American Express, commonly known as Amex, is a renowned multinational financial services corporation headquartered in New York City. Established in 1850, the company has evolved into one of the world’s leading providers of credit cards, charge cards, and traveler’s checks, catering to a diverse range of customers, including individuals, businesses, and corporations.

American Express has built a reputation for its premium services and a focus on customer satisfaction. It offers a wide array of financial products and solutions, including credit and charge cards with various rewards programs, business expense management tools, merchant services, and travel-related services.

The company’s distinctive card offerings, such as the iconic Green, Gold, and Platinum cards, have become synonymous with luxury, prestige, and exclusive privileges. American Express also boasts an extensive network of merchants, enabling cardholders to access unique benefits, discounts, and experiences across different industries.

In addition to its consumer-focused operations, American Express provides comprehensive financial services to businesses of all sizes. Its corporate payment solutions facilitate streamlined expense management, corporate travel, and vendor payments, empowering organizations to optimize their financial processes.

Furthermore, American Express is recognized for its commitment to innovation and technology. The company actively explores digital advancements, harnessing data analytics, mobile applications, and emerging technologies to enhance the user experience and provide seamless and secure transactions.

As a prominent player in the global financial services sector, American Express continues to shape the industry with its unwavering commitment to excellence, customer-centric approach, and strong corporate values. Through its continued expansion and strategic partnerships, the company aims to empower individuals and businesses alike, enabling them to navigate the complexities of modern finance and achieve their financial goals.

Glorious History of American Express

American Express, one of the most recognizable names in the financial services industry, has a rich and fascinating founding history that dates back to the mid-19th century. Let’s delve into the details of how American Express came to be:

Origins and Early Years

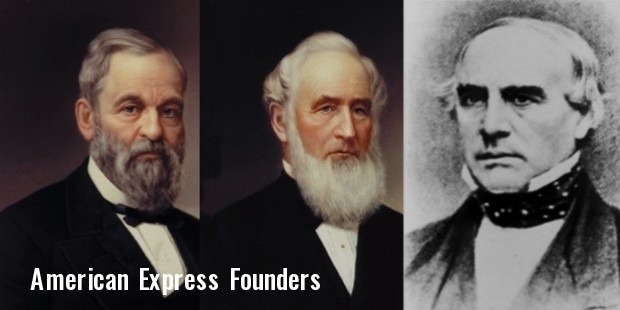

American Express was founded by Henry Wells, William G. Fargo, and John Warren Butterfield in Buffalo, New York, in 1850. The company’s original purpose was to provide a secure and efficient alternative to the United States Postal Service for delivering express packages, freight, and valuables.

At the time, Wells and Fargo were already established businessmen, having co-founded Wells Fargo & Company, a successful express and banking company operating primarily in the western United States. Butterfield, on the other hand, was a prominent entrepreneur involved in stagecoach operations.

Establishing a New Express Company

Seeking to expand their business ventures to the eastern United States, Wells, Fargo, and Butterfield identified a need for a reliable and fast express service that would cater to the growing population and businesses in the region. They saw an opportunity to capitalize on the transportation and communication advancements of the era, including the expanding railroad network.

On March 18, 1850, the trio launched their new enterprise, initially named Wells & Company. Their primary objective was to provide express services connecting Buffalo to major cities like New York and Boston.

Formation of American Express

In 1852, just two years after its inception, the company underwent a pivotal transformation. With a vision to extend their operations beyond regional boundaries and establish a national presence, Wells, Fargo, and Butterfield rebranded the company as American Express.

The new name represented their ambitious goal of becoming the preeminent express company in America. The founders believed that the name “American Express” captured the essence of their mission to connect people and businesses across the country through reliable and efficient express services.

Expansion and Innovations

Under the leadership of the founders, American Express quickly expanded its operations and became known for its commitment to innovation and customer service. The company embraced technological advancements, including the telegraph, which revolutionized communication and allowed for faster and more secure transactions.

American Express also forged partnerships with other express companies to establish a vast network of agents and offices across the United States. This strategic expansion enabled the company to serve a growing customer base and offer a comprehensive range of express services.

Entering the Financial Services Industry

In the late 19th century, American Express took a significant leap by venturing into the financial services industry. Recognizing the need for a reliable payment method for travelers, American Express introduced its first traveler’s cheque in 1891. This innovative product allowed individuals to carry a secure form of currency that could be easily replaced if lost or stolen.

