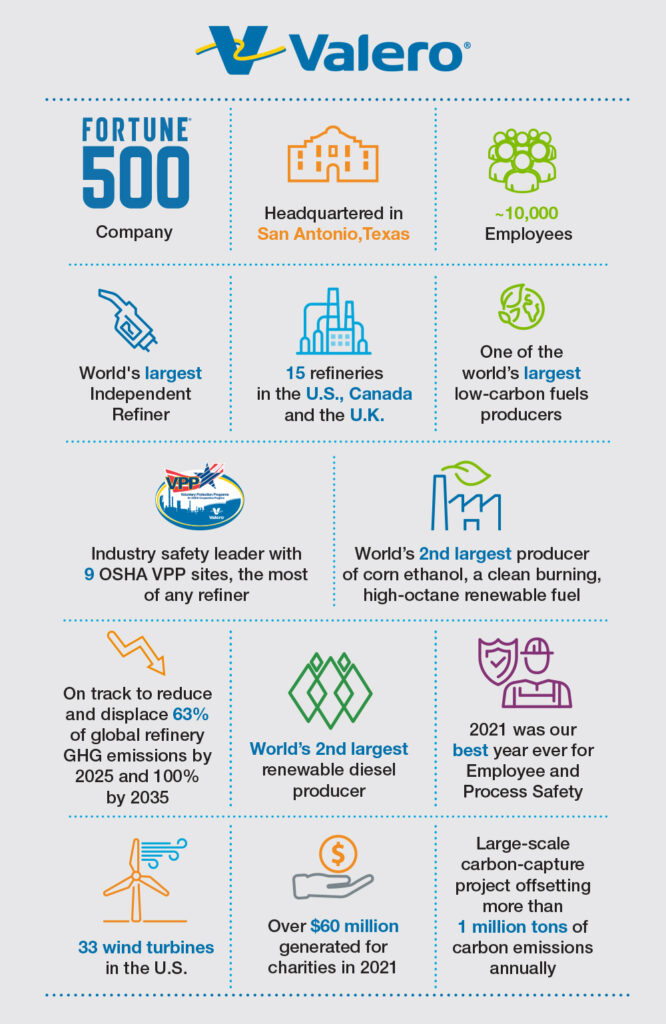

Valero Energy Corporation is an American multinational energy company that produces and refines petroleum and other fuels. The company is headquartered in San Antonio, Texas, and was founded in 1980 as a spinoff from Coastal States Gas Corporation.

Valero Energy operates 15 refineries across the United States, Canada, and the United Kingdom, with a total refining capacity of approximately 3.2 million barrels per day. The company’s refineries produce a wide range of products, including gasoline, diesel fuel, jet fuel, asphalt, and petrochemicals.

In addition to refining operations, Valero Energy also operates a network of retail fuel stations across the United States under the Valero, Diamond Shamrock, and Beacon brands. The company’s retail operations serve both individual consumers and commercial customers, offering gasoline, diesel fuel, and other products.

Valero Energy has grown significantly over the years through a combination of strategic acquisitions and organic growth. In 2005, the company acquired Premcor, Inc., a refining and marketing company with operations in the United States and Europe, for $8 billion USD. In 2011, Valero Energy acquired the Meraux Refinery in Louisiana from Murphy Oil Corporation for $325 million USD.

Despite its growth and success, Valero Energy faces a number of challenges, including volatile commodity prices, changing market conditions, and evolving regulatory requirements. The company has sought to address these challenges through ongoing investment in its refineries and other operations, as well as strategic partnerships and collaborations.

Overall, Valero Energy is a major player in the energy industry, with a strong presence in refining, retail, and other aspects of the fuel supply chain. The company’s continued focus on innovation, growth, and sustainability is likely to be key to its ongoing success in a rapidly changing market.

History of Valero Energy

Valero Energy was founded in 1980 in San Antonio, Texas, as a spinoff of the Coastal States Gas Corporation. The company’s founders, William Greehey and Donald L. Brinkman, initially focused on acquiring and operating oil refineries.

Valero Energy’s first refinery was located in Corpus Christi, Texas, and was purchased from the Coastal States Gas Corporation for $118 million USD. The refinery had a capacity of 85,000 barrels per day, and Valero Energy soon began investing in upgrades and improvements to increase its efficiency and profitability.

Over the next several years, Valero Energy continued to acquire and operate additional refineries across the United States, including facilities in California, Louisiana, and Tennessee. The company also invested heavily in research and development, seeking to improve its refining processes and products.

In 1997, Valero Energy made a significant strategic move when it acquired the Benicia Refinery in California from ExxonMobil for $895 million USD. The acquisition marked a major milestone for the company, as it gave Valero Energy a strong foothold in the lucrative California market and significantly expanded its refining capacity.

Valero Energy continued to grow and evolve over the following years, becoming one of the largest and most successful energy companies in the United States. Despite its success, the company has remained committed to its founding principles of innovation, efficiency, and profitability, and has continued to invest in research and development and other strategic initiatives to maintain its competitive edge in the rapidly changing energy market.

