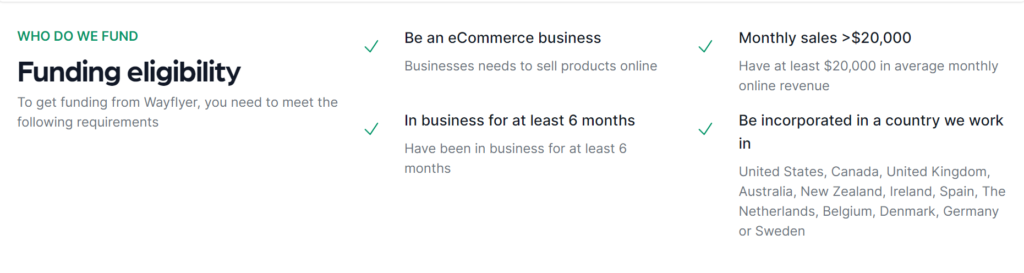

Wayflyer is a dynamic and innovative startup that has been making waves in the world of e-commerce and online retail. Founded with a mission to empower businesses to succeed and grow, Wayflyer has positioned itself as a game-changer in the financial technology (FinTech) industry.

This revolutionary company specializes in providing data-driven, revenue-based financing solutions to e-commerce entrepreneurs, helping them scale their operations, optimize cash flow, and navigate the often challenging terrain of digital commerce.

Wayflyer is a financial technology company that provides working capital solutions to e-commerce businesses. The company was founded in 2019 by former Goldman Sachs bankers – Aidan Corbett and Jack Pierse, and is headquartered in London, UK.

Wayflyer offers a range of products to help e-commerce businesses manage their cash flow, including:

- Invoice financing: Wayflyer provides businesses with upfront cash against their unpaid invoices. This can help businesses to free up working capital and avoid late payment fees.

- Buy now, pay later: Wayflyer offers businesses a buy now, pay later option to their customers. This can help businesses to increase sales and improve customer satisfaction.

- Inventory financing: Wayflyer provides businesses with financing to purchase inventory. This can help businesses to grow their business and meet demand.

Wayflyer has raised over $833 million in funding, and is backed by investors such as Sequoia Capital, Tiger Global, and Accel. The company has grown rapidly, and is now used by over 1,500 e-commerce businesses in over 100 countries.

Wayflyer’s mission is to “democratize access to capital for e-commerce businesses.” The company believes that all businesses should have access to the working capital they need to grow and succeed.

Wayflyer’s products are designed to be easy to use and accessible to businesses of all sizes. The company also offers a range of features to help businesses manage their cash flow, such as automated payments and reporting.

Wayflyer is a leading provider of working capital solutions for e-commerce businesses. The company is backed by some of the most respected investors in the world, and is growing rapidly.

Wayflyer Products and Services

Wayflyer offers a range of products to help e-commerce businesses manage their cash flow, including:

1. Wayflyer Funder

When entrepreneurs seek a financial partner that understands the intricacies of their unique journey, they turn to Wayflyer Funder. With Wayflyer, businesses gain access to flexible funding ranging from $10,000 to $20 million, empowering them to make strategic investments in inventory, marketing, and other critical aspects of their operations.

What sets Wayflyer apart is their commitment to tailored funding solutions; they eschew one-size-fits-all approaches. Instead, they invite businesses to specify their funding requirements, timelines, and preferences, creating bespoke offers that align perfectly with individual needs.

The process is swift, with businesses able to sign up and request funding in under 5 minutes. Within 24 hours, Wayflyer’s dedicated team reaches out to discuss personalized offers. Once satisfied, funds can be in your account within 1-3 days. Wayflyer’s funding amounts can go up to $20 million, and their offers are generated based on various factors, including financial and marketing performance.

With transaction fees typically ranging from 2% to 8%, Wayflyer ensures that businesses have access to the capital they need to thrive, without the burden of cookie-cutter financing. As businesses grow and evolve, Wayflyer stands as a trusted partner, offering tailored solutions that enable them to seize opportunities, minimize risk, and retain ownership of their journey.

