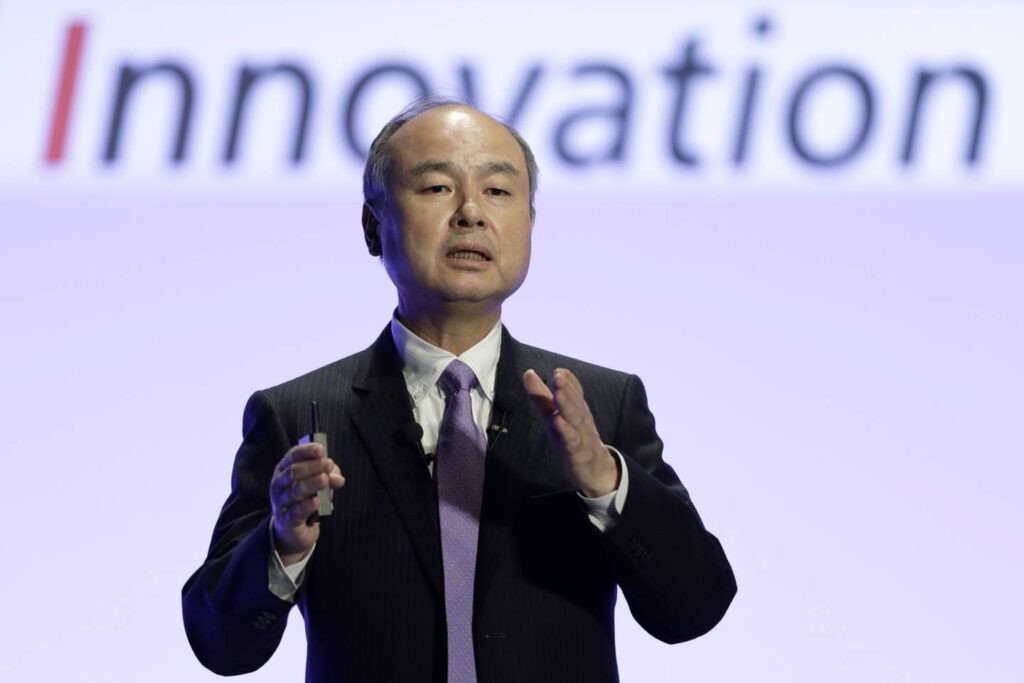

In the dynamic landscape of technology and innovation, one name stands out as a catalyst for transformative change and disruption: SoftBank. As a global conglomerate and investment firm based in Japan, SoftBank has carved a remarkable path, not only through its diverse portfolio of investments but also through its visionary leadership. With its founder and CEO, Masayoshi Son, at the helm, SoftBank has become synonymous with bold ventures, audacious bets, and a relentless pursuit of shaping the future.

Founded in 1981, SoftBank started as a software wholesaler, laying the foundation for what would eventually become a powerhouse in the world of technology and telecommunications. Over the years, the company expanded its reach and diversified its interests, delving into a vast array of industries and sectors. Today, SoftBank’s influence spans telecommunications, e-commerce, robotics, artificial intelligence, renewable energy, and more.

What truly sets SoftBank apart is its investment arm, the Vision Fund. Launched in 2017 with a staggering $100 billion in committed capital, the Vision Fund has revolutionized the investment landscape. It has enabled SoftBank to fund and support groundbreaking companies that have redefined entire industries, from ride-hailing and co-working spaces to food delivery and digital payments. SoftBank’s investment strategy focuses on identifying disruptive technologies, nurturing their growth, and accelerating their global expansion.

However, SoftBank’s impact extends beyond financial investments. The company’s vision goes beyond mere profit-seeking; it strives to leverage technology to solve some of humanity’s most pressing challenges. SoftBank’s initiatives in renewable energy, such as its significant investment in solar power projects, demonstrate its commitment to sustainability and a greener future.

While SoftBank’s journey has been marked by numerous successes, it has also weathered its share of challenges. The high-profile missteps, like the WeWork debacle, have highlighted the risks inherent in the company’s ambitious approach. Nevertheless, SoftBank’s ability to adapt, learn from setbacks, and pivot towards new opportunities has allowed it to maintain its position as a key player in the global tech landscape.

