Trade Republic is a German online broker that was founded in 2015. The company offers a mobile app that allows users to trade stocks, ETFs, cryptocurrency, and other financial instruments. Trade Republic is known for its low fees and its user-friendly interface. In this article, we’ll explore the startup story, history, founders, business model, revenue streams, valuation and growth of Trade Republic.

The company was founded by Christian Hecker, Thomas Pischke, and Marco Weidner. The three founders were all experienced in the financial industry, and they saw an opportunity to create a more affordable and accessible way for people to invest.

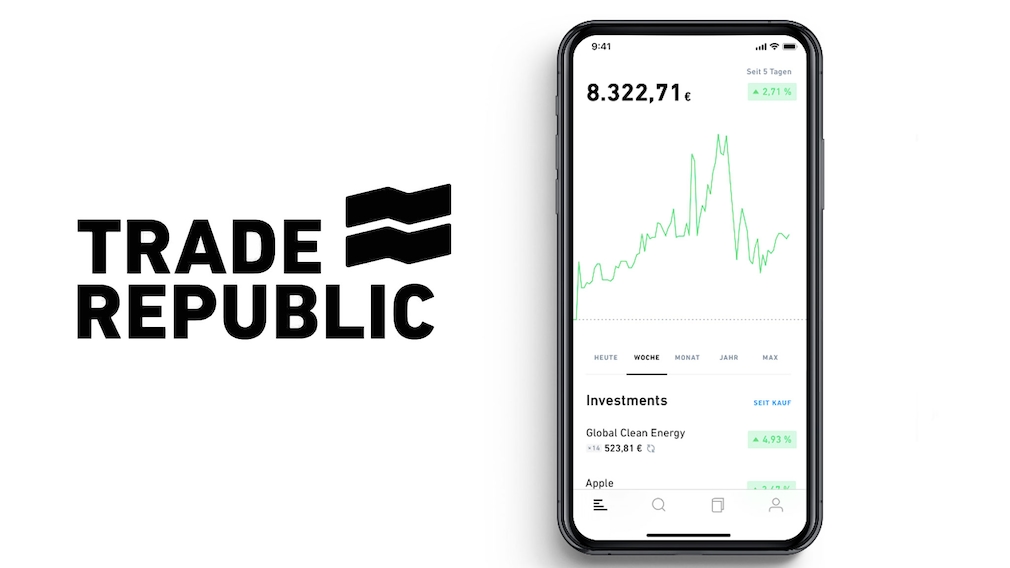

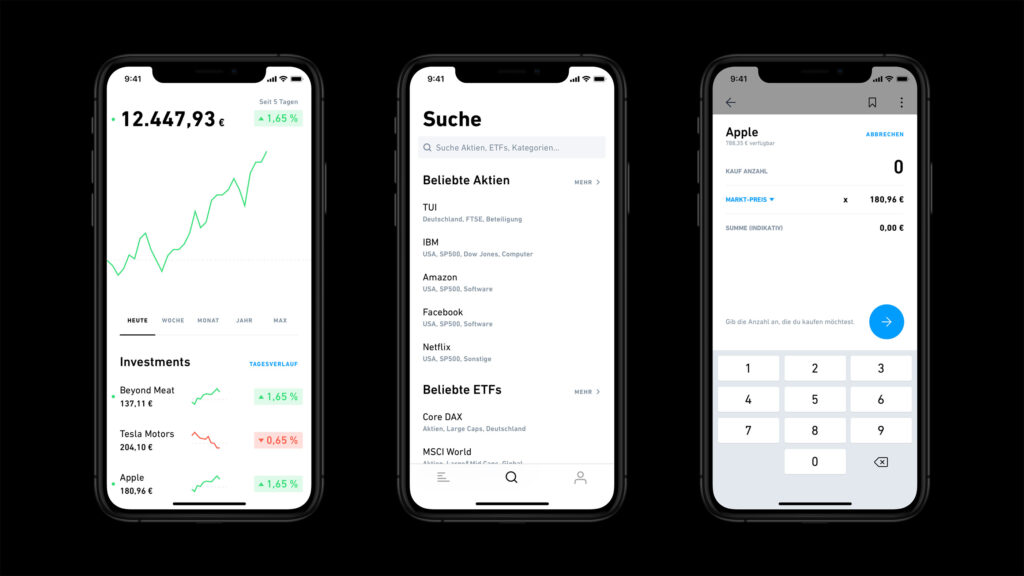

Trade Republic’s mobile app is designed to be simple and easy to use. The app allows users to buy and sell stocks and ETFs with a few taps of their finger. Trade Republic also offers a variety of educational resources to help users learn about investing.

