Brex is a San Francisco-based fintech startup that has been making waves in the financial industry with its innovative approach to corporate card services. Founded in 2017 by Henrique Dubugras and Pedro Franceschi, two Brazilian entrepreneurs who met at Stanford University, Brex has quickly become one of the most successful startups in Silicon Valley. In this article, we’ll delve deeper into Founders, Business Model, Revenue, Funding, Investors, Growth & Competitors of Brex.

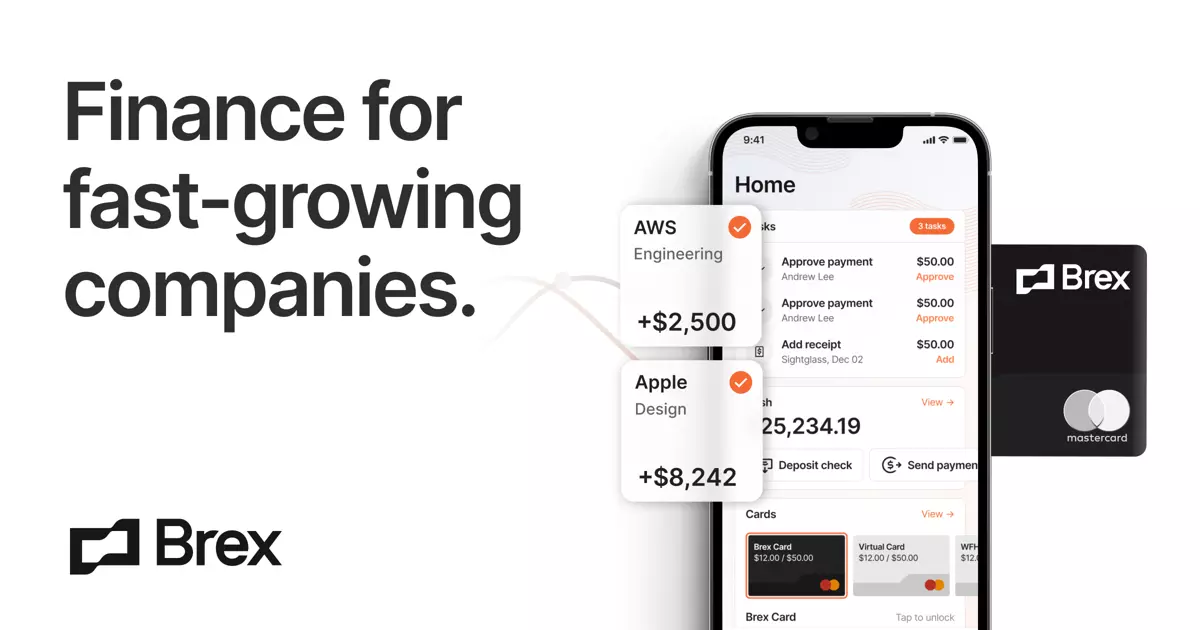

The company’s mission is simple yet ambitious: to revolutionize the way businesses manage their expenses by providing them with a modern, user-friendly platform that combines the convenience of corporate credit cards with the control and visibility of digital payments.

In just a few years, Brex has managed to disrupt the traditional corporate card market by offering a unique value proposition that appeals to both small startups and large enterprises.

