PhonePe, which started in 2015, is a digital wallet platform. It was founded by Mr. Samir Nigam, Mr. Rahul Chari, and Mr. Burzin Engineer. Mr. Rahul and Mr. Sameer launched and worked together at Flyte, a music downloading platform. One of the reasons for the shutdown was the firm’s inability to solve issues regarding payments and micro-transactions. Both of them also saw payment failures during big billion days at Flipkart. It made them realize the need for a platform that made financial services and payments simple, and this started the journey for PhonePe. Today, the company handles approximately 20 million transactions in a day and contributes 40% of over a billion UPI transactions per day. The company has 200 million users and over 10 million merchants on its platform, such as Ola, Swiggy, several Kirana stores and local vendors, etc. The app of PhonePe is available in 11 different languages.

Overview

Walmart-backed Flipkart acquired PhonePe in 2016. The application is based on Unified Payment Interface (UPI). In August 2017, the company surpassed BHIM, an emerging market leader in UPI transactions. PhonePe users can perform money transfer, DTH, utility, data card, phone payments, and services such as pay at shops, invest in the tax savings fund, and liquid funds. Along with these options, PhonePe has a tab named ‘PhonePe Switch,’ which allows customers to seamlessly switch between PhonePe and their favourite food, grocery, shopping, and travel apps. This feature also helps partners showcase exclusive offers and discounts to the users. Partners such as Ola, Goibibo, Myntra, Delhi Metro, Grofers are already part of PhonePe switch.

You might also like to read on Walmart

PhonePe uses Machine Learning to enhance its user experience. The data science team works on the model using Python and personalizes the user experience. PhonePe uses a combination of data-driven insights and user preference. The ML learns to generate personalized reminders like the date of the bill payment. With every transaction, the model learns itself. The company is also using ML to drive increased conversion rates for its users and partners. The In-App section contains various brands related to travel, food, lifestyle, etc. Based on user behaviour, transaction pattern preferences, the next best action of the user is anticipated, and consumers are offered personalized offers.

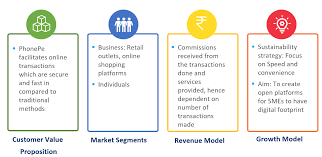

There are broadly five sources of revenue for PhonePe

- Mobile Recharges: Commission charged on every recharge from the operator.

- Bill Payments: Commission from the company for which you pay the bill.

- Gift Vouchers: On every gift vouchers sold through the app, it charges certain money.

- Mutual Fund: Whenever you invest in a Mutual fund through the app, the company charged a certain percentage from that Asset Management Company.

- PhonePe also gets its commission with the help of the promotion of various products. It collects revenues from a partner through the Switch platform.

PhonePe earned revenue of INR 245.8 crore in FY19 with 5X growth in its income over the preceding year. The losses too jumped 2.4x over the prior year to INR 1907 crore. The company spent 60% of the total expenditure on advertising and promotion. The spending on employees’ salaries also increased 4x in FY19. The O2O (offline to online) segment contributes less than 5% of the revenues. Payment distribution contributes 40% and advertisements 35% and the rest by financial services.

In 2017, the company launched a low-cost POS device, which looks like a calculator and works on a battery. This device enables payments through all devices using Bluetooth connectivity. In January 2020, the company launched PhonePe ATM. The ATM will allow customers to get cash from merchant partners through the transaction with their mobile phones. In February 2020, the company launched a chat feature that allows its users to send and receive messages while transferring money.

Recently, Flipkart announced a partial spin-off of PhonePe to help it access dedicated, long-term capital to fund its growth over the next three to four years. In the latest financing round, PhonePe raised $700 million in the capital at a post-money valuation of $5.5 billion from existing Flipkart investor Walmart.

