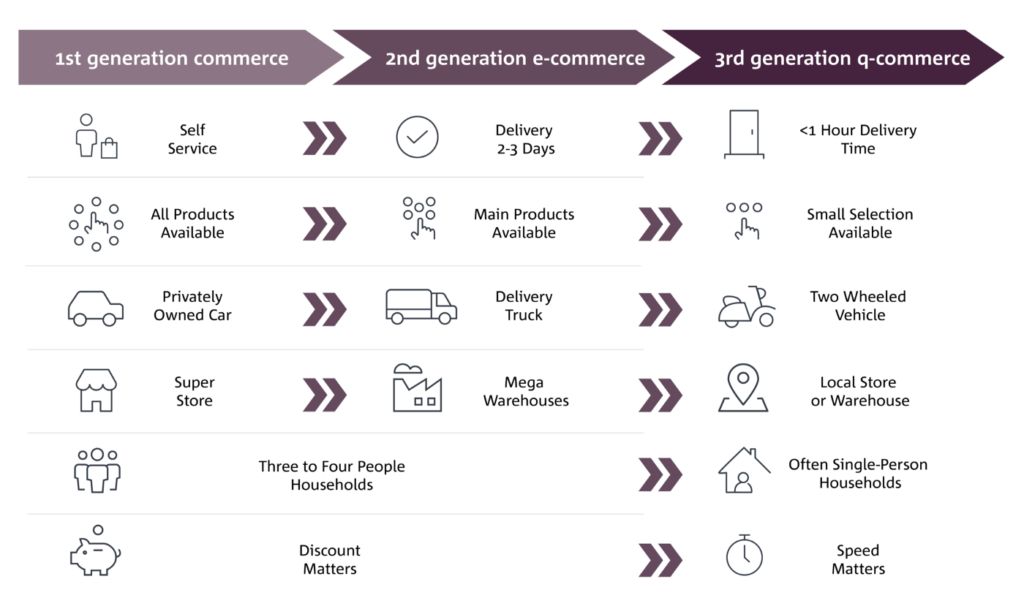

Grofers, an Indian on-demand online grocery delivery business located in Gurugram, was started in 2013. This e-commerce startup platform offers its consumers a wide range of everyday requirements products such as groceries, bakery items, baby care items, and many more.

Customers utilise a smartphone application to purchase groceries and other necessities online. The products are then secured from Blinkit’s warehouse and delivered to the consumer within 10 minutes. By November 2021, the firm had completed 1.25 lakh orders every day. Blinkit is presently available in over 30 Indian cities. By 2021, the business had raised around US$630 million from investors such as SoftBank, Tiger Global, and Sequoia Capital.

The origins of Blinkit (then Grofers)

After graduating, Albinder worked as a transportation analyst for URS Company in the United States. While working, he met Saurabh Kumar and maintained in touch with him with no aim of starting a business.

Both Albinder and Saurabh saw a significant gap in the delivery sector. They both saw an opportunity because it was a time when many startups were sprouting. They felt compelled to manage the disorganised hyperlocal area in the transaction between businesses and customers.

That is when they began to lay the groundwork for their startup. By offering on-demand pickup and drop services, they hoped to provide a one-stop shop for clients’ local delivery needs. This was done to help consumers with logistics from nearby establishments such as grocery stores, medical stores, and restaurants. Initially, both of them also permitted grocery delivery for consumers from nearby shops and supermarkets.

How do Grofers deliver their orders in 10 minutes?

Grofers said two months earlier, in June 2021, that it had already updated its delivery service, which would make deliveries within 10 minutes of an order being placed online. The renowned online food marketplace has promised that during the next 45 days, orders will be delivered in under 10 minutes in areas where Grofers is present. This promise of 10-minute delivery has sparked outrage from individuals around the country, who have accused Grofers of “exploiting” its staff to make it a reality.

One of Grofers’ founders, Albinder Dhindsa, appropriately responded to the company’s hatred, saying,

“It breaks my heart that instead of celebrating innovation coming from India, some of us stay cynical of people who are trying to break the status quo.”

.

While explaining how Grofers achieves 10-minute delivery, Dhindsa stated that the firm has partner stores within 2 kilometres of the clients, which is a significant benefit. The organisation has over 60 partner stores in Delhi and has expanded to over 30 partner stores in Gurgaon, as well as an acceptable number of partner stores in other suitable cities such as Mumbai, Kolkata, Bengaluru, and so on.

