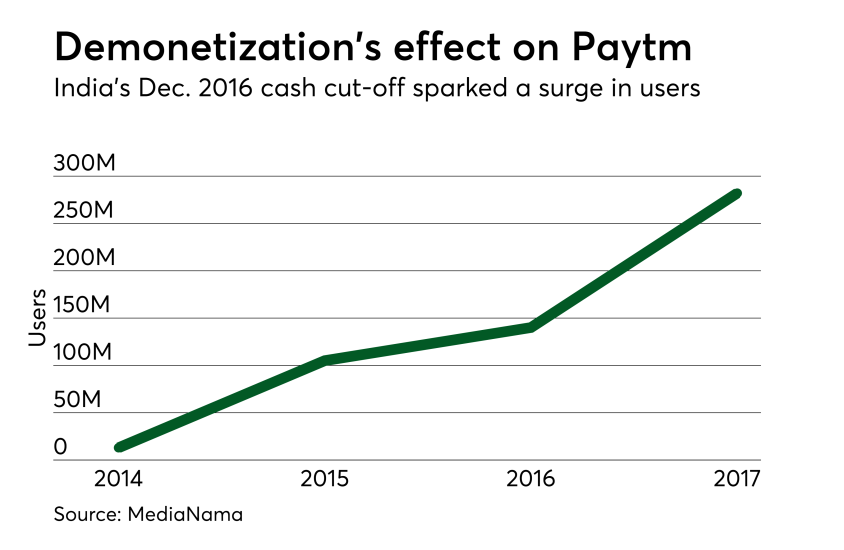

The day was 8th November 2016. Hon. PM Sh. Narendra Modi addressed the nation to wish the citizens at the ending of a joyous festive season. Little did people know at that time about the term ‘demonetization’ and what the Prime Minister said after his best wishes to the nation was shocking to many. Rs. 500 & Rs. 1000 notes were no longer considered to be a legal tender from the stroke of the midnight hour. In addition to that, he laid down the idea of Digital India was to reduce corruption cash payments were to be discouraged which had to become the foundation stone of Paytm.

Aligning with the vision of the PM, people started to use cashless online methods for payments. But every time using a debit/card is not convenient especially when you go to a retail store to buy your morning milk or maybe a Maggie for the breakfast.

The prodigy of One97 Communication Paytm helped solve this problem for most of us. Initially, this online wallet was mainly used to make payment for utilities like mobile and Direct to Home (DTH) recharge. But with the changes in paying pattern, Paytm has seen an extensive addition of users in recent times.

About

Paytm, in addition to being an e-wallet, is also an e-commerce player in the Indian market. It is based in Noida, Uttar Pradesh, India. It was founded by Mr. Vijay Shekhar Sharma in 2010 with an initial investment of $2 million. During initial years it acted as a mobile and DTH recharge platform and fast-forwarding in 2014, the company launched Paytm wallet which got a boost as Indian Railways and Uber added Paytm wallet as a payment option.

Paytm is extensively used by people as an online payment platform and these overwhelming responses earned a revenue of INR 3,579 crore in FY 2019. The user count of Paytm stands at above 350 million currently. Paytm also added features like ticket booking platforms for movies, events, and amusement parks.

In order to attract merchants to use Paytm in 2018, it started to allow merchants to accept Paytm, UPI, and card payments directly into their bank accounts at a 0% charge. This led to its merchant base growth by more than 7 million during 2018.

Funding and Shareholding

Starting in 2010 with a $2 million investment, Paytm was able to raise funds of $10 million from Sapphire Ventures (SAP Ventures) in October 2011. Going ahead, it received from venture giants like Alibaba Group, when they took a 40% stake in Paytm as a part of a strategic agreement.

It also raised funds in the following years from Mountain Capital, SoftBank, and Berkshire Hathaway.

Some Unique offerings from Paytm

Paytm Payments Bank

Reserve Bank of India granted a license to Paytm to launch Paytm Payments Bank which was inaugurated by then Finance Minister, Arun Jaitley in November 2017. However, the physical branches have not even touched double-digit till now due to the following reasons:

- Competition from existing banks whose physical presence is much higher

- Perception of customers – Consumers are associated with Paytm being a digital platform, So, when Paytm came out with the idea of a physical branch, it did not resonate with the consumer’s mind.

- The company authorities have accepted that few branches are opened to get experience and to get ideas about the kind of infrastructure needed.

Paytm Mall

Paytm Mall app, launched in Feb 2017, allows consumers to shop from 1.4 lakh registered users. It marked the entry of Paytm into the e-commerce industry. It is a B2C model that is inspired by China’s largest B2C retail platform TMall. Paytm Mall was successful in raising $200 million from Alibaba Group and SAIF Partners.

However, Paytm Mall also failed to attract customers and faced huge competition from e-commerce giants like Amazon & Flipkart, and as a result market share of Paytm Mall dropped to 3% in 2018 from 5.6% in 2017.

Reason for Paytm’s Success

First Mover

Paytm is one of the first online recharge companies which came into the market long back in 2010 when no other firm was available in that domain. Smartphones were just coming up during that time and due to higher penetration of the internet, it was able to place their product in a strategic way.

The availability of cheap smartphones helped the company reach a higher number of customers.

Value to Customers

In times of demonetization, when people had to stand in long queues to exchange money and withdraw from banks, Paytm provided an easy way in which you could pay just through a few taps on the phone. In addition to that, they also helped mobile & DTH users to pay their bills without any hassle of reaching a physical shop.

Tie-ups with government and private players

Paytm, during its initial stages, received backing from the Indian Government as the government is trying to promote cashless services. Indian Railways added it to its platform so that users can easily pay through their phone while booking tickets. Famous merchandise like Uber, Ola, and Zoom cars also added Paytm in their payment domain which helped the company reached a wide range of customers very easily.

Technological Platform

Paytm Wallet, which is the digital wallet, is way ahead of the other similar apps. With the introduction of the wallet, the company has actually reduced the steps of making payment which in turn reduces the time to a very good extent and that is what customers want.

Not only the wallet or the online recharge platform but Paytm has also started an e-commerce platform that provides facilities like online retail and ticketing.

Also Read: Dunzo – Creating A New Market Through New-Age Experiential Marketing

Future Goals

According to CEO Vijay Shekhar Sharma, the company already being successful in tier 1, tier 2, and tier 3 cities will focus more on reaching tier 4 and tier 5 cities. He also talked about expanding the payment accepting network. It also plans to upgrade some of the customers and provide them offers from banks and NBFCs for loans.

The CEO also made it very clear that they require large investments and many other players to participate. He thinks the entry of other players is beneficial as it will increase the market size. He is also aware of the fact that he needs to be one extra step ahead of other players to tap the increasing customer needs.

To read more content like this, subscribe to our newsletter.