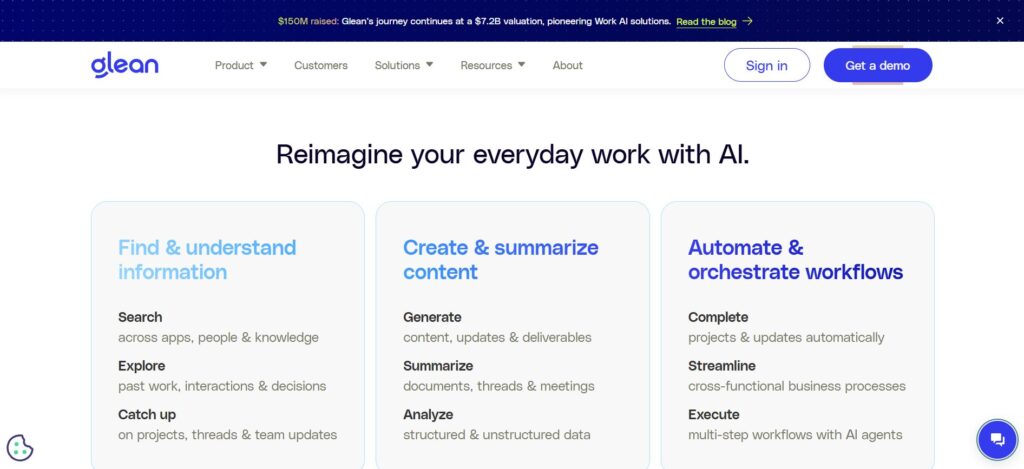

Glean is an AI-powered enterprise search and knowledge discovery platform that is transforming how employees find information at work. Founded in 2019 by a team of former Google engineers – and backed by Silicon Valley’s top investors – Glean has rapidly grown into a unicorn startup with a multi-billion dollar valuation. The company’s core product is a “Work AI” assistant that connects all of a company’s knowledge sources and applications, allowing users to instantly search for answers, discover insights, and even generate content using generative AI. Glean’s mission is to “expand human potential to do extraordinary work” by putting the right knowledge at every employee’s fingertips. In just a few years, Glean has attracted hundreds of enterprise customers (from tech firms like Databricks and Duolingo to Fortune 500 corporations) and surpassed $100 million in annual recurring revenue. This brand story explores Glean’s journey – from its founding vision and leadership to its business model, funding, competitors, and the unique advantages that have fueled its rise as a leader in enterprise AI search.

Founding Story of Glean

Glean’s origin traces back to a problem founder Arvind Jain encountered while scaling his previous company, Rubrik. In 2018, a survey of Rubrik’s fast-growing team revealed the number-one complaint: employees struggled to find the information or people they needed to do their jobs. Rubrik had ballooned from a few hundred to over 1,500 employees, with knowledge scattered across countless cloud apps and no unified way to search them. Even as an experienced Google search engineer, Jain found himself frustrated – “I tried to buy a product, and I found it didn’t exist,” he recalled. This pervasive “information discovery” problem (which a McKinsey study estimated costs workers 9+ hours per week searching for info) inspired Jain to create a solution.

In late 2018, Jain made the bold decision to leave Rubrik (then a multi-billion dollar data management startup he co-founded) and tackle enterprise search as his next venture. He soon pitched the idea to Mamoon Hamid of Kleiner Perkins, an early Slack investor who immediately grasped the vision. Hamid “invested on the spot” in what would become Glean, recognizing the timing was finally right – cloud adoption had reached critical mass, and no one had yet cracked workplace search despite years of attempts (even Google’s own efforts hadn’t succeeded). With seed funding secured, Jain assembled a founding team and set up shop in the basement of Kleiner’s Sand Hill Road offices, working in stealth for 18 months leading up to 2020.