2. Wayflyer Scaler

For eCommerce giants generating over $20 million in annual revenue, Wayflyer Scaler emerges as the ultimate solution to the complex realm of working capital. This specialized offering eliminates the hassles of traditional funding providers, sparing businesses from tedious paperwork and unnecessary fees.

With formidable backing from premier investment firms, Wayflyer Scaler possesses the capacity to furnish substantial capital precisely when it’s needed. The true essence of Wayflyer Scaler lies in its ability to provide businesses with unwavering certainty regarding their future funding needs.

The platform’s approach is straightforward, flexible, and remarkably expeditious, equipping businesses with the confidence to tackle forthcoming working-capital requirements seamlessly. With Wayflyer Scaler, large eCommerce enterprises can scale their operations with precision, knowing they have a trusted partner by their side to navigate the complexities of their financial needs.

3. Wayflyer Amazon

Wayflyer Amazon is here to transform the world of financing for Amazon sellers, offering revenue-based funding solutions ranging from $10,000 to $20 million. With a straightforward approach to revenue-based financing, Wayflyer Amazon simplifies the process and eliminates the need for equity or collateral.

Sellers can utilize their funding to bolster inventory or supercharge their marketing endeavors, enabling them to scale with confidence. What truly sets Wayflyer Amazon apart is its commitment to tailor each funding offer to the unique needs of the business, ensuring the most favorable terms.

The process is not only fast but also remarkably flexible and fair, allowing sellers to retain complete control over their growth journey. Wayflyer Amazon partners with sellers, taking a small percentage of future sales only when the funding is successfully paid back. This approach places sellers in the driver’s seat as they navigate their path to business expansion, with Wayflyer Amazon as their trusted financial ally.

4. Wayflyer Wholesale Solutions:

For retailers caught in the challenging space between suppliers demanding upfront payment and retailers requiring extended payment terms, Wayflyer Wholesale Funding presents a game-changing solution. This innovative funding option recognizes the complexities of the retail landscape, where cash flow can be a limiting factor in business growth.

With Wayflyer Wholesale Funding, retailers can break free from these constraints, as it scales alongside the expansion of their retail listings. The result is greater financial flexibility, reduced unpredictability, and the ability to seize opportunities for business expansion with confidence. Wayflyer Wholesale Funding understands the unique challenges faced by retailers and is here to empower them, ensuring that cash flow limitations no longer hinder their journey to success.

Business Model of Wayflyer – How Wayflyer makes money?

Wayflyer is a revenue-based financing company that provides funding to growing e-commerce businesses.

Wayflyer’s business model is based on the following principles:

- Funding is based on future revenue. Wayflyer does not require collateral or personal guarantees. Instead, the company purchases a percentage of a business’s future revenue up to an agreed-upon amount. This means that Wayflyer only makes money if the business is successful.

- Funding is flexible. Wayflyer offers funding from $10,000 to $20 million. The company also allows businesses to access top-ups as needed. This gives businesses the flexibility to scale their operations quickly and easily.

- No hidden fees. Wayflyer charges a simple fee based on the amount of funding provided. There are no hidden fees or interest charges.

Wayflyer’s target market is growing e-commerce businesses that are looking for flexible and affordable funding. The company has funded over 1,500 businesses in 11 countries.

Here is a more detailed explanation of how Wayflyer works:

- A business applies for funding from Wayflyer.

- Wayflyer evaluates the business’s financial performance and future growth potential.

- If approved, Wayflyer purchases a percentage of the business’s future revenue up to an agreed-upon amount.

- The business receives the funding within days.

- The business repays Wayflyer a percentage of its monthly revenue until the full amount is repaid.

Wayflyer’s revenue model is based on the fees it charges businesses for its funding. The fees are typically between 1% and 10% of the monthly revenue that is transferred to Wayflyer.

