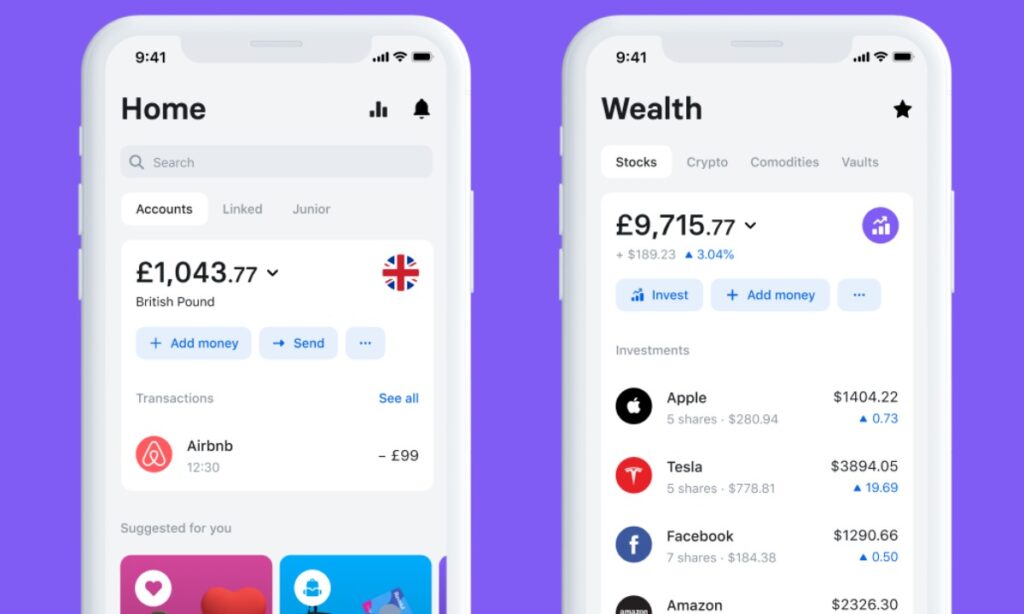

Revolut is a digital banking and financial services company that was founded in the United Kingdom in 2015. The company provides a range of financial services, including a multi-currency prepaid debit card, currency exchange, cryptocurrency exchange, and peer-to-peer payments.

Revolut aims to make financial services more accessible and convenient for people around the world by providing a mobile app that enables users to manage their finances easily and efficiently. The app allows users to open a bank account in minutes, track their spending, set up and manage budgets, and make payments and transfers with ease.

One of the unique features of Revolut is its ability to allow users to hold and exchange multiple currencies in the app. This is particularly useful for people who travel frequently or conduct business across borders. Users can also withdraw cash from ATMs using their Revolut card and benefit from competitive exchange rates.

Revolut has gained a significant following over the years, and as of 2021, the company has over 15 million users worldwide. The company has expanded its services to include stock trading, insurance, and other financial products, and has also launched a business banking service aimed at small and medium-sized enterprises.

Revolut History and Founders

Revolut was founded in 2015 by Nikolay Storonsky and Vlad Yatsenko. Storonsky, a former trader at Credit Suisse and Lehman Brothers, had the idea for the company after becoming frustrated with the high fees and poor exchange rates charged by traditional banks when he traveled abroad.

Storonsky teamed up with Yatsenko, a former software developer at Deutsche Bank and Credit Suisse, to build a digital banking platform that would allow users to exchange and spend money abroad without incurring high fees. The company launched its first product, a prepaid debit card that allowed users to spend money in multiple currencies at the interbank exchange rate, in 2015.

The company quickly gained popularity, and in 2017, Revolut raised $66 million in a funding round led by Index Ventures and Ribbit Capital. The company used the funding to expand its services, adding features such as insurance, cryptocurrency trading, and peer-to-peer payments.

In 2018, Revolut became a licensed bank in Lithuania, allowing it to offer deposit and lending services across the European Union. The company also expanded its operations to other parts of the world, including the United States, Canada, and Australia.

As of 2021, Revolut has over 15 million users and has raised over $900 million in funding from investors, including DST Global, Tiger Global Management, and TCV. The company is headquartered in London, UK, and has offices in several other countries.

Business Model of Revolut

Revolut’s business model is primarily based on providing financial services through its mobile app and generating revenue from transaction fees and premium subscription plans.

One of the key ways that Revolut generates revenue is by charging transaction fees when users make purchases or withdraw cash using their Revolut card. These fees vary depending on the type of transaction and the currency involved, but they are generally lower than the fees charged by traditional banks.

Revolut also offers premium subscription plans that provide additional benefits and features to users. The plans, which range in price from a few dollars to several hundred dollars per year, offer perks such as unlimited free foreign currency exchanges, travel insurance, and access to exclusive events.

In addition to transaction fees and premium subscriptions, Revolut generates revenue from a number of other sources. For example, the company earns interest on the funds held in users’ accounts, and it charges fees for certain types of transfers, such as those involving cryptocurrencies.

Revolut also offers a range of other financial products and services, such as stock trading and business banking, which generate additional revenue for the company. The company is constantly exploring new ways to expand its offerings and generate revenue, such as by partnering with other companies to offer joint products and services.