In this article, we will delve deeper into SoftBank’s transformative role in shaping the future, exploring its investment strategy, key ventures, and the broader implications of its actions. We will examine the visionary leadership of Masayoshi Son, the successes and failures of the Vision Fund, and the impact of SoftBank’s investments on industries and society as a whole. Join us as we explore the enigmatic world of SoftBank and the extraordinary influence it wields in our ever-evolving digital age.

The Founding History of SoftBank: From Software Wholesaler to Global Tech Powerhouse

SoftBank has a founding history that is deeply rooted in the world of software and telecommunications. The company was established in September 1981 by Masayoshi Son, a young and ambitious entrepreneur with a vision to harness the potential of emerging technologies.

At its inception, SoftBank was primarily a software wholesaler, importing and distributing packaged software to retailers across Japan. Masayoshi Son, armed with his keen entrepreneurial spirit and an understanding of the transformative power of technology, recognized the burgeoning opportunities in the nascent software industry. He sought to capitalize on the growing demand for software applications and computer technology, especially with the advent of personal computers.

SoftBank’s early years were marked by perseverance and the pursuit of innovation. The company thrived by forging strategic partnerships with renowned software developers and expanding its product offerings. Its commitment to delivering high-quality software solutions earned SoftBank a solid reputation in the industry and laid the groundwork for its future growth.

In 1984, SoftBank made a significant move by establishing a joint venture with California-based software distributor, ComputerLand Corporation. This partnership allowed SoftBank to gain access to cutting-edge software from the United States, which it could then distribute throughout Japan. The joint venture opened doors to a broader market, and SoftBank quickly emerged as a dominant player in the Japanese software industry.

As the technology landscape continued to evolve, SoftBank recognized the immense potential of telecommunications. In 1994, the company made a strategic pivot by entering the telecommunications market, capitalizing on the liberalization of Japan’s telecommunications industry. SoftBank ventured into various telecommunication services, including fixed-line telephone services, mobile communications, and broadband internet.

One of the pivotal moments in SoftBank’s history came in 2006 when the company made a bold move by acquiring Vodafone Japan, the Japanese subsidiary of British telecommunications giant Vodafone Group. This acquisition, which was the largest-ever acquisition in Japanese history at the time, enabled SoftBank to expand its presence in the mobile communications market exponentially.

Under Masayoshi Son’s visionary leadership, SoftBank continued to diversify its investments and expand its global footprint. The company made strategic acquisitions and investments in a wide range of industries, including e-commerce, internet services, robotics, artificial intelligence, clean energy, and finance. Notable investments include Alibaba Group, Yahoo Japan, Sprint Corporation, ARM Holdings, and WeWork, among many others.

In 2017, SoftBank launched the SoftBank Vision Fund, a groundbreaking investment vehicle with a capital commitment of $100 billion. The Vision Fund, led by Masayoshi Son, aimed to support and fund disruptive and transformative technologies worldwide. The fund’s substantial investments in companies such as Uber, Slack, DoorDash, and ByteDance have reshaped entire industries and cemented SoftBank’s position as a global tech powerhouse.

However, SoftBank’s journey has not been without challenges. The company faced setbacks, including the highly publicized financial struggles of its portfolio company, WeWork, which led to significant write-downs and reputational damage. Nevertheless, SoftBank has demonstrated resilience and adaptability, pivoting its investment strategy and focusing on solidifying the performance of its portfolio companies.

Today, SoftBank continues to push boundaries and redefine industries through its diverse portfolio of investments and ambitious vision. Masayoshi Son’s unwavering belief in the transformative power of technology, combined with SoftBank’s entrepreneurial spirit and global reach, have solidified the company’s position as a driving force in the world of innovation.

As SoftBank continues to shape the future of technology and investment, it remains an emblem of entrepreneurship, vision, and boldness. From its humble beginnings as a software wholesaler to its current status as a global conglomerate, SoftBank’s founding history is a testament to the power of innovation and the enduring impact of a visionary leader.

