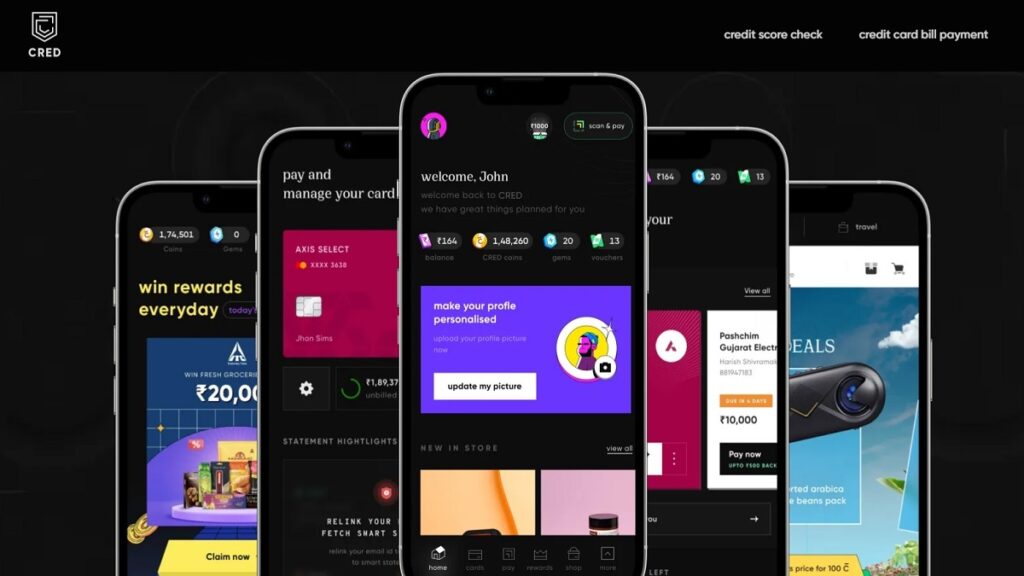

Cred is a digital platform that offers various financial services to its users, including credit score tracking, credit card payments, personal loans, and investment options. The company was founded in 2018 and is headquartered in Bangalore, India.

One of the unique features of Cred is its rewards program, which incentivizes users to pay their credit card bills on time by offering them Cred Coins that can be redeemed for various discounts and offers from partner brands. This rewards program has helped Cred gain a loyal user base, and the company has also been able to raise significant funding from investors.

Cred aims to simplify the complex world of personal finance and make it more accessible to people. By offering a user-friendly platform and personalized recommendations based on individual financial behavior, Cred seeks to help users improve their credit scores, reduce their debt, and make informed investment decisions.

Cred Founding Story / History of Cred

Cred was founded in 2018 by Kunal Shah, a serial entrepreneur and investor based in India. Shah had previously founded and sold two successful startups – FreeCharge, a mobile payments company, and Paisaback, a cashback and discount platform.

The idea for Cred came from Shah’s personal experience with credit cards. He noticed that many people struggle to manage their credit card bills and end up accumulating high levels of debt, which can have a negative impact on their credit scores. Shah saw an opportunity to create a platform that would make it easier for people to manage their credit cards and improve their financial health.

To bring his vision to life, Shah assembled a team of experienced professionals from the financial and technology industries. He also secured funding from several high-profile investors, including Sequoia Capital, Ribbit Capital, and DST Global.

Since its launch, Cred has quickly gained a reputation as one of India’s most innovative fintech startups. The company has been recognized for its user-friendly platform, its unique rewards program, and its commitment to helping users improve their financial literacy and well-being. Cred has also been able to attract a large and growing user base, as well as additional funding from investors who see the potential for the company to revolutionize the way people manage their personal finances.

Business Model of Cred

Cred’s business model is based on offering various financial services to its users and generating revenue through partnerships with financial institutions and other companies.

One of the main services offered by Cred is credit score tracking, which allows users to monitor their credit scores and receive personalized recommendations for improving them. Cred also offers credit card payments, personal loans, and investment options, as well as a unique rewards program that incentivizes users to pay their credit card bills on time.

Cred generates revenue by charging fees and commissions on some of these services. For example, the company earns a commission on personal loans that are originated through its platform. Cred also partners with financial institutions to offer co-branded credit cards to its users, and earns a percentage of the fees and interest charged on these cards.

Another key part of Cred’s business model is its partnerships with other companies. Through these partnerships, Cred is able to offer exclusive discounts and offers to its users, and earns a commission on any transactions that are made through its platform. For example, Cred has partnered with a range of e-commerce and lifestyle brands to offer discounts and cashback offers to its users.

Cred also generates revenue through its rewards program. This program, called Cred Coins, incentivizes users to pay their credit card bills on time by offering them rewards in the form of Cred Coins. Users can then use these Coins to redeem discounts and offers from a range of partner brands, including e-commerce and lifestyle companies.

Cred’s rewards program has been successful in driving user engagement and loyalty. It has also allowed the company to form partnerships with a range of high-profile brands, which benefits both Cred and its users. Cred earns a commission on any transactions that are made using Cred Coins, and users are able to access exclusive discounts and offers that they might not be able to find elsewhere.

