When you have an entrepreneurial mindset, nothing can stop you. Mr. Sriharsha Majety, the current CEO of Swiggy, believes in it when he says “Entrepreneurship was always in his blood”. Even after having his shares of failures, he, Mr. Nandan Reddy, and Mr. Rahul Jamini started what eventually became India’s largest and highest-valued online food ordering and delivery platform, Swiggy. In 2015, within a year of launch, Swiggy partnered with many restaurants to join forces with the platform. Now the firm has partnered with over 1.4 lakh restaurants, 2 lakh delivery personnel, and it has a presence in 500 cities. The company has a strength of ~2,18,000 employees. The firm saw many ups and downs, but its journey has always moved ahead.

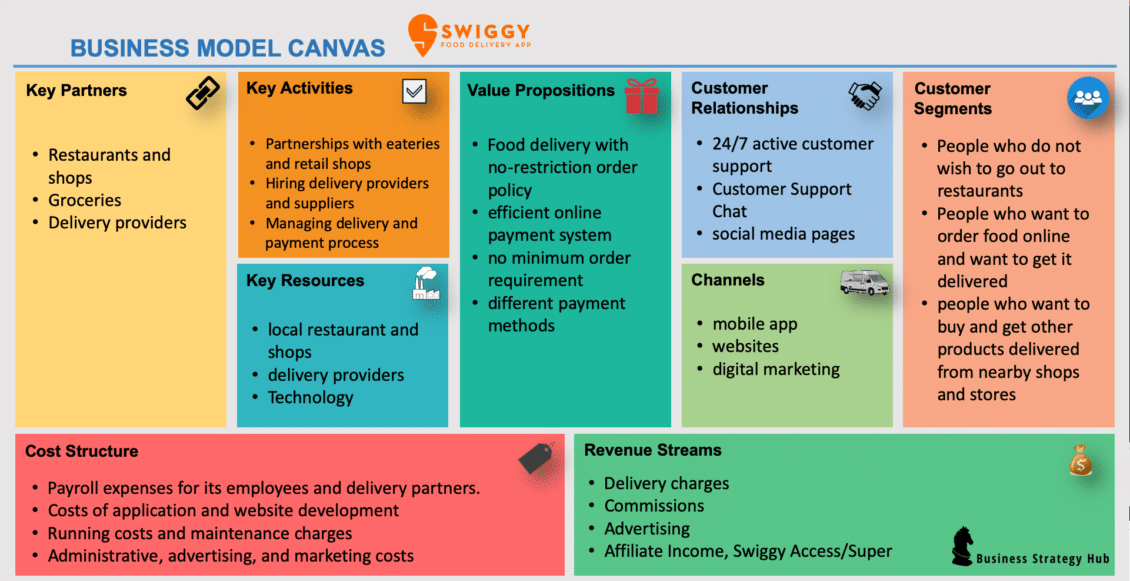

Business model

In this fast-moving world, people generally do not have time to go out to a restaurant, face traffic hurdles but they still prefer enjoying their delicious food.

Swiggy offers a value proposition to its customers when it delivers their favorite food at their doorsteps, saving them from unnecessary hardships. Everything it does from the design of their app, delivery algorithm, back-end systems, and the operational procedure is incredibly thought from the customer’s perspective.

Swiggy acts as a bridge between restaurants and customers with its innovative technology platform. Once customers place orders, all Swiggy drivers in the vicinity receive a broadcast signal to deliver the orders. Suitable delivery executives pick the order and deliver it to customer doorsteps.

Swiggy uses Machine Learning algorithms to gain insights on drivers’ time to deliver orders, restaurant to customer location by taking into account weekends, festive seasons, traffic routes, etc. Swiggy’s app has the best user interface in the online food delivery ecosystem. Its team monitors four apps for customers, restaurants, delivery executives, and in-house teams.

