BSNL was incorporated on October 1, 2000, by vesting with it the mandate of providing telecom services and network management hitherto done by the Department of Telecom (DOT), Government of India. This was done in a context where the telecom sector had been opened to the private sector beginning in 1994. While initially the sector was opened for one private operator per circle for fixed-line and two private players for cellular services, the number of private operators grew over time.

An independent regulator, TRAI, was created in 1997. The telecom market took off in the early 2000s with changes in telecom policies allowing greater pricing freedom and a greater number of private operators competing to acquire consumers in each circle.

Once a Cash Cow

Under Union Minister Ram Vilas Paswan, BSNL began its operations and was a crown jewel when carved out of the Department of Telecom in 2000. By 2004, it became the second-largest telecom firm, after Airtel. BSNL earned profits of INR 2,000 crores in FY 2002-03 and INR 3,600 crores in FY 2004-05.

Fall and Fall of BSNL – The testing times

Traditionally telecom was considered a natural monopoly, like the electricity sector, with “wires” being the core reason. Changes in technology led to the recognition that telecom can no more be considered as a natural monopoly. With the realization that monopolies, whether private and public, resulted in the loss of efficiency; the sector has been opened up for competition all over the world. This shifted the focus of attention from regulation on exercise of maintenance of competition.

Due to the fast-changing technology, the scope of services increased from voice to mobile Internet. Falling prices of technology and competition ensured that coverage expanded, prices fell, and the consumer-base grew exponentially accompanied by intense rivalry in the sector. Even though the sector subsequently saw consolidation, a new competitive threat emerged with the entry of Reliance Industries in the telecom sector under the “Jio” brand. With competitive pricing, it has been able to acquire a large market share (close to being the top). Because of intense rivalry, Idea decides to merge with Vodafone leaving three large private players in the Indian telecom sector – Reliance, Airtel, and Vodafone-Idea (Vi).

As the sector became more competitive, BSNL’s operating margins and market share started

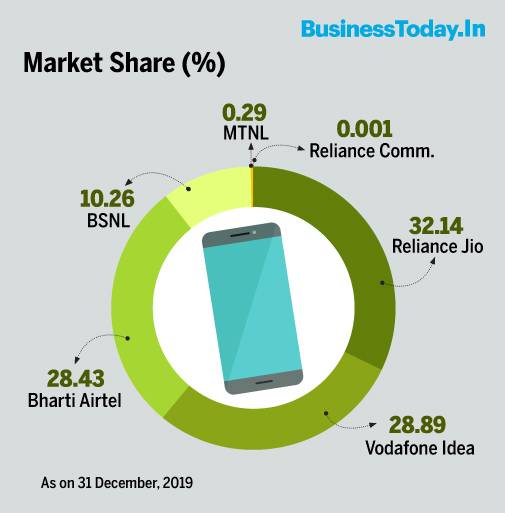

to decline. The subscriber market share as of BSNL as of March 31, 2018, was 12% and its revenue market share from Access Services was 8%. This decline had started even when the market shares of other operators were growing. The market share of other key operators has seen a decline only with the entry of Jio.

So, BSNL is not required anymore?

In the existing telecom scenario of three private and a public operator, it may be claimed that the existence of BSNL is necessary to maintain competitiveness in the sector and ensure that consumers do not face price increases.

However, even the concern of maintaining a competitive telecom sector by the revival of BSNL is difficult to justify in its current organizational and functional condition of a revenue market share of around 6% and subscriber market share of around 10.26% and mounting losses of nearly Rs 14,904 cr in 2020. In the current state, BSNL-MTNL can be an effective rival to the other players only through aggressive price based competition which has to be supported by the Government. And a case cannot be made for price support to BSNL-MTNL across the board.

In the future, competition policy in the sector may need to examine mergers more closely, especially when these reduce the number of market players to three. In such cases, there may be a need to specify remedies that do not harm consumer welfare.

In the current scenario, the concern is dealing with predatory pricing. Even from that perspective, and in the case of the emergence of a dominant player, it is obvious that BSNL-MTNL cannot play any meaningful role in such a situation, due to their lack of innovation, high costs, very few relevant content partnerships, and small and rapidly declining market shares as stated earlier.

It is clear that in its current organizational and financial condition, BSNL-MTNL cannot be an effective rival to the other players except through price-based competition which has to be supported by the Government.

Also Read: Vodafone India – The Journey From Hutch To Vodafone To Vi

The possible revival of BSNL

Two reasons for the continued presence of BSNL in the telecom sector could be: (a) coverage of areas not adequately covered by other private players; and (b) continued availability of key telecom infrastructure even if private players exit/become bankrupt.

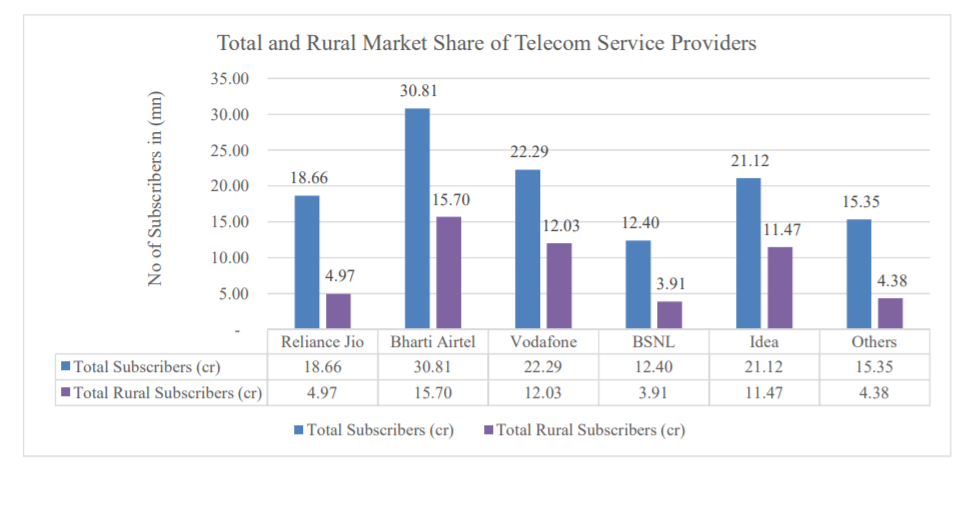

Even in this limited role, BSNL needs to undergo substantial restructuring. BSNL’s claim that it has been serving the rural population while private operators have not done so effectively is not borne out by data. As is evident from the data shows the rural subscribers and market shares for all operators, the rural penetration of BSNL is low in comparison to private operators, and thus if BSNL has to play a significant role in this area, a restructuring would be required.

In the short term, in order to become self-sustaining, BSNL needs to undergo a significant restructuring and must have strict performance orientation to emerge as full-fledged effective pan-India players competing with the private sector. A significant part of this revival will entail dealing with issues such as 4G spectrum allocation, creation of infrastructure, and project organizations, such as an Infrastructure Company and a Project Company. These would utilize the existing network and human resources of the existing BSNL and reduction in BSNL HR requirements.

If BSNL is able to turn around and emerge as a competitive player, then the options may include privatization through the listing or/and a strategic sale and may require policy changes both at the sectoral and competition level.

To read more content like this, subscribe to our newsletter.