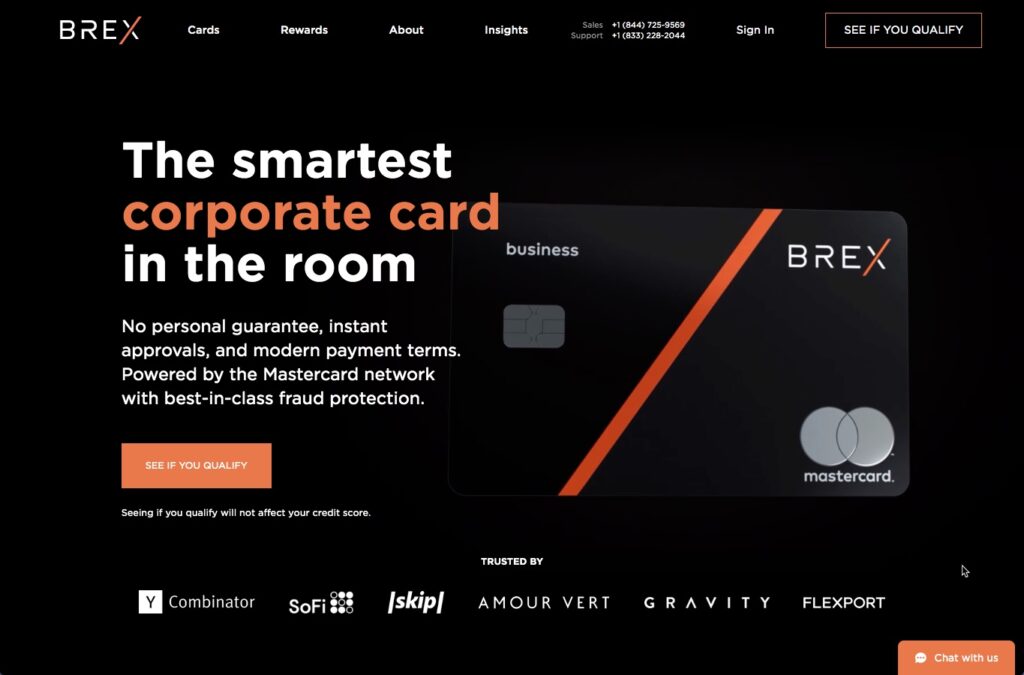

Unlike traditional corporate cards, which often come with strict spending limits, high fees, and cumbersome approval processes, Brex’s platform provides businesses with flexible payment terms, real-time expense tracking, and automated reconciliation tools. This allows companies to streamline their expense management processes, reduce fraud risks, and improve employee satisfaction.

But what sets Brex apart from other fintech startups is its focus on customer experience. By leveraging cutting-edge technology and machine learning algorithms, Brex is able to offer personalized support and tailored solutions to each client, regardless of their size or industry.

Whether it’s through customizable spending categories, automatic receipt matching, or instant virtual cards, Brex’s platform is designed to make expense management easier, faster, and more efficient than ever before.

With over $1.2 billion in funding from top investors like Y Combinator, Peter Thiel’s Founders Fund, Greenoak and TCV, Brex has already made significant strides in the corporate card market. Today, thousands of businesses across various industries use Brex’s platform to manage their expenses, including well-known brands such as Instacart, DoorDash, and Zillow.

As the company continues to expand its product lineup and partnerships, it’s clear that Brex is poised to be a major player in the future of B2B payments. In this article, we will explore how Brex’s innovative approach to corporate cards and spend management is transforming the way businesses operate, and why it may soon become the go-to solution for companies looking to simplify their expense management processes.

Founders of Brex

Brex stands on the shoulders of two visionary co-founders: Henrique Dubugras and Pedro Franceschi. Their unique blend of expertise and ambition has propelled Brex to a $12.3 billion valuation in just a few short years. Let’s dive deeper into their individual stories and their collaborative success:

Henrique Dubugras, co-Founder & co-CEO of Brex

Henrique began his journey in Brazil, founding Pagar.me, a successful online payments platform. This experience instilled in him a deep understanding of the challenges faced by businesses when managing finances.

He enrolled in Stanford University’s prestigious MBA program with a dream of revolutionizing virtual reality. However, he saw a bigger opportunity in simplifying financial management for businesses, leading to Brex’s birth.

Henrique possesses infectious enthusiasm and a natural ability to inspire others. He is the face of Brex, frequently interviewed and lauded for his visionary approach and dedication to building a world-class company.

Pedro Franceschi, co-founder and co-CEO of Brex

Pedro boasts a rich history in the tech world, co-founding Stone, a leading Brazilian payments processor. His years of experience provided Brex with vital operational expertise and a strong understanding of the financial landscape.

While Henrique takes the spotlight, Pedro thrives behind the scenes. He is the silent force behind Brex’s operational excellence, ensuring the company runs smoothly and efficiently.

