Etihad was established in 2003, and since that time it has become one of the fastest-growing major international airline companies, thanks in large part to the financial backing of its home government. As per the company’s website (www.etihad.com), in February 2020, the current passenger fleet consists of 96 aircraft (Airbus A320- Family, Airbus A380, Boeing 787, Boeing 777)and 5 cargo aircraft. Thus, the airline is looking to more than double its size in the next few years. Globally, the airline is reputed for its premium service and its vision to be a distinctive global airline.

Etihad Airways was inaugurated in 2007 by the Abu Dhabi ruling family and it is fully owned by the government of Abu Dhabi. The company is currently serving over 76 destinations while making more than 1,000 flights per week. Etihad Airways was founded by Sheikh Mohammed Bin Zayed Al Nahyan in partnership with other entrepreneurs with a vision to reflect the considerate, cultured, generous, and warm Arabian hospitality and enhance the prestigious position of the city of Abu Dhabi.

It is well known and has been statistically found that airline companies have played a significant role in the economic growth of the United Arab Emirates. These airline companies have not only connected the entire world to the UAE but also brought valuable foreign exchanges in billions through the direct and indirect promotion of tourism, trade, and commerce, etc. Etihad Airways as the flagship carrier of Abu Dhabi has remained a major player also in this regard.

‘Super-connectors’ from the Persian Gulf

Etihad is one of the big three carriers from the Persian Gulf. The other two are Emirates Airlines and Qatar Airways. The three airline companies are referred to as the “super-connectors” and their main business is to cater to international passengers originating from and destined for places outside their home bases. The three carriers have achieved a meteoric rise over the last decade and they dominate the long-haul routes between Asia and Europe. Their year-on-year growth between 2004 and 2012 averages an impressive 24% per annum. In 2014, the Emirates hub in Dubai surpassed London Heathrow airport as the world’s busiest hub for international traffic.

Etihad is more than just an airline

Etihad Cargo

Established in 2004, Etihad Cargo is now a major global player providing a complete suite of cargo and logistics products and services across the international network.

Etihad cargo serves the Middle East, Europe, and North America trade lanes using a combination of 101 passenger aircraft complemented by a fleet of five dedicated freighters. A full range of products and services are offered, all of which are designed to provide best in class solutions. Etihad cargo takes pride in innovation and provides the latest transportation techniques and technologies, to be the best cargo logistics provider in the industry. Charter options are also available for customers seeking bespoke solutions.

Etihad Airport Services

Etihad Airport Services (EAS) manages Etihad Aviation Group’s investment in the support businesses at the Abu Dhabi hub. These include Catering (EAS Catering), Ground Handling (above and below wing) (EAS Ground), and Cargo Logistics operations (EAS Cargo), all located at Abu Dhabi International Airport. As of January 2020, Cabin Cleaning joined ramp and baggage services.

Etihad Airport Services – Cargo: Etihad Airport Services Cargo is the cargo handling business at Abu Dhabi International Airport. It provides freight handling services as well as warehousing, documentation, security screening, and handling of specialized cargo for Etihad Airways and other carriers.

Etihad Airport Services – Ground: Etihad Airport Services Ground currently delivers passenger, aircraft, and ramp handling services to 27 airline customers at Abu Dhabi International Airport.

Welcoming passengers, and meeting their needs before or after a trip as well as receiving an aircraft upon arrival and preparing it to depart again in a safe and efficient manner to fit seamlessly within the airline schedules, are the trademarks of Etihad’s service promise to the customer airlines.

Etihad Airport Services – Catering: Etihad Airport Services Catering sources, prepares and provides food, bar supplies, and duty-free items for Etihad Airways and 28 other airline customers. It also manages food and beverage services for Etihad Airways airport lounges, as well as staff restaurants, events, and sales of ready-to-eat food products to the hospitality industry.

