Data analytics and data management are now critical for enterprises. The need for big technology is increasing and is not anticipated to subside anytime soon. Snowflake Data Cloud and Databricks Data Analytics are the two market leaders in this field.

When Databricks raised $1.6 billion last year, it was valued at $38 billion, and these two businesses are now increasingly competing with cloud platforms such as Amazon, Google, and Microsoft. Databricks’ tale is particularly compelling as it extends its product line and prepares to take on Snowflake.

About Databricks

Databricks is an American computer software company located in California. It specializes in the creation of a cloud-based platform that unifies the organization’s data that will eventually be utilized for data analytics.

It is not as straightforward as it sounds to store and analyze enormous volumes of data. This is especially true for major organizations, which deal with hundreds of transactions per day. The use of data analytics is critical for firms going forward, especially if they intend to develop a new product or enter a new area without incurring significant financial losses. However, data analytics does not begin with analytics, but with storage.

Databricks is not the industry’s first unified data analytics or data science platform, and it will not be the last. However, what distinguishes Databricks from competitors such as Snowflake and HDInsight is the platform’s simplicity and efficiency. Databricks is built on the Apache Spark cluster computing platform. According to several client reports, Databricks is 8x quicker than competing analytics solutions when it comes to caching, indexing, and sophisticated querying. It also promises to streamline the machine learning (ML) cycle by consolidating the majority of ML frameworks into a single central hub, resulting in quicker data intake, model construction, productionization, and experiment-tracking.

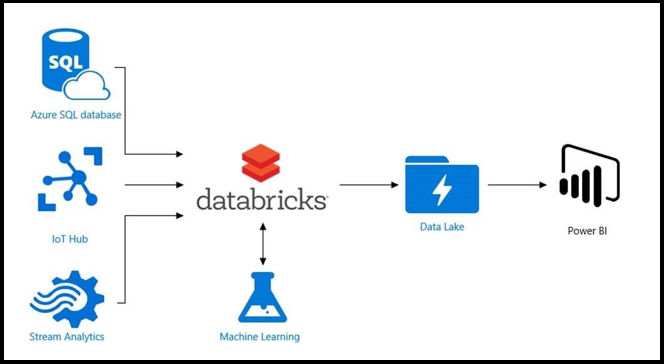

It also helps that the business collaborated with tech behemoth Microsoft, resulting in the development of a data science platform called Azure Databricks. Microsoft Azure is the company’s debut into the cloud computing business. Databricks will become an integrated Azure service as a result of the two firms’ collaboration. Data scientists and data engineers may utilize Azure Databricks to gain access to a variety of Azure services, including Azure Active Network (AAD), SQL Data Warehouse, and Power BI. AAD is a security architecture that securely protects sensitive company data without requiring users to meddle with multiple security options.

Databricks Founding Story

The history of Databricks may be ascribed mostly to academics building a name for themselves in the corporate sector. UC Berkeley professors Ali Ghodsi, Ion Stoica, and Matei Zahara, as well as UC Berkeley PhD students and alumni Patrick Wendell, Reynold Xin, Andy Konwinski, and Arsalan Tavakoli-Shiraji, created the startup in 2013.

Previously, the co-founders created a number of open-source data management solutions, including Apache Spark, Delta Lake, MLflow, and Koalas.

In 2013, the company received its first round of public investment, receiving $14 million in a Series A round headed by Andreessen Horowitz.

Databricks obtains $883 million in several Series fundings between 2014 and 2019. Andreessen Horowitz, Microsoft, New Enterprise Associates, Data Collective DCVC, SineWave Ventures, Green Bay Ventures, Geodesic Capital, Battery Ventures, Coatue Management, BlackRock, T. Rowe Price Associates, and Tiger Global Management all participated in the funding rounds.

In 2019, Microsoft joined in the Series E fundraising round that resulted in the launch of Azure Databricks. Databricks claimed revenues of more than $200 million in the same year.

Gartner named Databricks a Leader in Data Science and Machine Learning Platforms in their 2020 Magic Quadrant. In addition, the firm was placed fifth in the 2020 Cloud 100.

Databricks announced a partnership with Google Cloud in February 2021 to enable interaction with the Google Kubernetes Engine and the BigQuery platform.

Databricks claims that their cloud data analytics platform is utilized by over 5,000 businesses. The platform exemplifies how the database conflict has shifted from on-premise to cloud-based services platform fight.