The founding insight was that modern knowledge work was suffering under “SaaS sprawl” – companies use hundreds of different apps (the average enterprise uses nearly 300) and vital knowledge ends up siloed across emails, chats, documents, wikis, ticketing systems, and more. Existing enterprise search tools were outdated, hard to implement, or too limited in scope. Jain and his co-founders envisioned a unified search assistant that could index all enterprise data, understand context (like who a user is and what they’re working on), and deliver personalized answers in seconds. They named the company Glean – meaning to gather information bit by bit – reflecting its purpose to help users “glean” the knowledge they need from across their organization. In September 2021, Glean emerged from stealth with an intuitive work assistant that promised to “find the right information, the right teammate, or the right insights” via a powerful unified search experience. Early customer trials (40+ companies during beta) validated that Glean could save employees weeks of time per year by eliminating fruitless searches and redundant work. The stage was set for Glean to tackle one of the workplace’s most ubiquitous productivity problems.

Founders of Glean

Glean was founded by a quartet of seasoned tech leaders with deep search and infrastructure expertise:

Arvind Jain (Co-Founder & CEO)

A former Google distinguished engineer who spent over a decade leading core Search, Google Maps, and YouTube teams. In 2014 he co-founded Rubrik, a cloud data management company that reached a $5.5 billion valuation. Jain’s experience building Google’s search and seeing Rubrik’s internal knowledge challenges drove him to start Glean. He is known for his humility and clarity of focus on solving real enterprise problems. Under Jain’s leadership, Glean has grown from an idea into a unicorn valued at $7.2 billion.

Vishwanath “T.R.” Ramarao (Co-Founder, Engineering)

An expert in large-scale infrastructure, T.R. held technical leadership roles at Facebook (Meta) for nearly a decade and earlier was an engineer at Microsoft. At Glean, he leads technical infrastructure and integration development – designing fast, reliable solutions to connect Glean with countless enterprise data sources. T.R.’s background building Facebook’s developer platform and News Feed has been invaluable for Glean’s back-end architecture.

Tony Gentilcore (Co-Founder, Engineering)

A veteran Google engineer who spent 10+ years improving Google’s search user interface and web performance. Tony helped evolve Google’s results from the static “ten blue links” era to richer interactive pages, and later founded the Chrome Speed Team to make Chrome the fastest browser. At Glean, Tony leads product engineering, ensuring the search experience is fast and smooth for users. His two decades of frontend experience help Glean deliver a polished, intuitive UI.

Piyush Prahladka (Co-Founder)

An engineering leader from Google and Uber, Piyush brought expertise in building scalable systems at consumer-tech companies. At Google he worked on search and ads infrastructure, and at Uber on data platforms. Piyush was instrumental in architecting Glean’s early system to index data across cloud apps. (Note: Piyush was a co-founder listed at launch, though he is not featured on Glean’s current leadership page; he helped found the company but later moved into an advisory or early employee role.)

In addition to the founders, Glean’s early team included experienced executives like Chris O’Neill (former CEO of Evernote and Google executive) who joined as an advisor/board member, and engineers from Pinterest, Intercom, and other top tech firms. This powerhouse founding team – blending Google Search pedigree, cloud infrastructure skill, and enterprise savvy – gave Glean a formidable talent base from day one. As investor Ravi Mhatre of Lightspeed noted, “there are very few people with the technical expertise and vision [of Arvind and team]…no team is better suited to deliver safe, reliable generative AI in the enterprise”. The founders’ credibility helped attract major investors and early customers who believed in Glean’s approach to finally make “Google for work” a reality.

Business Model of Glean

Glean operates a B2B software-as-a-service (SaaS) model, providing its enterprise search platform to organizations on a subscription basis. The company primarily charges customers per user, per month for access to the platform. Pricing is tailored to each enterprise’s size, integrations, and needs, but industry estimates put Glean’s fees starting around $50+ per user per month. Deals often involve annual or multi-year contracts, with a typical annual contract value in the mid five to six figures (the median reported deal is ~$65K/year, with larger deployments reaching $100K+ annual spend). Glean does not publicly list prices, preferring a custom quote approach – a point of frustration for some mid-market buyers who desire more transparency.