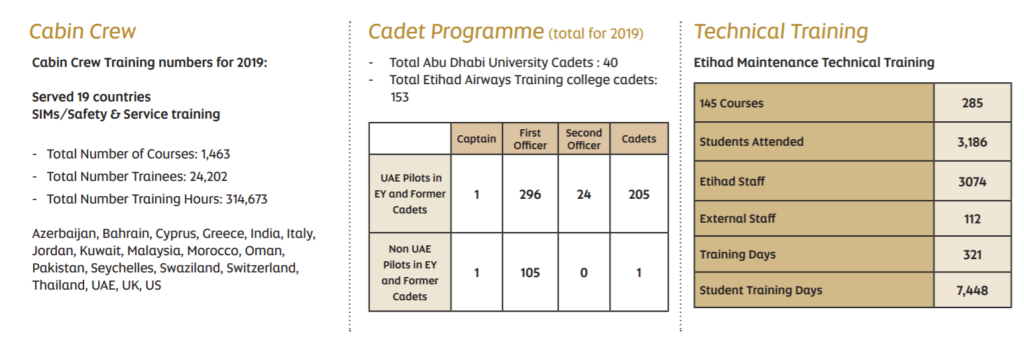

Etihad Aviation Training

Etihad Aviation Training has 10 full-flight simulators as well as a flight training school in Al Ain. Experienced instructors offer a comprehensive training program on Airbus 320, 330, 340, 350, 380, and Boeing 787 and 777 in addition to the instructor, examiner, and senior examiner.

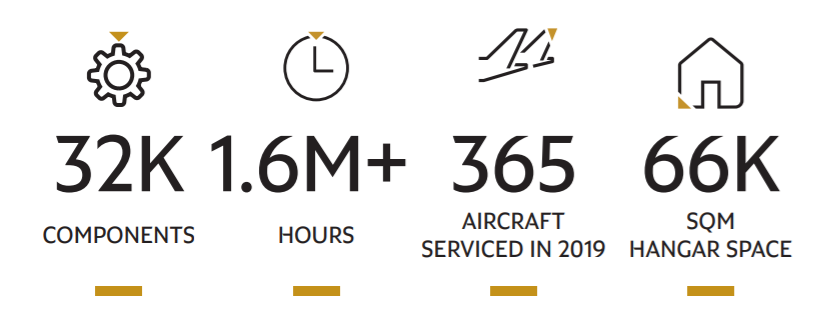

Etihad Engineering

Etihad Engineering is one of the world’s leading Maintenance, Repair and Overhaul (MRO) service providers, offering aircraft maintenance and engineering solutions to a host of global customers, and Etihad Airways. Approved by the GCAA, FAA, and EASA, with Part 21J Design Organisation Approval (STCs) and Part 21G Production Organisation Approval.

The team at Etihad Engineering are seasoned professionals from more than 50 nationalities. The comprehensive portfolio covers most Airbus and Boeing types, including heavy maintenance and complex modifications; cabin reconfigurations including connectivity and the Middle East’s first flammability test lab; and component repair services.

Growth Strategy Through Acquisitions and Alliances

In the 10 years up to 2016, Etihad grew from being a 22-plane regional carrier into a global operation of over 100 aircraft. Beyond investing in its own fleet, Etihad aggressively pursues codeshare partnerships, interline relationships, and minority equity investments in other airline companies to grow. The purpose is to allow Etihad to gain access to new markets as well as expand the network for its passengers. To date, the company has invested in carriers based in Australia, South-east Asia, the Indian Ocean, and Europe.

The company has regrouped its subsidiaries (i.e. the airlines in which it holds an equity or debt investment) under the “Etihad Airways Partners’ Program”. The subsidiary firms include Air Berlin, Alitalia, Air Serbia, Air Seychelles, Darwin Airline, Jet Airways, and Virgin Australia.

Ethihad’s acquisition of Air Alitalia

Etihad’s decision to acquire a 49% equity stake in Italian flag-carrier Alitalia proved to be a financial lifeline to the latter. Press reports suggest that the investment ultimately cost Etihad between $2 billion and $3 billion. Note that Alitalia averted bankruptcy (with an estimated net debt of €813million) in the year prior to Etihad’s investment, thanks to government support, and had not reported a profit since 2002. The investment turned out to be less than straightforward as Etihad faced legal challenges as a bloated company. The ownership structure of Alitalia posed a significant test for Etihad, which included Air France-KLM that viewed Etihad as a direct competitor, as well as ex-creditors to Alitalia including banks.

When Etihad first invested in Alitalia in 2014, the plan was for it to break even by 2017. Instead, the company has racked up over €1 billion in operating losses. Even so, employees voted down the rescue plan because it would have led to significant job losses, forcing Etihad to withdraw any further funding to keep the airline afloat. It shows how difficult it has been to turn around the fortunes of Alitalia since Etihad arrived.

In May of 2017, Etihad withdrew funding and Alitalia filed for bankruptcy for the second time in less than 10 years.

Also Read: American Airlines – The Brand Strategies Of World’s Largest Airlines

Air Seychelles

In 2012, Etihad bought 40% shares in Air Seychelles at a cost of $20 million. The government of Seychelles also invested an equal amount in the airline. Etihad has additionally made available to the airline a $25 million loan financing, and signed a five-year management contract to run Air Seychelles. Since Etihad’s investment, Air Seychelles has been growing its fleet and destinations served, and there are no real signs that this investment has not been a success.

