Groww is a web-based investing platform that allows users to make direct investments in mutual funds and stocks. The business developed a platform for mutual fund direct access. Groww’s technology is designed to make investing simple, accessible, transparent, and completely paperless, allowing clients to easily invest in mutual funds.

SIPs and equity-linked savings are two ways Groww members can invest in mutual funds. The company claims to have over 20 million registered users, the majority of whom are under the age of 40 and prefer to utilise their phones. It provides over 5,000 mutual funds that may be invested in directly through its website and app, both of which are available on iOS and Android.

It has a transparent pricing structure with low trading costs. There are no hidden costs when investing in a mutual fund. Groww does not charge an account setup or monthly maintenance fee. Furthermore, with Groww’s direct mutual fund plan, you may earn an extra 1.5 percent.

Groww provides stock market essentials and updates to help investors make smarter selections through E-books, Resources, and Blogs. It is incredibly simple to open a paperless account. You can apply for an IPO online if you wish to participate in the primary market. The programme includes a Brokerage Calculator.

Founders/History

Groww was established in 2016 by four former Flipkart workers, Lalit Keshre, Harsh Jain, Neeraj Singh, and Ishan Bansal, with the goal of making investing more accessible to young people by simplifying the process. Most millennials favour the DIY (Do It Yourself) approach, in which individual investors create and manage their own investment portfolios.

How it started?

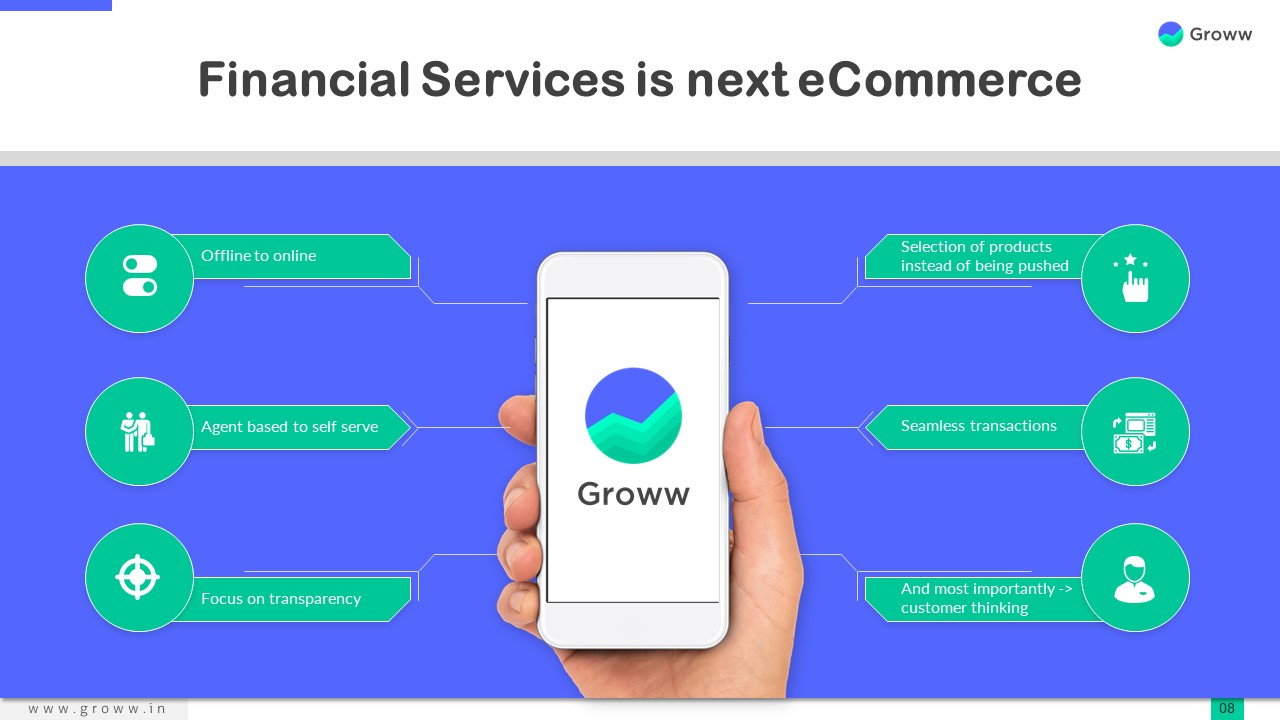

During their time at Flipkart, the company’s founders watched the evolution of the e-commerce business and decided that investing is the next great opportunity. The e-commerce boom suggested an increase in average income and technological expertise, and it was at this moment that the founders understood that people really have more money and will need help putting it to good use.