Under the hood, Glean’s cost structure and pricing reflect the value of its technology: the platform connects to 100+ enterprise applications and data sources, requiring continuous indexing and AI processing to deliver real-time results. Unlike pure usage-based models, Glean’s pricing is per seat rather than per query, encouraging customers to roll it out broadly to employees without worrying about metering each search. The company does, however, offer premium add-ons for advanced AI features. For example, the newer “Work AI” suite (which includes generative AI capabilities like Glean’s chat assistant and agents) may incur an extra fee of roughly $15 per user/month on top of the base search product. In practice, as of 2025 Glean has started bundling these AI features into its core platform for enterprise plans, reflecting the strategic importance of AI in its value proposition.

Glean’s revenue streams are therefore largely recurring subscription licenses. The company emphasizes quick cloud deployment with minimal professional services – in fact, Glean touts that it can be set up in hours without costly consulting projects. This means Glean doesn’t rely on implementation fees or extensive service revenue; the goal is a plug-and-play solution that drives subscription adoption and renewals. Over time, Glean may introduce new modules or tiers (for instance, higher-priced plans with more AI agent capabilities or security features), but the fundamental model is a classic enterprise SaaS: a secure cloud platform sold via an annual seat-license contract.

This yields a highly scalable business – Glean reported over $100M ARR achieved within ~4 years of launch, indicative of many large organizations subscribing and expanding usage. With substantial VC funding (over $700M raised) in the bank, Glean has prioritized growth over immediate profitability, even though the company is reportedly cash-flow positive by 2025. Investors are betting that Glean can continue to land big enterprise deals, leveraging its high ROI pitch: saving each knowledge worker 2-3 hours per week by eliminating search drudgery.

Funding and Funding Rounds of Glean

Glean has attracted significant venture capital investment across multiple rounds, reflecting investor excitement about AI in the enterprise. Below is a summary of Glean’s funding history through mid-2025:

| Date (Year) | Round | Amount Raised | Post-Money Valuation | Key Investors |

|---|---|---|---|---|

| March 2019 | Series A | $15 million | – (Undisclosed) | Kleiner Perkins, Lightspeed (co-leads); Slack Fund |

| March 2021 | Series B | $40 million | – (Undisclosed) | General Catalyst (lead); Kleiner Perkins, Lightspeed (existing). |

| May 2022 | Series C | $100 million | ~$1 billion | Sequoia Capital (lead); General Catalyst, Kleiner Perkins, Lightspeed, Slack Fund (existing). |

| Feb 2024 | Series D | $200+ million | $2.2 billion | Kleiner Perkins & Lightspeed (leads); Sequoia, Coatue, ICONIQ, IVP, Capital One Ventures, Citi Ventures, Databricks Ventures, Workday Ventures, Adams Street, General Catalyst (participating). |

| Sept 2024 | Series E | $260+ million | $4.6 billion | Altimeter Capital & DST Global (co-leads); Craft Ventures, Sapphire Ventures, SoftBank Vision Fund 2 (new); Coatue, ICONIQ, IVP, Kleiner Perkins, Lightspeed, Sequoia (existing). |

| June 2025 | Series F | $150 million | $7.2 billion | Wellington Management (lead); new investors Khosla Ventures, Bicycle Capital, Geodesic Capital, Archerman; existing backers including Sequoia, General Catalyst, Altimeter, DST Global, Coatue, IVP, Kleiner Perkins, Lightspeed, Sapphire Ventures, ICONIQ, Capital One Ventures, etc. |

Sources: Company press releases and media reports

By mid-2025, Glean’s total funding exceeds $765 million across these rounds, and its latest valuation of $7.2B firmly cements its unicorn (indeed decacorn) status. Notably, Glean’s valuation has skyrocketed in a short period – more than doubling between early 2024 and late 2024, and jumping another ~57% by mid-2025 amid a wave of investor enthusiasm for AI startups. The company’s backers are a who’s-who of top venture firms (Sequoia, Kleiner Perkins, Lightspeed, General Catalyst) along with strategic corporate investors (Workday, Capital One, Citi, and even Slack’s fund). This broad investor base provides not just capital but also industry connections and credibility in Glean’s target market.

