Stripe was founded in 2011 as an e-commerce payment processing software. Stripe has developed into a $94.4 billion firm that operates globally since its inception.

Two brothers from rural Ireland completely transformed internet payments with just 7 lines of code and a wonderful concept. How did they grow from a small-scale business to a financial sector dominant force?

Let’s dissect Stripe’s success story to find out.

About Stripe

Stripe was started 12 years ago by brothers John and Patrick Collison, who were 19 and 21 years old at the time. Both brothers were academically brilliant and showed a specific interest in math and physics from an early age, hailing from Dromineer, a tiny hamlet on the banks of Lough Derg in County Tipperary, Ireland.

While the internet was not widely available in their isolated region, by their early teens, they had nine computers at home and were spending €100 per month for a satellite broadband service. When they were 18 and 16, John and Patrick founded their first company, Auctomatic, which assisted eBay store owners in tracking their inventories. Ten months later, a Canadian corporation purchased it for $5 million, demonstrating the brothers’ brilliance.

While studying at Harvard and MIT in 2009 and continuing to create apps, the concept for Stripe arose from their personal experiences operating an internet business, where “the hardest part was finding ways of taking consumers money,” according to John. After discovering a problem that no one else seemed to have addressed, they quickly recognised it wasn’t through a lack of effort. It was simply because building such a safe and dependable payment system was a difficult task.

All of the internet payment options that existed at the time required multiple procedures, several costs, and took weeks to set up – none of which the Collison brothers desired. They took a risk and built seven simple lines of code that businesses could plug into websites and applications to quickly connect with credit card and banking systems and take payments, greatly speeding the process.

Both brothers dropped out of college in 2010 to try to get their company concept off the ground. Stripe, originally known as /Dev/Payments, was born as an online payment processing platform. The firm promised to serve web-based businesses of all sizes by eliminating fraud and providing simple payment options.

Success Story of Stripe

Still not sure what makes Stripe stand out? It’s because the platform’s software enabled internet firms to take digital payments without the need for licences or agreements with banks or credit card companies.

This arrangement offered Stripe an advantage and drove businesses to begin using the platform’s services. They got an estimated $20k-$30k in early money in 2010 from startup accelerator Y Combinator, which had previously backed Auctomatic, assisting the Collison brothers in starting their operations.

John and Patrick did everything they could to get their proposal off the ground. They approached investors such as Elon Musk and Peter Thiel and asked them to invest in Stripe.

“It’s a little premature to go to PayPal founders and say payments on the internet are completely broken,” John remarked in an interview, adding that “you can WhatsApp anyone across the world for free.” It’s an amazing feat of collaboration between telcos and ISPs, as well as the folks who own the fibre beneath the water, to build this worldwide communications network. Then, when it comes to economic infrastructure, we haven’t even begun.”