The SoftBank Vision Fund: Revolutionizing Investment and Reshaping Industries

In 2017, SoftBank unleashed a game-changing investment vehicle that would disrupt the traditional investment landscape and propel the company to new heights: the SoftBank Vision Fund. Led by its charismatic founder and CEO, Masayoshi Son, the Vision Fund set out to redefine the way technology startups were funded, accelerating innovation and transforming industries in the process.

At its core, the SoftBank Vision Fund is a massive investment fund focused on identifying and supporting visionary companies that are driving technological advancements across various sectors. With an unprecedented capital commitment of $100 billion, the Vision Fund instantly became the largest technology investment fund in the world, dwarfing its competitors and signaling SoftBank’s ambitious vision for the future.

The sheer scale of the Vision Fund enabled SoftBank to undertake audacious investments that had the potential to reshape entire industries. By pouring massive amounts of capital into disruptive startups, the fund aimed to propel these companies into global leadership positions and create substantial returns on investment.

The Vision Fund’s investment strategy is rooted in three key principles: identifying transformative technologies, fostering rapid growth, and expanding global market presence. SoftBank seeks out companies that possess disruptive technologies with the potential to revolutionize traditional industries and drive significant change. These technologies often include artificial intelligence, robotics, autonomous vehicles, biotechnology, and more.

Once identified, the Vision Fund provides these companies with unprecedented financial resources, allowing them to scale at an unprecedented pace. By injecting substantial capital, the fund accelerates their growth trajectories, empowering them to expand their operations, develop cutting-edge products, and penetrate new markets rapidly.

Beyond financial support, SoftBank leverages its vast network, industry expertise, and global reach to assist portfolio companies in navigating complex challenges and unlocking new opportunities. The Vision Fund’s portfolio companies gain access to invaluable resources, strategic guidance, and synergistic partnerships within SoftBank’s ecosystem, fostering a collaborative and mutually beneficial relationship.

The impact of the SoftBank Vision Fund has been far-reaching, reshaping industries, and redefining market dynamics. One of the most prominent examples of this influence is Uber, the ride-hailing giant. SoftBank’s investment in Uber provided the company with a significant cash infusion, enabling it to expand its global operations, invest in research and development, and pursue strategic acquisitions. The Vision Fund’s involvement helped solidify Uber’s market dominance and paved the way for its successful IPO.

Another notable investment is WeWork, a company that aimed to revolutionize the concept of shared workspaces. SoftBank’s significant investment in WeWork propelled the company’s rapid expansion, leading to a surge in valuations. However, WeWork’s subsequent financial struggles and governance issues highlighted the risks associated with the Vision Fund’s high-risk, high-reward approach.

Despite the challenges faced with WeWork, the Vision Fund’s portfolio includes numerous success stories. Companies such as Slack, DoorDash, and ByteDance (the parent company of TikTok) have experienced exponential growth and become household names, disrupting industries and capturing significant market share.

The impact of the Vision Fund extends beyond individual companies. Its massive investments have created a ripple effect throughout the tech investment landscape, prompting other venture capital firms and institutional investors to raise their stakes and make bolder bets on emerging technologies. The Vision Fund has injected a new level of competitiveness and urgency into the investment landscape, spurring a global race for technological dominance.

However, the Vision Fund’s ambitious approach has not been without criticism. The fund’s concentration of capital and willingness to overlook profitability in the pursuit of growth has raised concerns about valuation bubbles and potential market distortions. Additionally, the high-profile challenges faced by some portfolio companies have led to scrutiny regarding due diligence processes and risk management.

Nonetheless, the SoftBank Vision Fund’s impact on SoftBank itself cannot be overstated. The fund has solidified SoftBank’s position as a leading global technology investor, attracting attention from industry peers, entrepreneurs, and the financial world at large. It has also provided SoftBank with a steady stream of capital gains, contributing significantly to its financial performance.

Looking ahead, SoftBank’s commitment to the Vision Fund remains steadfast. The company has announced plans to launch subsequent Vision Funds, expanding its investment reach and further solidifying its position as a dominant player in the technology investment landscape.

