People.ai is an artificial intelligence (AI)-powered revenue intelligence startup that helps businesses unlock growth by leveraging data from every sales and marketing interaction. Founded in 2016 and headquartered in Redwood City, California, People.ai has built a platform that captures and analyzes all go-to-market (GTM) activities – emails, calls, meetings, and more – to provide actionable insights for revenue teams.

By automatically aggregating these formerly siloed data points, the company enables sales leaders to gain a complete, data-driven picture of their pipeline and team performance. This modern, AI-first approach addresses a common pain point in sales organizations: the lack of accurate, complete customer data in CRM systems, which traditionally forces managers to rely on intuition rather than facts. In an era where 80% of B2B sales interactions are projected to take place digitally by 2025, People.ai’s solution has positioned it at the forefront of the revenue operations and intelligence market.

Over nearly a decade, People.ai has emerged as a leading brand in revenue intelligence, recognized for its innovative use of AI and data. The company’s platform has been trained on billions of sales data points, delivering predictive analytics and coaching for sales teams. With high-profile enterprise clients such as Zoom, Okta, Red Hat, and Palo Alto Networks (primarily in the tech sector), People.ai has demonstrated its value by boosting sales productivity (Zoom, for example, saw a 42% increase in reps’ bookings using People.ai’s insights).

People.ai has also begun to extend into industries like manufacturing, telecommunications, and life sciences as those sectors adopt revenue intelligence tools. The venture-backed startup achieved unicorn status in 2021 with a valuation over $1.1 billion, and has been named a Visionary in Gartner’s 2025 Magic Quadrant for Revenue Action Orchestration – underscoring its growing influence in the U.S. sales technology landscape. Notably, the revenue intelligence market as a whole is projected to grow from about $2.8 billion in 2020 to $7.4 billion by 2030, reflecting strong demand for these solutions and a rapidly expanding competitive field.

This article will examine People.ai’s founding, leadership, business model, revenue streams, funding history, competitors, competitive advantages, products, and an overall outlook.

Founding Story of People.ai

People.ai’s inception is rooted in Oleg Rogynskyy’s firsthand frustration with sales data management. In previous roles, he saw how incomplete, messy CRM data could halt growth – at one point, a sales team was grounded for a week just to scrub Salesforce records. By early 2016, he was determined to solve this pervasive problem once and for all.

That conviction was catalyzed by an investor meeting in 2016. An angel backer from one of Rogynskyy’s prior ventures encouraged him to start a new company, even writing a check for $150,000 on the spot. Armed with this seed capital, Rogynskyy founded People.ai in early 2016 with a goal to use AI to automate the capture of sales data and eliminate the manual drudgery of CRM upkeep. People.ai joined Y Combinator’s Summer 2016 accelerator cohort, where feedback from dozens of prospective customers helped refine its focus. Initially, Rogynskyy had aimed to apply AI to a specific sales methodology (for example, automating the MEDDIC sales qualification process), but customer interviews revealed a broader need – to automatically capture all go-to-market activities and create a reliable, complete data foundation for sales teams.

From the outset, People.ai differentiated itself by pursuing a comprehensive data platform rather than a point solution. While other sales tech startups were focusing on narrow functions (such as only call recording or only forecasting), People.ai’s vision was to cover the entire sales cycle by aggregating every email, call, meeting, and interaction into one system. Rogynskyy believed that building this unified “source of truth” would give companies a powerful edge – much like the Oakland A’s in Moneyball, who gained advantage through superior data. This data-first strategy was a bold bet back in 2016, but it anticipated the rapid progress of AI. By 2024, as AI swept through enterprise software, People.ai’s early bet proved prescient: customers who had amassed years of sales data found themselves holding a data moat that competitors could not easily replicate.

Founders of People.ai

Oleg Rogynskyy is the founder and original CEO of People.ai, and his background has significantly shaped the company’s direction. A native of Ukraine, Rogynskyy moved to the United States as a teenager to attend Boston University, where he launched his first startup while still a student. Early in his career, he gained enterprise software experience as the first salesperson at Nstein Technologies in Canada, a content analytics company. There he worked alongside renowned AI researcher Dr. Yoshua Bengio and witnessed firsthand how poor CRM data could hamper a sales organization.