The company’s low fees have made it a popular choice for investors. Trade Republic charges a flat fee of €1 per trade, regardless of the size of the trade. This is significantly lower than the fees charged by traditional brokerage firms.

Trade Republic has grown rapidly since its inception. The company now has over 1 million customers in Germany, Austria, and France. Trade Republic is also expanding into new markets, and it plans to become a leading online broker in Europe.

Here are some of the key features of Trade Republic:

- Low fees: Trade Republic charges a flat fee of €1 per trade, regardless of the size of the trade. This is significantly lower than the fees charged by traditional brokerage firms.

- User-friendly interface: Trade Republic’s mobile app is designed to be simple and easy to use. The app allows users to buy and sell stocks and ETFs with a few taps of their finger.

- Educational resources: Trade Republic offers a variety of educational resources to help users learn about investing. These resources include articles, videos, and webinars.

- Secure trading: Trade Republic’s platform is secure and compliant with all applicable regulations. The company uses industry-leading security measures to protect its users’ data.

Founding History and Founders of Trade Republic

Founded in 2015 under the name Neon Trading within the startup incubator of Comdirect Bank in Munich, Trade Republic has emerged as a pioneering force in the world of fintech. The company was established by a trio of visionaries, including philosopher Christian Hecker, physicist Thomas Pischke, and computer scientist Marco Cancellieri. In 2017, the Düsseldorf-based Sino AG made a significant investment in the startup, acquiring the majority of its shares. However, subsequent venture capital investments from prominent firms like Creandum, Project A Ventures, Accel Partners, and Founders Fund gradually decreased Sino’s ownership.

Trade Republic introduced securities trading through its app, initially limited to a closed user group in Germany in February 2019, before opening up to all users in May 2019. As of April 2020, the platform had amassed 150,000 users, with over one-third of them being new to stock and ETF investments. The average user profile leaned towards males in their mid-30s. Expanding its reach, Trade Republic commenced operations in Austria in November 2020, followed by forays into France and Spain in 2021.

By the end of 2020, Trade Republic had achieved remarkable growth, boasting a customer base of 600,000 and managing a staggering four billion euros in assets. The platform’s appeal was evident from the fact that 80% of its users had set up equity or ETF savings plans.

In January 2021, amidst the GameStop stock surge, Trade Republic made headlines when it imposed a stop-buy on select stocks, including GameStop’s stock, citing an “extreme situation in the market” and investor protection. This decision led to over 4,000 complaints filed at the Federal Financial Supervisory Authority.

Demonstrating its continued success and potential, Trade Republic announced another financing round in May 2021, securing an impressive $900 million at a valuation of $5 billion. This ongoing growth led to further funding in June 2022, with an additional $250 million raised. However, the company also faced challenges in managing its expanding workforce and adapting to evolving business conditions, leading to a round of layoffs in June 2022.

Trade Republic’s journey from a Munich-based startup to a major player in the fintech landscape has been marked by both triumphs and challenges. As the platform continues to evolve and expand its services across borders, it remains at the forefront of democratizing finance and empowering individuals to take charge of their financial futures.

Founders of Trade Republic

The founders of Trade Republic, Christian Hecker, Thomas Pischke, and Marco Cancellieri, are visionary entrepreneurs who have played a pivotal role in shaping the trajectory of the fintech startup. Each founder brings unique expertise and experiences to the table, contributing to Trade Republic’s innovative approach and success in the world of digital investing.

Christian Hecker

Christian Hecker, a philosopher by profession, is a co-founder of Trade Republic. With a background in philosophy, Hecker’s involvement in the fintech world may seem unconventional at first glance. However, his academic pursuits have instilled in him a deep understanding of critical thinking, problem-solving, and the ability to question conventional norms – all essential qualities in driving innovation.

Hecker’s vision for Trade Republic lies in democratizing finance and making investment accessible to a broader audience. His philosophy-driven approach has been instrumental in shaping the company’s mission to remove barriers and complexities from traditional banking systems, empowering individuals to participate in the global financial markets confidently.

Thomas Pischke

Thomas Pischke, a physicist, is another co-founder of Trade Republic. His background in physics highlights his expertise in analytical thinking and data-driven decision-making. These skills have proved invaluable in navigating the complexities of the financial world and developing robust algorithms and systems to support Trade Republic’s platform.

