The Goldman Sachs Group, Inc., often simply referred to as Goldman Sachs, stands as a renowned American multinational investment bank and financial services institution. Founded in the year 1869, this financial powerhouse has its headquarters nestled in Lower Manhattan, New York City, and boasts an expansive global presence with regional headquarters strategically located in London, Warsaw, Bangalore, Hong Kong, Tokyo, Dallas, and Salt Lake City. Additionally, it operates numerous other offices across key international financial hubs, cementing its status as a global player in the financial services sector.

Goldman Sachs has firmly established itself as a behemoth in the financial industry, holding the coveted position of the second-largest investment bank globally, measured by revenue. It further solidifies its significance in the corporate world, securing the 55th spot on the prestigious Fortune 500 list, which ranks the largest corporations in the United States based on total revenue. Moreover, Goldman Sachs carries the distinction of being recognized as a systemically important financial institution by the Financial Stability Board, underscoring its crucial role in the global financial system.

While the company’s track record has been marked by financial success and prestige, it has not been without its share of controversies and criticisms. Goldman Sachs has faced scrutiny for ethical lapses, collaborations with authoritarian regimes, close ties with the U.S. federal government through a “revolving door” of former employees, and allegations of inflating commodity prices through futures speculation. On the flip side, the company has often found its name on Fortune’s list of the “Best Companies to Work For,” primarily due to its generous compensation packages. However, this accolade has been juxtaposed with complaints from its workforce, including grueling 100-hour work weeks, high levels of employee dissatisfaction among entry-level analysts, allegations of abusive treatment by superiors, a shortage of mental health resources, and excessively high levels of workplace stress leading to physical discomfort.

Goldman Sachs not only deals with traditional financial services but also actively engages in investments and financing for startups. The company’s involvement often extends to securing business opportunities when these startups make their initial public offerings (IPOs). Some notable IPOs where Goldman Sachs played a pivotal role include Twitter’s IPO in 2013 and several other prominent offerings in 2021. The firm has also invested in a range of startups, including well-known names like Spotify, Foodpanda, and Dropbox, solidifying its influence in the tech and startup ecosystems. Additionally, Goldman Sachs holds the distinction of being a partner organization of the World Economic Forum, further underlining its significance in the global economic landscape.

In this article, we will delve deeper into the success story of Goldman Sachs, exploring the key factors that have contributed to its rise as a financial giant and examining the challenges and controversies it has faced along the way.

Success Story of Goldman Sachs

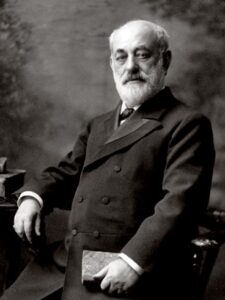

Goldman Sachs, founded in the heart of New York City in 1869 by Marcus Goldman, has embarked on a remarkable journey of financial success and transformation over its storied history. Through the decades, this financial institution has grown to become a global giant, leaving a mark on the world of finance and investment.

The Pioneering Years: Late 19th Century

The Goldman Sachs story began with humble origins when Marcus Goldman established the firm. However, it was in 1882 that the company’s trajectory took a significant turn when Samuel Sachs, Marcus’s son-in-law, joined the ranks. Three years later, Henry Goldman, Marcus’s son, and Ludwig Dreyfuss, Samuel’s son-in-law, came on board, leading to the adoption of the name we know today: Goldman Sachs & Co.

During this period, the firm’s innovative spirit shone as it pioneered the use of commercial paper to assist entrepreneurs. In 1896, Goldman Sachs took a momentous step by joining the New York Stock Exchange (NYSE), solidifying its presence in the world of financial markets. By 1898, the company had amassed capital amounting to $1.6 million, setting the stage for growth and expansion.

Venturing into Investment Banking: Early 20th Century

Goldman Sachs made a significant foray into the world of initial public offerings (IPOs) in 1906 when it facilitated the IPO of Sears, Roebuck and Company, thanks in part to Henry Goldman’s personal relationship with Julius Rosenwald, a key figure at Sears. This marked the beginning of a series of successful IPOs, including those of F. W. Woolworth and Continental Can.

In 1912, a historic moment occurred as Henry S. Bowers became the first non-member of the founding family to become a partner at the firm, symbolizing its commitment to growth and evolution. However, 1917 brought about challenges when Henry Goldman, under pressure due to his pro-German stance during World War I, resigned. Nevertheless, the Sachs family maintained control, and Waddill Catchings joined in 1918, further solidifying the firm’s position in the financial world.

Navigating Challenges: 1920s to Mid-20th Century

The 1920s were a time of transformation and challenges for Goldman Sachs. In 1928, the firm launched the Goldman Sachs Trading Corp, a closed-end fund. However, this endeavor met with adversity as it faced allegations of share price manipulation and insider trading, eventually culminating in the Stock Market Crash of 1929.

Under the leadership of Sidney Weinberg in the 1930s, Goldman Sachs shifted its focus from trading to investment banking, steering the firm towards more stable and reputable waters. Weinberg’s strategic decisions, including advising on Ford Motor Company’s IPO in 1956 and pioneering investment research and risk arbitrage, helped rebuild the firm’s reputation and solidify its presence on Wall Street.