In 2011, Rogynskyy founded a text-analysis startup called Semantria, applying AI to sentiment analysis at scale. The venture was bootstrapped and beset by challenges, but he still grew Semantria rapidly and successfully sold the company to Lexalytics in 2014. (Notably, a month after launching Semantria, Rogynskyy survived a serious accident that left him hospitalized for weeks and in a wheelchair for months – yet he continued pitching customers from his hospital bed, reflecting his extraordinary resilience.) This early success gave Rogynskyy deep expertise in artificial intelligence and data analytics, as well as a clear understanding of the pain points in managing customer data. These insights and experiences laid the groundwork for People.ai’s creation in 2016.

As People.ai’s CEO for nearly a decade, Rogynskyy drove the company’s vision of data-driven sales management and attracted an impressive roster of backers and advisors. Under his guidance, People.ai evolved from a scrappy startup to a market-leading platform used by Fortune 500 companies. In late 2025, Rogynskyy transitioned out of the CEO role (remaining on the board) to pursue new ventures, passing the baton to Jason Ambrose to lead People.ai’s next chapter. Rogynskyy’s founding vision and technological acumen, however, continue to influence People.ai’s innovative culture and strategic direction.

Business Model of People.ai

People.ai’s business model is a classic enterprise SaaS offering sold via annual subscriptions. Pricing is per user, and the base software (the core data capture and AI insights platform) is reported to cost roughly $500 to $1,000 per user annually. Customers can then pay additional fees to unlock advanced modules such as executive analytics dashboards and account planning tools. Notably, the company’s supplemental product PeopleGlass is offered free of charge to end users. PeopleGlass acts as a value-add interface for updating CRM data easily, helping drive user engagement but not directly generating subscription revenue.

Because People.ai primarily targets large enterprises, its deals tend to be high-value. The average contract value (ACV) typically falls in the range of $50,000 to $100,000 per year, reflecting deployments across sizable sales teams. Contracts are generally annual (or multi-year) agreements, and People.ai’s land-and-expand sales strategy often starts with a pilot deployment that grows once ROI is demonstrated. Sales of the platform are usually made at the executive level (e.g. Chief Revenue Officer or Head of Sales), with an emphasis on the return on investment (ROI) – improved sales performance and revenue lift – that People.ai’s data-driven approach can deliver.

Revenue Streams of People.ai

People.ai’s revenue streams are largely concentrated in its subscription software fees. The primary revenue source is the annual license subscriptions for its platform, which generate recurring revenue from enterprise clients. In addition, People.ai offers professional services – such as implementation support, training, and consulting – to help customers accelerate adoption and ROI. These services likely contribute some revenue, though they are ancillary to the core software business. People.ai’s strategy of providing the PeopleGlass tool for free means it forgoes direct revenue on that component, using it instead to increase customer stickiness and data quality.

The company also engages in strategic partnerships that can indirectly influence revenue. For example, People.ai has partnered with Zoom to power the “Zoom IQ for Sales” conversational intelligence offering, enriching Zoom’s product with People.ai’s buyer and relationship insights. Such collaborations expand People.ai’s reach and could lead to referral business or co-selling opportunities. Nonetheless, the vast majority of People.ai’s income comes from its SaaS subscriptions. Maintaining high renewal rates and expanding usage within existing accounts (by adding more users or upselling premium modules) are key to growing these revenue streams over time.

Funding and Funding Rounds of People.ai

People.ai has attracted substantial venture capital investment, raising roughly $200 million in total funding to date. The company’s early growth was fueled by seed investments in 2016 (including support from Y Combinator) and a $7 million Series A in 2017 led by Lightspeed Venture Partners. In October 2018, Andreessen Horowitz led a $30 million Series B, joining existing investors and adding A16Z’s Peter Levine as a board member. Around that time, People.ai also expanded its U.S. footprint by opening offices in Boston and Los Angeles, and it explored building an engineering hub in Canada to support product development for global clients. By mid-2019, People.ai secured a $60 million Series C led by ICONIQ Capital (with Andreessen Horowitz and others participating). Finally, in August 2021 People.ai raised a $100 million Series D co-led by Akkadian Ventures and Mubadala Capital, which valued the company at approximately $1.1 billion post-money. All told, People.ai’s backers include top-tier firms like Andreessen Horowitz, ICONIQ, Lightspeed, and Mubadala. These successive rounds (summarized in Table 1) provided People.ai with the capital to scale its product and expand its market presence. Notably, the Series D funding was earmarked to fuel global expansion and further development of People.ai’s AI data platform.

