MaintainX is a San Francisco–headquartered software startup founded in 2018 that provides mobile-first work order and maintenance management solutions to “deskless” industrial workers. The startup was born out of its founders’ recognition that frontline workers still relied on clipboards and spreadsheets as their system of record.

Today, MaintainX serves on the order of 11,000+ companies and manages over 11 million assets in its platform. Its products – a cloud-based CMMS/EAM platform with AI-enabled features – have been widely adopted across manufacturing, food/beverage, logistics and other asset-intensive sectors.

This article examines MaintainX’s origin, people, business model, financing history, competitive context, and product strategy.

Founding Story of MaintainX

MaintainX’s story began in 2018, when co-founders Chris Turlica and Hugo Dozois-Caouette (along with co-founders Mathieu Marengère-Gosselin and Nick Haase) set out to revolutionize industrial maintenance. Having previously built and sold a company together (Voo, a consumer-facing startup), the founding team observed that “frontline professionals” and plant workers remained “underserved by modern software”.

In nearly every industrial setting, the state-of-the-art record-keeping was still a clipboard. Motivated by this gap, the founders decided to build “a simple-to-use workflow deployment and orchestration environment” tailored to maintenance and operations. They envisioned a tool “as easy to understand as Slack and Asana but very use-case specific for frontline needs”.

In short, they set out to create a mobile-first digital platform to replace paper work orders and checklists, enabling frontline teams to collaborate on repairs, inspections, and safety tasks in real-time.

Financing the launch, MaintainX raised a $3.8 million seed round in March 2019, led by venture firms August Capital and Amity Ventures. This enabled the founders to expand development of their core product. By mid-2019, they were actively signing up early adopters across manufacturing, hospitality, retail and other industries.

In a series A later in 2019 (undisclosed publicly but reported to be $11M), MaintainX continued to refine its product and grow its customer base. Thus, the early founding period established MaintainX’s mission and initial traction: providing an intuitive, cloud-based maintenance management solution for industrial operations.

Founders of MaintainX

Four entrepreneurs with complementary backgrounds co-founded MaintainX.

Chris Turlica (CEO) and Hugo Dozois-Caouette (CTO) remain the highest-profile founders.

Turlica is a McGill-educated financial engineer and venture operator; prior to MaintainX he led and exited a fintech startup (Voo).

Dozois-Caouette is a lead software engineer who had worked at Autodesk and co-founded Voo with Turlica.

Both brought deep technical and startup experience to the new venture.

The other co-founders are Mathieu Marengère-Gosselin (Head of Engineering) and Nick Haase (go-to-market strategy).

Marengère-Gosselin has a decade of engineering experience and served as MaintainX’s lead engineer from day one.

Haase, an expert in maintenance technologies, has been responsible for MaintainX’s design and marketing direction.

Together, the founders combined tech and product vision (Turlica, Dozois-Caouette, Marengère-Gosselin) with marketing and sales leadership (Haase).

As of 2025, MaintainX’s leadership team reflects this founding split: Turlica and Dozois-Caouette are listed as CEO and CTO, respectively, while Haase’s role has evolved into community and growth leadership. Marengère-Gosselin remains the engineering head.

The company also built its executive team with experienced operators: for example, Will Lehrmann serves as President, and Tyson Gwaltney (ex-Parsable) as Chief Growth Officer (noted on the official site). In investor materials, MaintainX also cites board members such as David Hornik and Byron Deeter (Bessemer) helping guide strategy. The founders’ prior collaboration and alignment around frontline workflows set a culture emphasizing competence, humility and optimism, traits they credit with enabling rapid growth.

