MyGlamm is an Indian e-commerce website that sells cosmetics and personal care items. It was established in 2015 and is headquartered in Mumbai, India. The Good Glamm Group and Sanghvi Technologies jointly control the firm. The startup became the first Indian unicorn startup in the DTC beauty and personal care industry in 2021.

Business Model of MyGlamm

MyGlamm is an example of a D2C business model that developed a strong product and platform recall, as seen by the fact that 98% of its online purchases occur through its website and app. In 2015, the brand debuted as an on-demand beauty service, allowing users to schedule a home spa or beauty treatment.

Myglamm changed its business plan in October 2017 to provide beauty items under the same brand but with a new logo. MyGlamm went through four major stages on its way to become a digital powerhouse, as detailed here.

The brand provided extensive product education via social media, notably video material. Globally, beauty video views increased by 62% in 2018 over the previous year. However, videos of major cosmetic companies accounted for only 3% of overall beauty views on YouTube, with the balance dominated by individual bloggers.

The Quirky Marketing Strategies of Myglamm

It all started with a specific target demographic: busy, independent, and confident women. MyGlamm’s initial advertising campaign features six ladies with six various cosmetic demands and use scenarios, such as on the go in a cab or lift, fast touchups before a party, or leaving the office after a hard day. It was marketed as “makeup that multitasks for you.”

Celebrities’ Influence

MyGlamm launched ad campaigns with celebrities that used unconventional narratives. The #TurnOnYourEyes campaign with Lisa Haydon focused on women’s empowerment. Sidharth Malhotra, a popular Bollywood actor, was hired to establish LIT, a vegan cruelty-free cosmetics line. The campaign #TestedOnSID put a humorous perspective on the situation, with Sidharth claiming that things are tested on him rather than animals. A male celebrity was utilized to sell a cosmetic company in India for the first time.

In December 2018, MyGlamm made another industry first by co-branding its premium new launch with fashion designer Manish Malhotra. Then there was the debut of POSE, a cosmetics line marketed by Bollywood star Sonakshi Sinha. To generate interest, the business shared a teaser on social media in which Sonakshi was detained and brought into police custody. The actor then announced the upcoming release on her Instagram page.

3Cs at play – Content, Community & Commerce

According to a Facebook India and BCG analysis, Lockdown increased online beauty purchases in India by 1.35x. MyGlamm recognized this rise as a chance to aggressively grow its user base. While the brand expanded 400% in the previous year to reach a yearly revenue of 140 cr, high CAC (Customer Acquisition Cost) and low LTV (Lifetime Value) were causes for worry.

Customer retention is frequently six to seven times more expensive than new customer acquisition. CACs rose as several D2C businesses competed for the attention of the same online audience. As a result, MyGlamm devised a strategy to lower CAC by concentrating on three factors:

- Increasing conversion – Performance marketing focused. For example, one of its early conversion initiatives raised new user conversion from 12% to 19% and increased abandoned basket users by 166%.

- Marketing Automation – By working more closely with the firm WebEngage, the brand was able to efficiently target user cohorts at various points of the purchase experience.

- Creating customer relationships – Plixxo acquired POPxo, a content platform with almost 50 million women and 75k influencers.

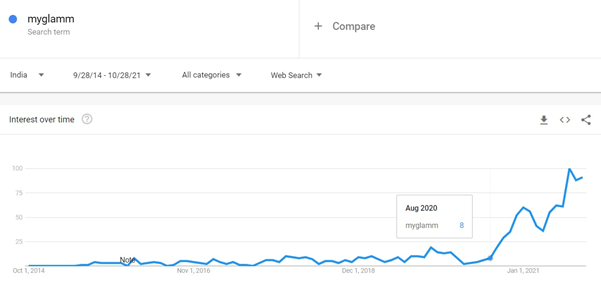

Within a month of the purchase, the number of new MyGlamm users increased from 30k to 60k. According to the creator, simply using POPxo would result in a $4-5 million cost savings in marketing. With this strong top-of-funnel marketing and lower CACs, MyGlamm generated 50% more revenue than before COVID, with a 45% retention rate. The gains are also obvious in the customer interest produced by the brand from August 2020, as seen below by Google Trends.

MyGlammXO was founded in order to co-create beauty goods with customers. MyGlamm will open India’s largest immersive beauty store, a 3000-square-foot flagship store in Mumbai’s Bollywood stars’ nest, Juhu, in November 2020. It is six times the size of the average beauty store in India.