Table 1: People.ai Funding History and Key Investors

| Round | Date | Amount | Lead Investor(s) | Post-Money Valuation |

|---|---|---|---|---|

| Seed/Angel | 2016 | ~$0.2 million | Angel investors, Y Combinator | N/A |

| Series A | May 2017 | $7 million | Lightspeed Venture Partners | N/A |

| Series B | Oct 2018 | $30 million | Andreessen Horowitz (a16z) | N/A |

| Series C | May 2019 | $60 million | ICONIQ Capital | ~$500 million |

| Series D | Aug 2021 | $100 million | Akkadian Ventures & Mubadala | $1.1 billion |

| Total | – | ~$200 million | – | – |

Competitors of People.ai

People.ai operates in a competitive landscape of sales technology and “revenue intelligence” solutions. Notable rivals include pure-play AI platforms such as Gong and Clari, which similarly aim to analyze sales data for insights, as well as sales engagement tools like Outreach and Salesloft that have added revenue intelligence features to their offerings. In addition, industry incumbents have entered the fray – for example, Salesforce’s Einstein analytics and Oracle’s CRM platform provide AI-driven sales forecasts, and ZoomInfo expanded into conversation intelligence by acquiring Chorus.ai in 2021. Table 2 below compares a few of People.ai’s key competitors:

Table 2: Select Competitors in Revenue/Sales Intelligence

| Competitor | Focus Area (Product) | Funding & Status (2021–2022) |

|---|---|---|

| Gong | Conversation intelligence platform (AI analysis of sales calls, meetings, emails) | Raised $583M total; valued at $7.3B (2021). |

| Clari | Revenue operations & forecasting platform | Raised $496M total; last round $225M in 2022 (multi-billion valuation). |

| Outreach | Sales engagement automation with integrated AI analytics | Raised $489M total; valued ~$4.4B (2021, unicorn status). |

| Salesloft | Sales engagement & coaching platform (added rev. intelligence features) | Raised $246M total; acquired by Vista Equity (2022). |

Each major competitor has a different origin – Gong from voice analytics, Clari from forecasting, Outreach/Salesloft from sales automation – but all are converging on providing data-driven sales insights. People.ai’s broad data-capture approach and deep CRM integration differentiate it, but the competition is intense. Smaller competitors also exist in niches – for example, Introhive focuses on automating contact data for professional services firms – further highlighting that the space is crowded and dynamic. People.ai must continue to innovate as these rivals (many of them well-funded unicorns) expand their capabilities.

Competitive Advantage of People.ai

People.ai’s competitive advantages largely derive from its head start in building a comprehensive, AI-driven data foundation for sales. First, the company has amassed a vast trove of sales activity data and experience training AI models on it, giving it a data “moat” that newer entrants lack. Since its founding, People.ai says it has captured and analyzed over 1.1 billion sales activities, yielding 14 billion AI-driven insights. This extensive dataset – combined with proprietary matching algorithms (protected by dozens of patents) – enables People.ai to deliver more accurate and robust recommendations to customers. Additionally, People.ai’s emphasis on email and activity data (rather than recording call audio) allows it to avoid some of the privacy and compliance challenges that pure conversation intelligence providers must contend with.

Second, People.ai’s solution is highly integrated and broad compared to point-solution competitors. It seamlessly plugs into CRM systems (like Salesforce) and automatically unifies data across email, calendar, calls, and other channels. By covering the end-to-end sales process – from initial prospect outreach to pipeline management to account growth – in one platform, People.ai provides a one-stop shop for revenue intelligence. This integration means sales teams don’t need to juggle disparate tools, and it increases the platform’s stickiness within a client’s workflow.

