DoorLoop is a venture-funded property management software startup founded in 2019 and headquartered in Miami, Florida. It offers an all-in-one platform for landlords and property managers to automate rental operations, from tenant onboarding to rent collection.

The company has quickly gained traction in the proptech industry, raising $130 million in total funding as of 2025. Recognized for its rapid growth and high customer satisfaction, DoorLoop has scaled to over 200 employees by 2025 and serves a global user base.

This article provides a strategic analysis of DoorLoop, covering its founding history, business model, revenue streams, funding milestones, competitive landscape, and product offerings.

Founding Story of DoorLoop

DoorLoop’s origin story begins with the personal frustrations of its founders managing real estate. Ori Tamuz, a serial software entrepreneur and real estate investor, struggled to find a property management solution that was simultaneously powerful, user-friendly, and affordable.

In 2019, Tamuz and his co-founders decided to build a better solution themselves. As they put it, “if it has a door, you can manage it with DoorLoop” – encapsulating their vision to handle any property type through their software.

Prior to DoorLoop, Tamuz and David Bitton had co-founded a legal practice management SaaS (PracticePanther) which was acquired in 2018. This exit provided both the capital and confidence to embark on a new venture. The idea for DoorLoop had actually sparked earlier, when Tamuz was self-managing his rental properties and realized existing tools were inadequate.

After selling their previous startup, the team formalized DoorLoop’s concept, raised initial capital, and began development in 2019. Over the next two years, the founding team quietly built the platform, ensuring it met their core criteria: ease of use, comprehensive functionality, and excellent customer support.

DoorLoop officially launched its services in early 2021. This “stealth mode” development period allowed the product to mature before public debut.

The founding story of DoorLoop is thus rooted in a clear market need identified through firsthand experience, combined with the founders’ prior success in SaaS – a synergy that shaped DoorLoop’s mission to “make property management easier for anyone that manages any type of unit”.

Founders of DoorLoop

DoorLoop was founded by a team of five industry veterans, whose diverse backgrounds in software, real estate, and operations shaped the company’s direction.

Ori Tamuz serves as Co-Founder & CEO. A 3x serial entrepreneur and technical developer, Tamuz had co-founded and sold two software companies used by thousands worldwide. His experience as both a technologist and a real estate investor drives DoorLoop’s product vision.

David Bitton, Co-Founder (formerly CMO), is a 5x entrepreneur and author who grew up around real estate. Bitton made his first property investment at 21 and previously led marketing at the founders’ prior startup, giving him deep insight into both real estate and growth strategy.

Itay Gardi, Co-Founder & CTO, is an expert software architect and product designer with a track record of transforming tech companies into industry leaders. Gardi’s leadership ensures DoorLoop’s platform is robust, secure, and scalable.

Matthew (Matt) Cave, Co-Founder & Director of Customer Success (CSD), brings a hybrid skillset in real estate and finance – he holds a master’s in real estate and has served as a project manager, CFO, and COO in prior companies. Cave’s focus is on ensuring that customers are onboarded smoothly and supported effectively, aligning with DoorLoop’s customer-centric ethos.

Adam Mait, Co-Founder (now an executive in operations/legal roles), is a licensed attorney and seasoned real estate developer. Mait’s background spans commercial real estate development and property management, providing practical industry know-how and ensuring the software meets real-world legal and operational requirements.

Collectively, their expertise in SaaS and property management gave DoorLoop a strong foundation and credibility in its early days. Notably, DoorLoop’s seed round was led by these co-founders themselves – a testament to their confidence in the venture and a “proven team and playbook” that even outside investors cited as key to DoorLoop’s success.

