PayPal is a digital payment platform that allows individuals and businesses to make online payments and money transfers. The company was founded in December 1998 under the name “Confinity” by Max Levchin, Peter Thiel, and Luke Nosek. Initially, the company developed security software for handheld devices, but later shifted its focus to digital payments.

In 1999, Confinity merged with another online payment company called X.com, which was founded by Elon Musk. X.com was focused on providing online banking services, but Musk saw potential in Confinity’s payment technology and shifted the company’s focus to digital payments.

The company’s original product was called PayPal, and it allowed users to send and receive payments securely over the internet. PayPal quickly gained popularity, particularly among eBay users, and became the preferred method of payment for many online transactions. eBay eventually acquired PayPal in 2002 for $1.5 billion, and the company continued to grow rapidly.

PayPal went public in 2002 and became a separate publicly traded company in 2015, with a market capitalization of over $50 billion. Today, PayPal is one of the world’s largest online payment platforms, with over 400 million active users in over 200 markets around the world. The company offers a range of services, including online payments, money transfers, and a digital wallet that allows users to store and use multiple payment methods.

In addition to its core business of digital payments, PayPal has also expanded into other areas, including mobile payments, point-of-sale payments, and online lending. The company has made a number of strategic acquisitions in recent years, including the mobile payments company Venmo and the e-commerce platform Honey.

Overall, PayPal has had a significant impact on the world of digital commerce, making it easier and more convenient for individuals and businesses to make and receive online payments. Its success has also paved the way for other digital payment platforms, such as Apple Pay, Google Wallet, and Square.

Founding History of PayPal

PayPal was founded in December 1998 by Max Levchin, Peter Thiel, and Luke Nosek. The three entrepreneurs had met while working at a software security company called Confinity, which Levchin had co-founded earlier that year. Confinity’s original mission was to develop software that would allow handheld devices to securely store and transmit encrypted data.

Max Levchin, Peter Thiel, and Luke Nosek founded Confinity in 1998, with the original intention of developing security software for handheld devices. However, after struggling to attract funding for the handheld device security software, the trio decided to pivot their focus towards developing a digital payment system.

Their initial vision was to allow individuals to securely send money to each other via handheld devices. They pitched the idea to venture capitalists, but struggled to generate interest. However, they continued to develop the payment system and eventually realized that the internet could be a much more viable platform.

In March 2000, Confinity merged with X.com, an online financial services company founded by Elon Musk. Musk was initially skeptical of the payment system, but soon saw the potential in it and began to focus X.com on digital payments. Musk eventually decided to rebrand the merged company as PayPal, and the name stuck.

PayPal’s early success was fueled largely by its integration with eBay. In 2000, eBay had acquired a similar payment system called Billpoint, but it proved to be unreliable and unpopular with users. PayPal’s ease of use and reliability quickly made it the preferred payment method for eBay users, and by 2002, eBay had acquired PayPal for $1.5 billion.

Under eBay’s ownership, PayPal continued to grow rapidly, expanding its services to include merchant accounts and digital wallets. In 2014, eBay announced plans to spin off PayPal into a separate publicly traded company, and the split was completed in July 2015.

Since becoming an independent company, PayPal has continued to innovate and expand its services. It has made a number of strategic acquisitions, including the mobile payments company Venmo and the e-commerce platform Honey. PayPal also offers a range of services beyond online payments, including mobile payments, point-of-sale payments, and online lending.

Today, PayPal is one of the largest digital payment platforms in the world, with over 400 million active users in over 200 markets. The company’s success has paved the way for other digital payment platforms, and has helped to drive the growth of e-commerce and online transactions around the world.

