IndiGo Airlines was set up in early 2006 by Rakesh Gangwal and Rahul Bhatia of InterGlobe Enterprises, with InterGlobe as the parent company holding 51.12 percent of the stake while Rakesh Gangwal’s Caelum Investments, a Virginia, and US-based Company hold 48 percent. Many reasons are trotted out for the success but there are some moves that IndiGo has played just right.

It is the largest airline in India in terms of passengers carried, with a 48% market share as of 2020. The airline operates to 41 destinations and is the second-largest low-cost carrier in Asia. It has its primary hub at Indira Gandhi International Airport, Delhi. The airline became the largest Indian carrier in terms of passenger market share in 2012. The company went public in November 2015

One of the chief reasons for IndiGo’s success is its sharp focus – “on-time performance, clean, neat aircraft, and good service”. IndiGo started life as a low-cost carrier and has stayed there firmly, sticking to its business model even in the worst economic crises, a move that has paid off brilliantly. Paid-for onboard meals, a single flying class with no-frills service, high aircraft utilization, and optimal use of space (150 seats to the 190 that a full-fare airline carries) are just some of the cost control methods that IndiGo uses.

History of IndiGo

IndiGo placed a firm order for 100 Airbus A320-200 aircraft in June 2005 with plans to commence operations in mid-2006. The company took delivery of its first Airbus aircraft on 28 July 2006, nearly one year after placing the order, and commenced operations on 4 August 2006 with a service from New Delhi to Imphal via Guwahati. By the end of 2006, the airline had six aircraft and nine more aircraft were acquired in 2007.

In December 2010, IndiGo replaced state-run carrier Air India as the third largest airline in India, behind Kingfisher Airlines and Jet Airways with a passenger market share of 17.3%. In 2011, IndiGo placed an order for 180 Airbus A320 aircraft in a deal worth US$15 billion. Indigo got permission to launch international flights after being 5 years in service and then launched international services in September 2011.

In December 2011, the DGCA expressed reservations that the rapid expansion could impact passenger safety. In February 2012, IndiGo took delivery of its 50th aircraft, less than six years after it began operations in 2006. For the quarter ending March 2012, IndiGo was the most profitable airline in India and became the second-largest airline in India in terms of passenger market share.

On 17 August 2012, IndiGo became the largest airline in India in terms of market share surpassing Jet Airways, six years after commencing operations. In January 2013, IndiGo was the second-fastest-growing low-cost carrier in Asia behind the Indonesian airline Lion Air.

In February 2013, following the announcement of the civil aviation ministry that it would allow IndiGo to take delivery of only five aircraft that year, the airline planned to introduce low-cost regional flights by setting up a subsidiary. Later, IndiGo announced that it plans to seek permission from the ministry to acquire four more aircraft, therefore taking delivery of nine aircraft in 2013.

In August 2015, IndiGo placed an order of 250 Airbus A320 neo aircraft worth $27 billion, making it the largest single order ever in Airbus history. IndiGo announced an Rs. 3,200 crore (US$480 million) initial public offering on 19 October 2015 which opened on 27 October 2015. As of October 2016, it was the largest airline in India in terms of passengers carried with a 42.6% market share.

About the industry

The aviation industry is one of the sectors in which most firms achieve shallow profit margins. However, the growth rate in terms of passengers is on the rise year after year. In the FY20 itself, the Indian aviation traffic in terms of passengers stood at around 341 million. The government also realizes the need for infrastructural improvements and is on its way to attracting investments. While there is heavy competition in the sector even during regular operating days, the pandemic had posed another challenging situation for the airline firms to operate with limited revenues. Despite the tough fight the airlines inevitably would have to face, one such airline in India is worth exploring its strategies, creating a brand for itself.

Market Share

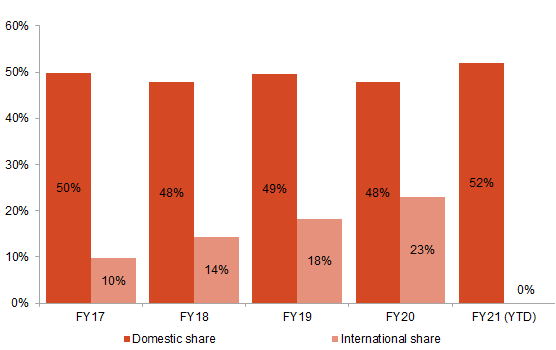

Every airline was going through the most challenging time that has been posted by the pandemic. While some of them had to lay off the workforce, others struggled to get their finances on track to keep them afloat when passengers avoided travel for their safety. At the same time, IndiGo’s market share soar up to 48%, retaining the market leader status it possessed. SpiceJet had taken the second position with a market share of 15.7%, AirIndia 9.1% share, Vistara 4.2%, AirAsia India at 6.2%, and GoAir with just a 3.8% the month ending July 2020.