Another important aspect of Cred’s business model is its focus on data and technology. The company uses machine learning and other advanced analytics tools to analyze users’ financial behavior and offer personalized recommendations. This allows Cred to tailor its services to individual users and provide a more intuitive and streamlined experience.

Cred’s data-driven approach also allows the company to form partnerships and collaborations with other companies. For example, Cred has partnered with some of India’s leading banks and financial institutions to offer co-branded credit cards and other products. By leveraging its user data and technology expertise, Cred is able to provide these partners with valuable insights and analytics, which can help them improve their own services and offerings.

Overall, Cred’s business model is focused on offering a comprehensive range of financial services, while also leveraging partnerships, technology, and data to drive engagement and generate revenue. By prioritizing user experience and providing personalized recommendations, Cred aims to build a loyal user base and become a leading player in the Indian fintech market.

Marketing Strategies of Cred

Cred has adopted a range of marketing strategies to promote its services and build brand awareness. Here are some of the key strategies that the company has used:

Influencer marketing: Cred has been successful in leveraging the power of social media influencers to build brand awareness and credibility with potential users. By partnering with popular Indian celebrities and social media personalities, Cred has been able to reach a wider audience and promote its services through engaging and entertaining content. Influencer marketing is an effective way for Cred to target specific demographics and build trust with potential users.

TV advertising: Cred has invested heavily in television advertising, which is a traditional but still highly effective way to reach a broad audience. The company’s TV ads are designed to be humorous and attention-grabbing, with the aim of building brand recognition and promoting Cred’s unique rewards program. TV advertising is a good way for Cred to establish itself as a household name and reach people who may not be active on social media or other digital channels.

Content marketing: Cred has created a range of informative and engaging content to educate users on personal finance topics and promote its services. This content includes blog posts, videos, and infographics, and is often shared on social media to reach a wider audience. By providing useful and relevant content, Cred is able to establish itself as a trusted source of information on personal finance topics, and build a relationship with potential users.

Partner marketing: Cred has formed partnerships with a range of companies and brands to offer exclusive discounts and promotions to its users. By partnering with high-profile companies in industries like e-commerce and travel, Cred is able to drive user engagement and promote its services through word-of-mouth and social media. Partner marketing is an effective way for Cred to reach new users and offer them additional value through exclusive discounts and offers.

Referral marketing: Cred’s unique rewards program is designed to encourage users to refer their friends and family members to the platform. Users who refer new users to Cred can earn additional Cred Coins, which can be redeemed for discounts and offers. Referral marketing is a cost-effective way for Cred to acquire new users, as it relies on existing users to spread the word about the platform. By offering rewards for referrals, Cred is able to incentivize users to promote the platform to their networks.

Overall, Cred’s marketing strategy is focused on building brand awareness, driving user engagement, and promoting its unique rewards program. By leveraging a range of marketing channels and techniques, Cred has been able to attract a large and growing user base, and establish itself as a leading player in the Indian fintech market.

Also Read: Paytm – The Torchbearer Of Cashless India

Investors and Funding of Cred

Cred has raised significant funding since its launch in 2018, with a range of high-profile investors supporting the company. Here are some of the key investors and funding rounds for Cred:

Series A: In 2019, Cred raised $30 million in a Series A funding round led by Sequoia Capital India and Ribbit Capital. Other investors included Morningside Venture Capital, Ru-Net, and Yuri Milner’s personal investment fund.

Series B: In 2019, Cred raised $81 million in a Series B funding round led by DST Global, with participation from Sequoia Capital India, Ribbit Capital, and others.

Series C: In 2020, Cred raised $215 million in a Series C funding round led by Falcon Edge Capital and Coatue Management. Existing investors including DST Global, RTP Global, and Tiger Global also participated in the round.

Series D: In 2021, Cred has raised $215 million in Series D funding round that valued the Indian startup at $2.2 billion. New investor Falcon Edge Capital and existing investor Coatue Management led the round. Insight Partners and existing investors DST Global, RTP Global, Tiger Global, Greenoaks Capital, Dragoneer Investment Group and Sofina also participated in the Series D

Series E: In 2021, Cred has raised $251 million funding in a Series E funding round at a $4.01 billion valuation, nearly double than its previous valuation at $2.2 billion. It was co-led by existing investors Tiger Global and Falconedge. Two new investors – Marshall Wace and Steadfast joined the new round. Investors including DST Global, Insight Partners, Coatue, Sofina, RTP, and Dragoneer have increased their shareholding in CRED with this round.

Series F: In 2022, Cred has raised $140 million in a Series F round at $6.4 billion valuation, led by GIC and existing investors. Existing Cred investors – Sofina, Tiger Global, FalconEdge, and Dragoneer have also participated in this round.

Debt financing: In addition to equity financing, Cred has also raised debt financing from a range of lenders, including several Indian banks.

Overall, Cred has raised over $800 million in funding since its launch, and is now valued at over $6.4 billion. The company’s high valuation and significant funding reflect the strong investor interest in the fintech sector in India, as well as Cred’s unique business model and strong growth potential.