As a co-founder, Pischke has played a key role in developing the technology that underpins Trade Republic’s seamless user experience. His expertise in data analysis and technology integration has been crucial in ensuring that the platform remains efficient, user-friendly, and capable of handling large volumes of transactions securely.

Marco Cancellieri

Completing the trio of founders, Marco Cancellieri brings a wealth of knowledge in computer science to Trade Republic. As a computer scientist, Cancellieri’s expertise lies in software development, coding, and creating innovative technological solutions.

Cancellieri’s contributions to Trade Republic encompass building a scalable and agile technology infrastructure that allows for rapid expansion and adaptability to changing market dynamics. His focus on user-centric design has also played a significant role in creating a platform that caters to the needs of modern investors, providing a seamless experience that appeals to both novice and experienced traders.

Together, these three founders have combined their diverse backgrounds and skill sets to create Trade Republic, a fintech startup that has disrupted the investment landscape and revolutionized the way people approach investing. Their shared vision of making finance accessible to all, coupled with their expertise in philosophy, physics, and computer science, has been the driving force behind Trade Republic’s success in empowering millions of investors worldwide.

Business Model of Trade Republic

Trade Republic operates on a disruptive business model that aims to democratize finance and provide individuals with easy and affordable access to global financial markets. Let’s explore the key elements of Trade Republic’s business model in detail:

Mobile-First Investment Platform: Trade Republic’s mobile-first approach is at the core of its business model. The company recognized the increasing use of smartphones and the need for convenient, on-the-go access to investment opportunities. By prioritizing mobile technology, Trade Republic provides users with a user-friendly app that offers a seamless and intuitive investing experience. The app’s interface is designed to be user-centric, making it easy for both seasoned investors and newcomers to navigate and manage their portfolios efficiently.

Commission-Free Trading: One of the most disruptive features of Trade Republic’s business model is its zero-commission trading. Unlike traditional brokerage firms that charge fees per trade or transaction, Trade Republic does not impose any commission charges. This approach eliminates a significant barrier for potential investors, especially for those who may have been deterred by high trading fees in traditional financial institutions. By offering commission-free trading, Trade Republic appeals to cost-conscious investors, attracting a broader and more diverse customer base.

Fractional Shares: Trade Republic’s fractional share investing is another innovative aspect of its business model. Fractional shares enable users to purchase portions of high-priced stocks or ETFs, making it possible for investors with limited capital to access a wide range of assets. This feature promotes portfolio diversification and empowers users to build investment portfolios tailored to their preferences and risk tolerance. Fractional shares democratize investment opportunities, as users are not restricted by the high costs associated with buying whole shares of expensive assets.

Investment Diversification: Trade Republic offers a broad selection of investment options to cater to various investment goals and risk profiles. Users can choose from a diverse array of stocks, ETFs, and other financial instruments, ensuring that they have the flexibility to craft portfolios that align with their unique financial objectives. The platform encourages responsible investing by promoting diversification, reducing the potential risks associated with relying heavily on a single asset or sector.

Straight-Through Processing (STP) Model: Trade Republic operates on a straight-through processing (STP) model, streamlining the investment process from start to finish. This automated approach ensures that user transactions are executed efficiently without manual intervention, leading to faster order execution and minimal delays. The STP model enhances user satisfaction by providing a seamless and hassle-free investing experience, further reinforcing Trade Republic’s reputation for user-centricity.

Regulatory Compliance: Trade Republic operates as a licensed and regulated financial institution, adhering to strict compliance standards and regulations. As a regulated entity, the company prioritizes transparency, investor protection, and data security. By maintaining regulatory compliance, Trade Republic builds trust with its user base, reassuring investors that their funds and personal information are protected.

In conclusion, Trade Republic’s business model encompasses key elements such as commission-free trading, fractional shares, a mobile-first platform, and international expansion. By combining these innovative features with a user-centric approach and regulatory compliance, Trade Republic has disrupted the investment landscape, democratizing finance and empowering individuals to take control of their financial future.

Revenue Streams of Trade Republic

Trade Republic generates revenue through a combination of traditional and innovative revenue streams. Let’s explore each revenue stream in detail:

Order Execution Fees: Trade Republic charges users a small fee for executing orders. Although the platform is known for its commission-free trading, it still imposes a minimal fee on certain types of trades, such as those involving foreign exchanges or specific financial instruments. These order execution fees contribute to Trade Republic’s revenue without significantly burdening its users, as the fees are generally lower compared to traditional brokerage firms.