All these apps coordinate with each other and offer seamless coordination. It uses AI to predict when it will require more delivery executives to deliver orders. Swiggy keeps the customer at the heart of everything they do. Its business model offers a value proposition to restaurants as they cater to more demands, which increase their revenues.

Swiggy delivers ~14 million orders monthly. Its customer segments include people who want convenience and timely delivery of food, groceries, medicines, electronics at their doorsteps.

Over the years, Swiggy has raised capital from investors such as Accel and SAIF Partners, who invested $2 million in the firm’s early stages. It also received funding from Naspers, Meituan-Dianping, Tencent, Bessemer Venture Partners, and Harmony Partners. Swiggy made some strategic acquisitions such as AI startup Kint.io, 48East, Scootsy logistics, Suprdaily, and Fingerlix to add value to its existing offerings.

Revenue Streams

Swiggy reported operating revenue of Rs. 1121.7 cr in FY19. This revenue growth rate is 2.7 times over FY18. As per Swiggy, they hold nearly 60% revenue share in the online food delivery market and are more significant than the rest of the players combined. Zomato is a considerable competitor for Swiggy in online food delivery. Faso’s, Foodpanda, UberEats (Acquired by Zomato), Box8 are other competitors for the firm.

There are various revenue streams for Swiggy:

- Swiggy charges delivery charges from the customer below a threshold value. These charges also increase as per the demand of orders.

- Swiggy charges a 15% to 25% commission from the restaurants to generate sales leads and deliver the order to customers through its fleet.

- Swiggy earns advertising revenues through banner promotions and priority listing of restaurants.

- Swiggy came up with Swiggy Access, an idea based on the cloud kitchen concept, wherein it provides ready to use kitchens to restaurants in areas where they are not present.

- Swiggy Stores deliver groceries to the customer within an hour, and this generates revenue for the firm.

- Swiggy offers a membership-based program called Swiggy Super, which allows customers free delivery on orders above INR 99 at a one time upfront cost.

- By offering the services of Swiggy Go, the company makes revenue by helping customers to send, pick, and drop anything from different locations anywhere across the city.

- Swiggy daily offers simple homestyle meals, and it is a subscription-based homestyle meal service.

- The bowl company, which offers services to the customer in a bowl, is a unique offering from Swiggy. It provides food in a bowl, rice or cereal on one side, and then a main dish on the top.

The company offers discounts to customers to expand the market share, which led to a loss of about INR 2300 crore in FY19. From 2019, Swiggy is taking steps to stop deep discounting policies to increase its profitability per order and overall profits.

Marketing Strategies

The company runs unique advertisements campaigns to interact with customers. Swiggy’s indigenous campaign Voice of Hunger challenged the users to create sound waves in the form of food items and send them to the brand’s Instagram.

During IPL 2018, the company came up with Swiggy Karo, Phir Chahe Jo Bhi Karo campaign wherein characters didn’t speak a dialogue but conveyed everything through action. The narrative on how Swiggy serves its customers reigned over the people’s hearts.

It also came out with a campaign #WhatsInaName to convey the unique message about delivery partners’ identities and that they must be respected. Recent Swiggy campaign, Match Day Mania, emphasizes its commitment to serving hygienic food to its customers.

Swiggy partnered with Snapchat, using their ad format to increase its user base to cater to Gen Z. It helped Swiggy generate 11,000 new orders per month. The Snapchat story and Snap ads proved to be an efficient and effective platform for Swiggy.

Swiggy worked hard on its Search Engine Optimisation (SEO). They have a good meta description that includes the names of famous cities and their most famous restaurants. It’s social media strategies sets it apart from the competitors. In the past, Swiggy came up with #eatyourveggies, #earnyourcheatmeal, where they conveyed the notion of healthy eating in witty one-liners to engage with the customers.