Finally, People.ai has built up significant market credibility. Its early adopter customers have reported tangible benefits – for example, using People.ai correlated with a 42% boost in sales bookings for Zoom’s sales reps. High-profile clients (Zoom, Okta, Zendesk, Red Hat, etc.) and industry recognition (e.g. inclusion in the Forbes AI 50 and Gartner’s Magic Quadrant) further validate its product quality. This track record gives People.ai an edge when selling to new enterprises, as it can point to proven ROI and a stable, well-funded business. In summary, a combination of unique data assets, a unified platform approach, and demonstrated results underpins People.ai’s advantage in the competitive revenue intelligence market.

Products and Services of People.ai

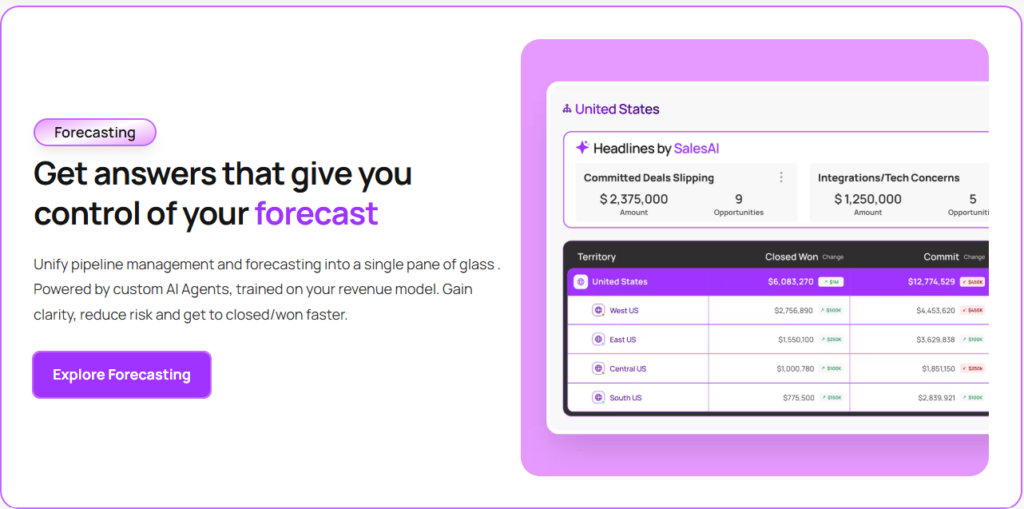

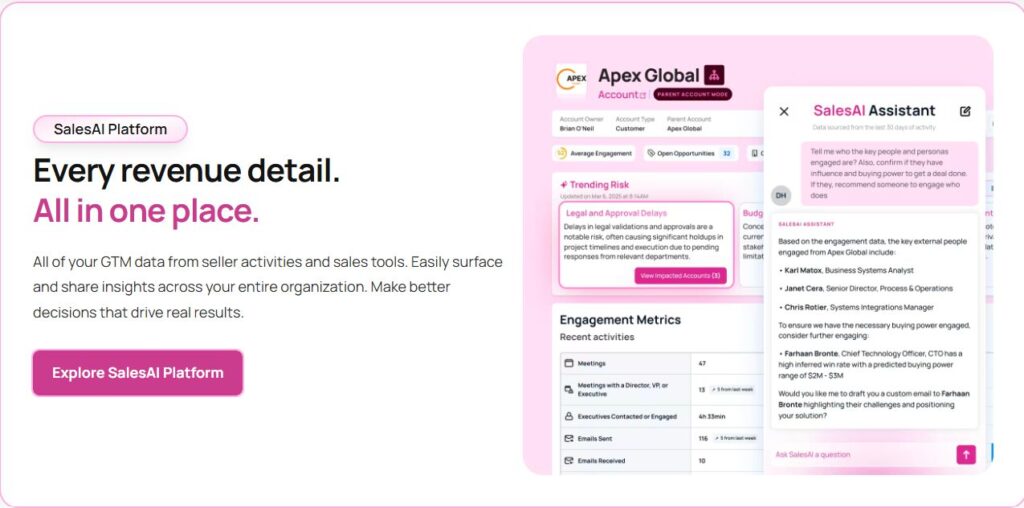

People.ai offers a suite of AI-driven products and services built on its core data platform. At the heart of its offering is the People.ai Revenue Intelligence Platform, an AI-powered system that integrates with a company’s existing tools (especially CRM). The platform automatically captures sales activities across email, calendar, phone calls, video conferences, and other channels, then uses AI to clean and match that data to the right accounts and opportunities in the CRM. This means every interaction with a prospect or customer – every sent email, meeting attended, or call made – is logged without relying on salespeople’s manual data entry. By aggregating these signals, People.ai provides a unified, up-to-date view of all engagement for each account and deal.

