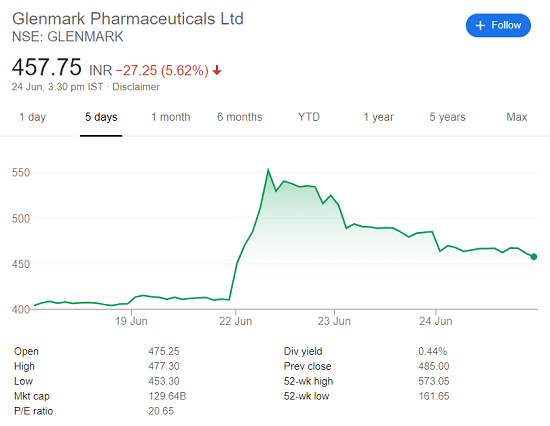

Glenmark recently announced that the Indian regulators have approved Fabiflu – a drug for the treatment of COVID-19. Fabiflu isn’t just another medicine. It is a hope to finally overcome the menace of COVID-19 which has led to the death of more than 400,000 people worldwide. The very virus that led to a severe economic recession and job loss for crores of the people. The results were evident in the stock price of Glenmark which went up by 30% in a single day. But for Glenmark, this was just another addition to the achievements they had made over time.

Glenmark Pharmaceuticals was founded by Gracias Saldanha in 1977 in India, as a generic drug and active pharmaceutical ingredient (API) manufacturer. Initially, they were into the manufacturing of oral tablets, liquids, and capsules. With time, many other products were added to the portfolio. In 1999, Glenmark went public and the proceeds were used to set up its first-ever research facility. Till then, Glenmark was only working as a generic drug manufacturer which means they manufactured drugs that were already being produced by other brands.

In 2001, Gracias Saldanha’s son Glenn Saldanha took over as the CEO of the company. Glenn took the reign of the company and decided to make changes to the company. The focus of the company was casually shifted from being best-in-class to being first-in-class. It is because of this newly-shifted focus, Glenmark launched Remogliflozin Etabonate for Type 2 Diabetes in April 2019, which brought medicine within the reach of millions of patients in India.

Glenmark started this journey of innovation under the guidance of Glenn Saldanha and today, Glenmark owned patents of:

- 537+ New Chemical Entity (NCE)

- 92+ New Biological Entity (NBE)

- 30+ Novel Drug Delivery System (NDDS)

- 135+ Active Pharmaceutical Ingredient (API)

Glenmark currently operates in more than 80 countries and ranks 15th in the domestic market, with a share of about 2.3%, as of March 2019. The company has a major presence in the acute therapy and chronic care segments. It has 16 manufacturing facilities and 6 R&D plants across the world. The research and innovation in terms of new molecules and ingredients have led Glenmark to become a global brand while having its roots in India, whereas most other brands only tried to follow, what the innovative companies created.

Download Glenmark’s 2018-19 annual report

Key divisions

Glenmark operates through three business units. These are branded products & generics, APIs, and Novel Molecular Entities (NME) & Specialty Products.

- The branded and generic business focuses on marketing formulations in India, Latin America, Central Eastern Europe, Africa, and other semi-regulated Asian markets. These formulations mostly cater to therapeutic areas such as dermatology, anti-infectives, respiratory, cardiac, diabetes, gynecology, central nervous system, and oncology.

- The company spun-off its API business in 2018-19 into an independent wholly-owned subsidiary called Glenmark Lifescience Ltd., which now owns all API related assets including R&D and manufacturing.

- The specialty business focuses on new drug development and branded product markets. Research for new drugs is being carried out in asthma / chronic obstructive disease (COPD), diabetes, and oncology segments.

As per the CEO of Glenmark himself, this culture of innovation is facilitated by 5 major areas in the organization:

-

Funding the Research and Development

Any Research and Development project requires a lot of funding. Glenmark usually spends about 12-13% of its revenues on its R&D projects. In 2019, this amounted to about ₹750 crores. But the amount is not enough to provide essential funds to continue the work. For this, Glenmark opted for out-licensing the innovations.

Out-licensing means licensing a foreign company the rights to use the patent registered by the original firm, to receive remuneration from that.

Glenmark out-licensed its first NCE at $190 million to Forest Labs in 2004. This amount was further invested in the Research and development to produce more of such patents and keep the wheel of innovations going.

-

Creating the Culture of Innovation

It is for a fact that not all organizations are suitable for innovation. Similarly, when Glenmark was operating as a Generic Drug Manufacturer, innovation was not a part of the foray. Shifting the objective of Glenmark to the First-in-class required them to reinvent the organization. This also included creating the culture of Innovation for the organization.

This meant allowing people to make mistakes and creating the appetite for long gestation periods required between starting the research work and getting the results from it. Glenn focused on providing the innovators in the organization, space to do what they are best at doing without many restrictions.

-

Talent Development

India has institutions that produce world-class researchers and innovators. But still, the innovations in the Indian companies lagged much behind their international counterparts. This was mainly due to the lack of opportunities in the Indian environment.

Glenn identified this and worked to bring the Indian talent working in other countries back to home and work for Glenmark. This helped to create an innovative ecosystem inside the organization that also helped in the development of more talent to lead this pharma innovation in the future.

-

Ability to be Patient

For a Generic Drug Manufacturer, it is quicker to produce the drugs and sell. But now that Glenmark was also focusing on Innovation and R&D, the time to see the results of the efforts and investment was significantly increased. This is quite evident when we see that it took Glenmark 4 years to create and out-license their 1st NCE (2000-2004) and 5 years to create and out-license their 1st NBE (2006-2011).

This gestation period requires the organization to be patient. The organization seeking quick results can not survive in this innovation race. Glenmark have been tremendously patient and waited for about 2 decades to get their 1st drug into the market.

-

Importance of partnering

The pharmaceutical business is a kind where it is almost impossible to survive by oneself. The business partners and shareholders of Glenmark are important parts of the business. Hence, Glenmark also has to create value for these business partners so that they can have their faith in the company and support it in its decisions.

Also Read: Google X – The Adobe of Google’s Most Ambitious Projects

Competition

The pharmaceutical industry in India has been dominated by generic drug manufacturers. Even today, not many companies are active in innovation and R&D in this industry.

The first-ever discovery of a new molecule in India was done in 1997 by Dr. Reddy’s Laboratory. But as stated above, the culture of innovation is difficult to continue and Dr. Reddy’s Laboratory could not keep up with the pressure of continued innovation. They exited in 2009 from the innovation part of the business. Many others started innovation before Glenmark including Ranbaxy, Wockhardt Ltd., And Piramal Life sciences. Not many could survive leaving the handful of survives in clear market leadership.

Today, Glenmark is the market leader in terms of innovation. Although, Wockhardt Ltd. has a larger team in the R&D but that still is not enough to outperform the cultural changes Glenmark made. Today, Glenmark is much behind in terms of market capitalization and revenues than many of the competitors. But it does not bother them as their target is to be the leader in innovation space which they have succeeded in doing.

Way Forward

Glenmark has not looked back ever since it decided to shift its focus to being first in class in the pharmaceutical industry. They are still keeping their eyes fixed on their goal and gradually moving towards achieving it. Glenmark plans to launch at least one New Molecular Entity each year. Also, to keep the innovation engine of the company up and running, they are still looking towards the out-licensing model and invest the returns back into the research. This is a solid example of how a company can take the path less traveled and acquire a monopoly-like place in the industry by way of innovations.

For more articles like these, Subscribe to our Newsletter.