Products and Services of Valero Energy

Valero Energy Corporation is primarily engaged in the production and marketing of various petroleum products. The company produces and refines crude oil and other feedstocks into gasoline, diesel fuel, jet fuel, asphalt, and other products.

Valero Energy operates 15 refineries with a total refining capacity of approximately 3.2 million barrels per day. These refineries are located in the United States, Canada, and the United Kingdom, and are designed to process a wide range of crude oils and feedstocks.

Valero Energy’s refineries produce a variety of petroleum products, including:

Gasoline: Valero Energy is one of the largest producers of gasoline in the United States, producing several different grades of gasoline for use in cars, trucks, and other vehicles.

Diesel Fuel: Valero Energy produces diesel fuel for use in trucks, trains, boats, and other heavy-duty vehicles.

Jet Fuel: Valero Energy produces jet fuel for use in commercial and military aircraft.

Asphalt: Valero Energy produces asphalt, which is used in the construction of roads, highways, and other infrastructure projects.

Petrochemicals: Valero Energy also produces petrochemicals, which are used in the manufacture of a wide range of consumer and industrial products.

In addition to its refining operations, Valero Energy also operates a network of retail fuel stations under the Valero, Diamond Shamrock, and Beacon brands. These stations offer gasoline, diesel fuel, and other products to both individual consumers and commercial customers.

Mergers and Acquisitions (M&A) of Valero Energy

Valero Energy has a history of mergers and acquisitions (M&A) that have helped the company expand its operations and increase its market share. Here are some of Valero Energy’s notable M&A deals along with their deal amount:

Ultramar Diamond Shamrock (2001): Valero Energy acquired Ultramar Diamond Shamrock (UDS) for $6.7 billion, making it the largest refining company in North America at the time. The acquisition included UDS’s 14 refineries, 12,000 retail outlets, and extensive pipeline and transportation networks.

Premcor (2005): Valero Energy acquired Premcor for $8 billion, adding four refineries to its portfolio and increasing its refining capacity to 3.3 million barrels per day.

Sunoco (2018): Valero Energy acquired two California refineries from Sunoco for $1.2 billion, increasing its refining capacity in California and expanding its presence on the West Coast.

SemLogistics (2019): Valero Energy acquired SemLogistics, a fuel storage and logistics company based in the United Kingdom, for $127 million. The acquisition added two fuel storage terminals to Valero Energy’s European operations and strengthened its supply chain capabilities.

PBF Energy (2021): Valero Energy announced plans to acquire PBF Energy’s Martinez Refinery in California for $360 million. The acquisition is expected to increase Valero Energy’s refining capacity in California and strengthen its position in the West Coast market.

Overall, Valero Energy’s M&A strategy has been focused on expanding its refining operations and increasing its market share in key regions. The company has also been selective in its acquisitions, looking for opportunities that will complement its existing operations and add value to its business.

Revenue and Growth of Valero Energy

Valero Energy has seen steady growth in its revenue and profits over the years. The company has been able to achieve this through a combination of strategic acquisitions, operational efficiencies, and effective marketing strategies. Here’s a detailed look at Valero Energy’s growth and revenue:

Revenue growth: The company has experienced consistent revenue growth over the years, driven by its expanding operations and increasing market share. The company’s operating revenue has grown from $64 billion in 2020 to $176 billion in 2022.

Profit growth: Valero Energy’s profitability has also increased steadily over the years, thanks to the company’s focus on operational efficiency and cost management. The company’s net income has grown from $4.1 billion in 2017 to $2.4 billion in 2020, representing a CAGR of 23%.

Refining capacity growth: It has been expanding its refining capacity through acquisitions and organic growth. The company’s refining capacity has increased from 3 million barrels per day (bpd) in 2017 to 3.2 million bpd in 2020.

Market share growth: It has been able to increase its market share in key regions through strategic acquisitions and effective marketing strategies. The company has a significant presence in North America, Europe, and the Caribbean, and is one of the largest gasoline retailers in the United States.

Investment in renewable energy: Valero Energy has also been investing in renewable energy sources, including ethanol and renewable diesel. The company’s renewable fuels segment has seen significant growth in recent years, driven by increasing demand for low-carbon fuel alternatives.

Overall, Valero Energy’s growth and revenue are a testament to the company’s ability to adapt to changing market conditions and capitalize on opportunities for expansion. The company’s focus on operational efficiency, cost management, and strategic acquisitions has positioned it for continued growth in the years to come.

Also Read: Chevron Corp – The Energy Giant Like No Other

SWOT Analysis of Valero Energy

Here’s a detailed SWOT analysis of Valero Energy, highlighting the company’s strengths, weaknesses, opportunities, and threats:

Strengths:

Diversified operations: Valero Energy has a diversified portfolio of operations, including refining, marketing, and renewable energy. This diversification allows the company to mitigate risk and capture opportunities in different markets.