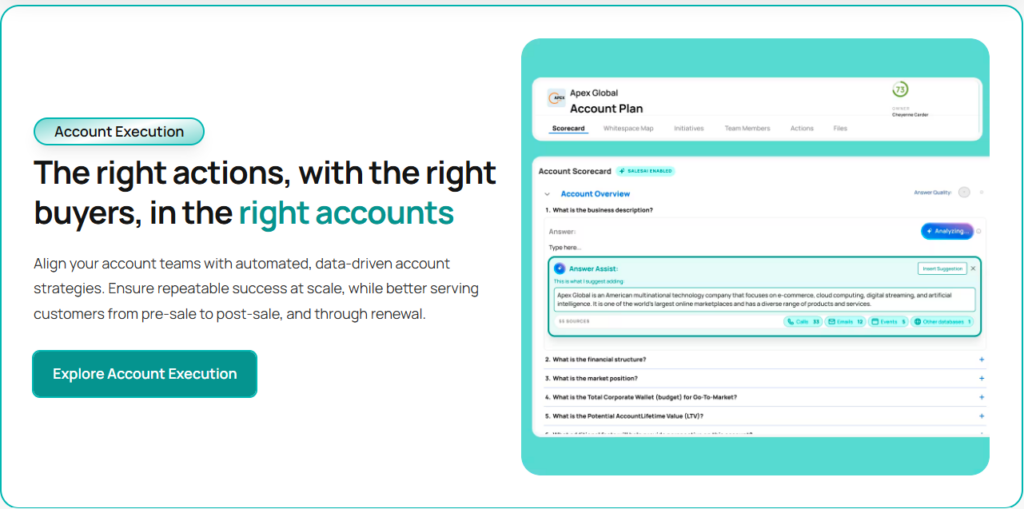

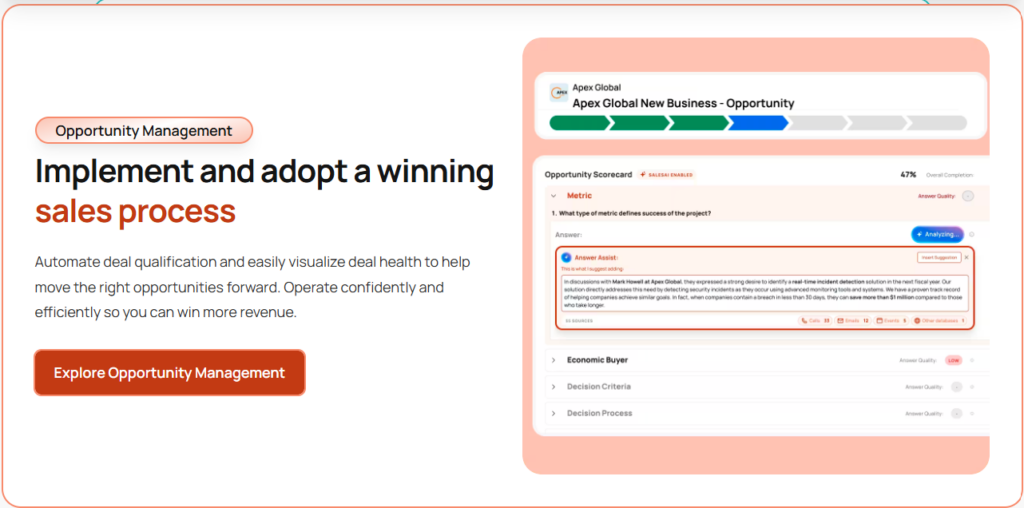

On top of this data layer, People.ai offers various analytics and execution modules to help drive revenue. For instance, it includes account management tools that score the health of each account and map out key contacts (influencers, decision-makers) to identify gaps or risk areas. (These account planning features were bolstered by People.ai’s acquisition of ClosePlan in 2020.) The platform also provides opportunity management features like deal qualification scorecards and playbooks aligned to common sales methodologies (MEDDICC, BANT, etc.), with AI highlighting deals that need attention. These capabilities help sales leaders enforce a consistent process and coaching cadence – for example, flagging when a deal lacks a high-level executive sponsor or when an opportunity is “single-threaded” with only one contact. Additionally, People.ai’s platform delivers reporting and insights that feed into sales forecasts, allowing managers to predict revenue more accurately based on real engagement data.

To complement the core platform, People.ai provides PeopleGlass – a free add-on (originating from People.ai’s 2021 acquisition of Hero, Inc.) that gives reps a spreadsheet-like interface to update and view CRM data easily. PeopleGlass helps drive user adoption by simplifying CRM upkeep (though it does not itself generate revenue). Beyond software, People.ai also offers professional services to assist with implementation and to train teams on best practices, ensuring customers fully realize the platform’s value.

People.ai continually updates its product with new AI capabilities. As of 2025, the platform introduced generative AI features that allow sales managers to query their data via natural language – for example, asking which deals are at risk due to low activity – and receive instant answers derived from the system’s analysis. The company’s technology stack (including proprietary identity resolution PeopleGraph® and matching algorithm SmartMatch™) is geared toward turning the flood of sales activity data into actionable recommendations. Overall, People.ai’s products and services are designed to increase sales productivity, improve data hygiene, and ultimately “unlock every revenue opportunity from every customer,” which is the company’s founding mission.

Conclusion