The traveler’s cheque proved to be a resounding success, revolutionizing the way people conducted financial transactions while traveling. It provided a convenient and safe alternative to carrying large amounts of cash and quickly gained popularity among tourists and business travelers worldwide.

In the early 20th century, American Express further expanded its financial offerings by introducing its charge card, known as the American Express Card. Initially targeting affluent travelers and businesspeople, the charge card allowed customers to make purchases and defer payment until a later date, essentially establishing a credit system.

Over the years, American Express continued to refine its charge card and credit card offerings, introducing different tiers and rewards programs tailored to various customer segments. The iconic Green, Gold, and Platinum cards became symbols of prestige, exclusivity, and access to a host of privileges and benefits.

Modernization and Global Expansion

Throughout the 20th century, American Express continued to adapt and modernize its operations, embracing technological advancements and evolving consumer demands. The company leveraged electronic data processing, computerized transaction systems, and telecommunications to streamline its services and enhance customer experiences.

American Express expanded its presence globally, establishing offices in major cities around the world and forging partnerships with international banks and financial institutions. This global expansion allowed the company to cater to the needs of an increasingly interconnected and mobile customer base.

Diversification and Beyond

In addition to its core financial services, American Express diversified its offerings to cater to a broader range of customer needs. It ventured into areas such as merchant services, corporate expense management, financial planning, and investment services, providing comprehensive solutions to individuals, businesses, and corporations.

American Express also became synonymous with world-class customer service, known for its dedication to resolving customer issues and providing personalized assistance. The company built a strong reputation for its exceptional customer care, earning numerous accolades and industry recognition.

In recent years, American Express has continued to innovate and adapt to the evolving financial landscape. It has embraced digital technologies, mobile applications, and data analytics to provide convenient and secure payment solutions to its customers.

Today, American Express remains a global leader in the financial services industry, offering a diverse range of products and services to millions of customers worldwide. With its unwavering commitment to excellence, innovation, and customer satisfaction, American Express continues to shape the future of finance while staying true to its founding principles of reliability, security, and superior service.

Business Segments of American Express

American Express operates through various business segments, each catering to specific customer needs and providing a range of financial services. Let’s explore these segments in detail:

Global Consumer Services (GCS): The Global Consumer Services segment is focused on serving individual consumers, providing them with a wide range of financial products and services. This segment includes the issuance of proprietary consumer cards, such as charge cards and credit cards, offering various rewards programs and benefits.

Within GCS, American Express offers a tiered system of cards, including the Green, Gold, Platinum, and Centurion (Black) cards, each with its own set of perks and privileges. These cards are known for their exclusive benefits, such as airport lounge access, travel credits, concierge services, and enhanced purchase protection.

The GCS segment also encompasses personal savings and deposit products, as well as personal loans and installment lending services. Additionally, American Express provides digital payment solutions, allowing customers to make secure transactions online and through mobile devices.

Global Commercial Services (GCS): The Global Commercial Services segment caters to businesses of all sizes, offering a comprehensive suite of payment and expense management solutions. GCS helps companies streamline their financial operations, manage expenses, and optimize their cash flow.

Under GCS, American Express provides corporate cards that offer businesses greater control over employee spending and simplified expense reporting. These cards often come with specialized features tailored to specific industries, such as travel rewards and expense management tools.

American Express also offers a range of payment and financing solutions for corporate clients, including vendor payment services, working capital optimization, and foreign exchange services. These services help businesses manage their cash flow, improve liquidity, and mitigate financial risks.

Global Merchant and Network Services (GMNS): The Global Merchant and Network Services segment focuses on expanding American Express’ merchant network and enhancing merchant capabilities. This segment collaborates with merchants globally, enabling them to accept American Express cards as a form of payment and providing them with value-added services.

GMNS supports merchants with tools and solutions to enhance their business operations, including data analytics, marketing programs, and customer engagement strategies. By leveraging customer insights and transaction data, American Express helps merchants drive sales, improve customer loyalty, and optimize their business performance.

Additionally, GMNS oversees the operation and maintenance of the American Express network, ensuring secure and efficient processing of transactions globally. The network facilitates the authorization, clearing, and settlement of card transactions, supporting the seamless flow of funds between merchants, cardholders, and financial institutions.

Global Network & International Card Services (GNICS): The Global Network & International Card Services segment focuses on American Express’ international operations and partnerships. This segment collaborates with local banks and financial institutions to issue American Express-branded cards and expand the company’s presence in markets around the world.

GNICS also manages strategic alliances with international partners, enabling card acceptance and access to services for American Express cardholders when traveling abroad. This ensures that American Express customers can use their cards globally and enjoy the benefits and privileges associated with the brand.

