Vanta is a leading startup in the security and compliance automation space, providing software that helps businesses streamline their security certifications and IT audits. Founded in 2018, Vanta has grown rapidly to become a unicorn valued at $4.15 billion as of mid-2025.

The company’s cloud-based platform continuously monitors security controls and gathers compliance evidence, enabling clients to achieve certifications like SOC 2, ISO 27001, HIPAA, and GDPR much faster than traditional manual methods. Vanta’s mission is “to help businesses earn and prove trust” between companies. By turning compliance into an automated, always-on process, Vanta allows even early-stage companies to prove their security posture and unlock bigger deals.

Today, over 12,000 organizations rely on Vanta’s software to manage trust and compliance programs worldwide.

This article presents a detailed brand story and business analysis of Vanta, including its founding narrative, the founders’ backgrounds, business model, revenue streams, funding history, competitors, competitive advantages, and recent developments.

Founding Story of Vanta

Vanta’s origin stems from co-founder Christina Cacioppo’s insight in 2017 that startups would soon need rigorous security practices to earn customer trust. At the time, getting a SOC 2 report or other compliance was an afterthought for most startups, often done via spreadsheets and manual checklists for auditors. Cacioppo – drawing on her experience in venture capital and product management – anticipated that security compliance would become a priority even for early-stage companies.

In 2018, she partnered with Erik Goldman to launch Vanta (initially through Y Combinator), aiming to automate the tedious parts of compliance audits.

The team validated the idea by closely working with first customers rather than building in a vacuum. They even set up desks inside their pilot customer’s office (Segment) and used a simple spreadsheet checklist as a prototype. This ultra-lean approach let them learn customer pain points firsthand and ensured Vanta’s first code solved real needs.

They discovered startups were wasting weeks preparing audit evidence, and an automated tool could save significant time. Early adopters like Segment and Front got value quickly, and word-of-mouth within the startup community drove Vanta’s first wave of growth.

Vanta even delayed any formal marketing hires until 2020, relying on referrals and the Y Combinator network for growth.

By focusing on “doing the hard things first” – even if that meant manual efforts to onboard customers – Vanta built product-market fit in a space that was nascent.

This founding story of obsessive customer focus and category creation set the stage for Vanta’s later scale.

Founders of Vanta

Christina Cacioppo, Vanta’s CEO and co-founder, has a background that prepared her to solve compliance challenges. She earned degrees in Economics and Engineering at Stanford, then joined Union Square Ventures as an analyst, where she met hundreds of startup founders and honed her product sense.

Wanting to build products herself, she learned to code and later led product management for Dropbox Paper. In 2016, spotting the gap in the market for startup security tooling, she left Dropbox to start what became Vanta.

Cacioppo is known for her scrappy, research-driven leadership style – she kept the company frugal and deeply focused on customer feedback. Under her guidance, Vanta achieved significant traction and revenue growth before taking on major venture funding.

Erik Goldman, Vanta’s technical co-founder, brought software engineering expertise to the founding team. He helped architect the platform and onboard early users. Goldman’s background included product and engineering roles in tech; at Vanta, he was instrumental from 2018 through 2020 in building the core automation features.

Goldman departed the company in 2020, but his contributions in Vanta’s formative stage were key in turning Cacioppo’s vision into a working product.

Together, Cacioppo and Goldman established Vanta’s foundational ethos: make security simple and proactive. The founders’ mix of product savvy, customer empathy, and technical skill enabled Vanta to turn a complex, traditionally consultant-driven process into an easy SaaS offering – a transformation central to the brand’s story.

Business Model of Vanta

Vanta operates a Software-as-a-Service (SaaS) business model focused on recurring subscriptions. Customers pay an annual (or multi-year) license fee to use Vanta’s cloud platform to manage their security and compliance programs continuously. Early on, Vanta shifted to annual-only pricing to encourage a mindset of ongoing security monitoring (rather than one-off audit projects).

This means clients subscribe for year-round coverage: the software runs 24/7, tracking the company’s infrastructure and policies against required controls, and alerting them to issues that need fixing for compliance.

The target customers began with venture-backed tech startups (especially those needing SOC 2 reports to sell to enterprise clients). As Vanta expanded, it moved upmarket to serve mid-size and larger enterprises, and even non-tech firms that handle sensitive data. For example, by 2023 Vanta had clients like Modern Health and even Omni Hotels using the platform to vet software vendors’ security. The common thread is that any organization needing to demonstrate strong security practices to an external party can use Vanta as a centralized solution.