Competitive Landscape

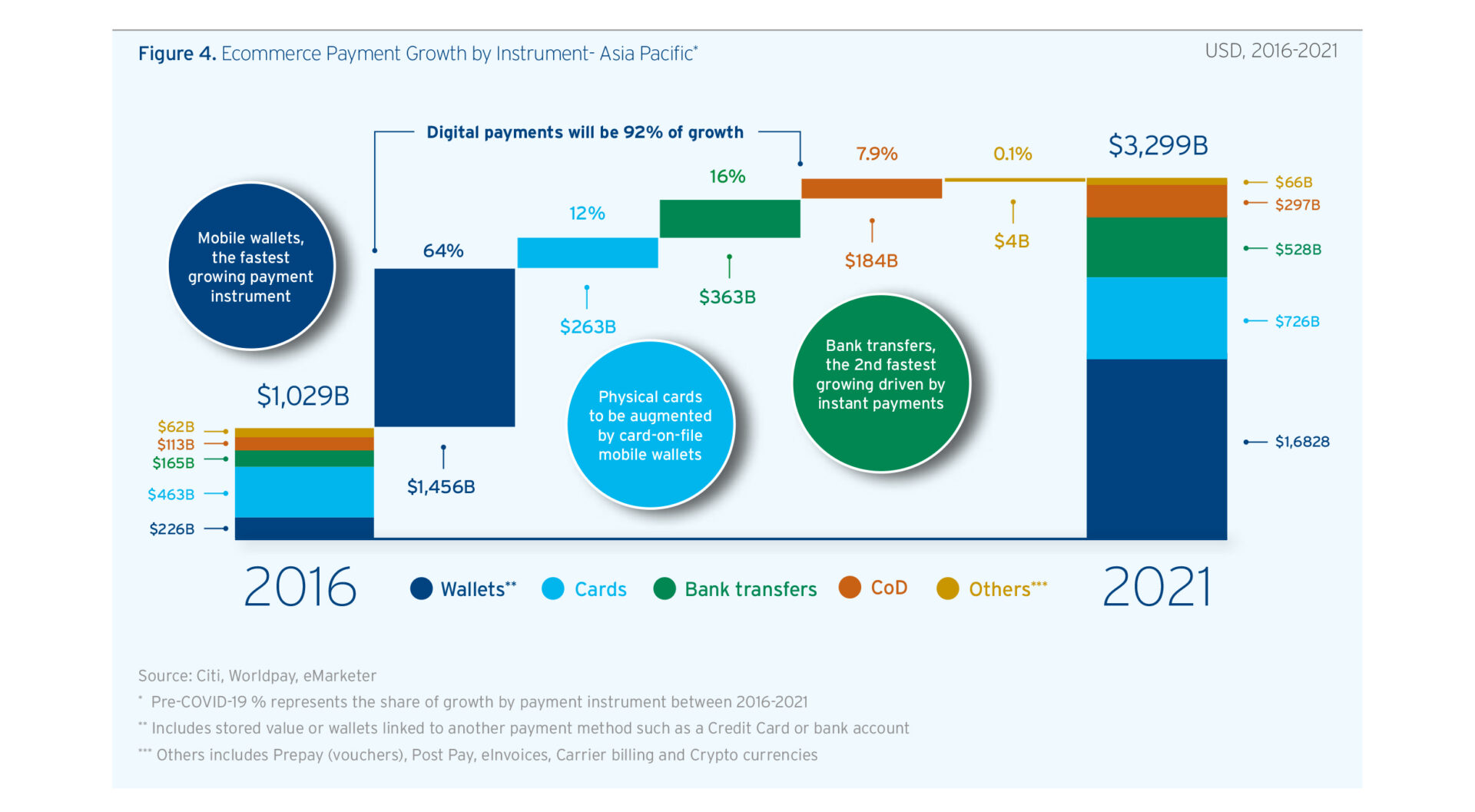

According to Global Data, UPI payments value in India rose from $1 billion to $306 billion at a CAGR of 574.5%. The market for digital payments services in India is likely to increase to $100 trillion by 2025.