What products does Databricks offer?

While Snowflake provides data warehouse as a service, Databricks creates and sells the “lakehouse” cloud data platform. The creative marketing name combines the terms data warehouse and data lake. Databricks’ lakehouse is built on the open source Apache Spark framework and supports analytical queries over semi-structured data.

Delta Engine, a new query engine that builds on top of Delta Lake to improve query speed, was announced by Databricks in June 2020. The launch of SQL Analytics as Databricks SQL followed. On top of data lakes, this is utilized to perform business intelligence and analytics reporting.

Databricks also provides a platform for various workloads, such as machine learning, data storage and processing, streaming analytics, and business intelligence, in addition to its core solutions. It has also participated in community development through online Spark classes and a conference dubbed the Data + AI Summit.

Competition of Databricks

Databricks competes not just with companies that provide unified data analytics, but also with companies that provide data science and machine learning platforms. Snowflake, Google (BigQuery), Amazon Web Services (SageMaker), and even Microsoft are among its biggest competitors.

Snowflake, like Databricks, is a worldwide leader. Among its numerous clients are Adobe, Lionsgate, Capital One, DocuSign, Sony Pictures, and 2K. When querying data, their data warehouse is among the fastest in the business. It is also lauded for its simple SQL query engine and the ability to work with Amazon S3, Google Cloud, and Microsoft Azure.

Business enterprises, colleges, and other private institutions also use Google BigQuery and Amazon Web Services Sagemaker. Both are commended for being systems that allow users to effortlessly query massive data sets while also storing these data sets for later use. Furthermore, when it comes to other sorts of data integration, such as data pipeline automation and data source integration, the majority of consumers have no concerns about BigQuery and Sagemaker.

Azure Databricks isn’t the only Microsoft data science program available for purchase. HDInsight, which was formerly built by data software company Hortonworks, operates in the same manner as the other platforms, making it a direct rival to Databricks. HDInsight is Azure-integrated and may be used with other open-source frameworks such as Hadoop.

Many firms, like Theia, Fivetran, Ahana, Aparavi, Stytch, and Cockoach Labs, have entered into building large data management software. Gartner has named Theia a “Cool Vendor” for its ability to handle material across many analytics platforms. Fivetran, which is ranked in the 2020 Cloud 100, also provides a data integration platform comparable to Databricks.

Also Read: SaaS Business Model and How It Works?

Revenue of Databricks

Their revenue surpassed $100 million for the first time in 2018 and will surpass $200 million in 2019. The addition of the Lakehouse element was a key reason in its success. The company’s valuation increased from $6.2 billion in the third quarter of 2019 to about $38 billion in the third quarter of 2021.

Databricks reported $425 million in yearly recurring revenue in 2020, with investors hoping for $1 billion by the end of 2022.

Future Ahead

You are accurate if you think of Amazon, Google, and Microsoft when you hear the term cloud. However, if you are thinking about Databricks or Snowflake, you are well-versed in the area of big data technologies. Databricks’ future will largely define the cloud-based data warehousing and data analytics market.

According to Gartner, the database management industry will more than double to $65 billion from $25 billion between 2011 and 2020. According to the technology research and consultancy organization, cloud databases are driving this rise. Snowflake and Databricks are definitely competitors in the cloud database business.

On the one hand, Snowflake announced a 102% increase in sales year over year, while Databricks has received significant funds to compete with Snowflake and other big data firms. According to IDC, the database market will be worth $100 billion by 2025, making the cloud database market one of the largest and fastest expanding in technology.

The fight between Databricks and Snowflake will be the core story of this growth, rather than the competition between Oracle and Microsoft. Upstarts are increasingly attempting to provide things that were formerly the domain of others.

With technologies like as data warehouses, data lakes, and artificial intelligence gaining traction, Snowflake and Databricks are racing to grow their market share. Oracle, IBM, and SAP are expected to lose ground to specialized data management businesses such as MongoDB, Databricks, Snowflake, Yugabyte, and others.

Databricks’ success can be attributed to its initial focus on meeting the need for data science tools. Its capacity to provide a data lake house that included the characteristics of a data warehouse and a data lake to analyze data was fundamentally new, and it was intended to promote digital transformation. With Snowflake encroaching on its business, Databricks will have to compete not only with another startup, but also with huge IT behemoths like Amazon and Microsoft.

To read more content like this, subscribe to our newsletter

Go to the full page to view and submit the form.