Air Serbia

In August 2013, Etihad joined forces with the Serbian government to start Air Serbia. Etihad holds a 49% stake in the new venture and signed a five-year contract to manage Air Serbia. The latter replaced the now-defunct Yugoslav airline, Jat, which was saddled with inefficient old aircraft and debt. The Serbian government could not support Jat, and its First Deputy Prime Minister, Aleksandar Vucic, sought the help of Sheik Mohammed, the crown prince of Abu Dhabi for help to relaunch the airline anew.

Note that Serbia is not part of the EU and is therefore not subject to the same regulations as Air Berlin and Alitalia. Most of the other airlines close to Serbia were either struggling or bankrupt, – for instance, Croatia Airlines, the national airlines of Bosnia and Montenegro, Malev, Solyom, and the likes. Therefore, the threat from competitors is low in that region. With this investment, Etihad gains favorable access to the Balkan and the neighboring European states.

Aer Lingus

In April 2012, Etihad bought a 3% stake in the Irish carrier Aer Lingus for €15 million. However, the two airlines did not have a codeshare agreement. As a result, Aer Lingus did not assist Etihad in expanding its network. Etihad increased its equity ownership to 5% before selling it at a profit to the International Airlines Group (IAG), the holding company of British Airways, Iberia and Vueling.

Jet Airways (Now grounded)

Etihad purchased a 24% stake in Jet Airways, India’s largest publicly-listed air carrier, for $379 million in 2013. Separately, Etihad paid Jet Airways $220 million to buy its slots at Heathrow Airports and for a majority stake in its Frequent Flyer Program. At the time of the investment, most Indian airlines were struggling financially — Jet Airways owed over $2 billion in debt — and its owners were lobbying the Indian government to liberalize ownership of the airlines such that foreigners could bail them out. Note that India is a developing nation and its rule of law lags behind those of developed nations like the EU countries.

Etihad’s investment in Jet Airways was built on strong economic and cultural ties between the UAE and India owing to the huge expatriate Indian population (30% of the UAE’s population) that lives in the UAE. India is also the most important FDI investor in the UAE as well as a major destination for the UAE’s outward investments. More importantly, many Indians travel to Europe, North America, the Gulf region, and Africa, and Etihad’s plan was to serve them by feeding traffic through its Abu Dhabi airport hub (which lies in between India and the aforementioned destinations). Furthermore, India’s air travel sector was growing significantly year on year, and Jet Airways was an important airline in that market. By investing in Jet Airways, Etihad was able to benefit from that growth.

Virgin Australia

Etihad first bought a 5% stake in Virgin Australia in 2012. By 2014, it had increased its stake to 21.4% (Paylor, 2014). Qantas, the national carrier of Australia, criticized Etihad’s intention to subsidize Virgin Australia to compete with Qantas on its most profitable routes. The Australian market is a duopoly with Qantas (the bigger company) and rival Virgin Australia (the smaller company) monopolizing most of the traffic, particularly the local traffic. Virgin Australia also counts Singapore Airlines (22.8%), Air New Zealand (25.99%), and Sir Richard Branson’s Virgin Group (10%), among its shareholders.

Despite Etihad’s investments, Virgin Australia’s performance has not been stellar. It continues to face stiff competition from Qantas, who controls the two-third of the local traffic (its main market). Between 2008 and 2015, the carrier’s return on equity has been positive only twice causing some of its investors to lose interest. Early 2016, Air New Zealand has announced its intention to liquidate its stake in Virgin Australia. Virgin Australia had just borrowed A$425 million from its major shareholders in March 2016. The sale was completed by 2016 year-end.

Darwin Airline

In 2015, and after waiting over a year to gain approval from the Swiss regulators, Etihad purchased a third of the equity ownership of Darwin Airline, a Swiss airline company. Darwin rebranded itself as Etihad Regional as part of the deal. The goal of the acquisition was to add traffic (both incoming and outgoing) to the airports already served by Etihad in Switzerland and neighboring airports.

Given that Darwin Airline is based in Europe, it would be less complex for the airline to add new routes and destinations within Europe as well as connect to the airports already served by the two other European airlines that were owned by Etihad – i.e. Air Berlin and Alitalia. Given the small size of Darwin Airline (operating only 10 50-seat turboprop aircraft), it was not going to add significantly to Etihad’s business. Etihad Airways divested this unit in July of 2017 following a strategic review of its equity alliances.

To read more content like this, subscribe to our newsletter.