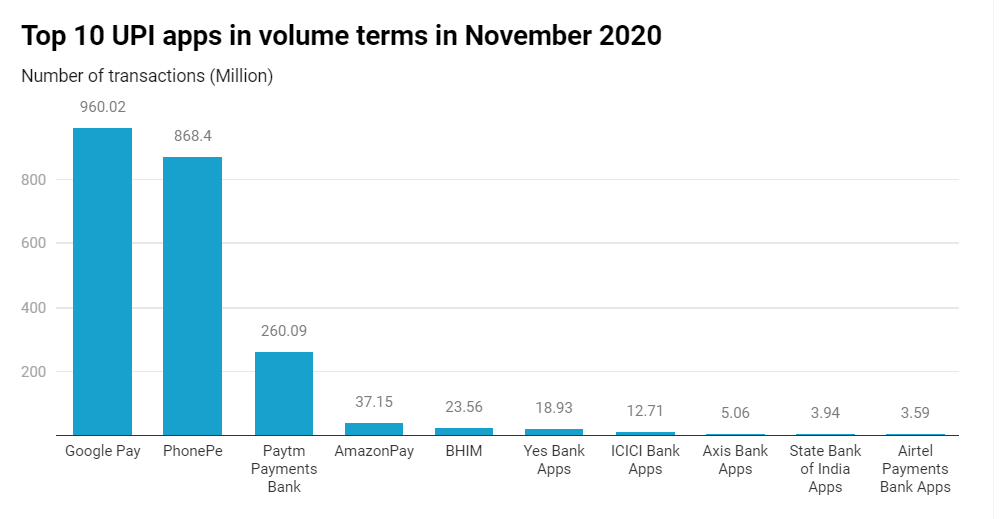

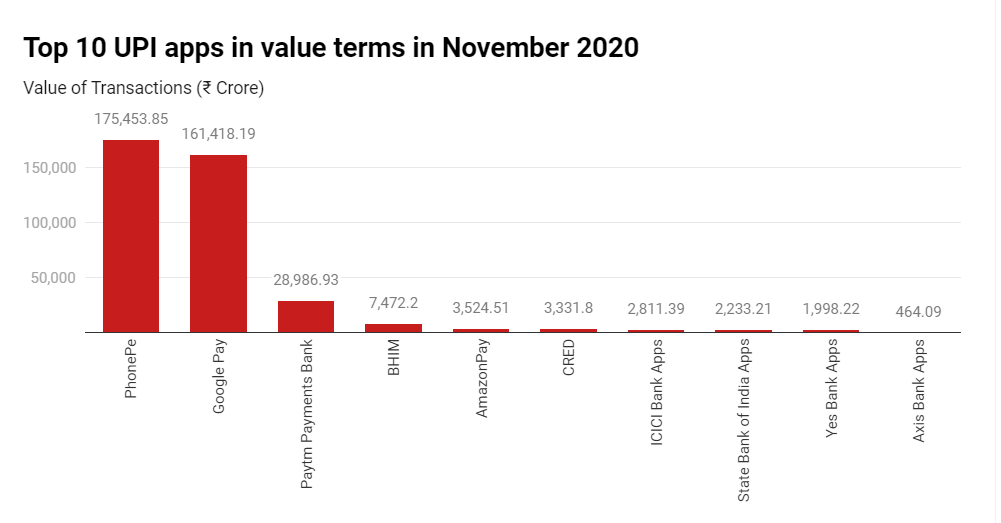

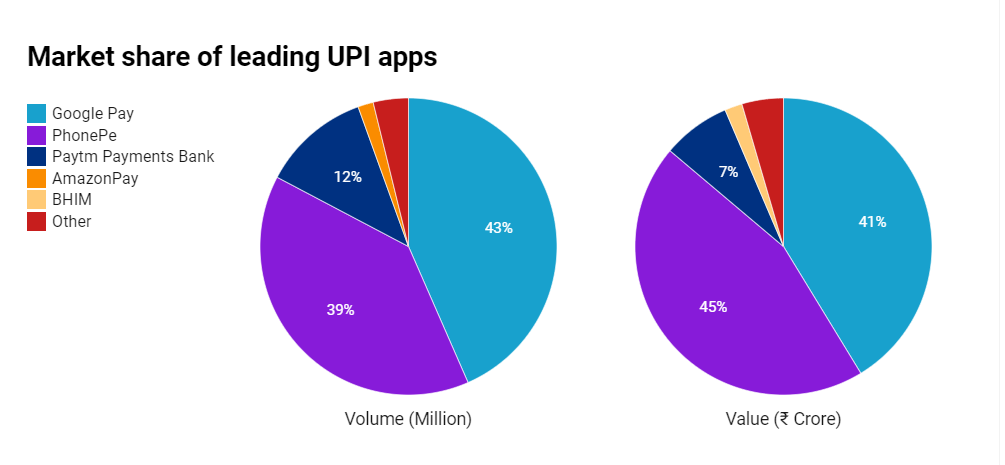

The major competitors for the company are Google Pay, Amazon Pay, BHIM, and Paytm. In the year 2019, Google Pay constituted a share of 39.5% of all UPI usage in India. PhonePe had a 40.3% market share, followed by Paytm and BHIM at 11.8% and & 6%, respectively.