Business Model of DoorLoop

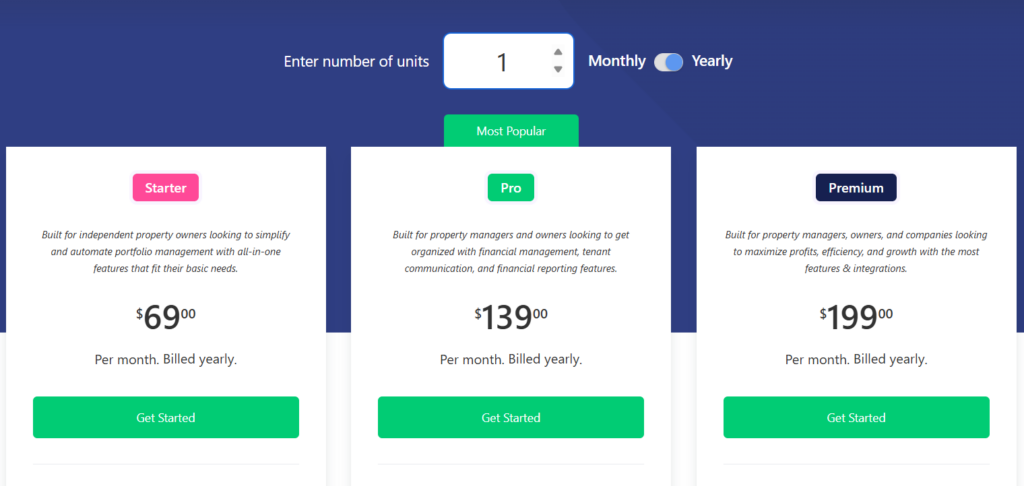

DoorLoop operates on a software-as-a-service (SaaS) business model, delivering its property management platform via cloud subscription. The software is offered in tiered plans but is uniformly priced at roughly $3 per rental unit per month across plans (with volume discounts for annual billing). This usage-based pricing makes DoorLoop scalable for both small landlords and larger property managers.

In practice, the monthly subscription fee constitutes the primary revenue driver, granting users access to the all-in-one management system. Each plan (Starter, Pro, Premium) includes a base set of features, with higher tiers unlocking advanced accounting, integrations, and support options.

DoorLoop’s go-to-market strategy initially targeted the mid-sized property management segment, typically customers managing up to 10,000 units. These are clients who often find enterprise systems too costly or complex, yet outgrow basic spreadsheets. By focusing on this middle market, DoorLoop positioned itself between legacy enterprise software and lightweight DIY solutions.

Notably, the company also accommodates small independent landlords – even those with just a handful of units – by offering an affordable entry-level plan and emphasizing ease of use. This broad approach led to rapid user adoption; the platform was reportedly taken up by “tens of thousands of customers worldwide” within months of its 2021 public launch.

DoorLoop distributes its product through online channels, offering free demos and highlighting quick onboarding. Implementation is fast by industry standards – new clients can be up and running in days, as opposed to weeks or months for some competitors.

The company’s value proposition is grounded in consolidating all necessary tools (leasing, accounting, maintenance, etc.) in one interface, thereby saving customers time and money. In summary, DoorLoop’s business model is a subscription SaaS platform tailored to a wide range of property owners/managers, with pricing and service strategies designed to lower barriers to adoption and encourage portfolio growth on the platform.

Revenue Streams of DoorLoop

DoorLoop’s revenue primarily comes from recurring subscription fees paid by property managers and owners for access to its cloud-based software. Users pay a monthly (or annual) fee per property unit managed, which scales with portfolio size. This subscription-based licensing drove the company’s financial growth – for instance, DoorLoop’s annual revenue quadrupled in 2021 to over $1 million, reflecting the surge in paying customers after launch.

Beyond subscription licenses, DoorLoop generates ancillary revenue through value-added services and integrations associated with property management.

One such stream is electronic payment processing: the software enables rent and fee collection via ACH, credit/debit cards, and digital wallets, typically charging transaction fees. In fact, DoorLoop’s premium plan waives ACH payment fees entirely as a perk, implying that lower-tier plans include a small fee per transaction that contributes to revenue.

Similarly, the platform offers tenant screening services (credit, criminal, and eviction checks powered by TransUnion) and rental application processing. These screenings carry a fee, often borne by applicants or passed through to landlords, from which DoorLoop can earn a margin or referral commission.

Another supplemental revenue source is electronic signatures for leases and documents: DoorLoop integrates e-signature functionality and notes that additional fees apply for e-sign usage on basic plans (unlimited free e-signatures are included in the top-tier plan). This indicates a pay-per-use revenue component for certain features. The company has also formed partnerships that could generate revenue or enhance customer value – for example, an integration with Western Union was launched to facilitate cash rent payments, likely involving service fees.

In aggregate, however, subscription fees remain DoorLoop’s financial backbone, with transaction-based fees and premium add-ons providing incremental revenue.

Funding of DoorLoop

Since its inception, DoorLoop has attracted significant investment to fuel product development and expansion.

The company’s funding journey began with an unusually large seed round of $10 million in 2021. Notably, this seed financing was led by DoorLoop’s own founders alongside private investors, reflecting the founders’ confidence (bolstered by their prior exit) and providing ample runway for the startup’s early growth. The seed capital funded DoorLoop’s initial platform build-out and product launch.