Vanta’s business model is to provide automation and efficiency in lieu of manual labor or consulting. Instead of hiring compliance consultants or diverting internal engineers to create documentation, a company installs Vanta and connects it to their systems (cloud accounts, laptops, identity providers, etc.). Vanta then automatically collects evidence (e.g. checking if all employee laptops have disk encryption enabled, or if AWS servers are properly configured) and maps it to compliance requirements. A dashboard shows the company’s real-time compliance status, and when ready, all necessary reports and documentation can be compiled for an auditor. By delivering tangible time savings and reducing errors, Vanta justifies its subscription cost.

Pricing: Vanta uses tiered pricing based on company size and needs. While exact prices are custom, an Essential plan for a small startup starts around $10,000 per year for core features (automated monitoring and basic frameworks). For growing companies, Pro and Enterprise plans can range in the tens of thousands of dollars per year depending on number of employees, the number of compliance frameworks, and added features or support levels.

Larger plans include advanced modules like vendor risk management and dedicated customer success support. This tiering allows Vanta to scale its revenue with the customer’s growth – as a client company expands and faces more compliance obligations, they are likely to upgrade to higher tiers or add more licenses.

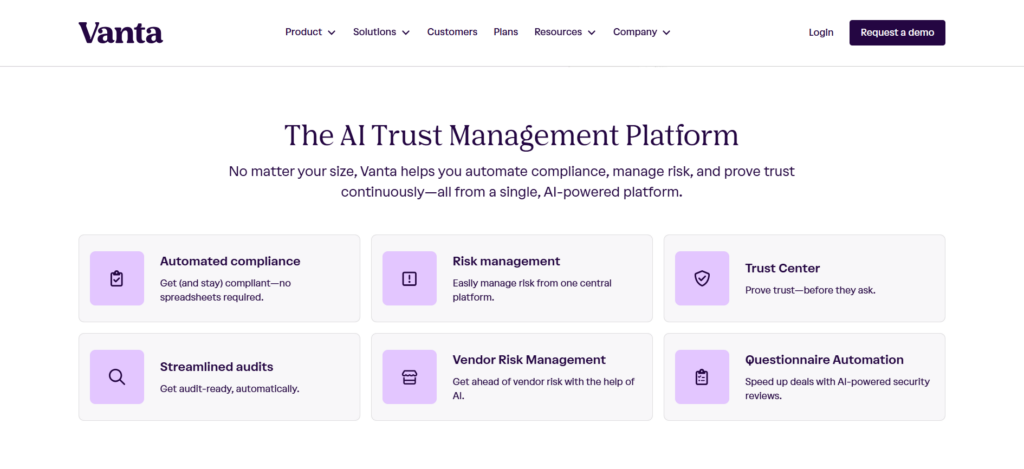

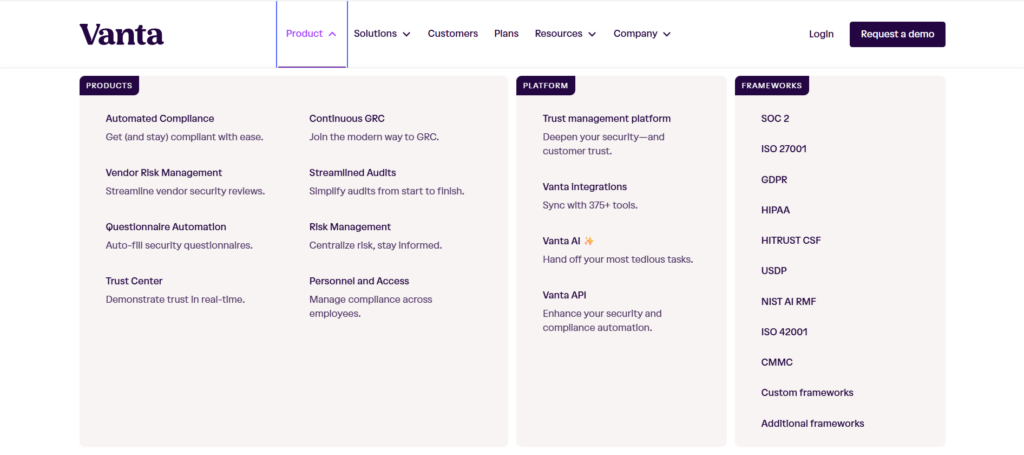

Vanta’s key product components that underpin its model include:

-

Compliance Automation Platform: Continuous monitoring and evidence collection across dozens of integrations (cloud platforms, endpoint devices, SaaS apps). This is the core service that keeps customers audit-ready.

-

Frameworks & Certifications: Support for multiple standards (SOC 2, ISO 27001, HIPAA, GDPR, etc.) so that a single platform suffices for various compliance needs.

-

Trust Center: A customizable web page where Vanta customers can share up-to-date compliance reports and security information with their clients, turning security into a sales asset.

