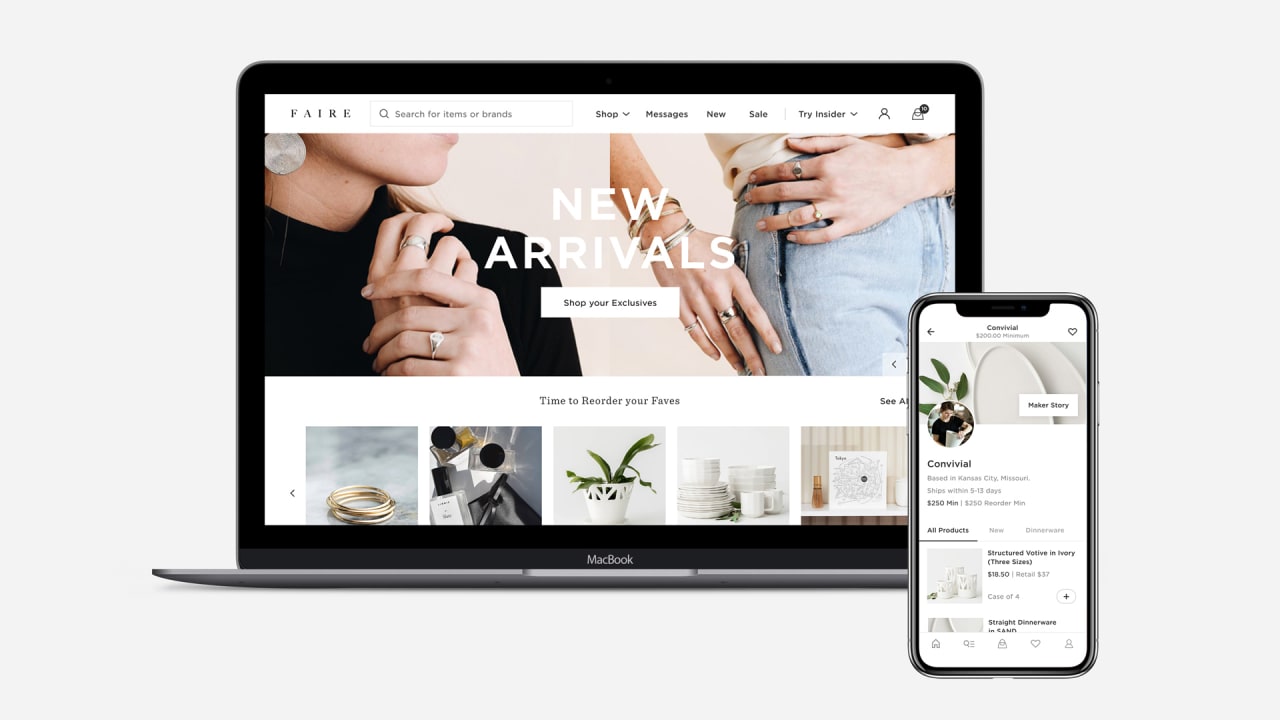

Faire is an online wholesale marketplace that connects independent retailers with small and medium-sized makers and brands. The company was founded in 2017 and is based in San Francisco, California, USA.

Faire offers a curated selection of unique and high-quality products across a variety of categories, including home goods, fashion and accessories, beauty and personal care, and food and drink. Retailers can browse and order products directly from the Faire platform, which streamlines the buying process and offers a range of tools and resources to help retailers manage their inventory and grow their businesses.

One of the key features of Faire is its focus on supporting small businesses and makers. By providing a platform for independent brands to reach a wider audience, Faire helps to level the playing field for small and medium-sized businesses and promote more diverse and innovative product offerings.

Faire has quickly become one of the fastest-growing marketplaces in the retail industry, with thousands of retailers and makers using the platform to connect and transact. The company has also raised significant funding from top investors, including Sequoia Capital, Forerunner Ventures, and Lightspeed Venture Partners.

Faire History and Founders of Faire

Faire was founded in 2017 by Max Rhodes, Marcelo Cortes, and Daniele Perito. The three co-founders had previously worked together at Square, the mobile payments company, and were inspired to create a new type of marketplace that would serve the needs of small and independent retailers.

Rhodes had experienced firsthand the challenges faced by independent retailers when trying to source unique and high-quality products for their stores. He saw an opportunity to use technology to connect these retailers with small and medium-sized makers and brands, helping to level the playing field and promote greater diversity and innovation in the retail industry.

The Faire platform officially launched in January 2018, and quickly gained traction with both retailers and makers. The company’s focus on curation, quality, and community building helped to differentiate it from other wholesale marketplaces, and Faire soon became one of the fastest-growing startups in the retail industry.

Since its founding, Faire has raised over $1.7 billion in funding from top investors such as Sequoia Capital, Forerunner Ventures, and Lightspeed Venture Partners. The company has also expanded its offerings to include additional tools and services for retailers and makers, such as financing and inventory management software. Today, Faire serves 300,000 retailers and makers across the United States, Canada, and Europe, and continues to be a major player in the wholesale marketplace industry.

Business Model of Faire

Faire’s business model is based on providing a platform that connects independent retailers with small and medium-sized makers and brands. The company earns revenue by charging a commission on sales made through its platform, as well as through other value-added services that it offers to both retailers and makers.

Specifically, Faire charges makers a commission on all orders placed by retailers on the platform. This commission varies depending on the category of the product being sold, but typically ranges from 15-30%. In exchange for this commission, makers receive access to Faire’s network of retailers, as well as a range of tools and resources to help them grow their businesses.