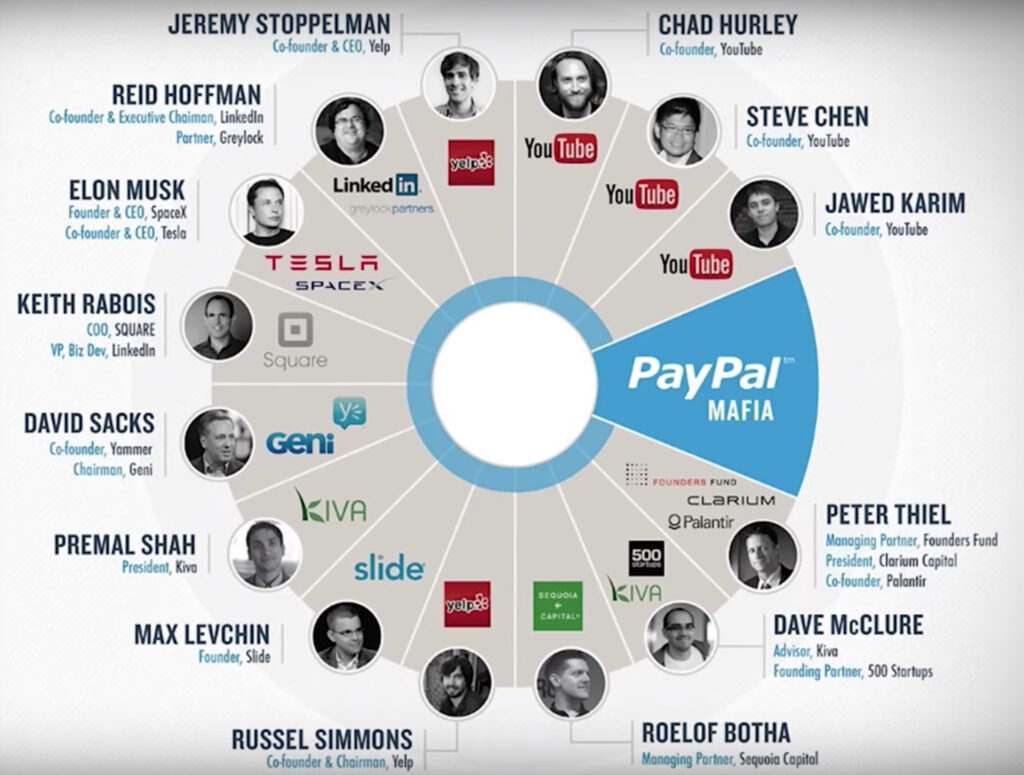

The PayPal Mafia – tech entreprenuers who are ruling the tech world

The term “PayPal Mafia” refers to a group of early employees and executives of PayPal who have since gone on to become successful entrepreneurs and investors in the tech industry. This group includes individuals such as Peter Thiel, Elon Musk, Reid Hoffman, David Sacks, Max Levchin, and many others who have founded or invested in successful companies such as Tesla, LinkedIn, SpaceX, Yelp, and YouTube.

The PayPal Mafia gained its name because many of these individuals met and worked together at PayPal during its early days. The company was known for its intense and competitive work culture, which fostered a sense of loyalty and camaraderie among its employees. After PayPal’s successful acquisition by eBay in 2002, many of these individuals left the company to pursue other ventures, taking with them the knowledge, experience, and connections they gained at PayPal.

The PayPal Mafia has been credited with playing a significant role in the growth and success of the tech industry over the past two decades. Many of these individuals have used their wealth and influence to fund and support new start-ups, helping to create a network of innovative companies that have transformed industries and changed the way we live and work.

In addition to their entrepreneurial endeavors, members of the PayPal Mafia have also become known for their outspoken views on politics and society. Peter Thiel, for example, has been a vocal supporter of conservative causes and has been involved in several high-profile political controversies. Elon Musk, meanwhile, has become a prominent advocate for renewable energy and has made headlines with his ambitious plans to colonize Mars.

Business Model of PayPal – How does PayPal make revenue?

PayPal’s business model is primarily based on processing online payments for individuals and businesses. The company provides a secure, convenient, and fast way to send and receive money, and charges a fee for each transaction.

Here are the key elements of PayPal’s business model:

Payment processing: PayPal’s primary business is processing payments made between individuals and businesses. It provides a secure platform for users to send and receive money using their PayPal account or credit/debit card.

Fees: PayPal charges a fee for each transaction, which varies depending on the type of payment and the country in which the payment is made. The fees can range from 2.9% + $0.30 per transaction in the US to 4.9% + fixed fee in some international markets.

Value-added services: PayPal offers a range of value-added services to its users, such as fraud protection, buyer and seller protection, and currency conversion. These services are designed to enhance the security and convenience of online transactions.

Merchant services: PayPal also offers a range of merchant services, such as payment gateway services and point-of-sale solutions. These services enable businesses to accept online payments, in-store payments, and mobile payments.