Additionally, GNICS oversees the provision of foreign exchange and travel-related services for international travelers, including travel insurance, currency exchange, and global assistance services.

These distinct business segments collectively contribute to American Express’ overall success by serving a diverse range of customers and meeting their financial needs. Through these segments, American Express continues to innovate, provide exceptional customer experiences, and reinforce its position as a leading global financial services company.

Mergers & Acquisitions of American Express

American Express has a rich history of mergers and acquisitions that have played a significant role in shaping the company’s growth and expanding its range of financial services. Here is an overview of some notable mergers and acquisitions involving American Express, along with their deal amounts:

Shearson Loeb Rhoades (1981) – Deal Amount: $930 million

In 1981, American Express acquired Shearson Loeb Rhoades, a prominent investment banking and brokerage firm. This acquisition marked American Express’ entry into the financial services sector beyond its traditional focus on travel and entertainment. The deal amounted to $930 million, making it one of the largest acquisitions at the time.

First Data Resources (1992) – Deal Amount: $7.8 billion

In 1992, American Express acquired First Data Resources, a leading provider of payment processing and transaction services. This strategic acquisition allowed American Express to enhance its capabilities in processing credit card transactions and expanding its merchant network. The deal was valued at $7.8 billion.

Travel Related Services Company (1994)

American Express consolidated its operations under a single entity by merging its Travel Related Services Company with American Express Company in 1994. This merger brought together various business segments and brands under one corporate structure, streamlining operations and enabling synergies across different divisions.

Lehman Brothers’ Banking Business (1994) – Deal Amount: $360 million

American Express acquired the banking business of Lehman Brothers in 1994. This acquisition allowed American Express to expand its presence in the retail banking sector, including offering mortgages and other financial products. The deal was valued at $360 million.

Ameriprise Financial (2005) – Deal Amount: $1.6 billion

American Express spun off its financial advisory and asset management business, creating Ameriprise Financial as a separate entity in 2005. This move allowed American Express to focus on its core businesses while Ameriprise Financial became an independent wealth management company. American Express received $1.6 billion from the initial public offering (IPO) of Ameriprise Financial.

Revolution Money (2010) – Deal Amount: $300 million

In 2010, American Express acquired Revolution Money, a digital payments company founded by Steve Case, the co-founder of AOL. This acquisition aimed to strengthen American Express’ presence in the emerging digital payment space. The deal was valued at $300 million.

Kabbage (2020) – Deal Amount: Undisclosed

American Express acquired Kabbage, an online financial technology company focused on providing small business loans, in 2020. This acquisition aimed to bolster American Express’ capabilities in providing financial solutions to small and medium-sized enterprises. The deal amount was not disclosed.

These mergers and acquisitions demonstrate American Express’ strategic moves to diversify its business lines, expand its market presence, and enhance its offerings to customers. While some deals involved significant financial amounts, others focused on acquiring specific capabilities and expertise to drive innovation and growth in the evolving financial services landscape.

Financial Performance of American Express

American Express’s financial performance has been strong over the years. The company’s revenue has grown steadily, and its profits have increased even more rapidly. In 2022, American Express’s revenue was $55.6 billion, and its net income was $13.8 billion. This represents a 27.4% increase in revenue and a 30.3% increase in net income from the previous year.

American Express’s financial performance has been driven by a number of factors. The company has a strong brand, and it offers a wide range of credit cards that appeal to a variety of customers. American Express also has a strong focus on customer service, and it provides its customers with a number of benefits, such as travel rewards and airport lounge access.

American Express is a well-managed company with a strong financial performance. The company is well-positioned for continued growth in the future.

Here is a more detailed look at American Express’s financial performance over the past five years:

| Year | Revenue (in billions of dollars) | Net income (in billions of dollars) |

|---|---|---|

| 2022 | $55.6 | $13.8 |

| 2021 | $43.7 | $10.4 |

| 2020 | $38.2 | $7.9 |

| 2019 | $42.8 | $9.9 |

| 2018 | $40.4 | $8.8 |

As you can see, American Express’s revenue and net income have grown steadily over the past five years. The company’s revenue has increased by an average of 8.2% per year, and its net income has increased by an average of 11.4% per year.

American Express’s financial performance is strong, and the company is well-positioned for continued growth in the future. The company has a strong brand, a wide range of credit cards, and a focus on customer service. American Express is a good investment for investors who are looking for a company with a strong financial performance and a bright future.