Following strong initial traction, DoorLoop secured a Series A round of $20 million in September 2022. The Series A was led by Alpine Software Group (ASG), a strategic investor known for scaling vertical SaaS companies. ASG had previously acquired the founders’ earlier startup, underscoring their trust in DoorLoop’s team. With this $20M infusion (bringing total funding to $30M), DoorLoop invested heavily in growth: by the time of the Series A, the company had grown 400% in revenue and expanded to 50+ employees. Funds were allocated to accelerating product development and hiring across engineering, marketing, and customer success.

The substantial Series B round came two years later. In October 2024, DoorLoop announced a $100 million Series B led by JMI Equity, a prominent growth equity firm focused on software. This raise (bringing total funding to $130M) is being used to “accelerate product innovation and team expansion” as DoorLoop transitions from disruptive startup to an industry leader. Part of the capital is earmarked for scaling the team and opening new offices – by late 2024, DoorLoop had about 150 full-time employees across its Miami and Tel Aviv locations.

Each funding round corresponded with key milestones: the seed round supported product launch, the Series A propelled market expansion and new features (e.g. broadening into HOA and self-storage management), and the Series B is positioning DoorLoop for broad market leadership with a robust war chest.

Funding Rounds of DoorLoop

The table below summarizes DoorLoop’s major funding rounds, including the date, amount raised, and lead investors for each round:

Each round marked a step-change in DoorLoop’s growth. The Seed round in mid-2021 provided early financing to build the platform and prove the concept in the market. The Series A in late 2022 came as DoorLoop demonstrated rapid revenue and user growth, and it brought on ASG not just as a capital source but as a strategic partner familiar with scaling SaaS businesses. Finally, the Series B in October 2024 – a very large proptech investment – aimed to solidify DoorLoop’s position. JMI’s backing was seen as a vote of confidence that DoorLoop could “launch into its next phase of growth” and continue setting industry standards. With $130M total funding raised, DoorLoop has ample resources to execute its roadmap, from accelerated R&D to aggressive marketing and global expansion.

Competitors of DoorLoop

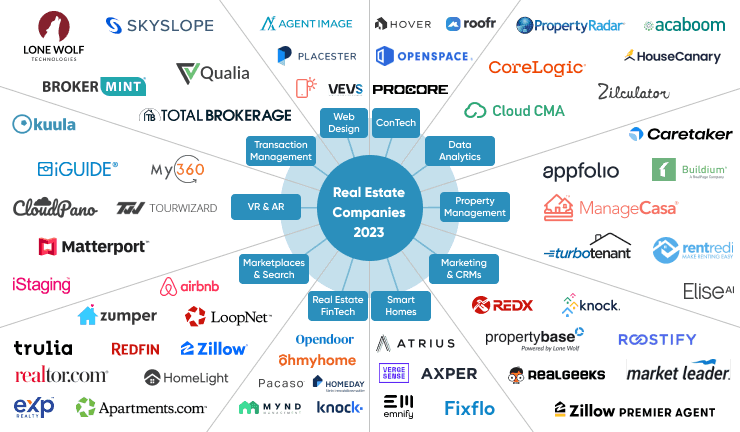

DoorLoop competes in a crowded property management software market that includes both long-established giants and newer tech-driven entrants.

Traditional “goliaths” in the rental management software space include Yardi (founded 1984), RealPage (founded 1998, major multi-family housing platform), and AppFolio (founded 2006, a public SaaS company). These incumbents collectively serve millions of rental units and have deep feature sets, but are often criticized as cumbersome and outdated in user experience.

Real estate tech analysts note that many legacy systems have not kept pace with modern UX standards, integration capabilities, or onboarding speed. Moreover, some established players historically targeted larger enterprise clients, leaving a gap in the small-to-mid landlord segment. This landscape provided an opening for DoorLoop and peer PropTech startups to differentiate.

DoorLoop’s founders have publicly welcomed the existence of many competitors, seeing it as validation of strong market demand: “there’s a lot of competition, and we love that, because it tells us there’s a big need in the market,” Bitton said. DoorLoop explicitly framed its mission as taking on the massive companies that dominated the field, aiming to “dethrone” them with a better, faster, cheaper offering.

A qualitative comparison reveals DoorLoop’s strategic positioning: it offers the breadth of functionality that rivals like AppFolio or Yardi provide, but with a focus on greater usability, faster implementation, and attentive support.

For instance, whereas switching to a legacy system can take weeks or months, DoorLoop can onboard new clients within days. The software also prides itself on an open API and easy integrations, addressing complaints that older systems silo data and cannot connect to modern apps.

Many customers switching from competitors cite superior customer service as a key reason for choosing DoorLoop.