Dhindsa went on to say in his Twitter post that the outlets are so close together that Grofers can easily deliver 90 percent of orders in 15 minutes even if the vehicles travel at 10 km/hr. Furthermore, Grofers’ in-store planning and administration are now so well structured, thanks to sophisticated technologies, that they can pack orders within 3 minutes of receiving them. Riders of Grofers are also “Orders are not (dis)incentivised to be delivered quickly. They do things at their own pace and in their own way “Dhindsa stated. The entrepreneur finished by referencing the last two months of statistics since launching the 10-minute grocery delivery service and claiming that Grofers has had no recorded rider accidents.

Grofers is now double-equipped to deliver groceries at the blink of an eye as Blinkit. When questioned about the intense focus on speedy commerce, Albinder Dhindsa, Co-founder CEO of Blinkit (ex-Grofers), remarked that the 10-minute delivery that Blinkit offers should not just be doable but a requirement in the fast-paced life that people are living now. This will allow them to devote more time to more vital tasks.

Business Model

Grofers operate on a marketplace business model and are also known as the Hyper-Local on-demand logistics system. It tries to eliminate the need for customers to travel to local stores to purchase consumer products in favour of ordering online. There are no supermarket shops or warehouses owned by this startup.

It just collaborates with the city’s local grocery stores and then sends their delivery guys to pick up the groceries purchased by customers from these retailers. They take orders through their mobile app or website. This tie-up strategy helps local grocery store owners acquire more orders while also allowing Grofers to benefit from these transactions because the firm charges a fee.

Revenue Model

Grofers’ business model is comparable to the commission-based income model. Grofers has partnered with local business owners and merchants to provide grocery and daily needs products in the surrounding communities.

On these orders, Grofers charges these merchants a commission. When orders are less than 700, the commission runs from 8% to 15%, and when orders are less than 1000, the fee ranges from 12% to 15%. Grofers also charges a delivery cost if the order is less than INR 250.

Also Read: Swiggy – The Ultimate Food Delivery App

Funding and Investors

Grofers has been quite successful in terms of investors and financing. Grofers has raised around $1 billion in funding to far. Zomato led the most recent financing round on March 11, 2022, investing $100 million in Blinkit. The rapid commerce startup has also announced that the $100 million fundraise is the first tranche of a $400 million investment round, with further money expected to arrive during the next week. In its place, the foodtech behemoth provided a $150 million loan.

The online grocery delivery firm received $100 million from Zomato, an Indian food delivery juggernaut, and was certified on August 16, 2021. This aided the online grocery delivery company in reaching a valuation of more than $1 billion and becoming a member of the unicorn club. Grofers is now valued at $1.01 billion following the latest round of funding. Through a new round of funding, the fast commerce startup hopes to raise close to $500 million from its existing investor Zomato.

Revenue and Growth

Blinkit is currently delivering 1.25 lakh orders per day. Blinkit felt that it could be a rapid commerce firm that delivered all of the things that people needed on a daily basis, and as of December 13, 2021, the company reported processing 1 million+ orders each week across 12 cities in India.

With over 5,000 products assorted on its website, which are ready for home delivery in as fast as 10 minutes, Grofers is already one of the largest e-grocery companies in India and has witnessed quite a growth all along the way.

Also Read: Eatigo – The Idea, Business Model And Success Story

Blinkit-Zomato Deal

Zomato provided a $150 million loan to Blinkit on March 16. TechCrunch claimed at the time that the two had negotiated an all-stock merger agreement. In consequence, Zomato would pay about $700 million for the latter.

Blinkit has shrunk down and was battling for money since turning to rapid delivery last August. With this transaction, it has lost its unicorn status and raised concerns about the viability of such a business strategy.

Scaling up will be difficult for Blinkit and Zomato.

‘The costs will rise dramatically.’ “[This approach] requires a larger workforce,” said Vidhyashankar Sathyamurthi, CEO of Network of Indian Cultural Enterprises, when Grofers first started making speedy deliveries.

According to RedSeer, in order to realise the full potential of rapid commerce, organisations must explore outside metros and establish private labels to enhance unit economics and margins.

Zomato, for its part, has an incentive to support Blinkit: ammunition to combat Swiggy’s Instamart. Unfortunately, its acquisition history is not encouraging.

“Zomato has had its share of problems, such as expanding abroad with minimal success and acquiring Uber Eats, which did not work out.” “And now this,” Joshi explained. “Only time will tell whether or not this acquisition is a success.” However, the likelihood looks to be modest.”

To read more content like this, subscribe to our newsletter