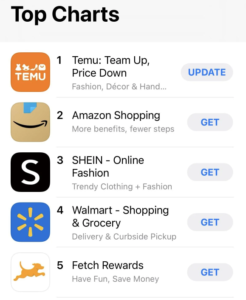

Temu, the name on everyone’s lips in the e-commerce world, has exploded onto the scene with a promise too good to be true: unbelievably cheap products delivered to your doorstep for free. Launched in September 2022 by Pinduoduo (PDD), a Chinese e-commerce giant, Temu has become a social media darling, boasting the title of the most downloaded app in the US by March 2024. But with its aggressive marketing blitz and rock-bottom prices, a crucial question lingers: can Temu be sustained, or is it destined to become another flash in the pan like Wish.com? This article delves into the intricate world of Temu, exploring its business model, the factors behind its meteoric rise, and the challenges that lie ahead.

The Powerhouse Behind Temu: Pinduoduo’s Innovation

To understand Temu’s strategy, we must look to its parent company, Pinduoduo (PDD). Founded in 2015, PDD carved a niche in China’s crowded e-commerce market by offering a unique shopping experience. They gamified the process with features like “team purchases,” where users could secure discounts by banding together to buy items. This fostered a social shopping environment and boosted user engagement. Additionally, PDD prioritized low prices by working directly with manufacturers and minimizing excess inventory through data-driven production forecasts. This innovative approach propelled PDD to success, capturing a significant market share in China.

Temu attempts to replicate this winning formula in the US market. They leverage PDD’s established network of manufacturers in China, offering a vast array of unbranded products at deeply discounted prices. Their marketing strategy has been nothing short of aggressive, with a Super Bowl ad and a social media presence that has captivated younger demographics.

Unveiling the Enigma: How Temu Achieves Ultra-Low Prices and Why Temu is so cheap?

Temu’s unbelievably low prices compared to established e-commerce giants like Amazon raise a red flag for many consumers. So, how does Temu manage to pull it off? Here’s a breakdown of their key strategies:

- Direct Sourcing: Temu cuts out the middleman by sourcing products directly from Chinese manufacturers, employing a similar strategy to Alibaba’s AliExpress platform. This eliminates markups associated with wholesalers and distributors.

- Low Manufacturing Costs: Production in China generally boasts lower costs compared to the US, allowing manufacturers to offer Temu competitive pricing.

- Minimal Inventory: PDD utilizes user data to predict demand and optimize production, minimizing excess inventory that can lead to price markdowns.

- Free, Expedited Shipping: This is where Temu takes a significant gamble. Unlike AliExpress, which relies on slower and cheaper sea freight, Temu utilizes air freight for faster delivery, likely incurring substantial losses on each order. To offset these costs, Temu reportedly partners with J&T Express, an Indonesian logistics company seeking market share, who might be subsidizing shipping costs in the short term.

The Unsustainable Gamble: Can Temu Keep the Party Going?

While Temu’s aggressive approach attracts users in droves, there are significant concerns about the long-term viability of its current model. Here’s why the current strategy might not be sustainable:

High Cash Burn: The free, expedited shipping with air freight likely costs Temu significantly more than $10 per order. Considering their average order value, this translates to billions of dollars burned annually to maintain their free shipping promise.

The Wish.com Cautionary Tale: Wish.com, a platform with a similar story of aggressive marketing and rock-bottom prices, serves as a cautionary tale. After an initial surge in popularity, Wish.com failed to generate repeat business due to the low quality of its products. Their stock price plummeted after they were forced to cut back on marketing spend, highlighting the reliance on unsustainable advertising.

Can Temu Avoid the Wish.com Trap?

Despite the looming shadow of Wish.com, Temu has some potential advantages that could help them avoid a similar fate:

PDD’s Financial Backing: Unlike Wish.com, Temu is backed by PDD, a financially healthy company with a $90 billion market cap. This allows Temu to potentially sustain cash burn for a longer period while they establish their user base.

Stronger Product Selection: PDD’s established manufacturer network provides Temu with a wider variety of products compared to Wish.com. This could potentially attract a broader customer base seeking more than just low-priced trinkets.

Economies of Scale: As Temu grows, they can leverage their increasing order volume to negotiate better shipping rates with companies like J&T Express. This could help make their free shipping model more sustainable in the long run.

Beyond the Price War: Building a Sustainable Future for Temu

Temu’s current strategy hinges on a price war, a tactic with a limited shelf life. To achieve long-term success, Temu needs to evolve beyond just being the cheapest option. Here’s what they can do to build a sustainable future:

Focus on Product Quality: While low prices are attractive, repeat business hinges on product quality. Temu can work with its manufacturing partners to ensure products meet basic quality standards without significantly impacting the price point. Partnering with reputable factories and implementing quality control measures will be crucial.

Building Brand Identity: Currently, Temu lacks a distinct brand identity. Developing a brand that resonates with their target audience and conveys values beyond just being cheap will be essential for fostering customer loyalty. This could involve highlighting ethical sourcing practices, sustainability initiatives, or a focus on specific product categories.

Cultivating a Community: Temu’s gamified shopping elements from PDD have potential in the US market. They can leverage these features to create a sense of community and encourage user engagement beyond just the initial purchase. User reviews, loyalty programs, and interactive features can all contribute to a more engaging shopping experience.

Data-Driven Personalization: Temu has access to a massive amount of user data through PDD. Leveraging this data to personalize product recommendations and curate a user experience that caters to individual preferences can go a long way in increasing customer satisfaction and repeat purchases.

The Verdict: A Promising Enigma with Uncertainties

Temu’s meteoric rise has undoubtedly shaken up the US e-commerce landscape. Whether they can translate their initial success into long-term sustainability remains to be seen. Their ability to find a balance between aggressive marketing, low prices, and building a loyal customer base will be paramount.

Here are some key factors to consider in the coming months:

- Changes in Temu’s Pricing Strategy: Will Temu introduce minimum order sizes or implement paid shipping tiers to offset their current losses?

- The Evolution of Temu’s Product Selection: Will Temu prioritize higher-quality products or maintain their focus on unbranded, low-cost items?

- The Impact of Economic Downturns: How will Temu’s price-centric model fare in the face of potential economic recessions?

Temu presents a fascinating case study in the ever-evolving world of e-commerce. While the future remains uncertain, one thing is clear: Temu is a force to be reckoned with, and its impact on the US online shopping landscape will be closely watched in the months and years to come.

Also Read: Success Story and Success Factors of Amazon

To read more content like this, subscribe to our newsletter