Robinhood Markets, Inc. is an American financial services company based in Menlo Park, California. It is best known for pioneering commission-free stock and ETF transactions through a mobile app launched in March 2015. Robinhood is a FINRA-regulated broker-dealer that is also a member of the Securities Investor Protection Corporation. It is also registered with the US Securities and Exchange Commission. Interest gained on customers’ cash balances, selling order information to high-frequency traders (a practice for which the SEC started an investigation into the company in September 2020), and margin lending are the three main sources of revenue for the company.

Robinhood is a commission-free trading software that allows investors to trade stocks, options, exchange-traded funds, and cryptocurrencies. Robinhood was one of the first brokers to offer free trades in its early days. However, because nearly all major online brokers have abolished trading commissions and fees, Robinhood has had to find new methods to differentiate itself. A new recurring investing option and the ability to buy fractional shares of stocks are two recent examples. It’s also one of the few brokers that allow investors to trade cryptocurrency at the moment.

Robinhood provides web and mobile trading, but the platforms are intentionally stripped-down, and some investors may find the range of tradable assets and account settings to be limited (the broker does not offer retirement accounts). In the past year, Robinhood has been chastised for unexpected outages and trade limits due to market volatility, as well as being penalized by regulators for misleading users, which resulted in large fines.

History

The company debuted its app in front of the public for the first time at LA Hacks, then released it on the AppStore in December 2014 and then formally launched it in March 2015.

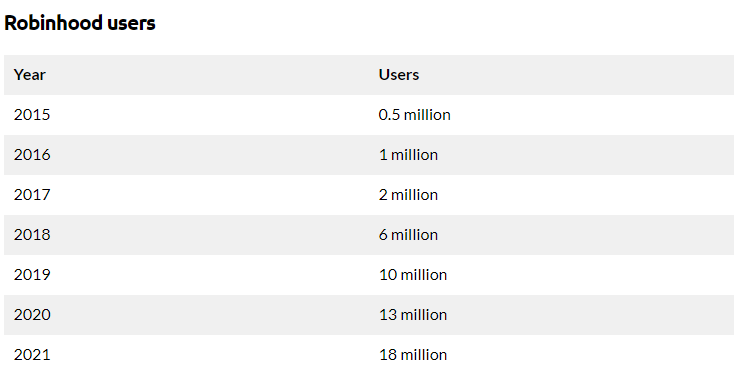

In January 2015, 80% of the company’s customers belonged to the “Millennial” generation, with an average age of 26. Users who have made a trade use the app on a daily basis, and 90% use it on a weekly basis. Robinhood has 18 million users as of 2021.

The company announced in February 2018 that it would relocate its headquarters from Palo Alto to the former Sunset magazine headquarters in Menlo Park.

Bloomberg and other news sites reported in May 2019 that Robinhood was seeking an additional $200 million in the capital, valuing the firm at $7 billion to $10 billion. Robinhood announced its expansion to the United Kingdom in November 2019.

Robinhood trading rose during the 2020 stock market crisis. The subsequent market surge was credited in part to Robinhood traders, although a study found that they had a little daily impact on large stocks.

Robinhood reported in May 2020 that it had raised $280 million in venture investment from Sequoia Capital at a pre-money valuation of $8.3 billion, and three months later, on August 17, the business announced a $200 million Series G funding round from a new investor, D1 Capital Partners.

The FINRA fined Robinhood $57 million in late June 2021, and it was forced to pay $13 million in restitution to customers who were affected by outages and deceptive statements in March 2020. This was the greatest FINRA penalty in the organization’s history.

On July 29, 2021, the company went public on the Nasdaq under the ticker HOOD. The opening price was $38, but it quickly plummeted to $33.35 before beginning to rebound.

How does Robinhood earn?

Robinhood operates as a single business sector and presents its financial results as such. It does, however, categorize revenue into three categories: transaction-based revenues, net interest revenues, and other income. Below, we take a closer look at various revenue streams.

Transaction-based revenues

Payment for order flow (PFOF) is how Robinhood obtains transaction-based revenue by sending its users’ orders for options, stocks, and cryptocurrency to market makers. Brokerage firms that use PFOF are compensated for steering orders to a specific market maker with a nominal fee. Although the payment is normally only a fraction of a penny per share, it can be a major source of revenue for businesses that handle a high number of orders. PFOF is one of the main reasons Robinhood can offer zero-commission trading. In Q1 FY 2021, Robinhood’s transaction-based revenue increased 339.6% to $420.4 million, accounting for more than 80% of total revenue.

