Klarna is a Swedish financial technology company that provides a range of payment and shopping services to consumers and merchants. The company was founded in 2005 and has since grown to become one of the most popular payment options in Europe and the United States.

Klarna offers several payment options, including “Pay now” options, such as credit and debit cards, as well as “Pay later” options, which allow customers to defer payment for up to 30 days or split the cost of their purchase into multiple installments. Klarna also offers financing options that allow customers to pay for large purchases over a longer period of time.

In addition to payment services, Klarna also offers a shopping app that allows users to discover and buy products from a variety of retailers. The app offers personalized recommendations and the ability to create wish lists and save favorite items. Klarna also provides merchants with a range of tools to help them manage their payments and increase their sales, including fraud prevention services and the ability to offer discounts and promotions to customers.

Overall, Klarna is a popular payment and shopping service that offers a range of options to both consumers and merchants, with a focus on convenience and flexibility.

History of Klarna

Klarna was founded in 2005 by Sebastian Siemiatkowski, Victor Jacobsson, and Niklas Adalberth in Stockholm, Sweden. The idea for the company came about when the founders were frustrated with the online shopping experience and the difficulty of making payments online. They wanted to create a payment solution that would be easy, fast, and secure, and would improve the online shopping experience for both consumers and merchants.

The company initially started as an online payment platform for e-commerce merchants in Sweden, but quickly expanded to other countries in Europe, such as Norway, Denmark, and Finland. Klarna gained traction in these markets by offering innovative payment solutions, such as “pay after delivery,” which allowed customers to receive their products before paying for them.

In 2014, Klarna expanded its operations to the United States and launched its first office in New York. The company’s success in the U.S. market helped it to raise significant funding, with investors including Sequoia Capital, Silver Lake, and BlackRock.

In recent years, Klarna has continued to grow and expand its services. It has acquired several companies, including German payment company BillPay, and has launched new products, such as “Slice It,” which allows customers to finance purchases over a longer period of time. Klarna has also expanded its presence in the retail sector, partnering with major brands such as H&M, ASOS, and IKEA.

Today, Klarna is one of the largest financial technology companies in the world, with over 3,500 employees and operations in 17 countries. The company processes more than 2 million transactions per day and has over 90 million active users worldwide.

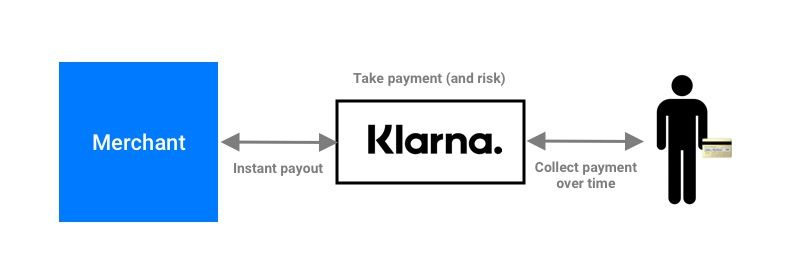

Business Model of Klarna

Klarna is a financial technology company that offers a range of payment and shopping services to consumers and merchants. The company’s business model is based on providing innovative and convenient payment solutions that improve the online shopping experience for consumers while increasing sales and revenue for merchants.

Klarna’s business model is based on three key revenue streams:

Payment processing fees: Klarna generates revenue by charging merchants a fee for processing payments. This fee varies depending on the payment method used and the country where the transaction takes place. Merchants can also access additional services, such as fraud prevention and marketing tools, for a fee.

Financing fees: Klarna’s “Pay later” financing option allows customers to defer payment for up to 30 days or split the cost of their purchase into multiple installments. Klarna earns revenue from this service by charging interest or fees to consumers who choose to use it. The fees vary depending on the amount of the purchase, the duration of the financing, and the country where the transaction takes place.

Commission on sales: Klarna’s shopping app features products from a variety of retailers. Klarna earns a commission on each sale made through the app, which is shared with the retailer.

Klarna’s business model is focused on providing value to both consumers and merchants. By offering flexible payment options and a seamless shopping experience, Klarna can help merchants increase their sales while providing consumers with a convenient and user-friendly payment system.

Overall, Klarna’s business model has been highly successful, with the company becoming one of the largest financial technology companies in the world. Its ability to provide innovative payment and shopping solutions has made it a popular choice for consumers and merchants alike.

Also Read: Stripe – Success Story, Business Model, Revenue, Growth & Funding

Investors and Funding

Klarna has raised a significant amount of funding since it was founded in 2005. The company has attracted investment from some of the world’s leading venture capital firms, as well as prominent individual investors. Here are some of the key investors and funding rounds for Klarna:

Sequoia Capital: In 2010, Klarna raised $10 million in a Series B funding round led by Sequoia Capital, a leading venture capital firm.

General Atlantic: In 2011, Klarna raised $155 million in a funding round led by General Atlantic, a global growth equity firm.

Atomico: In 2014, Klarna raised $100 million in a funding round led by Atomico, a venture capital firm founded by Skype co-founder Niklas Zennström.

Visa: In 2017, Visa announced a strategic investment in Klarna as part of a partnership agreement between the two companies.

BlackRock: In 2019, Klarna raised $460 million in a funding round led by BlackRock, one of the world’s largest investment management firms.