Strong market position: Valero Energy is one of the largest independent petroleum refiners in the world and has a significant market share in North America, Europe, and the Caribbean. The company’s strong market position provides it with a competitive advantage and helps it to generate steady revenue.

Operational efficiency: Valero Energy has a strong focus on operational efficiency and cost management, which allows the company to maintain a low-cost structure and generate strong margins even during periods of low commodity prices.

Investment in renewable energy: Valero Energy has been investing in renewable energy sources, including ethanol and renewable diesel, which positions the company well to benefit from the growing demand for low-carbon fuels.

Weaknesses:

Dependence on commodity prices: Valero Energy’s profitability is highly dependent on commodity prices, which can be volatile and unpredictable. This dependence can result in fluctuations in revenue and profitability.

Environmental concerns: Valero Energy’s operations have a significant environmental impact, which can result in increased regulatory scrutiny and public backlash.

Opportunities:

Expansion in emerging markets: Valero Energy has an opportunity to expand its operations in emerging markets, including Asia and the Middle East, where demand for petroleum products is expected to grow.

Growth in renewable energy: Valero Energy’s investment in renewable energy sources positions it well to benefit from the growing demand for low-carbon fuels.

Strategic acquisitions: Valero Energy has the opportunity to make strategic acquisitions that will complement its existing operations and add value to its business.

Threats:

Competition: Valero Energy operates in a highly competitive industry, and faces competition from other petroleum refiners and alternative fuel producers.

Regulatory risks: Valero Energy’s operations are subject to numerous environmental and safety regulations, which can result in increased compliance costs and regulatory fines.

Volatility in commodity prices: Valero Energy’s profitability is highly dependent on commodity prices, which can be volatile and unpredictable, and can result in fluctuations in revenue and profitability.

Overall, company’s SWOT analysis shows that the company has several strengths that can help it capitalize on opportunities in the market. However, the company also faces several challenges and threats that it must address to maintain its competitive position in the industry.

Brand Campaigns of Valero Energy

“Power of Performance” campaign: This campaign was launched in 2019 and aimed to showcase the company’s commitment to innovation and high-performance products. The campaign featured a series of television and digital ads that highlighted Valero’s investment in research and development, and its focus on delivering high-quality fuels and energy products.

“Driving America” campaign: This campaign was launched in 2016 and aimed to promote Valero’s contributions to the U.S. economy. The campaign featured a series of television ads and billboards that showcased the company’s commitment to job creation and economic growth, and highlighted the positive impact of Valero’s investments in the U.S. energy sector.

“Sustainability Matters” campaign: This campaign was launched in 2015 and aimed to promote Valero’s efforts to reduce its environmental impact and promote sustainable practices. The campaign featured a series of print and digital ads that highlighted Valero’s investment in renewable energy and its commitment to reducing greenhouse gas emissions and promoting sustainable energy practices.

“Pure Energy” campaign: This campaign was launched in 2014 and aimed to promote Valero’s gasoline products. The campaign featured a series of television ads and billboards that highlighted the performance benefits of Valero’s gasoline, including improved engine performance and fuel efficiency.

“Fueling Good” campaign: This campaign was launched in 2010 and aimed to showcase Valero’s philanthropic efforts and community outreach programs. The campaign featured a series of television ads and social media promotions that highlighted the positive impact of Valero’s charitable initiatives, including support for local schools, hospitals, and other community organizations.

Overall, Valero’s brand campaigns have been effective in promoting the company’s brand and products to a wide range of audiences. By highlighting the company’s commitment to innovation, sustainability, and community engagement, these campaigns have helped to build brand loyalty and establish Valero as a leader in the energy industry.

Read More: Inside ExxonMobil: Exploring World’s Largest Energy Corporation

Future of Valero Energy

Valero Energy is a leading energy company that has a strong presence in the refining, marketing, and logistics segments of the industry. Looking ahead, the company is well-positioned to continue to grow and expand its operations in the coming years.

One key area of focus for Valero Energy is its commitment to sustainability and reducing its environmental impact. The company has made significant investments in renewable energy and is working to develop new technologies and processes that will enable it to produce cleaner, more efficient fuels. In addition, Valero is actively pursuing partnerships and collaborations with other companies and organizations to advance sustainable practices throughout the energy industry.

Another area of growth for the company is its expanding retail network. The company has been investing in new retail locations and upgrading existing ones to better serve customers and improve its market share. Valero’s retail business is expected to continue to grow in the coming years as the company expands its footprint and develops new products and services to meet evolving customer needs.

In terms of financial performance, Valero Energy has a strong track record of delivering consistent revenue growth and shareholder value. The company has a solid balance sheet and generates significant cash flow, which allows it to reinvest in its business and pursue growth opportunities.

Overall, the future of the company looks bright, with the company well-positioned to capitalize on emerging trends and opportunities in the energy industry. By continuing to focus on sustainability, expanding its retail network, and driving innovation and efficiency throughout its operations, it is well-positioned to deliver strong financial results and drive long-term value for shareholders.

To read more content like this, subscribe to our newsletter

[wpforms id=”320″]