Each funding round has enabled Glean to accelerate growth. For example, the $100M Series C in 2022 came just 8 months after Glean’s public launch and granted the company “unicorn” status at a $1B valuation. The massive Series D and E rounds in 2024 – totaling nearly $500M – allowed Glean to invest heavily in R&D (notably generative AI features) and international expansion at a time when demand for AI solutions exploded. By Series F in mid-2025, Glean had over $100M ARR and was already cash-flow positive, so the $150M raise was characterized as “opportunistic” fuel to expand faster rather than a lifeline. CEO Arvind Jain noted they had $550M+ cash on hand after Series E, implying the subsequent round was driven by ambition to seize a market leadership position in enterprise AI, with Wellington’s late-stage expertise guiding them into a future IPO. Indeed, as AI’s importance grows, Glean’s hefty war chest and strong backers position it to remain independent and pursue an eventual public offering when market conditions allow.

Competitors of Glean

The enterprise search and AI assistant space has become highly competitive, with players ranging from tech giants embedding search in their ecosystems to startups tackling knowledge discovery from new angles. Below is a comparison of some key competitors and how they stack up:

| Competitor | Product Focus | Strengths | Weaknesses |

|---|---|---|---|

| Microsoft Copilot & Graph | AI assistant and search embedded in Microsoft 365. Focused on enhancing MS Office apps and Teams. | Deep integration with the ubiquitous Microsoft ecosystem; powerful generative AI that automates tasks in Office apps. Leverages Microsoft’s AI research and cloud. | Primarily benefits Microsoft-centric workflows – limited support for non-Microsoft apps. Requires investment in Microsoft 365 stack. Lacks a standalone knowledge hub; not as cross-platform as dedicated search solutions. |

| Google Cloud Search | Enterprise search for Google Workspace and beyond. Designed to index Gmail, Drive, etc., plus other data via connectors. | Google-grade search relevance and speed across company data. Easy adoption for Google Workspace users; robust cloud infrastructure. | Best suited for Google Workspace environments – connectors to third-party systems exist but are not as extensive as Glean’s 100+ integrations. Fewer AI features (focuses on search, not generative answers by default). |

| Coveo | AI-powered search platform for both internal knowledge and customer-facing use-cases (e.g. website or e-commerce search). | Mature machine-learning relevance engine that personalizes result. Supports a wide range of data sources and can improve customer support and commerce experiences. Strong in hybrid internal/external search scenarios. | Implementation can be complex – consolidating data into Coveo’s index takes effort. Advanced features may require tuning. Pricing starts moderate but enterprise costs add up (custom quotes for large scale). Less focused on generative AI answers compared to Glean’s latest capabilities. |

| Guru | Knowledge management platform with Q&A knowledge base and integrated enterprise search. Emphasizes capturing and reusing team knowledge. | Easy-to-use interface for teams to create verified knowledge cards. AI-powered search delivers natural language answers from curated content. Great for improving support and onboarding with up-to-date FAQs. | Relies on manual knowledge curation – content must be entered into Guru. May not automatically cover all company documents. Geared towards small-to-mid size teams or specific departments. Fewer integrations (focus on syncing with major apps like Slack, CRM, etc., but not as broad as Glean). |

| Sinequa | Enterprise search platform for large organizations with complex, multi-format data. Provides deep indexing of both structured and unstructured data. | Very powerful search analytics: supports entity extraction, natural language queries, and retrieval augmented generation (RAG) for contextual answers. 300+ connectors and a no-code UI builder for custom search apps. Proven in demanding, data-intensive environments (e.g. global banks). | Heavyweight implementation – can be challenging to deploy and tune without technical expertise. Time-to-value is longer (projects can take months). The interface and setup are more complex, making it less agile for quick rollout. Typically higher cost tailored to Fortune 1000 scale. |