Business Model of MaintainX

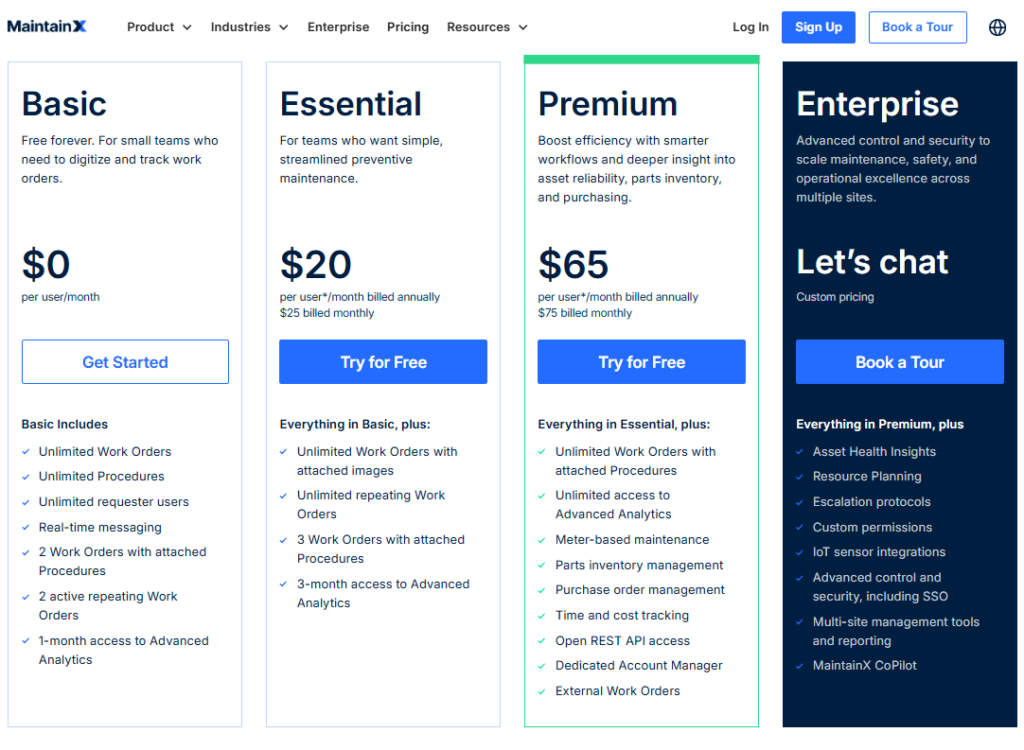

MaintainX’s business model is that of a cloud-based SaaS (Software-as-a-Service) platform targeted at industrial and facilities management. It offers its software primarily on a subscription licensing basis. The company serves a wide range of customer sizes – from small facilities teams to large enterprises – and accordingly has tiered pricing plans.

A free “Basic” tier provides core CMMS functionality at no cost (with limit on users/features), enabling easy trial and adoption. Paid tiers (Essential and Premium) add advanced features and analytics.

For example, as of 2025 the Essential plan is priced around $20 per user per month (with discounts for annual billing), and Premium around $65/user/month. Larger organizations typically negotiate custom enterprise agreements with additional services.

MaintainX’s revenue streams center on these subscription fees. Beyond pure software licenses, the company also offers professional services and add-ons. For instance, it provides expert implementation packages and training (e.g. “Expert Implementation”) to help large customers roll out the system.

It has forged partnerships and integrations with enterprise software ecosystems (notably SAP and AWS): an AWS Marketplace listing was established in 2025, and strategic alliances with SAP and other partners were built under its Director of Partnerships.

These partnerships expand its channel reach and integration offerings. In short, MaintainX sells recurring software subscriptions (often multi-year contracts) to industrial customers, supplemented by implementation consulting, support services, and ecosystem extensions on cloud marketplaces.

Revenue Streams of MaintainX

MaintainX’s revenues derive almost entirely from customer subscriptions and related services.

The core is the multi-tiered subscription model: many small teams start on the free or Essential plan, while midsize and enterprise clients pay for Premium or custom enterprise licenses. Subscription revenue scales with number of users and modules used.

Additionally, MaintainX can generate one-time or ongoing fees from implementation, training, and data migration services for large deployments. The partnerships with SAP and AWS suggest revenue share or referral streams via marketplaces. Although the company does not publicly report revenue figures, investor reports emphasize rapid revenue growth (over 10× in 2021–2023) and high retention (~98% customer retention rate noted in 2021).