When the founding team began researching Indian financial choices for interested customers, they spent a significant amount of time studying about the industry and identified the users’ primary pain points. They have to do multiple experiments to identify the optimal user experience. Furthermore, the users’ hard-earned cash was at stake. As a result, they needed to provide a safe and secure solution, which took some time to design.

Groww launched in 2016 as a direct mutual fund distribution platform and has since evolved to become one of the most popular mutual fund investment platforms in the country. In response to consumer demand, Groww introduced stocks in early 2020, and the following year released digital gold, ETFs, intraday trading, and IPOs in fast succession.

Business Model

Groww charges a little fee, however it is paid by the mutual fund company, not the client. They earn from the funds they sell, but the process is difficult.

To begin, mutual fund investments are classified into two types: regular and direct. In normal mode, a distributor appears, and you must pay a commission to the distributor. The commission is established so that you are compensated for your investment and earnings.

Groww, on the other hand, provides customers with a direct investing opportunity by uniting many funds and firms into a single platform, therefore broadening their options.

The first priority for a fintech firm like Groww is to develop its client base. Groww uses technology to reach the right audience, which reduces its operational expenses. People seldom move between these kinds of apps. As a consequence, if you’ve created the right consumer base, they’re more likely to continue with you for the long haul.

Groww’s high level of technology enables customers to invest in mutual funds and shares from anywhere in the globe. You can become a shareholder in a certain stock or mutual fund with a few mouse clicks.

Revenue and Growth

Groww is one of several startups that have piqued the curiosity of investors. Earnings climbed by 4.7 times to little more than INR 1 crore in FY20, up from INR 20.14 lakhs in FY19. Operating revenue rose 3.25 times to INR 52.05 lakhs, with financial assets contributing INR 48.24 lakhs more.

In addition, the company’s operational sales increased in FY21, reaching INR 52.71 crores in consolidated operating revenues. The brokerage and allied services provided by the firm generated around INR 34.3 crore in revenue, which was followed by income from its tech platform charges and other operational revenue, which generated Rs 12.7 crore and INR 5.71 crore in revenue, respectively. The company’s expenditure also increased in lockstep, bringing the total expenditure to INR 155.66 crore. According to the company’s financials at the unit level, Groww earned Re 1 of operational revenue while spending INR 2.95 during FY21.

Although the Y Combinator-backed company’s earnings have increased, it still behind startups like Zerodha and Upstox, which have earnings of INR 1,094 crore and INR 148 crore, respectively. In FY20, Groww earned INR 1 crore, whereas ET Money earned INR 2.24 crore.

Groww is rapidly increasing and attained unicorn status in April 2021. The firm secured a $83 million Series D fundraising round sponsored by Tiger Global Management, allowing it to become a unicorn startup.

Some other growth insights of the brand can be compiled as:

- Groww boasts that it has over 20 million registered users.

- Nearly $400 million has been invested in the platform.

- Groww is a one-of-a-kind firm that has seen its worth more than tenfold increase (from $250-300 million to $3 billion) in just over a year in India.

- Groww’s main competitor is Upstox, which just raised a fresh round at a valuation of roughly $3.4 billion.

Also Read: Upstox – Success Story, Business Model, Revenue, Growth & Funding

Funding and Investors

Groww has raised around $393 million in 7 investment rounds to far. On October 24, 2021, the firm secured around $251 million in its Series E fundraising round.

Future Plans

Groww will introduce deposits, US stocks, sovereign gold bonds, Futures & Options, and other derivative products in the following months. Groww has focused financial education content from its inception.

Over the next two years, the business plans to launch a flurry of financial education programmes aimed at millennials, as well as strengthen the financial services industry. According to the company, it signed up around 7 million users between September 2020 and April 2021, with 60% of them in Tier 2 cities and beyond.

Official Website – https://groww.in/

To read more content like this, subscribe to our newsletter