Stripe Funding and Valuation

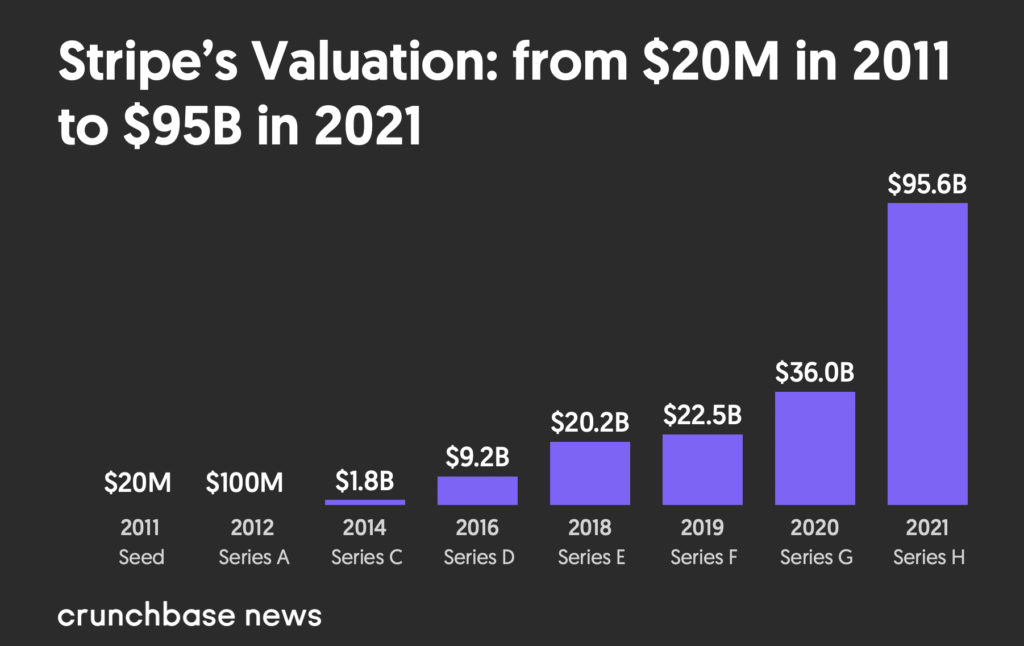

Thiel’s optimism paid off in 2011, when he led a $2 million seed round alongside Sequoia Capital and Andreessen Horowitz. Sequoia Capital, together with PayPal co-founder Elon Musk, Elad Gil, and Max Levchin, led the Series A investment in 2012, boosting Stripe’s valuation to $100 million. Its valuation surpassed the billion-dollar mark when a $80 million Series C financing in 2014 spearheaded by Sequoia Capital and Founders Fund, Khosla Ventures, and Allen & Company lifted its worth to $1.8 billion.

Stripe has raised eleven rounds of equity investment, ranging from its pre-seed Y-Combinator round to its most recent $600 million Series H round, which valued the firm at $95 billion. Stripe has collected $2.2 billion from 39 investors, which is more than the firm requires, allowing it to be very capital efficient. This has also contributed to the Collison brothers’ net wealth increasing to $11 billion apiece.

Stripe was valued at $95 billion earlier in 2021, making it the third most valuable venture-backed private firm in the world and the most valuable in the United States.

Also Read: Paytm – The Torchbearer Of Cashless India

Stripe Revenue

Stripe handles hundreds of billions of dollars each year for 2.9 percent of total transaction value and 30 cents each transaction. According to the Wall Street Journal, this business strategy helped the corporation achieve $7.4 billion in sales last year, a 70% increase year over year.

Stripe’s current client list includes household brands like Google, Slack, Zoom, Shopify, Lyft, Amazon, and others, implying that more than half of the world’s customers may be making transactions through a Stripe-powered firm without ever realising it!

As the saying goes, excellent design is invisible, something Stripe has taken to heart. And because so many of the world’s IT titans use Stripe for financial transactions, the firm has found it relatively straightforward to approach investors and venture capitalists the way it does.

Stripe Business Model

Stripe now has 50 corporate clients, each of which processes more than $1 billion each year. Stripe generates revenue through transaction fees. Fees for online transactions, subscription billing, invoicing, connecting clients who pay through third-party vendors, and in-person point of sale purchases are examples of these.

Stripe also earns money via its Stripe Capital Service business loans, the Radar tool, and specialised financial and data analysis reports.

The firm also employs 2,500 workers across 14 global offices, demonstrating how far this modest company has come in just a decade. Stripe has been the default choice for organisations globally over time, which is reason enough to trust that this platform will always be important in current internet age.

Stripe Investments and Acquisitions

Stripe has also contributed to the funding of other businesses. Stripe has announced $2 billion in investment over 40 acquisitions since 2017. The first $1.1 billion comes from 14 investments in 2021 alone.

Step Mobile, Wave, TrueLayer, Balance, Fast, Safepay, Check, Pilot, Codat, and others are among these firms. Most notably, Step, which is financed by Stripe, is in the midst of developing a debit card for children at a $1 billion value.

Stripe has also purchased 11 businesses since 2011. The most recent of these was Seachange (June 2021). Stripe has also acquired Bouncer, Tax Jar, Paystack, Touchtech Payments, Index Systems, Payable, Indie Hackers, and others.

Stripe and the Crypto Market

Stripe has announced the formation of a new crypto team to help shape the future of Web3 payments.

Stripe was one of the first payment processors to accept Bitcoin. However, in 2018, the firm declared that it would no longer accept Bitcoin payments, citing the fact that Bitcoin had “become less helpful for payments.”

Stripe’s Bitcoin mindset appears to have shifted, since the business is now reentering the crypto industry. They’re keeping mum on how this will play out, but it’ll be an intriguing step from the payment processor.

To read more content like this, subscribe to our Newsletter