In summary, MaintainX’s monetization is classic enterprise SaaS: recurring license fees for software and cloud usage, with professional services as a secondary stream.

Funding of MaintainX

MaintainX has raised venture capital through multiple rounds, totaling roughly $254 million by mid-2025.

The funding history began with a $3.8 million seed round in March 2019 (led by Amity Ventures and August Capital). Later in 2019, the company secured an $11 million Series A (not publicly announced at the time, but confirmed in later reports).

In June 2021, MaintainX announced a $39 million Series B led by Bessemer Venture Partners (with participation from Amity, Vulcan, August and others). This round brought the total raised to $54M (including seed and Series A) and came during a period of ~12× revenue growth.

The next major round was a $50 million Series C in December 2023 (led by Bain Capital Ventures), which valued MaintainX at about $1.0 billion. Most recently, in July 2025 the company raised $150 million in Series D funding (led by existing investors Bessemer, Bain and new backers) at a $2.5 billion post-money valuation.

These investments have fueled product development, AI integration, and global expansion. For example, the Series D round (July 2025) more than doubled the company’s valuation from the Series C level. With each round, investor participation expanded: by mid-2025 MaintainX’s backers included top SaaS-focused VCs (Bessemer, Bain, Amity) and strategic capital (D.E. Shaw, etc.). Company press releases and filings indicate that the capital will also support scaling sales and marketing, and continued R&D in AI and IoT features.

Overall, MaintainX’s strong funding profile reflects confidence in its market opportunity and growth trajectory.

Funding Rounds of MaintainX

| Round | Date | Amount Raised | Lead Investors | Notable Valuation |

|---|---|---|---|---|

| Seed | Mar 2019 | $3.8M | Amity Ventures, August Capital | – |

| Series A | May 2019 | $11M | Undisclosed lead (VC-backed) | – |

| Series B | Jun 2021 | $39M | Bessemer Venture Partners | – |

| Series C | Dec 2023 | $50M | Bain Capital Ventures | $1.0B (post-money) |

| Series D | Jul 2025 | $150M | Bessemer, Bain, Amity, etc. | $2.5B (post-money) |

Table: MaintainX major funding rounds (2019–2025).

In its Series B announcement, the company noted that the $39M round (Jun 2021) combined with prior raises (seed + an 2019 Series A) summed to $54M total. By Series D, MaintainX had raised $254M cumulatively, doubling its valuation from the prior $1B series C figure. These funds have underwritten rapid staff growth (to ~500–1000 employees) and extensive R&D in AI-driven maintenance technologies.

Competitors of MaintainX

MaintainX operates in the crowded CMMS/EAM software market.

Key competitors include other cloud CMMS providers like UpKeep, Fiix (Rockwell Automation), and eMaint (Fluke), all of which target maintenance teams with similar offerings.

In addition, newer SaaS players such as Hippo CMMS, Limble CMMS, and Fracttal are relevant. At the higher end, enterprise asset management suites like IBM’s Maximo and IFS (Industrial and Financial Systems) compete for large manufacturing and utility customers.

According to market research, MaintainX is already listed among the leading CMMS vendors globally – alongside Fiix and IBM – underscoring its competitive position. In practice, MaintainX often competes head-to-head with UpKeep and Fiix for mid-market industrial clients, while also positioning itself as a modern alternative to legacy EAM systems (leveraging ease-of-use and AI features to displace older products).

Each competitor has strengths (e.g. Maximo’s deep integration into utilities, Fiix’s large installed base, UpKeep’s mobile focus), so MaintainX differentiates on user experience and AI. Review sites and Gartner Peer Insights list MaintainX against these alternatives; for example, Gartner’s top alternatives to asset management software include IBM Maximo, UpKeep, eMaint, and others. MaintainX’s market share in overall CMMS is smaller than giants like IBM, but it has achieved rapid growth and high rankings (e.g. #1 on G2 in EAM/CMMS) through aggressive innovation.