Read more on Snapchat

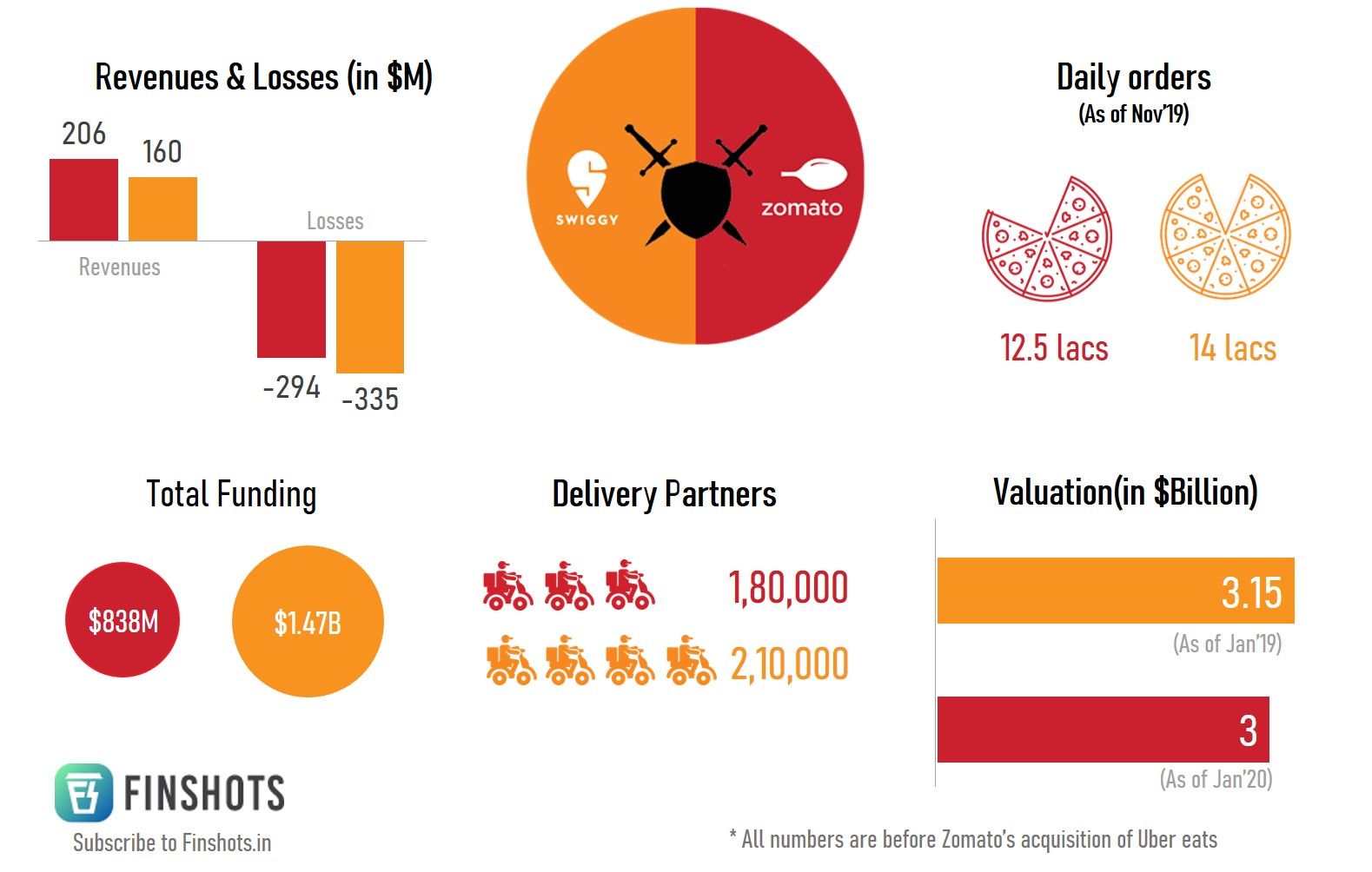

Rivalry with Zomato

The food-tech industry in India is predominantly a duopoly. The largest competitor in India for Swiggy is Zomato. For December 2019, the market share of Zomato is 52% of gross order volume compared to Swiggy’s share of 43%. The valuation of both Zomato and Swiggy is around $3.3 billion.