Financing: In addition to payment processing and merchant services, PayPal also offers financing options to businesses and individuals. PayPal Credit provides a line of credit that users can use to make purchases, while PayPal Working Capital provides loans to small businesses.

Acquisitions: PayPal has made a number of strategic acquisitions over the years to expand its product offerings and reach new markets. For example, it acquired Venmo, a popular peer-to-peer payment app, to target the millennial market.

Overall, PayPal’s business model is focused on providing a convenient and secure platform for online payments, while also offering a range of value-added services and financing options to its users. The company’s success has been built on its ability to innovate and adapt to changing market conditions, and it continues to be a major player in the digital payments industry.

Pioneer in Payments Processing – Innovation at PayPal

PayPal has been a pioneer in the digital payments industry, and has a long history of innovation. Here are some examples of how PayPal has innovated over the years:

Early adoption of online payments: PayPal was founded in 1998, at a time when online payments were still in their infancy. PayPal’s founders saw the potential of the internet as a platform for commerce, and built a system that allowed individuals and businesses to send and receive payments online.

Secure payment system: One of the key innovations that PayPal introduced was a secure payment system that protected both buyers and sellers. PayPal’s system used encryption and other security measures to ensure that transactions were safe and secure.

Mobile payments: PayPal was one of the first companies to offer mobile payments, with the launch of its mobile app in 2008. The app allowed users to send and receive payments from their smartphones, and was one of the first mobile payment apps to gain widespread adoption.

Peer-to-peer payments: In 2009, PayPal launched its Venmo service, which allowed users to send and receive payments to their friends and family members. Venmo quickly became popular among millennials, and helped to establish PayPal as a leader in the peer-to-peer payments market.

One-touch payments: In 2014, PayPal introduced One Touch, a feature that allowed users to make payments with a single click, without having to enter their payment information each time. This feature made online shopping faster and more convenient, and helped to drive increased adoption of PayPal’s platform.

Digital wallet: In recent years, PayPal has been working to expand its digital wallet capabilities, with the launch of features like PayPal Cash and PayPal Cash Plus. These services allow users to store and manage their money in a PayPal account, and to use it to make purchases and withdraw cash from ATMs.

Overall, PayPal’s history of innovation has helped it to stay ahead of the curve in the digital payments industry. By introducing new features and services that make payments faster, easier, and more secure, PayPal has continued to attract new users and to expand its reach into new markets.

Growth Strategy of PayPal

PayPal’s growth strategy has evolved over time, but it has always been focused on innovation and expansion. Here are some additional details on the elements of PayPal’s growth strategy:

Partnerships: PayPal’s partnerships have been instrumental in expanding its reach and attracting new users. For example, PayPal has formed partnerships with major retailers like Walmart and Target, allowing customers to use PayPal for online and in-store purchases. PayPal has also partnered with tech companies like Facebook and Uber, allowing users to pay for services within these apps. These partnerships not only increase transaction volume, but also help to establish PayPal as a trusted and convenient payment option.

International expansion: PayPal has been successful in expanding into new markets around the world. For example, PayPal has formed strategic partnerships in China, where it has invested in local payment platforms and formed alliances with Chinese banks. In Europe, PayPal has established itself as a leader in mobile payments through its acquisition of iZettle. By expanding into new markets, PayPal has been able to diversify its revenue streams and reduce its reliance on any single market.

Acquisitions: PayPal’s acquisitions have been key to its growth strategy. For example, its acquisition of Venmo in 2013 has helped PayPal establish itself as a leader in peer-to-peer payments. More recently, PayPal’s acquisition of Honey has given it access to a large and engaged audience of online shoppers. By acquiring complementary companies, PayPal has been able to expand its capabilities and offer new products and services to its users.

Product innovation: PayPal has always been focused on product innovation, and has introduced a number of new features over the years. For example, PayPal One Touch allows users to make purchases with a single click, reducing friction and increasing conversion rates. PayPal Credit allows customers to finance purchases over time, increasing their spending power and generating additional revenue for PayPal. PayPal has also introduced new services like PayPal for Business, which offers tools and services to help small businesses manage their payments and finances.