Overall, the competitive landscape is intense, but MaintainX’s fast adoption suggests it has carved out significant niche traction.

Competitive Advantage of MaintainX

MaintainX’s competitive advantage lies in its combination of usability, data-driven intelligence, and rapid innovation. Unlike many legacy CMMS products, MaintainX is designed for mobile, on-the-floor use by technicians – an approach praised by customers.

Its platform has consistently yielded strong operational results: for instance, MaintainX reports that its customers experience, on average, a 34% reduction in unplanned downtime within the first year of use. Investor case studies note that typical clients also see a ~15% boost in production capacity and cost savings of up to ~32% on maintenance spending. These quantifiable ROI figures (reducing downtime and labor waste) are powerful proof points that set MaintainX apart from simpler CMMS tools.

On the technology side, MaintainX has infused artificial intelligence and Internet-of-Things integration into its offering. Its “CoPilot” AI features can auto-generate maintenance procedures from documentation, detect anomalies in equipment behavior, and even transcribe voice memos from field technicians into work orders.

This emphasis on AI-driven knowledge capture gives MaintainX an edge over competitors that lack such smart maintenance assistants. Furthermore, the platform offers broad IoT connectivity (in partnership with systems like Ignition and AWS IoT) so that sensor data can feed into maintenance workflows. As a recent press release explains, MaintainX “leverages AI and IoT to connect asset and work intelligence data”, enabling predictive maintenance insights and proactive actions.

Finally, MaintainX has earned high marks from users and industry analysts. It has been ranked as the #1 CMMS/EAM provider on G2 (Summer 2025) and recognized in Deloitte’s Tech Fast 500.

Customers cite the intuitive user interface and ease of implementation as key differentiators: in a Duracell case study, the maintenance manager praised MaintainX’s smooth SAP integration and mobile access to inventory data as “the smoothest integration I’ve ever seen in my career”.

In sum, MaintainX’s advantage is its customer-centric design combined with cutting-edge analytics. By “amplifying human capability” rather than replacing technicians, it offers a modern solution that incumbents and pure-mobile competitors both struggle to match.

Products and Services of MaintainX

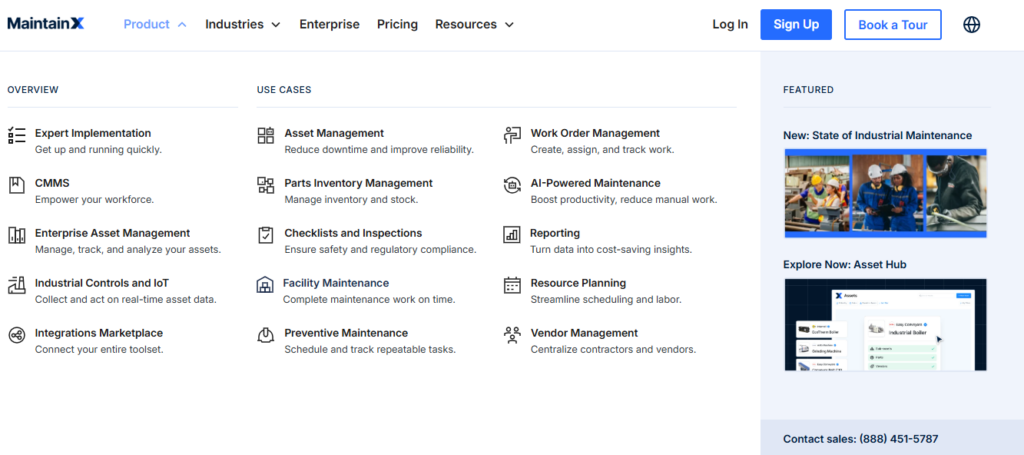

MaintainX’s product is a modular cloud platform for maintenance and asset management. The core offering can be described in functional segments (Table 1).