Growth Strategy of American Express

American Express has implemented a comprehensive growth strategy that focuses on several key areas to expand its market presence, strengthen customer relationships, and drive innovation in the financial services industry. Here are the details of American Express’ growth strategy:

Customer-Centric Approach: At the core of American Express’ growth strategy is a customer-centric approach. The company strives to understand the evolving needs and preferences of its diverse customer base and tailors its products and services to meet those needs effectively. By maintaining a deep understanding of its customers, American Express aims to foster long-term loyalty and increase customer engagement.

Expanding Card Member Base: American Express continuously seeks to expand its card member base by targeting new customer segments and demographics. The company focuses on attracting and retaining customers who value the premium benefits, rewards programs, and exclusive services associated with American Express cards. This expansion strategy involves targeted marketing campaigns, partnerships with other companies, and innovative card offerings designed to appeal to different customer segments.

Global Expansion: American Express has a strong commitment to expanding its presence in international markets. The company aims to leverage its brand recognition and global network to establish partnerships with local financial institutions and extend its reach to new regions. By offering its products and services to a broader international customer base, American Express can tap into new sources of revenue and diversify its operations.

Strategic Partnerships and Alliances: To enhance its offerings and provide additional value to its customers, American Express forms strategic partnerships and alliances with various organizations. These collaborations may include merchants, airlines, hotels, and other companies that align with American Express’ customer base and business objectives. Through these partnerships, American Express can offer exclusive benefits, discounts, and rewards to its card members, further strengthening customer loyalty and engagement.

Digital Transformation and Innovation: American Express recognizes the importance of digital transformation and continuously invests in technology and innovation. The company leverages emerging technologies, data analytics, and digital platforms to enhance the customer experience, streamline operations, and develop new products and services. American Express embraces mobile payment solutions, digital wallets, and online account management tools to provide convenient and secure financial services in the digital age.

Focus on Small and Medium-Sized Enterprises (SMEs): American Express aims to be a trusted partner for small and medium-sized enterprises (SMEs) by offering tailored solutions to meet their unique financial needs. The company provides expense management tools, business credit cards, and financing options designed to simplify and optimize SMEs’ financial operations. By catering to this segment, American Express aims to capture a significant share of the growing SME market and foster long-term relationships with business owners.

Strengthening Merchant Relationships: American Express places a strong emphasis on building and nurturing relationships with merchants. The company works closely with merchants to offer value-added services, marketing support, and data analytics insights to help them grow their businesses. By providing tools and resources to enhance merchant capabilities, American Express aims to increase merchant acceptance of its cards and drive transaction volume.

Continuous Service and Operational Excellence: To support its growth strategy, American Express places a high emphasis on delivering exceptional customer service and operational excellence. The company invests in training its customer service representatives, implements robust security measures, and ensures seamless transaction processing. By providing reliable and top-quality service, American Express aims to differentiate itself from competitors and build a strong reputation for customer satisfaction.

American Express’ growth strategy revolves around understanding and anticipating customer needs, expanding its reach in domestic and international markets, fostering strategic partnerships, embracing digital innovation, and providing excellent customer service. Through these initiatives, American Express aims to strengthen its position as a leading global financial services company and drive sustainable growth in the years to come.

Role of American Express in 2008 financial crisis

During the 2008 financial crisis, American Express, like many other financial institutions, faced significant challenges and experienced the impact of the economic downturn. Here’s a detailed explanation of the role of American Express in the 2008 financial crisis:

Exposure to the Mortgage Market: American Express, primarily known for its credit card and financial services, had limited exposure to the subprime mortgage market that triggered the crisis. Unlike banks heavily involved in mortgage lending, American Express did not have a significant portfolio of mortgage-backed securities or subprime loans.

Impact on Cardholders and Spending: Although American Express was not directly involved in the mortgage crisis, the overall economic turmoil had an indirect impact on the company. As the crisis unfolded, consumer confidence declined, leading to reduced consumer spending. This decrease in spending affected American Express cardholders and their ability to repay outstanding credit card balances.

Increased Delinquencies and Charge-Offs: As unemployment rates rose and individuals faced financial hardships, American Express experienced an increase in delinquencies and charge-offs. Cardholders who were unable to make timely payments or defaulted on their obligations contributed to a rise in losses for the company. American Express, like other credit card issuers, had to adjust its risk management strategies and make provisions for potential losses.