Table: Select Glean competitors, their focus, and a brief assessment of strengths vs. weaknesses. (Sources: Competitor product literature and analyses)

Despite this crowded landscape, Glean has managed to stand out, which we explore next in its competitive advantages. But it’s clear the company must continually innovate, as it’s competing not just with specialized search vendors, but with tech giants bundling AI search into their productivity suites and platforms – a dynamic that raises both opportunities (partnerships) and threats for Glean’s standalone solution.

Competitive Advantage of Glean

Glean’s competitive edge lies in a combination of cutting-edge technology, user-centric design, and strategic focus on the enterprise problem that its founders know intimately. Here are the key factors that give Glean an advantage:

-

Unified “All-in-One” Search Platform: Glean differentiates by truly connecting all of a company’s knowledge sources – from cloud storage (Google Drive, SharePoint), to communication tools (Slack, email), wikis, ticketing systems, HR portals, code repositories, and more. It ships with over 100 pre-built connectors to popular enterprise apps. Many competitors support a subset of data sources or require extensive custom integration for new sources. Glean’s broad connectivity and centralized knowledge graph give it a comprehensive view of an organization’s information landscape. This means when an employee searches in Glean, they are truly searching everything their company knows – a powerful proposition.

-

Personalized and Contextual Results: Leveraging its Google Search heritage, Glean emphasizes relevant, personalized results using AI. The platform builds a knowledge graph of how people, content, and activity relate in an organization. It uses this along with each user’s role and behavior to tailor search results. For example, an engineer asking about “API usage” will see code docs or JIRA tickets relevant to their team, whereas a salesperson might see CRM records – even on the same keyword. This context-aware ranking improves result relevance significantly. Customers and investors note Glean’s search is “highly personalized” and acts almost like a “second brain” for users. By contrast, generic search tools often return one-size-fits-all lists of documents.

-

Generative AI with Trustworthy Answers: Glean has been a frontrunner in bringing generative AI into enterprise search in a safe way. In early 2023, it launched a conversational Work Assistant (Glean Chat) that uses large language models (LLMs) to answer employees’ questions in natural language. Crucially, Glean addresses the common AI issue of “hallucinations” by using Retrieval-Augmented Generation (RAG) – the assistant first retrieves relevant company knowledge (documents, pages, etc.) and then has the LLM generate an answer grounded in those real sources. Every answer comes with citations linking back to the original internal documents, so users can verify facts. This approach means employees get ChatGPT-like convenience with enterprise accuracy and security. Many competitors are only beginning to add such capabilities. Glean further extended its lead by introducing agentic AI features: its Glean Agents can break complex queries into steps and automatically execute tasks or multi-step workflows (for example, finding information and drafting a summary email). These agent abilities – essentially giving every user a personal AI that can not only find info but also act on it – position Glean ahead in the emerging “AI agent” trend in enterprise software.

-

Security and Permission Controls: In the enterprise, security is a non-negotiable requirement, and Glean was designed from the ground up to respect all underlying permissions and data governance policies. Every action on Glean is authenticated and authorized – users only see results they have access to in the source systems. Glean never creates a separate “walled garden” of data; it indexes metadata but enforces original app permissions on each query. It also offers admin tools like Glean Protect to monitor and proactively defend sensitive data use. This security-first philosophy has been critical in winning trust, especially when CIOs are wary of generative AI tools accidentally exposing data. By being enterprise-grade on day one (the founders’ backgrounds with Google and Facebook security helped), Glean gained an edge over startups that treated security as an afterthought.