As of July 2019, PhonePe’s market share stands at 33.4%, behind market leader Paytm’s 42%, but its app was used in 53% of smartphones in the domestic market, compared to Paytm’s 51.3%. As of November 2020, Google Pay and PhonePe account for 86% market share on UPI.

In November 2020, Whatsapp Pay was approved by NPCI for offering payment services in India. NPCI has capped the Whatsapp Pay users to 20 million. At present, PhonePe and Google pay owns nearly 80% of the market share in UPI transactions. Whatsapp has a large user base of 400 million people in India. As per analysts at Bernstein, the market share of Whatsapp pay could increase to 30% in India. The app can be easily used to transfer money to people within the contact list. It has the potential to reduce the market share of PhonePe with its large user base.

Recently, NPCI has also capped UPI transactions on third-party apps at 30%. The limit of 30% will be calculated based on the total volume of transactions processed in UPI during the preceding three months. This rule will be effective from 1 January 2021, but existing UPI apps were given time till Jan 2022 to comply with this. This will force PhonePe to limit its operation. As a market leader in the UPI transaction, PhonePe’s revenue might take a hit with this regulation.

Strategies

To gain customers’ trust for payment-related services, PhonePe made sending money ubiquitous and straightforward. PhonePe aims to become profitable by 2022 and go public in 2023. The company plans to enable digital payments for over 25 million small merchants across India in the next one year. The company will onboard Kiranas on its PhonePe for Business app, offering them end-to-end control of the payment process. The company also plans to reach 5500 talukas via its merchant acquisition team, leading to over 10k jobs in rural and semi-urban areas. The company plans to add over 100 million users every year. In January 2020, Phone became the first digital payment service platform in India to launch International Travel Insurance, offering more services to attract customers to its platform.

The company comes out with innovative marketing campaigns to attract customers. PhonePe has set aside INR 800 crore as a marketing budget to take on the competition. The company has roped in Alia Bhatt along with its existing brand ambassador Aamir Khan to create awareness about the platform. The company launched a five-week campaign ‘Karte Ja. Badhte Ja’ which aims to reflect the role of PhonePe in India’s progress by catering to various needs and aspirations of 20 crore users across the country. Recently, during IPL 2020, the company launched an eight-week long marketing campaign. Weaved in the form of a story, the six brand advertisements show a sceptical Aamir Khan gradually convinced by Alia Bhatt to become a PhonePe customer. The objective of the campaign is to introduce digital payments and explain their benefits to the customer who is not using the PhonePe app. PhonePe has launched a new campaign, ‘Unstoppable India.’ Through this campaign, the company sent a message that Indians have persevered through the Pandemic and, even in these tough times, have found ways to cope successfully. The campaign conveyed that PhonePe is proud to have contributed to helping India move forward in these challenging times with its wide variety of digital offerings through its platform.

In January 2018, the company partnered with Freecharge, enabling PhonePe users to link existing Freecharge wallets with the PhonePe app. The company also entered into similar partnerships with Jio and Airtel Money. The PhonePe switch platform integrates apps such as Ola. Swiggy, etc., onto its platform. PhonePe launched Liquid Funds in partnership with Aditya Birla Mutual Fund to give the mixed benefits of an FD and a mutual fund. In May 2020, the company partnered with Bajaj Allianz and ICICI Lombard to launch COVID specific insurance policies.

Recognition

- PhonePe was awarded Best Mobile Payment Product or Service category at IAMAI India Digital Awards 2018 and 2019.

- In 2018, the company also won the SuperStartUp Asia award.

- In 2018, the company was recognized by the National Payments Corporation of India for driving the largest number of merchant transactions in India.

- The company was awarded at the India Advertising Awards 2018 in the Telecom and Technology category.

- In 2019, it won the Best Digital Wallet initiative award at the Indian retail and e-Retail awards 2019.

- Recognized as the Best Digital Wallet initiative at the 8th Annual Indian Retail and eRetail Awards 2019 organized by Zee Business and The Economic Times.

Conclusion

The rise of digital payments in India has made the sector very competitive. With the likes of Amazon, Facebook, Google in the market, the competition will be intense. PhonePe, with the backing of Flipkart, is a market leader in UPI and has reached many new customers during the Pandemic. The company has contributed to the digital payment ecosystem of the country, and it will look to strengthen its position in the market.

You might also like to read on Swiggy or Dunzo

[wpforms id=”320″ title=”true”]