Marketing Strategies

By defining themselves clearly with the kind of fleet they operate, IndiGo Airlines have positioned itself to the customers with a low-budget air travel option. To keep the ticket fare minimum, the firm doesn’t include complimentary meals in its ticket price. A significant amount of revenues flow from the in-flight services and the merchandise they offer. Bundle pricing is one such strategy that provides discounts for passengers choosing seats along with meals and other additions like excess baggage. By keeping the fares minimum, it almost becomes a market penetrator that attracts customers.

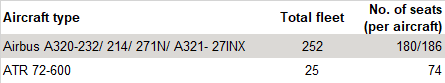

IndiGo currently operates a fleet of 282 spread across various types of aircrafts such as A320 CEO, NEO, and A321. By operating a similar kind of fleet, the training that is to be given to the pilots becomes standardized, whereas a frequent change of aircraft models also includes costs to be incurred to train the pilots. Indigo has recognized the need for flying to remote locations and has come up with an idea of operating ATRs. The low-cost airline currently operates 25 ATRs to different destinations in India. These ATRs have a seating capacity of 78 as opposed to 180 seats in A320 type of aircraft and 222 seats in A321 type of fleet. Since the number of seats is less comparatively, so would the fuel costs be. Also, the rate of seat occupancy can be met easily. This is a strategy that most airlines use to make profits flying fewer passengers to remote destinations or in cases where the landing strips have not been renovated to support landing the regular flights such as A320.

The airline has proven that it doesn’t just provide a service, but an experience using several taglines such as “Our GroundWork takes You Sky High” on its various ground equipment. Also, the IATA code for the airline is 6E, which the firm uses to advertise most of the services and marketing strategies such as 6E Prime, In-flight magazine which is titled Hello 6E, 6E Seat and Eat 6E Flex, and many others.

Selling Points

The airline has strived to maintain its service level high in terms of customer satisfaction. On-Time Performance of Indigo, as in September 2019, stood at 83.7%, which is the mantra they use to display their punctuality. On-Time, All Time used to be their key selling point then. However, a challenge that always remains in terms of operating flights as per schedule is the weather conditions, which would be beyond operational capabilities.

One has to make the right forecast and follow up with the customers subtly, which is the key to customer satisfaction. IndiGo’s Plan B allows customers to reschedule or cancel their flight at no-cost should a situation arise where the airline modifies the flight. Keeping their marketing relevant to contemporary conditions is something that IndiGo has always been doing.

The ‘Tough Cookie’ is one such strategy they used to show that the airline cares for those who care. Through this, doctors and nurses are entitled to a discount of up to 25% when bookings are made through the website with valid proof of identity.

CarGo

While IndiGo is known as the largest domestic passenger airline, not many might have noticed that it is also the largest domestic cargo airline with its wide range of the network. Revenue from the ancillary products and services, which primarily include cargo, has seen an increase of 30.2% from the FY2019, which is Rs.39,458.47 million in FY2020.

Impact of COVID-19

The airline is one among many industries that were severely hit by the pandemic. With the government announcing a complete lockdown, the entire fleet had been grounded, which resulted in a loss of Rs. 2750.89 million in the FY-2020, which is an increase of 84.5% from the previous year’s loss. While this was inevitable, the airline seems to be regaining from the economic conditions’ hard turbulence.

The recent news that the airline is recovering from the hard-hit situation posed by the pandemic and optimistic plans to start re-hiring in the upcoming months seems to give a push-back to the firm to fly again and retain the position of the market leader. Whether IndiGo retains the ‘Best Low-Cost Airline in Central Asia and India’ award it received for the tenth consecutive time in the FY2020 at the Skytrax World Airline Awards is something that time would answer.

You might light to read about American Airline & Etihad Airline

[wpforms id=”320″ title=”true”]