SoftBank: In 2021, Klarna raised $639 million in a funding round led by SoftBank’s Vision Fund 2, which valued the company at $45.6 billion.

In 2022, the Swedish fintech firm said it raised $800 million in fresh funding from investors at a $6.7 billion valuation — down sharply from the $45.6 billion value it secured in a 2021 cash injection led by Japan’s SoftBank

In addition to these investors, Klarna has also received funding from other venture capital firms, including Silver Lake, HMI Capital, and DST Global, as well as prominent individual investors, such as Snoop Dogg, Will Smith, and Ant Group founder Jack Ma.

Overall, Klarna’s ability to attract investment from such a wide range of investors is a testament to its innovative business model and the significant growth potential of the financial technology sector. The company’s continued success and expansion into new markets suggest that it will remain a major player in the global payments industry for years to come.

Revenue and Growth

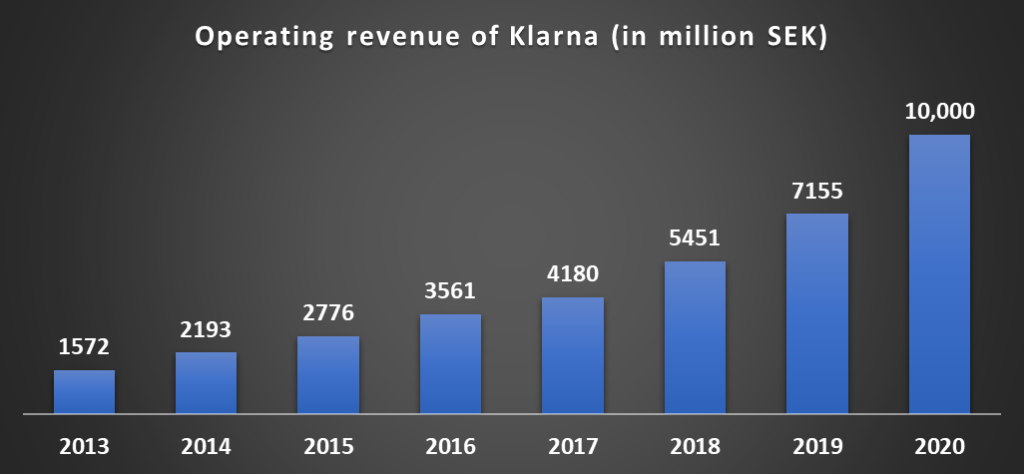

Klarna has experienced significant revenue growth since its founding in 2005. The company has expanded rapidly into new markets and has launched new products and services to meet the changing needs of consumers and merchants. Here are some key details about Klarna’s revenue and growth:

Revenue: Klarna’s revenue has grown steadily over the years, with the company reporting total revenues of $1.1 billion in 2020, up from $634 million in 2018. The company generates revenue primarily through transaction fees charged to merchants for payment processing and interest or fees charged to consumers for its financing services.

User base: Klarna has a rapidly growing user base, with over 16 million active users as of 2021. The company has expanded into over 20 markets, including the United States, the United Kingdom, Germany, and Australia, and has partnerships with thousands of merchants around the world.

Financing services: Klarna’s “Pay later” financing option has become a significant driver of growth for the company. In 2020, the company processed $35 billion in transactions through its financing services, up from $13 billion in 2018.

Valuation: Klarna has also experienced significant growth in its valuation. In June 2021, the company raised $639 million in a funding round led by SoftBank’s Vision Fund 2, which valued the company at $45.6 billion. This makes Klarna one of the most valuable privately-held companies in the world.

Overall, Klarna’s revenue and growth have been driven by its innovative payment and financing services, as well as its ability to provide value to both consumers and merchants. The company’s expansion into new markets and partnerships with leading retailers have helped it to build a strong brand and become a major player in the global payments industry.

Future of the Company

The future of Klarna looks promising, as the company continues to expand into new markets and develop new products and services. Here are some potential areas of growth for the company:

Expansion into new markets: Klarna has already expanded into over 20 markets around the world, but there are still many regions where the company could potentially grow its user base. For example, the company recently launched in Spain and Italy, and it may continue to target other countries in Europe, as well as Asia and Latin America.

Increased focus on sustainability: Klarna has made sustainability a key part of its brand and mission. The company is committed to reducing its carbon footprint and helping consumers make more sustainable choices. This focus on sustainability could help the company to attract environmentally conscious consumers and differentiate itself from competitors.

Continued development of new products: Klarna has a history of developing innovative new products and services that meet the changing needs of consumers and merchants. The company may continue to launch new products in areas like mobile payments, financial planning, and customer loyalty programs.

Expansion into new industries: While Klarna has primarily focused on the retail sector, the company may also explore opportunities in other industries, such as travel or healthcare. For example, the company recently launched a “buy now, pay later” service for healthcare expenses in the United States.

- Potential for an IPO: Klarna has not yet gone public, but there is speculation that the company could pursue an initial public offering (IPO) in the future. This would allow the company to access additional funding and provide liquidity for its existing investors.

Overall, the future of Klarna is likely to be shaped by its ability to continue to innovate and provide value to both consumers and merchants. With a strong brand and a history of growth, the company is well-positioned to remain a major player in the global payments industry for years to come.

To read more content like this, subscribe to our newsletter