-

Fast Deployment and Adoption: Glean can often be rolled out in hours or days, not months. Thanks to modern APIs and cloud infrastructure, it sidesteps the lengthy implementations of legacy enterprise search (which could require extensive tuning or hardware). Early customers were delighted that Glean could connect to their apps and be useful almost immediately. Faster time-to-value gives Glean an edge in pilot comparisons. Additionally, the product’s ease of use drives adoption: it integrates into where users already work – e.g. a browser extension lets you search Glean from any webpage, and there are integrations to query Glean directly from Slack or Microsoft Teams. High daily usage (40–60% of employees use Glean monthly at customer organizations, with some using it 5+ times per day) is a testament to its stickiness. That user engagement dwarfs typical enterprise software and makes Glean a must-have once deployed.

-

Visionary Leadership and Investor Support: Finally, Glean benefits from an experienced leadership team that has single-minded focus on search and AI. This is not a side feature for them – it is the company’s entire mission. CEO Arvind Jain’s credibility (having built Google Search and a successful enterprise startup) reassures customers that Glean can deliver. Investors like Kleiner Perkins’ Mamoon Hamid liken Glean’s potential to that of Slack in terms of ubiquity for knowledge workers. Such confidence has led to strong funding, which in turn allows Glean to invest heavily in product innovation (e.g. hiring top AI researchers, running its own large-scale training experiments) ahead of many competitors. Glean’s pace of releasing new features – from basic search in 2021, to generative chat in 2023, to full AI agents in 2024/25 – highlights a cycle of rapid innovation that others are racing to match.

Together, these advantages have made Glean a leader in enterprise search despite competition from much larger companies. It is often described as “Google for work,” but in truth Glean is pushing beyond traditional search into a more proactive, intelligent assistant for the workplace. Its blend of comprehensive search, generative AI, and enterprise readiness gives it a defensible moat, as evidenced by its growing roster of Fortune 500 clients and accolades (Fast Company, Gartner, and CNBC have all recognized Glean as a pioneer in applying AI to enterprise productivity). Of course, Glean must continue executing well to maintain this lead – but the foundation it has built is strong.

Future Outlook of Glean

Glean’s future outlook is bright, as the company sits at the intersection of powerful trends reshaping work: the explosion of enterprise data, the urgency for productivity gains, and the rise of AI as a transformational tool. Looking ahead through the remainder of 2025 and beyond, several developments can be anticipated:

-

Global Adoption of “Work AI”: Glean is poised to become a standard part of the modern digital workplace if it executes well. Just as tools like Slack or Zoom became ubiquitous for collaboration, AI assistants for knowledge could be the next must-have. Glean’s leadership believes every knowledge worker will eventually have an AI helper to find information and automate tasks. We can expect Glean to evangelize this vision globally. The company will likely continue its international expansion aggressively, potentially opening offices in key markets in Europe (e.g. London, Frankfurt) and Asia-Pacific (Singapore, Tokyo) as demand for AI solutions grows. Its hiring of sales and partner teams in Japan and Europe is an early indicator of this push. By localizing the product and leveraging partners, Glean could capture significant non-U.S. revenue in the coming years, turning itself into a truly global SaaS provider.

-

Advancements in AI Capabilities: Technologically, Glean will keep advancing its platform. Future versions might incorporate multimodal search (e.g. the ability to search within images, videos, diagrams used in company content), given the progress in computer vision and OCR. Glean could also integrate predictive AI that surfaces information proactively – for example, warning you if a document relevant to your project has been updated, or an AI that joins meetings to answer questions in real-time. With its “system of context” already unifying enterprise data, Glean is well positioned to layer more AI on top to drive insights (think of discovering trends or expertise within an organization automatically). The company’s strong cash position allows heavy investment in emerging AI research, possibly including its own specialized LLMs fine-tuned on enterprise corpora. By mid-2025, Glean was already recognized as pushing the envelope on “agentic AI in the enterprise”. Going forward, it might develop more domain-specific agents (for HR, for DevOps, etc.) or even an AI app marketplace where third-parties build extensions on Glean’s platform.