Pedro’s calm demeanor and analytical mind help him navigate complex challenges and make sound decisions. He ensures Brex’s growth is measured and sustainable, mitigating risks while pursuing ambitious goals.

Business Model of Brex

Brex, the corporate credit card and financial management platform, has taken the business world by storm, boasting a $12.3 billion valuation and a growing roster of satisfied clients. But what are the secrets behind their success? Let’s break down Brex’s business model in detail:

The Core: Corporate Credit Cards

Brex’s bread and butter are business-focused credit cards, designed to address the specific needs of startups and growing companies. These cards offer:

- High spending limits: Cater to the cash-flow needs of growing businesses.

- Reward programs: Tailored towards business expenses, like travel and software purchases.

- Automated expense management: Simplifies tracking and reporting, saving time and money.

- Fraud protection: Provides security and peace of mind for business owners.

Brex earns revenue from interchange fees, typically 2–3% of each transaction and are split between the issuing bank, merchant bank, payment processors, and card networks. They also generate income from interest on unpaid balances and annual fees for certain cards.

Beyond the Card: Building an Ecosystem

Brex doesn’t stop at cards. They’ve built a robust ecosystem of financial management tools integrated with their cards, creating a sticky and valuable platform for users. These features include:

- Expense tracking and reporting: Streamlines workflow and improves financial visibility.

- Bill pay and virtual cards: Facilitates easy payments and adds another layer of security.

- Cash management accounts: Offers interest-earning accounts for idle business funds.

- Integrations with accounting software: Simplifies data entry and reconciliation.

These additional features not only enhance the value proposition of their cards but also create recurring revenue streams through subscription fees and other transaction-based charges.

Data-Driven Insights and Partnerships

Brex leverages the massive amount of transaction data they collect to provide valuable insights to their customers. This includes identifying spending patterns, optimizing budgets, and suggesting cost-saving measures. By leveraging this data effectively, Brex becomes a strategic financial partner for their clients, not just a card provider.

Furthermore, Brex strategically partners with other fintech companies like Deel and Ramp to offer a wider range of financial services to their customers. This network collaboration expands their reach and provides a one-stop-shop for businesses’ financial needs.

While its current focus is on financial services, Brex has ambitions to become a one-stop-shop for business operations. They are exploring venturing into areas like payroll, accounting, and even HR, aiming to become a comprehensive business management platform.

Revenue of Brex

According to Sacra, Brex’s net annualized revenue in 2023 was $319 million, a 48% increase from 2022. This growth was primarily driven by a 302% year-over-year increase in revenue from deposits.

Here’s some more information about Brex’s revenue:

- In 2021, Brex’s revenue and transaction volume both doubled.

- In 2022, Brex’s revenue was $400 million.

- In 2022, Brex’s revenue grew by 200%.

- In 2023, Brex’s revenue from deposits grew from $26 million annualized in 2022 to roughly $105 million annualized.

Funding and Investors of Brex

Brex has raised a total funding of $1.2B over 10 rounds. It’s first funding round was on Apr 01, 2017. It’s latest funding round was a Series D round on Oct 22, 2021 for $300M. 2 investors participated in it’s latest round, lead by Greenoaks, TCV.

| Date of funding | Funding Amount | Round Name | Post money valuation | Investors |

| Oct 22, 2021 | $300M | Series D | $12.3B | Greenoaks, TCV |

| Aug 25, 2021 | $150M | Venture Debt | – | SVB, American Express, Bank of America |

| Apr 26, 2021 | $425M | Series D | $7.4B | Tiger Global Management, TCV, Baillie Gifford, Durable Capital Partners, Base10 Partners, Y Combinator, Ribbit Capital, Greenoaks, GIC, DST Global, Lone Pine Capital, IVP, Endeavor |

| May 19, 2020 | $150M | Series C | – | Lone Pine Capital, DST Global |

| Dec 11, 2019 | $200M | Conventional Debt | – | Credit Suisse |

| Jun 11, 2019 | $100M | Series C | $2.6B | Kleiner Perkins, Y Combinator, Greenoaks, Ribbit Capital, DST Global, IVP |