-

Vendor Risk Management: Tools to automate sending and tracking security questionnaires to third-party vendors, and to assess vendors’ security postures (useful for Vanta customers who need to ensure their suppliers are secure).

-

Risk & Access Management: Features to conduct periodic access reviews and manage risk registers. These help companies not only get compliant faster, but also stay secure continuously.

-

AI Assistance: Newer features like the Vanta AI agent can draft answers to security questionnaires and highlight compliance gaps using large language models, reducing the manual work for compliance teams.

All these capabilities are offered under Vanta’s subscription, making it a comprehensive one-stop platform. The breadth of the product also creates upsell opportunities – a customer might start with SOC 2 compliance and later add ISO or HIPAA frameworks, or adopt the vendor risk module, thereby increasing their spend with Vanta over time.

Revenue Streams of Vanta

Vanta’s revenue comes almost entirely from subscription fees for its SaaS platform. Clients typically sign annual contracts, providing Vanta with predictable recurring revenue (ARR – Annual Recurring Revenue). As of early 2024, Vanta had reached over $100 million in ARR, reflecting its success in signing and retaining thousands of customers on yearly subscriptions. There are no one-off license sales; instead, all functionality is bundled into the service. This means revenue grows primarily by acquiring new customers and expanding existing accounts (either as those customers grow or adopt more Vanta modules).

The company enjoys high gross margins typical of software businesses, since delivering the cloud service to additional customers costs relatively little. Vanta does not rely on professional services for income – any onboarding help or compliance coaching is generally included to drive subscription value rather than sold separately.

A key dynamic in Vanta’s revenue is strong net retention. Compliance is not a one-time need; once a company uses Vanta and passes audits successfully, they are likely to stick with the platform year after year. Moreover, as they face new compliance requirements or grow in complexity, they often increase their subscription level. This translates to expansion revenue, as existing customers spend more over time. The combination of new client growth plus expansion within the install base has driven Vanta’s rapid ARR climb.

Furthermore, the value proposition is reinforced by ROI data – for instance, an independent analysis found Vanta customers achieved a 526% return on investment over three years due to efficiency gains and fewer lost deals. High ROI for clients makes it easier for Vanta’s team to renew and upsell accounts, thereby boosting its own revenue growth.

Funding and Funding Rounds of Vanta

Vanta was notably capital-efficient in its early years, raising only a seed round through Y Combinator and angels to get started in 2018. The company operated leanly and reached significant revenue milestones before seeking large venture funding. This changed in 2021 when Vanta secured a major Series A as demand took off. Below is a summary of Vanta’s funding history:

| Date | Round | Amount Raised | Post-Money Valuation | Lead Investor(s) |

|---|---|---|---|---|

| 2018 | Seed | ~$2M (estimate) | – (N/A) | Y Combinator, Angels |

| May 2021 | Series A | $50 million | Not disclosed | Sequoia Capital |

| Oct 2022 | Series B | $110 million | ~$1.6 billion | Sequoia Capital |

| July 2024 | Series C | $150 million | $2.45 billion | Sequoia Capital, others |

| July 2025 | Series D | $150 million | $4.15 billion | Wellington Management |

Table: Vanta’s Funding Rounds. (Series B and beyond valuations are approximate as reported.)

Vanta’s Series A in 2021 ($50M led by Sequoia) came at a time when the startup was already profitable or at least breakeven on its seed funding. Raising such a large Series A indicated strong conviction from investors and allowed Vanta to accelerate hiring and product expansion. In 2022, the Series B (also led by Sequoia, $110M) valued Vanta at about $1.6B, officially making it a unicorn. Notably, all of Vanta’s major early rounds were led by Sequoia Capital, showing a rare level of continued support. (Sequoia partner Andrew Reed joined Vanta’s board and remarked that the company has “some of the best numbers in Silicon Valley” under Cacioppo’s leadership.)

By July 2024, Series C brought in $150M at a $2.45B valuation. This round added a set of strategic corporate investors alongside Sequoia. The capital was aimed at global expansion (entering Europe/APAC) and product innovation, especially new AI features. Finally, in July 2025, Vanta’s Series D raised another $150M at a $4.15B valuation.

Led by Wellington Management (with participation from existing backers like Sequoia and strategic investors like Goldman Sachs), this round brought Vanta’s total external funding to about $504M. The company’s disciplined use of funds means Vanta can now focus its new capital on strategic growth initiatives and international expansion. As of mid-2025, the company remains well-capitalized and is potentially positioning for an eventual IPO in the coming years.

