Pine Labs is a financial technology company that provides payment and merchant commerce solutions to businesses in India and other countries in the Asia-Pacific region. The company was founded in 1998 and is headquartered in Noida, India.

Pine Labs offers a range of products and services, including point-of-sale (POS) devices, payment gateway solutions, and other value-added services such as loyalty programs, EMI options, and cashback offers. The company’s products and services are designed to help businesses manage their transactions and improve their customer engagement and loyalty.

Pine Labs has partnerships with major banks and financial institutions in India and other countries, and its products and services are used by thousands of merchants across various industries, including retail, hospitality, healthcare, and e-commerce. In addition to its operations in India, Pine Labs has expanded into other markets in the Asia-Pacific region, including Singapore, Malaysia, the Philippines, and the United Arab Emirates.

Founding History of Pine Labs

Pine Labs was founded in 1998 by Lokvir Kapoor, Rajul Garg, and Tarun Upadhyay, who were all students at the Indian Institute of Technology (IIT) Kanpur at the time. The three friends had a shared interest in technology and a passion for entrepreneurship, and they saw an opportunity to leverage their skills and knowledge to address a problem in the Indian market.

At the time, most retailers in India were still using traditional cash registers to process transactions, and there was a growing demand for more efficient and secure payment solutions. The founders recognized this need and decided to develop a point-of-sale (POS) device that could process electronic payments and offer other value-added services to merchants.

The founders initially bootstrapped the company, investing their own money and working out of a small office in Noida, a suburb of Delhi. They spent several years developing and refining their POS device, which they named “Pine,” and building relationships with banks and other financial institutions in India.

In 2003, Pine Labs launched its first product, a POS device that could process credit and debit card payments. The device was well received by merchants and quickly gained traction in the Indian market. Over the years, Pine Labs continued to innovate and expand its product portfolio, adding new features and services such as EMI options, loyalty programs, and cashback offers.

Today, Pine Labs is one of the leading fintech companies in India and has expanded its operations to other countries in the Asia-Pacific region. The company has raised significant funding from investors, including Sequoia Capital, PayPal, and Mastercard, and has received numerous awards and accolades for its innovative products and services.

Business Model of Pine Labs – How does Pine Labs earn money?

Pine Labs operates on a business-to-business (B2B) model, offering payment and merchant commerce solutions to businesses in India and other countries in the Asia-Pacific region. The company’s revenue model is primarily based on transaction fees and subscription fees.

Here is a more detailed breakdown of Pine Labs’ business model:

POS devices: Pine Labs offers several types of POS devices that merchants can use to accept electronic payments. These devices range from basic countertop terminals to more advanced mobile and wireless solutions. The company charges a transaction fee for each payment processed through its POS devices. The fee is typically a percentage of the transaction value, ranging from 0.5% to 2%, depending on the payment type and the merchant’s pricing plan. Pine Labs also charges a fixed monthly rental fee for its POS devices.

Payment gateway solutions: Pine Labs’ payment gateway solutions enable merchants to accept online payments through their websites or mobile apps. The company charges a transaction fee for each payment processed through its payment gateway. The fee is typically a percentage of the transaction value, ranging from 1% to 3%, depending on the payment type and the merchant’s pricing plan. Pine Labs also charges a setup fee and a recurring annual maintenance fee for its payment gateway solutions.

Value-added services: Pine Labs offers a range of value-added services to help merchants improve their customer engagement and loyalty. These services include loyalty programs, EMI options, cashback offers, and other promotions. Merchants can subscribe to these services for a monthly fee, which is typically based on the number of transactions or the value of the merchant’s business. For example, merchants can offer their customers EMI options for purchases above a certain amount, which allows customers to pay for their purchases in installments over a period of time. Pine Labs charges a fee for each EMI transaction processed through its platform.

Partnerships: Pine Labs has partnerships with major banks and financial institutions in India and other countries. These partnerships enable Pine Labs to offer its payment solutions to a wide range of merchants, while also providing additional services such as loan and insurance products. In some cases, Pine Labs may receive a commission or referral fee from its partners for each merchant that signs up for its services.

Overall, Pine Labs’ business model is based on providing a comprehensive payment and merchant commerce solution to businesses, with a focus on offering innovative products and services that help merchants improve their customer engagement and loyalty. By charging transaction fees, rental fees, subscription fees, and other fees, Pine Labs is able to generate revenue while also providing value to its customers. The company’s partnerships with banks and financial institutions also help to expand its reach and provide additional services to merchants.

Growth of Pine Labs over the years

Transaction Volume: Pine Labs has reported consistent growth in transaction volume over the years. According to a report by RedSeer Consulting, Pine Labs processed over $30 billion in transactions in FY 2021, up from $18 billion in FY 2020. This represents a growth rate of over 60%.

Merchant Base: Pine Labs has also been able to grow its merchant base over the years. According to a report by The Economic Times, Pine Labs has over 1.5 million merchants on its platform as of 2021, up from 500,000 merchants in 2018. This represents a growth rate of over 200%.

Geographic Expansion: Pine Labs has expanded its operations beyond India to other countries in the Asia-Pacific region. According to a report by The Economic Times, Pine Labs has operations in Malaysia, the Philippines, and Thailand, and is planning to expand to other countries in the region. This expansion has helped the company to tap into new markets and increase its transaction volume.

Partnerships: Pine Labs has formed strategic partnerships with major banks and financial institutions in India and other countries. These partnerships have helped the company to expand its reach and provide additional services to its merchants. For example, in 2020, Pine Labs partnered with Mastercard to launch an integrated “pay later” solution for merchants.