The only fee you will quickly notice will be the €1 external fee per trade in stocks, ETFs, derivatives, and crypto. The company states that this cost is 100% third-party related (settlement cost). In the case of partial executions, the third-party fee is charged only once per trading day.

Currency Exchange Fees: Trade Republic offers access to global financial markets, allowing users to invest in stocks and ETFs denominated in various currencies. When users convert their funds from their base currency to another currency to make international investments, Trade Republic charges a currency exchange fee. This fee applies to ensure the platform covers the costs associated with currency conversion and risk management.

Income in foreign currencies, e.g. foreign dividends or as a result of corporate actions, is converted into euros. All currency conversions are carried out at the applicable selling rate (foreign exchange buying rate) for debits and at the applicable buying rate (foreign exchange selling rate) for credits.

Interest on Uninvested Cash Balances: When users have uninvested cash in their Trade Republic accounts, the platform pools these balances and invests them in interest-bearing accounts or other low-risk financial instruments. The interest earned on these uninvested cash balances generates revenue for Trade Republic.

Trade Republic is the first broker to seize on the opportunity to pay interest on all customers’ uninvested cash assets. With an effective annual interest of 2 percent p.a. for all existing and new customers, Europe’s largest savings platform clearly sets itself apart from the competition.

Securities Lending Income: Trade Republic participates in securities lending, a process where it lends securities held by its customers to other financial institutions or investors in exchange for fees. The securities lent out are typically in high demand, and the lending process helps facilitate short-selling activities and enhances market liquidity. The income generated from securities lending contributes to Trade Republic’s overall revenue.

Premium Subscription Services: In some markets, Trade Republic offers premium subscription services that provide users with additional benefits and features beyond the standard offering. These premium services may include access to advanced investment tools, real-time market data, educational resources, and priority customer support. Subscribers pay a monthly or annual fee, providing an additional revenue stream for Trade Republic.

Interest on Margin Loans: Trade Republic allows users to trade on margin, which means they can borrow funds from the platform to invest in securities. The platform charges interest on these margin loans, and the interest earned contributes to Trade Republic’s revenue. Margin trading is subject to regulatory requirements, and the interest rates are typically competitive compared to traditional margin loans offered by banks or brokerages. Margin interest rates range from 4.75% to 12%

In conclusion, Trade Republic’s revenue streams encompass a combination of fees, interest income, premium services, and data-related activities. The platform’s innovative approach to generating revenue, combined with its user-friendly and transparent fee structure, has contributed to its success in democratizing finance and establishing a strong presence in the fintech industry.

Valuation, Funding and Investors of Trade Republic

Valuation

Trade Republic’s valuation has increased significantly in recent years. In June 2022, the company raised $268 million in Series C extended funding round and was valued at $5.4 billion.

Funding

Trade Republic has raised a total of $1.3 billion in funding over 5 rounds. The company’s most recent funding round was a Series C round on Jun 3, 2022. Trade Republic is funded by 11 investors. Ontario Teachers’ Pension Plan and Project A Ventures are the most recent investors.

| Round | Date | Amount Raised | Investors |

|---|---|---|---|

| Series A | Jul 16, 2019 | $12 million | Sequoia Capital, Thrive Capital, TCV, and Project A Ventures |

| Series B | April 16, 2020 | $75 million | Ontario Teachers’ Pension Plan, Sequoia, TCV, Thrive, Accel, Founders Fund, Creandum, \and Project A. |

| Series C | May 20, 2021 | $900 million | Sequoia Capital, Founders Fund, Creandum, and Thrive Capital |

| Series C Extension | Jun 3, 2022 | $268 million | Ontario Teachers’ Pension Plan, Temasek Holdings, SoftBank Vision Fund 2, and Project A Ventures |

Investors

The investors in Trade Republic include:

- Accel

- Creandum

- Project A

- Technology Crossover Ventures

- Thrive Capital

- Sequoia Capital

- Founders Fund

- Ontario Teachers’ Pension Plan

- Temasek Holdings

- SoftBank Vision Fund 2

Trade Republic is a rapidly growing online broker that has attracted significant investment from some of the world’s leading venture capital firms. The company’s valuation has increased significantly in recent years, and it is poised to become a major player in the European investment landscape.

Also Read: iCapital Network – Founder, Features, Business Model and Funding

To read more content like this, subscribe to our newsletter