Net interest revenues

On securities lending transactions, Robinhood earns net interest revenue (interest revenue minus interest expenditures). Interest is also collected on margin loans to users, as well as interest expenditures related to the company’s revolving credit facilities. In Q1 FY 2021, net interest revenues increased 160.2 percent to $62.5 million, accounting for almost 12% of Robinhood’s total revenue.

Other revenues

Other sources of revenue for Robinhood include subscription fees for Robinhood Gold. Robinhood Gold is a paid subscription service that gives customers access to premium services such as increased quick deposit access, expert research, Nasdaq Level II market data, and approved users’ access to margin investing. Proxy rebates and other user fees are also sources of revenue. In Q1 FY 2021, revenue from these sources increased by 396.5 percent to $39.2 million, accounting for over 8% of total revenue.

Funding and investors

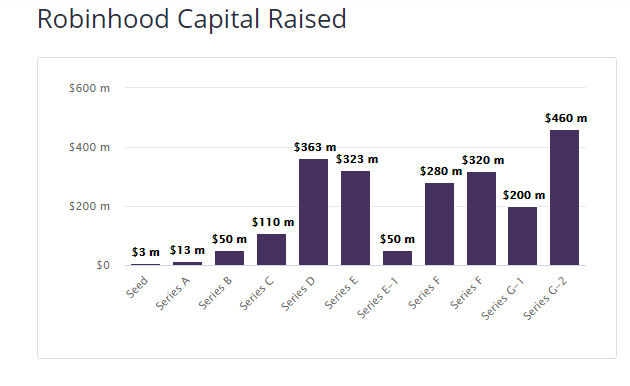

Robinhood raised $110 million in April 2017 at a valuation of $1.3 billion, led by Yuri Milner of DST Global, Greenoaks Capital, and Thrive Capital. DST Global led a $363 million Series D fundraising round for Robinhood on May 10, 2018.

In May 2020, Robinhood revealed that it had raised $280 million in venture capital from Sequoia Capital at a pre-money valuation of $8.3 billion, and three months later, on August 17, the company announced a $200 million Series G funding round from D1 Capital Partners, a new investor.

Also Read: Zerodha – From A Crazy Idea To Biggest Retail Broker Of India

How trading on Robinhood works

A user must first create an account on Robinhood before they can begin trading. All brokerages operating in the United States are required by the Securities and Exchange Commission (SEC) to collect and verify the personal information of individuals trading on their platforms, including their net worth and Social Security number.

Although most applications are approved quickly, the procedure can take up to a week. Users must also link a bank account in order to transfer money between their Robinhood brokerage accounts.

The Robinhood app differs from most online brokerage tools in 2 key ways:

- It provides the user with only the most relevant information in an effort to reduce complexity.

- It encourages frequent use with behavioral triggers that reward certain actions.

Rather than risk overwhelming customers with the breadth of information provided by certain professional trading programs, Robinhood makes things as simple as possible. A basic line graph, for example, depicts the performance of a single stock or cryptocurrency over time. A standard search field allows users to obtain information about certain stocks.

The positions of account holders are summarised in green (positive) or red (negative) to provide rapid overviews of their complete portfolio. On their ticker pages, shares or cryptocurrency can be bought and sold with just two clicks. Trades are displayed in a user’s account history as basic transactions, similar to how banking apps display deposits and withdrawals.

However, simplicity is just half the equation. Robinhood’s use of behavioral triggers and incentives is the other side of the equation.

The gamified aspects begin as soon as clients begin engaging with the software. One of Robinhood’s promises is that new users would receive a free stock – a single share in a firm chosen at random. While new customers may obtain a share in a business such as Apple or Tesla, Robinhood recognizes that this is improbable. New users have a 98 percent probability of obtaining a stock worth between $2.50 and $10 — but the motivation remains.

Positive reinforcement and short-term reward systems underpin much of the Robinhood user experience. When account holders make their initial deposit, they receive a celebratory message informing them that their money are now accessible for trade. Free stocks act as a referral engine, directing others to the product. Robinhood also sends push alerts to consumers to notify them of changes in their positions, drawing them back to the app.

To read more content like this, subscribe to our newsletter