Also Read: BuzzFeed – Creating The Best Digital Media Strategies

The Digital FMCG conglomerate

It was time for a new brand vision: to improve the beauty journeys of millions of women at every stage of their lives, from tween to adolescent to adult. As a result, MyGlamm announced the foundation of Good Glamm Group, the parent entity in its quest to become a digital House of Brands, in September 2021. This huge goal was fueled by a Rs 785 crore fundraising round (175 crore in March, 355 crore in July, and 255 crore in September) – the highest ever series C round in the Indian beauty market. In July of this year, the Group was valued at more than Rs 2000 crore.

Shraddha Kapoor, a Bollywood celebrity, joined as an investor and ambassador to give the company wings. Apratim Majumdar, a marketing veteran from HUL who came as the company’s new CMO, was drawn to the new vision. Interestingly, Amazon debuted their investment in beauty D2C at this round.

To succeed in new areas, Good Glamm Group is currently depending on a series of strategic acquisitions. Darpan Sanghvi, the company’s founder, expects a $5 billion potential and an IPO in 2023. With the acquisition of BabyChakra, a parenting platform with 25 million members, it began its new adventure in the Mom and Baby category. This was followed by the acquisition of The Moms Co for a whopping 500 crore, making it India’s largest D2C cosmetics brand acquisition to date.

Good Glamm Group is now directly competing with the thriving Thrasio-style D2C aggregators Mensa Brands, Goat Brand Labs, UpScalio, GlobalBees, Powerhouse91, and others. This change has a number of ramifications for how startups and investors see the D2C industry. The new playbook developed by Good Glamm Group is best presented using the graphic below:

To create their strategic journeys, D2C brands can choose three parts from this framework.:

- the starting point,

- the direction of movement, and

- the boxes ticked.

Good Glamm Group then bought famous lifestyle portal ScoopWhoop, which counts 1.5 billion impressions and 60% male users, with an eye on the expanding men’s grooming industry. This comes at a time when recent study by Google, Kantar, and WPP indicated that, contrary to common assumption, males are quite interested in purchasing beauty products online.

Funding of Myglamm

MyGlamm secured $6 million in a Series A financing in April 2016 from French personal care store L’Occitane en Provence, private equity company Tano Capital, and Brand Capital. Tano Capital provided $15 million in its second round of fundraising in August 2018. In 2021, the firm raised $4.35 million through a rights issue from Tano India Private Equity, L’Occitane International, Bessemer Venture Partners, Trifecta Venture Debt Fund II, and the company’s founder Darpan Sanghavi as part of a Series B round of investment.

It raised $14.42 million in a round headed by Bessemer Venture Partners, L’Ocitane, and Mankekar Family Office in June 2019. It was valued at $500 million in March 2021 and had secured $24 million in a Series C financing sponsored by Ascent Capital Group, Amazon, and Wipro.

It became a unicorn in November 2021 after raising $150 million at a valuation of $1.2 billion.

The Road Ahead

With releases such as SUPERFOODS, Treat Love Care, Wipe Out, GLOW, YOUTHFUL, and K. Play, MyGlamm expanded into personal care categories such as hair care, skincare, and bath & body, as well as new beauty niches, to establish a broader branded house. According to Darpan Sanghvi, Good Glamm Group now has an annualized revenue run rate of 740 crores and is anticipated to reach Rs 1800 crores by March 2022.

From a D2C standpoint, two factors distinguish the brand from competitors such as Sugar Cosmetics, Plum, Mamaearth, and WOW Skin Science: its offline presence, which accounts for 40% of revenue through 15k points of sale across 70 cities, and its speed of innovative customer acquisition despite being a late entrant using content, community, and commerce.

Over the next several months, the Group intends to attain 100 million MAU for POPxo and 5 million influencers for Plixxo via an app. Following the success of its experience shop in Mumbai, the firm intends to create a similar location in Delhi. BabyChakra branded items will be available before the end of the year. A piece of the men’s grooming market will be a feather in the cap. The creator intends to increase the amount of personal care in the portfolio from 25% to 40% through product and regional expansions.

We can only speculate on the next big step in this journey, which may be the acquisition of women’s hygiene and lifestyle businesses. Let us observe how and when the FMCG behemoths pick up their game.

To read more content like this, subscribe to our newsletter