As a part of its operations strategy, Swiggy formed its delivery fleet, unlike Zomato, that operated with a marketplace model. It believed that outsourcing it to a third party could hamper the quality of deliveries. Since it has its fleet to deliver orders, it does not have a minimum delivery amount policy for customers. It charges a commission from restaurants on orders above a certain amount.

In contrast, Zomato has a feature of on-time or free. To avail, the customer must pay Rs.20 as an additional charge. It is a smart move because the insurance is on the 90 percentile order time. The majority would pay Rs.20, which would cover the refund for the minority of defaulters, and insurance is profitable.

Zomato is trying to capture the market by offering end to end solutions to the foodies. Its app has a complete list of restaurants and their ratings, average costs, menus, and reviews. So even if a restaurant is not offering home delivery, Zomato has it catalogued in their app. They also have their streaming of 18 original shows to keep customers engaged.

The Zomato’s entire focus is on food alone. Swiggy, on the other hand, has diversified into new categories such as groceries, medicines, etc. due to their autonomous logistics operations. They have a massive workforce to diversify into B2B business also. So Swiggy is looking beyond food space, and that is the crucial difference between their core strategy.

The merger of Uber Eats with Zomato is a step towards consolidation in the food tech space. Uber eats held a 12% market share. With the acquisition, Zomato gets access to delivery partners of Uber Eats, which is a critical factor in the food-tech business. With the addition of the delivery fleet, it is expected to surpass the delivery fleet of Swiggy. This acquisition will also help Zomato grow its market share in the south to offer more fierce competition to Swiggy. It gives Zomato an advantage over its competitors in terms of consumer data it will take from Uber.

The Gamechanger: Amazon’s Entry

The entry of Amazon Food is going to hurt the profitability of Swiggy and Zomato. It is listed on the Amazon app and is currently run in a pilot mode in Bengaluru.

Amazon plans to build a broader product portfolio for its prime service. Amazon Food charges half the commissions charged by the company to partner restaurants. As per reports, it could lose $15 billion trying to attract and retain customers after Amazon enters the market.

Amazon has a robust workforce that can be utilized as delivery partners to beat the competition. Amazon has entered the Indian market at an opportune moment as both the existing significant players Swiggy and Zomato are looking to streamline their cost structures by reducing discounts as well as face the brunt of the pandemic.

Interestingly, Amazon entered into the food delivery market after its chief rival Walmart-backed Flipkart has announced its entry into food retail through Flipkart Farmermart Pvt Ltd.