People.ai’s brand story – from a founder’s personal crusade against poor sales data to a Silicon Valley unicorn in under a decade – illustrates the impact of marrying domain experience with cutting-edge technology. The company has grown from an ambitious 2016 startup to a leading revenue intelligence platform, backed by over $200 million in capital and valued above $1 billion. Its journey has been defined by a data-first strategy and AI innovation, which have proven prescient as sales organizations increasingly prioritize data-driven decision making. In the U.S. market especially, People.ai has won major enterprise clients and garnered industry accolades, validating its approach.

Looking ahead, People.ai faces both opportunities and challenges. The space is heating up with competitors converging on all-in-one sales intelligence solutions, and market conditions demand continued innovation. However, People.ai’s head start in data and AI, coupled with its strong customer base, provide a solid foundation for the future. The company’s leadership transition in late 2025 – with CEO Jason Ambrose taking over from founder Oleg Rogynskyy – signals a planned evolution aimed at scaling the business and potentially positioning for an IPO in the coming years. Under new leadership, the focus is likely to remain on delivering tangible ROI to customers and extending People.ai’s product capabilities. The next few years will be crucial in translating People.ai’s early lead into durable market leadership in the coming decade and beyond. If the company continues to execute on its vision, it could cement itself as an indispensable part of the sales tech stack for enterprises worldwide, sustaining its status as a category leader in revenue intelligence.

In summary, People.ai stands at the forefront of AI-powered transformation in sales. It has helped turn the art of selling into more of a science by harnessing data that was once scattered and unused. As businesses worldwide continue to embrace AI-first strategies to drive growth, People.ai’s mission to “unlock every revenue opportunity from every customer” positions it well for continued success. With its robust platform and clear vision, People.ai is poised to help many more organizations achieve data-driven revenue excellence in the years ahead. The brand story of People.ai – blending innovative AI technology with a relentless focus on solving real customer problems – positions it as a company to watch in the evolving landscape of sales automation and intelligence.

Also Read: Gong – Founders, Features, Business Model, Growth & Investors

To read more content like this, subscribe to our newsletter