhance the ecosystem around its product.

This allows Zoom to onboard a whole new set of customers, which may originally come from the startups it funds. Additionally, the more integrations Zoom possesses, the more attractive its products generally become.

To that extent, Zoom has also introduced its own app marketplace, allowing other software companies to integrate into Zoom’s product suite. However, Zoom does currently not monetize its app marketplace but could do so in the future, for example by charging a listing fee or taking a percentage cut from every sale.

Zoom Funding, Valuation & Revenue

According to Crunchbase, Zoom has raised a total of $276 million in eight rounds of venture funding.

Notable investors include the likes of Horizons Ventures, Emergence Capital, Sequoia Capital, and many others.

Zoom raised another $356.8 million in its IPO, which was announced in April 2019. At the time, public investors valued Zoom at $9.2 billion. Its valuation has now risen to over $47 billion.

For the fiscal year 2020, Zoom has recorded total revenues of $2.65 billion, up from just $623 million in the year prior. Profits surged to nearly $1 billion, up significantly from the $101.3 million it posted in 2019.

Source: Productmint

To read more content like this, subscribe to our newsletter