Valuation of Wayflyer

In Feb 2022, Wayflyer raised $150 million in an all-equity Series B funding round, and in doing so, joined the unicorn club at a $1.6 billion valuation. The round was co-led by DST Global and QED Investors, with newcomers Prosus, Madrone Capital Partners, and J.P. Morgan joining the cap table. Existing investors Left Lane Capital and Checkout.com founder Guillaume Pousaz also participated in the round.

Funding of Wayflyer

Wayflyer has raised a total of $889.2M in funding over 8 rounds. Their latest funding was raised on Sep 1, 2022 from a Debt Financing round. Wayflyer is funded by 20 investors. JP Morgan and JP Morgan are the most recent investors.

| Round | Date | Amount | Investors |

| Series A | May, 2021 | $76 million | Left Lane Capital, DST Global, QED Investors, Speedinvest and Zinal Growth |

| Series B | Feb, 2022 | $150 million | DST Globa, QED Investors, Prosus, Madrone Capital Partners, J.P. Morgan, Left Lane Capital and Guillaume Pousaz |

In May 2022, Wayflyer secured and began deploying $300m in debt financing from global financial services leader J.P. Morgan, with Neuberger Bermann acting as a mezzanine provider.

Competitors of Wayflyer

Wayflyer’s competitors primarily include other financial technology (FinTech) companies and traditional financial institutions that offer similar financing and analytics solutions for e-commerce businesses. Please note that the competitive landscape in the FinTech industry is dynamic, and new competitors may have emerged since then. Here are some of the key competitors and their details:

1. Clearbanc (Now ClearCo)

-

- Business Model: Clearbanc offers e-commerce financing through revenue-share agreements similar to Wayflyer. They provide capital in exchange for a percentage of daily or weekly revenue until the agreed-upon amount is repaid.

- Differentiator: Clearbanc is known for its data-driven approach, using algorithms to assess the creditworthiness of e-commerce businesses and determine financing offers.

2. Shopify Capital

-

- Business Model: Shopify Capital provides funding to businesses using the Shopify e-commerce platform. It offers merchant cash advances and loans to Shopify store owners based on their sales history and performance.

- Differentiator: Shopify Capital integrates seamlessly with the Shopify platform, making it convenient for Shopify store owners to access financing.

3. PayPal Working Capital

-

- Business Model: PayPal Working Capital offers loans to PayPal merchants, including e-commerce businesses. The loan repayment is based on a fixed percentage of daily PayPal sales.

- Differentiator: Integration with PayPal’s payment processing platform allows for easy access to funds and repayment.

4. Kabbage (now part of American Express)

-

- Business Model: Kabbage offers lines of credit and small business loans, including to e-commerce businesses. They assess creditworthiness using a variety of data sources and provide fast access to funding.

- Differentiator: Kabbage’s automated lending platform can quickly evaluate and approve financing applications.

5. OnDeck (now part of Enova International)

-

- Business Model: OnDeck provides small business loans and lines of credit, which can be used by e-commerce businesses for various purposes, including inventory management and expansion.

- Differentiator: OnDeck offers a range of financing options, including term loans and lines of credit, giving businesses flexibility in choosing the right financing solution.

6. Traditional Banks and Credit Unions

-

- Business Model: Traditional financial institutions also offer business loans, lines of credit, and financial services to e-commerce businesses. They may require more extensive documentation and have longer approval processes compared to FinTech competitors.

- Differentiator: Established relationships with traditional banks and access to a wide range of financial services can be advantageous for businesses seeking comprehensive financial solutions.

7. Other FinTech Lenders

-

- Business Model: Various other FinTech companies may offer e-commerce financing, often with unique features or tailored solutions. These competitors can vary in terms of their lending models, fees, and eligibility criteria.

- Differentiator: Different FinTech lenders may focus on specific niches or offer specialized services that cater to the specific needs of e-commerce businesses.

In the ever-evolving FinTech landscape, competition is fierce, and these competitors continue to innovate and refine their services to meet the dynamic needs of e-commerce entrepreneurs. As a result, businesses can choose from a diverse range of financing and analytics options to fuel their growth and success.

Also Read: The Inspiring Success Story and History of PayPal

To read more content like this, subscribe to our newsletter