Why is SoftBank respected around the world?

SoftBank has garnered widespread respect and admiration on a global scale. The company’s remarkable journey, driven by visionary leadership, a commitment to innovation, and transformative investments, has established SoftBank as a revered name in the business and technology world. Let’s delve into the key factors that contribute to SoftBank’s global respect.

Visionary Leadership: At the heart of SoftBank’s success lies the leadership of its founder and CEO, Masayoshi Son. Known for his boldness, foresight, and unwavering belief in the power of technology, Son has carved a unique path for SoftBank. His visionary approach has propelled the company to explore new horizons, take calculated risks, and seize opportunities that others may have overlooked. Son’s ability to anticipate industry shifts, identify emerging trends, and make audacious bets has earned him and SoftBank immense respect.

Transformational Investments: SoftBank’s investment prowess has played a significant role in earning global respect. The company has a proven track record of identifying and nurturing game-changing startups. Through its SoftBank Vision Fund and other investment vehicles, SoftBank has injected massive capital into innovative companies, allowing them to scale rapidly, disrupt industries, and reshape market dynamics. Its investments in companies such as Alibaba Group, ARM Holdings, and Uber have generated substantial returns and contributed to the success of the invested ventures.

Disruption and Innovation: SoftBank’s focus on disruptive technologies and fostering innovation has earned it a reputation as a trailblazer. The company recognizes that transformative technologies hold the key to shaping the future, and it actively seeks out startups and ventures that push the boundaries of what is possible. SoftBank’s involvement in artificial intelligence, robotics, biotechnology, and other cutting-edge fields demonstrates its commitment to driving technological advancement and embracing the opportunities they present.

Global Reach and Influence: SoftBank’s global presence and influence have contributed to its respected status. The company’s investments span continents and industries, fostering cross-border collaborations and facilitating the exchange of knowledge and expertise. SoftBank’s ability to bridge markets and connect businesses has positioned it as a catalyst for international growth and collaboration, strengthening its reputation as a global player with a broad impact.

Resilience and Adaptability: SoftBank’s ability to weather challenges and adapt to evolving circumstances has contributed to its respected status. The company has faced setbacks and learned from its mistakes, demonstrating resilience in the face of adversity. SoftBank’s capacity to pivot its investment strategies, refine its portfolio, and navigate complex business landscapes showcases its agility and ability to stay relevant in a rapidly changing world.

Positive Impact on Job Creation and Economic Growth: SoftBank’s investments have had a tangible impact on job creation and economic growth, particularly in the technology sector. By supporting startups and fostering their growth, SoftBank has played a role in fueling entrepreneurship, creating employment opportunities, and driving economic prosperity. Its contributions to job creation and economic development are recognized and respected by governments, industry leaders, and communities worldwide.

SoftBank’s global respect is a culmination of its visionary leadership, transformative investments, commitment to innovation, global influence, sustainability initiatives, adaptability, and positive impact on economies. As SoftBank continues to shape the future through its investments and ventures, its respected status is likely to endure, cementing its position as a key player in the global business and technology landscape.

The Financial Growth Trajectory of SoftBank

In fiscal year 2022, SoftBank’s net income attributable to owners of the Company increased by ¥14.3 billion (2.8%) year on year to ¥531.4 billion. This was driven by the strong performance of its Vision Funds, which invested in a number of successful technology companies, including Alibaba Group Holding Limited, Coupang, and DoorDash.

SoftBank’s financials are expected to continue to grow in the coming years, as it continues to invest in technology companies. The company has a large war chest of cash, and it is looking for opportunities to invest in the next generation of technology companies.

Here are some of the key drivers of SoftBank’s financial growth:

- Strong performance of the Vision Funds: The Vision Funds are a series of investment funds that SoftBank has raised to invest in technology companies. The funds have been very successful, and they have helped to drive SoftBank’s financial growth.

- Investments in successful technology companies: SoftBank has invested in a number of successful technology companies, including Alibaba Group Holding Limited, Coupang, and DoorDash. These investments have helped to drive SoftBank’s financial growth.