Competitors of Vanta

Vanta created a robust market for automated security compliance, and several competitors have emerged, ranging from fellow startups to established enterprise software firms. Below is a comparison of Vanta with some key competitors:

| Company | Founded | Total Funding | Latest Valuation | Focus & Notable Aspects |

|---|---|---|---|---|

| Vanta | 2018 | ~$504M | $4.15B (2025) | Broad trust management platform; automates SOC 2, ISO 27001, HIPAA, etc.; strong in startups and mid-market (8k+ customers by 2024). |

| Drata | 2020 | ~$328M | $2.0B (2022) | Continuous compliance automation (SOC 2, etc.); closest rival to Vanta in product scope; known for aggressive growth (raised $200M in 2022). |

| Secureframe | 2020 | ~$79M | N/A (private) | Compliance automation for SMBs; supports SOC 2, ISO, PCI; emphasizes simplicity; smaller scale and funding relative to Vanta. |

| Thoropass | 2019 | ~$98M | N/A (private) | End-to-end compliance with software + services (formerly Laika); helps companies with audits and certifications via human support. |

| OneTrust | 2016 | ~$1.13B | $4.5B (2023) | Comprehensive privacy, security & GRC platform; serves large enterprises (14k customers, ~$500M ARR); entered compliance automation via acquisition (Tugboat Logic). |

Table: Vanta and Selected Competitors.

Drata and Secureframe are the closest startup competitors, often competing for the same high-growth tech clients. Drata in particular directly targets Vanta in its marketing (even calling Vanta a “one-trick llama” as a jab at its mascot). Both companies offer similar cloud compliance automation, but Vanta’s head start (founded 2018 vs 2020) gave it an edge in product maturity and customer base. Thoropass (formerly Laika) takes a somewhat different approach by blending automation with expert advisory services, appealing to companies that want more hands-on guidance. OneTrust and other legacy GRC platforms (e.g. AuditBoard) are broader enterprise solutions that overlap with Vanta’s space; however, Vanta’s focus on easy integration and a developer-friendly experience distinguishes it from these older tools.

Despite the increased competition, Vanta has retained a leadership position. It reports that 75% of new Y Combinator startups choose Vanta for compliance, indicating strong brand preference in its core segment. The competitive pressure has also pushed Vanta to keep innovating (e.g. adding support for more frameworks, integrating AI, expanding internationally) to stay ahead of rivals.

Competitive Advantage of Vanta

Several factors give Vanta a competitive edge in the market:

First-Mover Advantage: Vanta addressed the need for automated startup compliance early, giving it a head start to refine its product and build credibility. By the time others like Drata launched, Vanta had already established itself with hundreds of customers and a proven solution, making it the default choice in many circles.

Comprehensive Platform: Vanta offers a wider scope of features than most point-solution competitors. It evolved from a SOC 2 tool into a full “trust management” platform covering multiple standards and continuous security monitoring. This one-stop approach is convenient for customers and leads to higher “stickiness” and usage of Vanta’s platform across needs. Clients can handle SOC 2, ISO 27001, HIPAA and more in one place, and use Vanta’s trust center and risk modules instead of procuring separate tools.

Strong Customer Trust and Brand: Vanta’s strategy of over-delivering for clients early on led to strong word-of-mouth and trust in its brand. The company successfully turned compliance from a mere obligation into a value-add; many customers use Vanta’s Trust Center to expedite their own sales and signal reliability to prospects. Being trusted by prominent tech companies (like Atlassian and Snowflake) further bolsters Vanta’s reputation. This level of trust and brand recognition is hard for newer entrants to replicate quickly.

Operational Discipline: Unlike some startups that chased growth at all costs, Vanta ran lean and focused on sustainable growth. Cacioppo’s emphasis on prudent spending and scaling headcount carefully resulted in an efficient business. This discipline meant Vanta didn’t face major setbacks even when market conditions tightened, and it impressed investors (as reflected in Vanta’s strong metrics and the confidence of repeat backers). More of Vanta’s venture funding can be directed to product and market expansion, rather than covering high burn rates – a competitive advantage in periods of economic uncertainty.

Continuous Innovation: Vanta has been quick to integrate new technologies and features to maintain its edge. For instance, it began embedding AI into the platform for tasks like answering security questionnaires and detecting policy inconsistencies as early as 2022-23, ahead of many competitors. By 2024, its AI features could help finish security reviews 81% faster. By adopting innovations early, Vanta keeps competitors playing catch-up. Additionally, Vanta’s rapid development pace (over 350 new features shipped in a year) means it can respond to customer needs faster than less-resourced rivals.

In summary, Vanta’s advantages lie in its head start, breadth of offering, trusted brand, disciplined execution, and relentless product improvement. These factors create a high barrier to entry and have established Vanta as a frontrunner in the security compliance automation market.

Also Read: Skyflow – Founders, Business Model, Funding & Competitors

To read more content like this, subscribe to our newsletter