In essence, DoorLoop’s competitive strategy is to combine the comprehensive scope of “all-in-one” incumbents with the agility and user-centric approach of a startup. The market remains highly competitive, but DoorLoop’s rapid expansion to tens of thousands of users in over 100 countries by leveraging these advantages illustrates its ability to win share against established rivals.

Competitive Advantage of DoorLoop

DoorLoop’s rise in a mature industry can be attributed to several competitive advantages grounded in product and service excellence.

1) Software Design

First and foremost is its intuitive, modern software design, which minimizes the learning curve for new users. The interface was built with simplicity and “minimal learning” in mind, in contrast to clunkier legacy systems. David Bitton, DoorLoop’s co-founder, emphasized that the technology is “intuitive, easy to use, and speedy” compared to larger competitors. This ease of use directly translates to saved time – customers report saving dozens of hours per month by automating workflows that were manual before.

2) Customer Support

Secondly, DoorLoop distinguishes itself with exceptional customer support. All users, even on the basic plan, receive access to “world-class support…available in minutes via phone, chat, or email”. This contrasts with competitors who may tier support or take hours/days to respond. In fact, DoorLoop boasts an average support response time of around 3 minutes. Fast, helpful service has turned many clients into loyal “raving fans,” and customer feedback consistently highlights support as a major DoorLoop advantage.

3) Speed

Thirdly, the company’s speed of implementation and innovation gives it an edge. As a nimble startup, DoorLoop can deploy new features and improvements on a rapid cycle (often monthly), and its onboarding team offers white-glove data migration so that new customers “go live in days, not months”. This responsiveness means the product often incorporates customer feedback faster than larger competitors can.

4) Comprehensive Platform

Additionally, DoorLoop’s platform is highly comprehensive and flexible – it covers an array of functions (accounting, leasing, maintenance, communications, etc.) in one system, and also provides an open API for integrations. This allows tech-savvy property managers to connect DoorLoop with other tools (e.g. marketing websites or external accounting systems), addressing a historical pain point where older software lacked integration options.

These strengths have been validated by external recognition: in 2024 DoorLoop was ranked #13 on Forbes’ list of America’s Best Startup Employers and earned the highest user satisfaction score among property management software on Capterra’s annual rankings.

In summary, DoorLoop’s competitive advantage lies in delivering a “best of both worlds” solution: a platform as feature-rich and scalable as major providers, but with the user-friendliness, responsive support, and agility of a startup.

Products and Services of DoorLoop

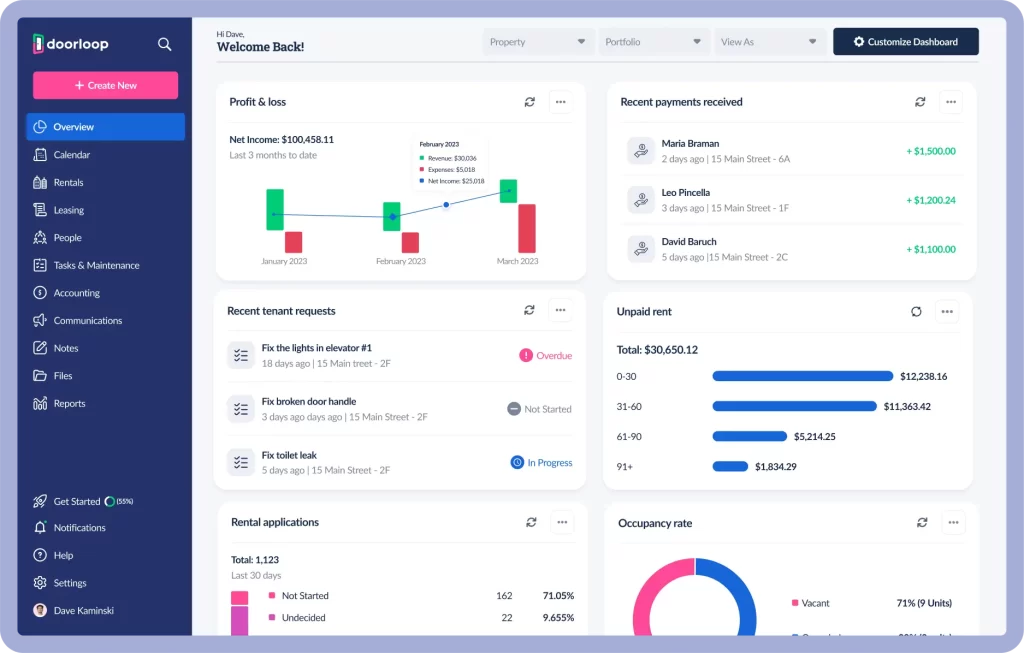

At its core, DoorLoop’s platform covers the entire rental lifecycle from marketing a vacancy to move-out. The software automates tasks such as listing units, tenant screening, rent collection, maintenance requests, and move-outs, all in one interface. Major product modules include:

-

Marketing & Tenant Onboarding: Tools to create and syndicate rental listings, accept online applications, and run background/credit checks (via TransUnion) for screening tenants. Lease agreements can be executed with built-in e-signature support.