Investors and Funding of Revolut

Revolut has raised a significant amount of funding from a number of high-profile investors since its launch in 2015. Here are some of the key funding rounds and investors:

Seed funding: In 2015, Revolut raised £1 million in seed funding from a group of investors, including Seedcamp, Point Nine Capital, and Venrex.

Series A funding: In 2016, Revolut raised $10 million in a Series A funding round led by Balderton Capital, with participation from Ribbit Capital and Index Ventures.

Series B funding: In 2017, Revolut raised $66 million in a Series B funding round led by Index Ventures and Ribbit Capital, with participation from Balderton Capital and DST Global.

Series C funding: In 2018, Revolut raised $250 million in a Series C funding round led by DST Global, with participation from Index Ventures and Ribbit Capital.

Series D funding: In 2020, Revolut raised $500 million in a Series D funding round led by TCV, with participation from a number of other investors, including Ribbit Capital, DST Global, and Lakestar.

Overall, Revolut has raised more than $900 million in funding from a range of investors, including venture capital firms, private equity firms, and individual investors. Some of the other notable investors in the company include Balderton Capital, Lakestar, TSG Consumer Partners, and GP Bullhound.

Marketing Strategies of Revolut

Here are some of the marketing strategies Revolut has used to grow its brand and acquire customers:

Viral Marketing: Revolut’s referral program encourages existing customers to refer friends and family to join Revolut. This has helped the company to grow its customer base rapidly.

Social Media Marketing: Revolut has a strong social media presence on platforms such as Twitter, LinkedIn, and Facebook. They use these platforms to communicate with customers, share information about new features, and run social media campaigns.

Content Marketing: Revolut has a blog that provides customers with information on finance, budgeting, and saving tips. The company also produces podcasts and webinars to help customers better understand their finances.

Influencer Marketing: Revolut has collaborated with influencers, including YouTube creators, to promote its services to a wider audience. They also work with bloggers and other content creators in the personal finance space to raise brand awareness.

Product Features: Revolut focuses on developing innovative product features, such as real-time spending notifications and in-app budgeting tools, to provide customers with a better user experience. This has helped the company to attract customers who are looking for more advanced digital banking services.

Traditional Advertising: Revolut has run billboard and print ads in targeted locations to raise awareness and attract new customers.

Overall, Revolut’s marketing strategy has focused on using digital channels to create brand awareness and attract new customers, while also providing innovative product features and a high-quality user experience.

Revolut Growth and Revenue

Revolut has experienced impressive growth since its launch in 2015. The company has rapidly expanded its user base and revenue streams by offering a range of innovative financial products and services through its mobile app.

As of September 2021, Revolut has more than 16 million registered users and processes over 150 million transactions per month. The company operates in 35 countries and supports over 30 currencies.

One of the key drivers of Revolut’s growth has been its ability to offer low-cost international money transfers and currency exchange services to its users. These services have helped the company to attract a large number of customers who frequently travel or make international transactions.

In addition to its core currency exchange and money transfer services, Revolut has also added a range of other financial products and services to its platform, including personal and business accounts, debit cards, savings accounts, cryptocurrency trading, and stock trading.

Revolut generates revenue through a variety of channels, including transaction fees, premium subscription plans, and interest on user deposits. The company also earns fees from its cryptocurrency and stock trading services.

According to its 2020 financial results, Revolut’s revenue for the year was £222 million (approximately $302 million). This represents a significant increase from the previous year, when the company reported revenue of £163 million (approximately $222 million).

Despite its impressive growth and revenue, Revolut has yet to turn a profit. Revolut reported a £167 million net loss in 2021, its largest ever annual net loss. The company reported a loss of £201 million (approximately $274 million) in 2020, up from a loss of £107 million (approximately $146 million) the previous year. However, the company has stated that it expects to become profitable in the near future as it continues to scale its operations and diversify its revenue streams.

Also Read: Klarna – Founders, Business Model, Investors, Growth & Future

Future of Revolut

The future of Revolut looks promising, as the company continues to expand its product offerings, grow its user base, and increase its revenue streams.

One key area of focus for the company is expanding its presence in new markets. Revolut currently operates in 35 countries, but the company has ambitious plans to enter new markets and offer its services to more customers around the world. The company has recently launched in the United States, Japan, and Australia, and has plans to expand into more countries in the near future.

Another area of focus for Revolut is developing new products and services to meet the evolving needs of its customers. The company has already added a wide range of financial products and services to its platform, including cryptocurrency trading, stock trading, and business banking. Revolut has stated that it plans to continue developing new products and services that can help users manage their finances more efficiently and easily.

Revolut is also working on expanding its revenue streams beyond its core services of currency exchange and money transfers. The company has recently launched a number of new revenue streams, such as its Revolut Junior service for children and teenagers, and its Revolut Plus subscription plan. Revolut has also stated that it plans to explore new partnerships and collaborations that can help drive revenue growth and increase the value it offers to its customers.

Overall, Revolut is well-positioned to continue growing and expanding its offerings in the coming years. The company has a strong brand, a loyal user base, and a track record of innovation and disruption in the financial services industry. As the company continues to scale its operations and expand its product offerings, it is likely to remain a major player in the financial services industry for years to come

To read more content like this, subscribe to our newsletter