Customer acquisition: PayPal has invested heavily in customer acquisition, particularly in its early years. For example, PayPal offered new users $10 to sign up, and paid existing users $10 for each friend they referred. This “refer-a-friend” program helped PayPal rapidly expand its user base and establish itself as a leader in online payments. Today, PayPal continues to invest in marketing and advertising in order to attract new users to its platform.

Overall, PayPal’s growth strategy has been successful in establishing it as a leader in the digital payments industry. By focusing on innovation, expansion, and partnerships, PayPal has been able to grow rapidly and diversify its revenue streams. As the digital payments industry continues to evolve, PayPal is likely to continue to adapt and innovate in order to maintain its position as a market leader.

Growth of PayPal over the years

PayPal has experienced significant growth since its founding in 1998. Here’s a brief overview of its growth over the years:

Early growth: PayPal launched in December 1998 as a money transfer service, and quickly gained popularity among eBay users who needed a secure way to make online payments. In 2002, PayPal went public and raised $61 million in its IPO.

Expansion: In the early 2000s, PayPal began to expand its services beyond eBay, and introduced a number of new features like PayPal Buyer Credit and PayPal Here. In 2005, eBay acquired PayPal for $1.5 billion, which helped to further fuel PayPal’s growth.

Mobile payments: In 2012, PayPal launched its mobile payments app, which allowed users to make payments using their smartphones. This was a major milestone for PayPal, as it allowed the company to tap into the rapidly growing mobile payments market.

Acquisitions: PayPal has made a number of strategic acquisitions over the years to expand its capabilities and reach new markets. For example, PayPal acquired Braintree in 2013, which gave it access to popular mobile payments platform Venmo. In 2018, PayPal acquired European payments company iZettle, which helped it expand its reach in the European market.

Partnerships: PayPal has formed partnerships with a number of major retailers and tech companies over the years, which has helped to expand its reach and attract new users. For example, PayPal has partnered with Walmart, Target, and Facebook, among others.

Continued growth: Today, PayPal is a market leader in digital payments, with over 300 million active users in more than 200 markets worldwide. PayPal processed $1.36 trillion in payment volume in 2022, compared to $1.25 trillion in 2021—a growth of 9% year over year. PayPal’s growth has been driven by a number of factors, including its strong brand, focus on innovation, and strategic partnerships and acquisitions.

Overall, PayPal’s growth has been impressive over the years, and the company has established itself as a leader in the digital payments industry. As the industry continues to evolve, PayPal is likely to continue to adapt and innovate in order to maintain its position as a market leader.

Competitors of PayPal

PayPal operates in the highly competitive digital payments industry, and faces a number of competitors that offer similar services. Here are some of PayPal’s major competitors:

Square: Square is a payment processing company that offers a range of services, including point-of-sale systems and payment processing tools for businesses. Square’s Cash App also competes with PayPal’s Venmo in the mobile payments space.

Stripe: Stripe is a payment processing company that focuses on serving developers and online businesses. Stripe offers a range of tools and APIs for businesses to accept payments, manage subscriptions, and handle other payment-related tasks.

Amazon Pay: Amazon Pay is a digital wallet service that allows users to make payments on websites and apps using their Amazon account. Amazon Pay competes with PayPal in the online payments space, particularly in the e-commerce sector.

Apple Pay: Apple Pay is a mobile payment service that allows users to make payments using their iPhone or Apple Watch. Apple Pay competes with PayPal’s mobile payments offerings, including Venmo and PayPal’s mobile app.

Google Pay: Google Pay is a mobile payment service that allows users to make payments using their Android phone or tablet. Google Pay competes with PayPal’s mobile payments offerings, particularly in the Android ecosystem.

Adyen: Adyen is a global payment processing company that offers a range of services, including online payments, point-of-sale systems, and mobile payments. Adyen competes with PayPal in the digital payments space, particularly in Europe.

Klarna: Klarna is a payment and shopping service that allows users to make purchases on credit and pay in installments. Klarna competes with PayPal’s credit offerings, including PayPal Credit and Bill Me Later.

Overall, PayPal faces stiff competition from a range of players in the digital payments industry. While PayPal has established itself as a market leader, it will need to continue to innovate and adapt in order to maintain its position in the face of intense competition.

Also Read: Stripe – Success Story, Business Model, Revenue, Growth & Funding

Also Read: Klarna – Founders, Business Model, Investors, Growth & Future

To read more content like this, subscribe to our newsletter