Late 20th Century and Beyond: Innovation and Expansion

The late 20th century saw Goldman Sachs thrive under leaders like Gus Levy, who brought innovation to securities trading, and Stanley R. Miller, who oversaw the firm’s first international office in London. During this period, Goldman Sachs introduced the concept of the “white knight” strategy to defend companies against hostile takeovers.

Robert Rubin and Stephen Friedman took the reins in 1990, focusing on globalization, mergers, and acquisitions. Goldman Sachs played a pivotal role in key financial events, such as underwriting Microsoft’s IPO, advising General Electric on its acquisition of RCA, and participating in global debt offerings.

New Horizons in the 21st Century

In the 21st century, Goldman Sachs continued to evolve and diversify its offerings. It ventured into consumer financial products, launching GS Bank and Marcus by Goldman Sachs in the mid-2010s. The partnership with Apple in 2019 led to the creation of the Apple Card, a testament to the firm’s adaptability in an ever-changing financial landscape.

However, the firm also faced challenges, notably the fallout from the 2008 financial crisis, which resulted in a significant fine and scrutiny over executive bonuses. Additionally, the 1Malaysia Development Berhad (1MDB) scandal in the 2020s led to substantial legal penalties.

As of July 2023, Goldman Sachs finds itself navigating turbulent waters, with declining revenues and increasing scrutiny. The company remains a prominent player in the world of finance, but it faces the challenges of adapting to a rapidly changing global economy.

Goldman Sachs’ journey from its modest beginnings to its current status as a financial powerhouse is a testament to its ability to adapt, innovate, and overcome adversity. The firm’s enduring legacy is a reflection of its relentless pursuit of excellence in the world of finance, and its story continues to unfold in the dynamic landscape of the 21st century.

Success Factors of Goldman Sachs

Goldman Sachs has enjoyed remarkable success over its long history. This success can be attributed to a combination of factors that have shaped its business model and culture. Let’s delve into the key elements that have contributed to Goldman Sachs’ prominence.

Strong Leadership: Goldman Sachs has had a series of strong leaders throughout its history, starting with its founder Marcus Goldman. These leaders have been able to adapt to changing market conditions, identify new opportunities, and make strategic decisions that have positioned the firm for long-term growth.

Innovative Culture: Goldman Sachs has a culture that encourages innovation and creativity. The firm has been at the forefront of developing new financial products and services, such as mortgage-backed securities, collateralized debt obligations, and other structured finance instruments. This willingness to embrace change and take calculated risks has helped the firm stay ahead of competitors.

Client Focus: Goldman Sachs has built a reputation for providing exceptional service to its clients. The firm’s client base includes some of the world’s largest corporations, governments, and institutional investors. By understanding their needs and delivering tailored solutions, Goldman Sachs has established itself as a trusted advisor and partner.

Risk Management: Goldman Sachs has a strong risk management culture that emphasizes discipline and prudence. The firm has developed sophisticated models and systems to monitor and manage risk, which has allowed it to navigate complex markets and weather financial storms better than many of its peers.

Diversification: Goldman Sachs has diversified its business across multiple product lines and geographies. This has helped the firm reduce its dependence on any one revenue stream and mitigate the impact of economic downturns. For example, during the 2008 financial crisis, Goldman Sachs’ investment banking business was less affected than its trading and asset management divisions, helping the firm maintain stability.

Talent Acquisition and Retention: Goldman Sachs invests heavily in recruiting and retaining top talent. The firm attracts highly motivated individuals who are driven by the opportunity to work on challenging projects and advance their careers. Goldman Sachs also offers competitive compensation packages and fosters a collaborative environment that encourages teamwork and innovation.

Global Reach: Goldman Sachs operates in over 30 countries and has a deep understanding of local cultures and regulatory environments. This global presence allows the firm to provide cross-border advice and execution capabilities to clients, as well as access to diverse markets and opportunities.

Brand Recognition: Goldman Sachs is widely recognized as a leader in the financial industry, with a brand that symbolizes excellence, integrity, and expertise. This reputation has enabled the firm to attract high-caliber clients and employees, as well as build partnerships with other influential organizations.

Philanthropic Efforts: Goldman Sachs has a strong commitment to philanthropy and community development. Through its foundation, the firm supports various initiatives focused on education, healthcare, and environmental sustainability. This commitment to social responsibility helps enhance the firm’s reputation and contributes to society’s well-being.

Adaptability: Finally, Goldman Sachs has demonstrated an ability to adapt to changing market conditions and regulatory requirements. The firm has evolved its business model over time, expanding into new areas while exiting others that are no longer strategic or profitable. This flexibility has allowed Goldman Sachs to remain relevant and resilient in the face of disruption and uncertainty.

In conclusion, Goldman Sachs’ enduring success is the result of a multifaceted approach that includes strong leadership, a focus on investment banking, risk management expertise, innovation, diversification, talent management, a client-centric mindset, global expansion, ethical conduct, and adaptability. These factors have allowed the firm to thrive in a dynamic and challenging financial landscape, making it a leading player in the industry.

Also Read: Top 10 Competitors and Alternatives of Citigroup

To read more content like this, subscribe to our newsletter