On the retailer side, Faire does not charge any upfront fees or membership fees to join the platform. Instead, the company earns a commission on all orders placed by retailers, which is typically around 15% of the total order value. In addition to this commission, Faire also offers a range of value-added services to retailers, such as financing, inventory management software, and customer support.

Faire’s focus on providing a curated selection of high-quality and unique products helps to differentiate it from other wholesale marketplaces, and has helped to attract a loyal customer base of independent retailers. By providing a platform that supports small and medium-sized makers and brands, Faire is helping to promote greater diversity and innovation in the retail industry, while also earning revenue through its commission-based business model.

Investors and Funding of Faire

Faire has raised a total of $438 million in funding across several rounds since its founding in 2017. Here’s a breakdown of the company’s funding history:

Seed Round: In November 2017, Faire raised $3.4 million in a Seed Round led by Khosla Ventures, with participation from Forerunner Ventures, Founders Fund, and Lightspeed Venture Partners, among others.

Series A: In November 2018, Faire raised $12 million in a Series A round led by Khosla Ventures and Forerunner Ventures with participation from Sequoia Capital.

Series B and Series C: In July 2019, Faire has today announced a $100 million fundraise across two financing rounds: a $40 million Series B led by Taussig at Lightspeed and a $60 million Series C led by Y Combinator’s Continuity fund. New investors Founders Fund, the venture firm founded by Peter Thiel, and DST Global also participated.

Series D: In 2020, Faire raised $150 million in a series D round of funding co-led by Lightspeed Ventures and Peter Thiel’s Founders Fund. Khosla Ventures, Forerunner Ventures, and YC Continuity also participated in the round. This takes Faire’s total funding to nearly $270 million since its inception. At a $1 billion valuation, Faire is now a bona fide unicorn.

Series E: In November 2020, Faire raised $170 million in a Series D round led by Sequoia Capital, with participation from Founders Fund, Forerunner Ventures, and Khosla Ventures, among others.

Series F: In 2021, Faire raised $260 million in a Series F investment round led by Sequoia Capital. The funding, which includes all existing investors as well as new global investors Baillie Gifford and Wellington Management, values Faire at $7 billion, nearly tripling its previous valuation of $2.5 billion.

Series G: In 2021, Faire raised $400 million in a Series G investment round co-led by new investors, Durable Capital Partners LP, and returning investors, D1 Capital Partners, and Dragoneer Investment Group. This round, which includes all existing investors, is Faire’s third in just over a year and values the wholesale market leader at $12.4 billion, bringing its total funding to more than $1 billion.

Faire lands $416M extension from YC, Sequoia and others for online wholesale marketplace

Faire’s funding history reflects the company’s rapid growth and expanding reach in the retail industry. With each new funding round, Faire has been able to further develop its platform and expand its offerings to better serve its customers, including retailers and makers alike.

Also Read: What is Shopify ? Shopify Business Model And How Does It Make Money

Revenue Streams of Faire

Faire generates revenue through several streams, including:

Commission-based revenue: Faire charges a commission on each transaction made on its platform. The commission rate varies depending on the product category and supplier, but it typically ranges from 15% to 30% of the wholesale price.

Subscription revenue: Faire offers a premium subscription service called Faire Plus, which provides retailers with additional benefits, such as free shipping and extended payment terms. Retailers pay a monthly fee to access these benefits, providing Faire with a recurring revenue stream.

Advertising revenue: Faire allows suppliers to promote their products through paid advertising on its platform. Suppliers can choose to pay for targeted ads that appear in front of specific retailers, increasing their visibility and driving more sales. Faire generates revenue by charging suppliers for these advertising services.

Data monetization: Faire collects a vast amount of data on retailers and suppliers, including sales data, product performance, and customer feedback. Faire can use this data to provide valuable insights and analytics to suppliers and charge them for access to this information.

In summary, Faire generates revenue through commission-based transactions, subscription services, advertising, and data monetization. These revenue streams have allowed Faire to become one of the fastest-growing e-commerce marketplaces and attract significant investment from top venture capital firms.

Growth of Faire

Faire has experienced rapid growth since its inception in 2017, becoming one of the fastest-growing e-commerce marketplaces in the industry. Some of the factors that have contributed to Faire’s growth include:

Expanding user base: Faire has attracted a large and growing user base of independent retailers and wholesale suppliers. As of 2021, Faire had over 200,000 active retailers and more than 20,000 suppliers on its platform, which has helped to drive sales and revenue growth.

Increased transaction volume: Faire has experienced significant growth in transaction volume over the past few years, with a 100% increase in new retailers joining the platform and a 50% increase in the number of orders placed in 2020. This growth has helped to drive revenue growth for the company.

Diversification of product categories: Faire has expanded its product categories beyond traditional gift and home goods to include categories such as beauty, wellness, and pet products. This diversification has helped to attract new retailers and suppliers to the platform, further driving growth.

Investment and partnerships: Faire has received significant investment from top venture capital firms, allowing it to scale its operations and expand its services. Faire has also partnered with leading retailers such as Nordstrom to expand its reach and provide more opportunities for its suppliers.

Innovative technology: Faire has invested in innovative technology, such as its machine learning algorithms, which help to personalize the buying experience for retailers and suppliers. This technology has helped to improve the platform’s usability and increase customer satisfaction.

Overall, Faire’s growth can be attributed to a combination of factors, including its expanding user base, increased transaction volume, diversification of product categories, investment and partnerships, and innovative technology.

To read more content like this, subscribe to our newsletter