At its heart is a Work Order and Task Management module: digital work orders, checklists, safety inspections and audit trails accessible via web and mobile apps. This replaces manual paper forms, allowing managers to assign tasks, technicians to update progress in real-time, and organizations to capture data from the shop floor.

Closely related is the Asset and Preventive Maintenance module: a registry of equipment and assets, with scheduling of recurring preventive tasks and calibration checks. Customers use this to automate routine maintenance and ensure compliance. According to a company blog, the platform “streamlines workflows and boosts productivity” by covering reactive maintenance, preventive tasks, safety inspections and quality checks – with a digital audit trail for each.

Table 1. Overview of MaintainX Solutions

| Solution Area | Description & Key Capabilities |

|---|---|

| Work Order & Task Management | Digital creation and tracking of work orders, checklists, audits, and standard operating procedures for frontline teams. Real-time status updates, attachments (photos/docs), and team collaboration features on mobile and web. |

| Asset & Preventive Maintenance | Asset registry with equipment details and lifecycle data. Scheduling of preventive maintenance tasks and inspections to avoid breakdowns. Analytics and reporting on asset health and downtime. |

| AI-Enabled Maintenance (CoPilot) | AI-driven features for maintenance: automated procedure generation from manuals, anomaly detection on sensor data, and voice-memo transcription for technicians. Enables predictive maintenance and guides users with data-driven recommendations. |

| Inventory & Parts Management | Tracking of spare parts and supplies inventory (syncs with ERP systems like SAP). Allows technicians to search parts, check stock levels, and manage vendor orders on mobile (e.g. Duracell saved $50K/yr by syncing inventory with SAP). |

| Integrations & IoT Connectivity | Open APIs and connectors to integrate with sensors, control systems, and enterprise software (SAP, AWS, Ignition, etc.). This brings real-time asset data into MaintainX, enabling rich analytics and seamless information flow across systems. |

| Mobile Frontend & Support | Native iOS/Android apps with offline capability, multi-language support, and user-friendly UI. Backed by enterprise support and implementation services (including expert onboarding and training for large customers). |

Each solution area leverages mobile accessibility and data integration. For example, the Duracell case study highlights how technicians use the MaintainX mobile app to check inventory and assets directly on the shop floor.

In July 2025, MaintainX further enhanced its product suite by adding advanced AI maintenance functions: new generative AI procedures, anomaly detection dashboards, and field-speech recognition, all integrated into the existing modules. It also offers APIs and an integrations marketplace to connect with accounting, ERP and IoT platforms.

Overall, MaintainX’s services encompass the software licenses above plus implementation consulting. Large customers often engage MaintainX for custom integration work (as with SAP) and staff training, reflecting a full-platform solution model.

Conclusion

MaintainX’s brand story is one of rapid growth and strategic focus in a niche but critical market. Starting from a founders’ insight about inefficient maintenance processes, the company has developed a modern CMMS/EAM platform that emphasizes frontline usability and AI-driven efficiency. Its funding history (now $254M total) and valuation ($2.5B as of mid-2025) demonstrate investor confidence. Recent case studies (e.g. Duracell’s $50K yearly parts-saving) illustrate MaintainX’s impact at large enterprises. As of 2025, MaintainX reports deployment in over 11,000 organizations, processing tens of millions of work orders annually. It continues to expand globally, adding machine learning capabilities (e.g. AI co-pilot) and enterprise-grade features to capture a larger share of the $50+ billion maintenance software market.

Strategically, MaintainX leverages its differentiated user experience and AI to challenge incumbents and serve the wave of digital transformation in industry. Its competitive advantage – demonstrated by measurable downtime reduction and customer satisfaction – positions it well against peers. Future growth will likely depend on further scaling enterprise sales, deepening technology integration (including IoT and data analytics), and maintaining product leadership. In summary, MaintainX’s brand narrative reflects an insurgent IT startup that has turned workplace inefficiencies into a high-growth business, backed by strong venture capital and delivering evidence-backed results for the physical operations sector.

Also Read: Otter.ai – Founders, Business Model, Funding & Competitors

To read more content like this, subscribe to our newsletter