| Apr 16, 2019 | $100M | Conventional Debt | – | Barclays |

| Oct 05, 2018 | $125M | Series C | $1.1B | Greenoaks, DST Global, IVP, Mindset Ventures, Greyhound Capital Management |

| Mar 01, 2018 | $50M | Series B | – | Y Combinator, Peter Thiel, Max Levchin, Yuri Milner, Ribbit Capital, Саrl Pаsсаrellа |

| Apr 01, 2017 | $7M | Series A | – | Ribbit Capital, Y Combinator |

Growth and Growth Factors of Brex

Brex, the rising star in the fintech world, has achieved impressive growth since its launch in 2017. Let’s take a deeper dive into the key factors behind its successful trajectory:

1. A Growing Customer Base:

Explosive Initial Traction: Brex went from 100 to 1,000 customers within five months of launch, showcasing the strong market fit for its unique offerings.

Consistent Growth: The customer base continued to expand, reaching 20,000 by 2020 and showing no signs of slowing down. This sustained growth demonstrates the value Brex creates for businesses across various stages of development.

2. Revenue Streams on the Rise:

Net Annualized Revenue: Brex’s revenue is estimated to have reached $319 million in 2023, marking a 48% increase from 2022. This consistent upward trend highlights the success of their business model.

Diversified Revenue Drivers: Brex doesn’t rely solely on credit cards. Card revenue, deposit spread revenue, and Empower revenue (from their software product) all contribute to their income stream. This diversification creates a robust financial foundation for continued growth.

3. Automation as a Competitive Advantage:

Simplifying Finance: Brex’s focus on automation through expense rules, receipt reminders, and smart spend alerts resonates with businesses seeking to streamline their financial processes. This user-centric approach saves time and resources, further enhancing the platform’s value proposition.

4. Valuation Explosion:

A Testament to Success: Brex’s valuation skyrocketed from $2.6 billion in 2019 to $12.3 billion in 2022, highlighting investor confidence in their growth potential. This impressive increase reflects the company’s ability to deliver on its promises and build a sustainable business model.

In conclusion, Brex’s growth story is driven by a potent mix of factors: its expanding customer base, diverse revenue streams, focus on automation, and its ability to consistently impress investors. By addressing the specific needs of businesses with innovative solutions and a user-centric approach, Brex has established itself as a force to be reckoned with in the fintech landscape. As they continue to expand their offerings and refine their strategies, we can expect Brex’s growth trajectory to remain upward bound for years to come.

Competitors of Brex

Brex isn’t operating in a vacuum. The fintech landscape is teeming with companies vying for attention in the corporate spending and financial management space. Let’s explore some of Brex’s key competitors and how they stack up:

Direct Card Challengers:

Divvy (Now Bill)

Similar to Brex, Divvy offers business credit cards with expense management features. They focus on a more budget-conscious market, offering a free version and competitive pricing.

Ramp

Another Brex competitor in the corporate card space, Ramp emphasizes features like virtual cards, fraud protection, and integrations with accounting software.

Airbase

A comprehensive expense management platform with its own corporate card, Airbase targets larger companies with complex financial needs.

Software and Financial Management Rivals:

Expensify

A well-established expense management software provider, Expensify targets companies seeking a more affordable and customizable solution.

Pleo

Offering both corporate cards and expense management tools, Pleo focuses on the European market and emphasizes user-friendliness and ease of use.

Zoho Expense

Part of the Zoho suite of business software, Zoho Expense integrates seamlessly with other Zoho products and caters to companies already using their ecosystem.

Traditional Players:

Big Banks: Traditional banks still offer business credit cards and financial management tools, though they can be less flexible and innovative than fintech startups like Brex.

Accounting Software Giants: Major accounting software companies like SAP and Oracle also offer expense management features, but their solutions may be less user-friendly and cater to larger enterprises.

Also Read: Trade Republic – History, Founders, Business & Revenue Model, Funding

To read more content like this, subscribe to our newsletter