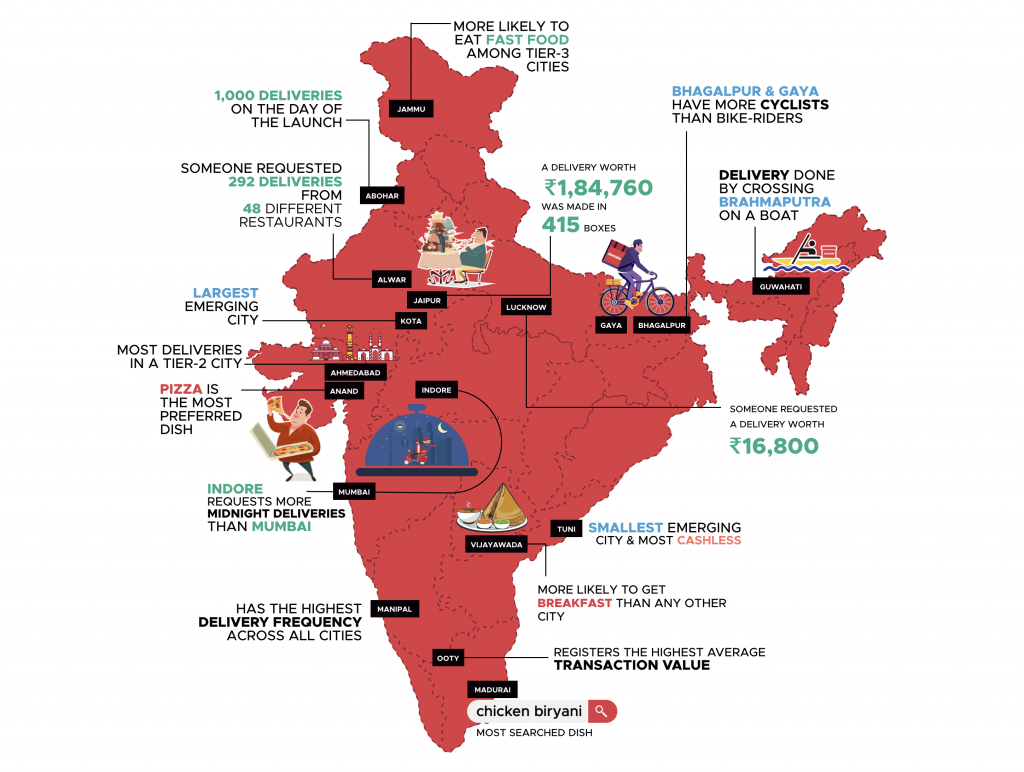

Unique facts

- Pepsi partnered with Swiggy to launch Lays and Kurkure e-stores on its app. The partnership is in pilot stages and planned to expand into 20 cities.

- Consumers can also order Quaker oats from the Swiggy app.

- Swiggy revealed that coffee is India’s most preferred drink.

- Swiggy launched Swiggy money in partnership with ICICI bank to store money for all food items.

- Swiggy collaborated with burger king to provide delivery services.

- It partnered with Sodexo to accept payments through meal cards by the customer.

- Swiggy also has women delivery executives working with them to deliver orders.

Nemesis: COVID-19

Lockdowns around the country have severely impacted the business of the startup. During the lockdown, order volume and restaurant listings plummeted by 60%-70%. To gain customer confidence during the lockdown, it launched the ‘At Your Service’ campaign in collaboration with the National Restaurant Association of India. It also laid-off employees to control the costs. It doubled down on its grocery business and launched a task management service Genie, and used its delivery fleet to deliver orders to the customer. The company also focused on providing medicines to customers during the lockdown. It also started putting masks on its app and delivered it to the customer’s doorsteps. It also set up a COVID-19 relief fund for its delivery partners, catering to delivery partners and their families. Swiggy also came up with contact-less delivery to deliver the food.

Swiggy partnered with Pepsi and NRAI, taking the initiative to provide relief to restaurant industry employees. As per the initiative, with every beverage of Pepsi ordered on Swiggy, Pepsi provided part of proceeding to NRAI. In Sept 2020, the demand reached 80-85% of the pre-COVID level for Swiggy, which showed a positive recovery sign. The demand increase was mainly on account of IPL 2020 and the economy’s opening up in almost every part of India.

Conclusion

The food and beverage industry is facing one of its most challenging times due to the pandemic. As customers prefer home-cooked food for hygiene purposes, investing in technology, innovations, and diversifying can put the firms out of troubled waters. However, industry insiders see 2020 as a blip and see robust growth in India’s food delivery ecosystem. Amazon’s entry into this segment is an indicator of growth opportunities in this industry. Swiggy already had plans to diversify its offerings and obtain 30% business from the non-food segment. It applied a multi-pronged approach during lockdowns to foray into hyperlocal deliveries and groceries. It also reduced its operational costs. With the kind of business model, customer base, and partnerships Swiggy has, it will look to weather this storm before rising again to its peak.

To read more content like this, subscribe to our newsletter.