-

Lease Management & Rent Collection: Features to schedule rent charges, issue invoices, and collect payments electronically. DoorLoop supports multiple payment methods (ACH, credit/debit, digital wallets) and even cash payments via a Western Union integration. Automated reminders and receipts streamline the rent collection process.

-

Accounting & Financial Reporting: A full general ledger system for tracking income and expenses per property. Users can reconcile bank transactions, sync data to QuickBooks Online, and generate reports (income statements, balance sheets, owner statements, tax documents) for their portfolios.

-

Maintenance & Operations: A tenant portal and mobile app allow tenants to submit maintenance tickets (with photos) which managers can track and assign to vendors. Work orders, vendor assignments, and status updates are managed centrally. The platform also handles other operational needs like move-in/move-out checklists and document storage.

-

Communication & Additional Capabilities: Built-in email and SMS tools enable two-way communication with tenants for notices or announcements. A CRM-like record is kept for each tenant, consolidating lease documents and interaction history. DoorLoop also provides an Owner Portal for clients managing properties on behalf of investors, and an open API for connecting external software. A companion mobile app (iOS/Android) allows on-the-go access to all these features.

DoorLoop continuously expands its product offerings. For example, in 2023 it launched “DoorLoop HOA,” a tailored module for homeowners association management, reflecting its strategy to broaden supported portfolio types. The company also rolled out new payment integrations (e.g. adding support for Cash App and Chime for rent payments) to cater to tenant preferences.

Additionally, DoorLoop introduced an AI-powered virtual assistant called “Looper AI” in 2023. This chatbot (built on ChatGPT) serves as a free real estate knowledge base and helps users with property management questions, showcasing DoorLoop’s commitment to innovation.

Complementing the software, DoorLoop produces extensive educational content – including a blog, webinars, a podcast (“Loop It In”), and DoorLoop University (a self-service learning portal) – to help customers succeed and to establish thought leadership in the industry.

By late 2024, DoorLoop also began geographic expansion, opening a new office in New York City to support its growing client base on the East Coast. Overall, DoorLoop’s product suite is holistic, aiming to be a one-stop solution so clients do not need multiple platforms for different tasks.

New features and improvements are added regularly, often guided by user feedback. This breadth of services, combined with constant enhancement, underpins DoorLoop’s value proposition of simplifying property management through technology.

Conclusion

In conclusion, DoorLoop’s brand story is one of experienced entrepreneurs leveraging personal insight to disrupt an established industry with a modern, customer-centric solution. From its founding in 2019 with the goal of making property management effortless, DoorLoop has evolved into a high-growth proptech company with strong fundamentals. The founders’ background in both software startups and real estate enabled a strategic blueprint that attracted sizable funding and achieved product-market fit quickly.

As of 2025, DoorLoop stands supported by $130M in venture funding and is scaling up to challenge incumbents on a larger stage. Its business model – recurring SaaS revenue augmented by service integrations – provides a solid financial base, while its relentless focus on usability and support has translated into industry-leading customer satisfaction. The competitive analysis shows that DoorLoop has carved out a differentiated position: filling the gap for an all-in-one platform that is both powerful and easy to use, with an agility that outpaces older rivals.

Of course, challenges lie ahead. The property management software arena remains dynamic, with established firms and new entrants vying for market share. DoorLoop will need to continue innovating (as it has with AI integration and specialized solutions for HOAs, etc.) and expanding its brand recognition to win larger clients.

The company’s leadership has signaled ambitions for an eventual unicorn valuation and public offering in the coming years, which will require sustained growth and execution.

However, the evidence to date – from rapid customer adoption and revenue growth to high retention and industry accolades – suggests that DoorLoop’s strategic formula is working. The startup’s trajectory thus far exemplifies how a clear mission and strong execution can yield a compelling brand in a traditional sector.

DoorLoop’s leadership asserts it will stay true to its mission of helping property managers save time and grow their portfolios through technology. With a robust product, loyal customer base, and significant capital, DoorLoop is well-positioned to continue changing the way properties are managed in the years to come.

Also Read: Pacaso – Founders, Business Model, Funding & Competitors

Also Read: QuintoAndar – Founders, Business and Revenue Model & Funding

To read more content like this, subscribe to our newsletter