Revenue Model of Cred

Cred’s revenue model is based on a commission-based business model. The company earns revenue by charging a commission to its partner banks for each transaction made on its platform. Here are some of the key aspects of Cred’s revenue model:

Commission-based revenue: Cred earns a commission on each transaction made on its platform. When a user pays their credit card bill through Cred, the company charges a fee to the bank that issued the credit card. This fee is typically a percentage of the transaction amount, and can vary depending on the bank and the specific transaction.

Premium subscription revenue: Cred has also introduced a premium subscription service called Cred Plus, which offers additional benefits and rewards to users who pay a monthly fee. Cred Plus subscribers get access to exclusive discounts and offers, as well as higher cashback rewards and a range of other perks. The revenue generated from Cred Plus subscriptions is an additional source of revenue for the company.

Data monetization: Cred has access to a large amount of data on user spending habits and credit scores, which can be valuable for banks and other financial institutions. The company may explore opportunities to monetize this data in the future, either through partnerships with other companies or by offering data analytics services to clients.

Overall, Cred’s revenue model is focused on generating revenue through commission-based transactions, with the potential to earn additional revenue from premium subscriptions and data monetization in the future. The company’s commission-based model is a proven and reliable source of revenue, and is likely to remain the primary driver of the company’s growth in the near term.

Growth of Cred

Cred has experienced rapid growth since its launch in 2018, driven by its unique rewards program, user-friendly platform, and effective marketing strategies. Here are some of the key factors that have contributed to Cred’s growth:

Unique rewards program: Cred’s rewards program offers users cashback, discounts, and other benefits for paying their credit card bills through the platform. This has helped the company to differentiate itself from other payment platforms and attract a large user base.

User-friendly platform: Cred’s platform is designed to be user-friendly and intuitive, with a simple interface and easy-to-use features. This has made it popular among young urban professionals, who appreciate the convenience and ease of use of the platform.

Effective marketing strategies: Cred has invested heavily in marketing, using a range of channels including TV advertising, social media, and influencer marketing to build brand awareness and attract new users.

Strategic partnerships: Cred has partnered with a range of banks and financial institutions, which has helped to expand its user base and increase the range of services it offers. The company has also entered into partnerships with other companies, such as Swiggy and Dunzo, to offer additional benefits and rewards to its users.

Expansion into new markets: Cred has expanded its services to new markets, including smaller cities and towns, which has helped to increase its user base and grow its revenue.

As a result of these factors, Cred has experienced significant growth since its launch. The company has reported a 5x increase in its user base since 2020, and is now valued at over $6.4 billion. With its focus on user experience, rewards, and partnerships, Cred is well-positioned to continue its growth trajectory in the years to come.

Cred Financials

Here are some key points about Cred’s financials:

Valuation: As of 2022, Cred is valued at over $6.4 billion, making it one of the most valuable fintech startups in India.

Funding: Cred has raised over $800 million in funding since its launch in 2018. The company has received investment from a range of high-profile investors, including Sequoia Capital, Ribbit Capital, and Tiger Global Management.

Revenue: Cred’s revenue is primarily generated through a commission-based model, where the company earns a fee for each transaction made on its platform. As of 2021, the company is reported to have generated around $100 million in revenue.

Expenses: Cred’s expenses include marketing and advertising costs, platform development, employee salaries and benefits, and other operational costs. The company has been investing heavily in marketing, which has helped to build its brand and attract new users, but has also contributed to its high expenses.

Profitability: Cred is not yet profitable, as the company is still in a growth phase and is investing heavily in expanding its user base and services. However, the company has stated that it aims to achieve profitability in the coming years.

Overall, Cred’s financials suggest that the company is in a strong position, with a high valuation and significant funding. The company’s revenue is growing, but its high expenses mean that it is not yet profitable. However, with its focus on user experience and rewards, and its expanding range of services and partnerships, Cred is well-positioned to continue its growth trajectory in the years to come.

Future of Cred

The future of Cred looks promising, as the company continues to expand its user base, services, and partnerships. Here are some key factors that could shape the future of Cred:

New services: Cred has already expanded beyond its original focus on credit card bill payment, and now offers a range of other services including personal loans, insurance, and investments. In the future, the company could continue to add new services to its platform, potentially including savings accounts, wealth management, and other financial products.

Partnerships: Cred has already formed partnerships with a range of banks, financial institutions, and other companies, and could continue to expand these partnerships in the future. By partnering with other companies, Cred can offer additional benefits and rewards to its users, and increase its visibility and reach.

International expansion: Cred is currently focused on the Indian market, but could potentially expand to other countries in the future. With its unique rewards program and user-friendly platform, Cred could be well-positioned to enter new markets and compete with established payment platforms.

Competition: The Indian fintech sector is highly competitive, and Cred will need to continue innovating and differentiating itself in order to remain competitive. The company will need to keep pace with new technologies, regulatory changes, and evolving user preferences in order to stay ahead of the curve.

Overall, the future of Cred looks bright, as the company continues to grow and innovate in the Indian fintech sector. With its focus on user experience, rewards, and partnerships, Cred is well-positioned to continue its growth trajectory in the years to come.

To read more content like this, subscribe to our newsletter