-

Potential IPO or Late-Stage Milestones: On the business front, if Glean continues its growth trajectory (targeting $200M+ ARR by 2025’s end), it will be a strong candidate for an IPO in 2025–2026 provided market conditions are favorable. An IPO would bring additional capital and credibility, but also scrutiny. Glean’s leadership will weigh this alongside the option of remaining private longer (especially given investors like Wellington, known for pre-IPO rounds, are involved). Even pre-IPO, we might see Glean make bold moves like strategic acquisitions. For example, it could acquire a niche competitor to consolidate the market or a complementary tech (perhaps a company strong in voice assistance or a vertical-specific search solution). Also, as valuations soared, one cannot ignore the possibility that a major tech company could attempt to acquire Glean. However, at $7.2B and climbing, an acquisition would be costly, and Glean seems intent on pursuing independence and market leadership rather than folding into a larger entity.

-

Wider Enterprise AI Ecosystem Integration: Glean’s future will also involve tighter integration with the broader enterprise software ecosystem. We can expect deeper partnerships – possibly with cloud platform providers (imagine Glean offered as a service on Azure or GCP), or with business application suites (e.g. deeper integration into Salesforce’s platform). As AI becomes a layer in all software, Glean could position itself as the “search and intelligence layer” that other apps plug into. The mention of partnerships with the likes of Workday and Snowflake hints at this strategy – Glean doesn’t seek to replace those systems, but rather to enhance them with AI-driven search. In the future, Glean might certify integrations or become part of reference architectures for digital workplace solutions.

-

Impact on Ways of Working: If Glean’s vision succeeds, the day-to-day impact on employees could be profound. The company often cites that users save 2–3 hours per week and reach much higher productivity. Over years, that could recalibrate how organizations structure knowledge work – employees spend less time searching or doing routine knowledge synthesis, and more time on creative, strategic tasks. By freeing people from “hunting and gathering” information, Glean and similar tools might lead to leaner teams or redefined roles focusing on higher-value work. There is also a cultural aspect: Glean’s usage encourages a more open knowledge-sharing culture (since everything can be found, silos break down). The future workplace might be more transparent and efficient as a result. Glean’s motto of “Work AI for all” encapsulates this democratization of information access.

-

Staying True to Mission: Lastly, we can expect Glean to continually articulate its mission as its North Star. Jain has stated the mission is to “bring people the knowledge they need to make a difference in the world” and to ensure every employee can leverage AI meaningfully. In the future, as AI evolves, Glean might expand that mission to not just finding knowledge, but building organizational intelligence – helping companies learn from their data to make smarter decisions. Already, Glean calls itself the “system of context” for organizational intelligence. In a decade’s time, if Glean realizes its ambitions, it could be as indispensable as internet search is today, but within every enterprise – a kind of neural layer connecting all people and information in a company.

In conclusion, Glean’s story is still in early chapters, but the trajectory suggests a potential industry-defining company in the making. The convergence of enterprise needs and AI capabilities creates a ripe environment for Glean’s growth. There will undoubtedly be twists and turns – competitors, technology shifts, and economic cycles will exert influence. However, with its strong foundation of leadership, vision, and backing, Glean is well positioned to lead the AI-powered revolution in workplace knowledge. If mid-2020s trends continue, the future workplace will be one where asking a digital assistant for any piece of information (and getting it instantly) is routine – and Glean aims to be the platform delivering that experience. The journey from startup to potential enterprise staple is underway, and mid-2025 finds Glean at the forefront of how AI can unlock the collective intelligence of organizations, driving a new era of productivity and innovation in the years to come.

Also Read: VAST Data – Founders, Business Model, Funding & Competitors

To read more content like this, subscribe to our newsletter