- Large war chest of cash: SoftBank has a large war chest of cash, which it is looking to invest in the next generation of technology companies. This cash position gives SoftBank a significant advantage over other technology investors.

Overall, SoftBank’s financials are expected to continue to grow in the coming years. The company has a strong track record of investing in technology companies, and it has a large war chest of cash to fund its investments.

Challenges Ahead for SoftBank: Navigating Complexity in a Changing Landscape

SoftBank faces a multitude of challenges as it continues its ambitious journey in the ever-evolving business and technology landscape. While SoftBank has enjoyed significant successes and earned global respect, the road ahead presents several complex hurdles that require careful navigation and strategic decision-making. Let’s explore some of the key challenges that lie ahead for SoftBank.

Portfolio Performance and Risk Management: SoftBank’s extensive portfolio of investments encompasses a diverse range of industries and companies, each with its own set of risks and growth trajectories. The performance of portfolio companies, especially high-profile investments such as WeWork, has a direct impact on SoftBank’s financial performance and reputation. Effectively managing risk, conducting thorough due diligence, and making informed investment decisions will be crucial to ensuring long-term profitability and mitigating potential losses.

Economic Uncertainty and Market Volatility: Global economic fluctuations and market volatility present ongoing challenges for SoftBank. Economic downturns, geopolitical tensions, and unforeseen events can disrupt industries and impact the valuation and growth prospects of portfolio companies. SoftBank’s ability to navigate through economic uncertainties, adapt its investment strategies, and identify resilient sectors and opportunities will be key to maintaining stability and maximizing returns.

Regulatory and Legal Considerations: SoftBank operates in multiple jurisdictions, each with its own regulatory frameworks and legal requirements. Compliance with evolving regulations, antitrust laws, and data privacy regulations poses challenges for the company’s investments and operations. SoftBank must stay abreast of changing regulatory landscapes, effectively manage compliance risks, and ensure that its investments align with legal requirements to avoid legal disputes and reputational damage.

Geopolitical Dynamics and Trade Relations: SoftBank’s global presence exposes it to geopolitical risks and trade tensions. Shifts in trade policies, geopolitical disputes, and changing international relations can impact cross-border investments and hinder global expansion opportunities. Adapting to geopolitical dynamics, diversifying investment strategies across regions, and building resilient partnerships will be crucial for SoftBank to navigate geopolitical challenges successfully.

Technological Disruptions and Industry Shifts: The rapid pace of technological advancements and disruptive innovations pose both opportunities and challenges for SoftBank. The company must continuously identify emerging technologies, invest in the right companies, and adapt its portfolio to capture new growth areas while staying ahead of industry shifts. Failure to anticipate industry disruptions or missing out on emerging trends could result in missed opportunities and loss of competitive advantage.

Managing Debt and Financial Liabilities: SoftBank’s significant debt burden, primarily stemming from its investment activities, poses financial challenges. Managing debt levels, ensuring sufficient liquidity, and optimizing capital structure will be critical to maintaining financial stability and flexibility. SoftBank must carefully balance its leverage and cash flow management to support its investment strategies while managing potential financial risks.

Reputation and Public Perception: SoftBank’s reputation and public perception are essential assets in attracting investments, securing partnerships, and maintaining stakeholder trust. The company’s high-profile investments, such as WeWork, have faced scrutiny and garnered negative attention, impacting SoftBank’s reputation. Maintaining transparency, improving governance practices, and effectively communicating its strategic vision and investment rationale will be crucial in rebuilding and strengthening trust among investors and stakeholders.

Navigating these challenges requires strategic foresight, adaptability, and a comprehensive risk management framework. SoftBank’s leadership, including Masayoshi Son, will play a pivotal role in guiding the company through these complexities, leveraging their experience, vision, and expertise to make informed decisions and capitalize on emerging opportunities.

As SoftBank continues its quest to shape the future through visionary investments, successfully addressing these challenges will be paramount in sustaining its global influence and reputation as a leading force in the business and technology world.

Also Read: The Rise and Challenges of Uber: A Story of Disruption

To read more content like this, subscribe to our newsletter