Overall, Pine Labs has demonstrated strong growth in key performance indicators over the years, including transaction volume, merchant base, geographic expansion, and partnerships. The company’s focus on innovation and customer service has helped it to establish a strong position in the payment and merchant commerce space in India and other countries in the region.

Also Read: OneCard: A Fintech Revolutionizing the Credit Card Industry

Financials of Pine Labs over the years

Pine Labs is back on track in FY22 after witnessing a dip in its scale during FY21 due to the pandemic. The fintech startup has managed to go past Rs 1,000 crore in operating revenues in the fiscal year ending March 2022.

Pine Labs’ operating scale grew by 40.1% to Rs 1,017 crore in the last fiscal from Rs 726 crore during FY21, as per the company’s financial statements filed by its holding company Pine Labs Pte Ltd in Singapore.

Its core offering: point of sale (PoS) accounted for 60.5% of the total collections which grew 38.8% to Rs 615 crore in FY22. Pine Labs’ PoS terminals let merchants accept plastic cards and QR-based payments in their stores. The company’s PoS income consists of fixed charges or variable fees from merchants, banks, and brands.

Funding and Investors of Pine Labs

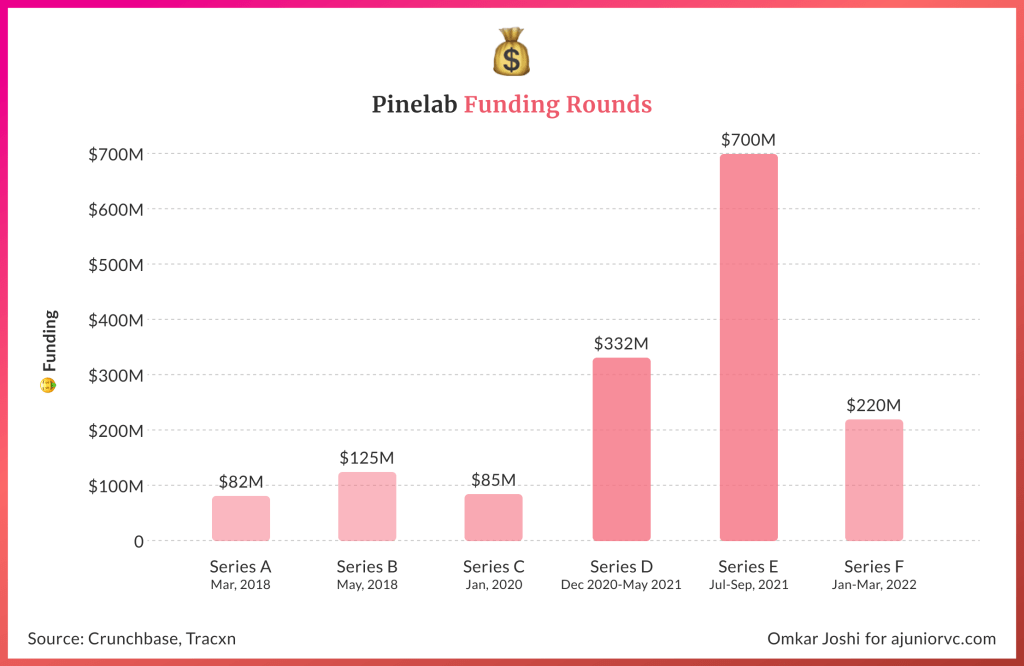

Pine Labs is a leading merchant platform and provider of payment and financial technology solutions in India and Southeast Asia. The company has raised several rounds of funding from a range of investors since its inception in 1998.

Here is a detailed breakdown of Pine Labs’ funding and investors:

Pine Labs’ investors include some of the most prominent names in the global investment community, such as Sequoia Capital India, PayPal, Temasek Holdings, Actis Capital, Altimeter Capital, DST Global, and Lone Pine Capital. The company has raised a total of $1.2 billion in funding to date. These funds have helped Pine Labs to expand its operations, invest in research and development, and acquire other companies in the payment and financial technology space.

Future of Pine Labs

Pine Labs has a promising future as a leading merchant platform and provider of payment and financial technology solutions in India and Southeast Asia. The company has been expanding its operations and introducing new products and services to meet the evolving needs of merchants and consumers.

Here are some key factors that will shape the future of Pine Labs:

Expansion into new markets: Pine Labs has been expanding its operations beyond India into other Southeast Asian countries, such as Singapore, Malaysia, and Thailand. The company plans to further expand its presence in these markets and explore new markets in the future.

Introduction of new products and services: Pine Labs has been introducing new products and services to cater to the changing needs of merchants and consumers. The company recently launched Pine Labs Paper POS, a contactless payment acceptance solution for small merchants. Pine Labs is also planning to introduce new products and services, such as digital lending, insurance, and loyalty programs.

Strategic partnerships and acquisitions: Pine Labs has been forging strategic partnerships with other companies in the payment and financial technology space to enhance its offerings and expand its reach. The company has also been acquiring other companies to strengthen its capabilities and enter new markets.

Innovation and technology: Pine Labs has been investing heavily in research and development to innovate and develop new technologies to enhance its offerings and improve the payment experience for merchants and consumers.

Evolving regulatory landscape: The payment and financial technology industry is highly regulated, and regulatory changes could impact the future of Pine Labs. The company will need to stay up-to-date with regulatory developments and adapt its offerings accordingly.

Overall, Pine Labs is well-positioned to capitalize on the growing demand for digital payments and financial technology solutions in India and Southeast Asia. The company’s focus on innovation, expansion, and strategic partnerships will help it to maintain its leadership position in the industry and drive future growth.

To read more content like this, subscribe to our newsletter