Government Assistance and Regulatory Measures: In response to the financial crisis, the U.S. government implemented several measures to stabilize the financial system. American Express, despite not being a traditional bank, was granted approval to convert into a bank holding company. This change allowed the company to access funding from the Troubled Asset Relief Program (TARP), which was established to provide capital to financial institutions.

Capital Infusion and Repayment: As part of the government’s assistance, American Express received $3.39 billion in capital injection from the TARP program. This infusion helped strengthen the company’s financial position and mitigate the impact of the crisis. However, American Express was determined to regain its financial independence and stability. The company repaid the TARP funds in full, including the associated dividends, by 2009, showcasing its ability to rebound from the crisis.

Strategic Focus and Risk Management: The 2008 financial crisis prompted American Express to reevaluate its business strategies and risk management practices. The company implemented stricter lending standards, tightened credit lines, and enhanced its risk assessment models to better identify potential credit risks and manage exposure to delinquencies and charge-offs.

Shift in Business Model: Following the crisis, American Express adjusted its business model to reduce reliance on borrowing and diversify revenue sources. The company focused on expanding its fee-based services, such as travel and entertainment partnerships, merchant services, and financial advisory offerings, to mitigate risks associated with credit lending.

Resilience and Recovery: Despite the challenges faced during the financial crisis, American Express demonstrated resilience and embarked on a path to recovery. The company actively managed its portfolio, worked with cardholders to navigate financial difficulties, and implemented strategic initiatives to regain profitability and rebuild customer confidence.

Overall, while American Express experienced some adverse effects from the 2008 financial crisis, its limited exposure to the mortgage market and proactive risk management strategies helped mitigate the impact. The company’s ability to adapt, repay government assistance, and refocus its business model played a crucial role in its recovery and subsequent growth in the years following the crisis.

Also Read: The Business of Banking: Analysis of US Major Bank Wells Fargo

Controversies involving American Express

American Express, like many large corporations, has faced its share of controversies over the years. Here are some notable controversies surrounding American Express, explained in detail:

Merchant Fees and Antitrust Lawsuits: One significant controversy involving American Express relates to its merchant fees and the resulting antitrust lawsuits. American Express charges higher fees to merchants compared to other credit card networks, citing the added value and benefits it provides to cardholders. This practice has led to legal disputes, with merchants arguing that American Express’ fee structure violates antitrust laws by limiting their ability to steer customers towards lower-cost payment options. The company has faced multiple lawsuits, including a high-profile case with the U.S. Department of Justice and various merchant groups.

Foreign Exchange Rate Manipulation: In 2018, it was reported that American Express had engaged in misleading practices related to foreign exchange (forex) rates charged to its customers. The company was accused of providing less favorable exchange rates to cardholders making international transactions, resulting in higher costs for customers. American Express settled with the U.S. Securities and Exchange Commission (SEC) and the Office of the Comptroller of the Currency (OCC) by agreeing to pay fines and reimburse affected customers.

Misleading Sales Practices: American Express has also faced scrutiny over misleading sales practices. In 2012, the Consumer Financial Protection Bureau (CFPB) and the Federal Reserve ordered American Express to pay $85 million in refunds to customers for deceptive marketing and billing practices. The investigation revealed that American Express had misrepresented rewards programs, failed to provide promised benefits, and charged unauthorized fees.

Discrimination in Cardholder Practices: American Express has been accused of discriminatory practices in its treatment of cardholders. In 2013, the company faced a lawsuit filed by the U.S. Department of Justice, alleging that American Express discriminated against certain cardholders based on age and gender in the sale of credit card add-on products. American Express settled the lawsuit by agreeing to pay $85 million in customer refunds and changing its business practices.

Data Security Breach: In 2013, American Express experienced a significant data breach where hackers gained unauthorized access to customer information, including names, account numbers, and security codes. The breach affected approximately 76,000 American Express cardholders. The incident raised concerns about the company’s data security measures and its ability to protect sensitive customer information.

Customer Service Issues: American Express has faced criticism regarding its customer service, particularly in handling customer disputes and complaints. Some cardholders have expressed dissatisfaction with the company’s response to billing errors, fraud claims, and other customer concerns. While American Express has taken steps to improve customer service, addressing these issues remains an ongoing challenge.

It’s worth noting that while American Express has faced controversies, the company has also taken steps to address and resolve these issues. It has implemented changes in its business practices, paid fines and refunds to affected customers, and worked to improve customer service. As with any large corporation, ongoing vigilance and efforts to maintain transparency and accountability are crucial for American Express to rebuild trust and uphold its reputation.

To read more content like this, subscribe to our newsletter